- The Market Share Of Manhattan Cash Is Falling With Mortgage Rates

- The Higher The Purchase Price, The Higher The Probability Of Cash

- Manhattan September Contracts Surged 18% YOY

I forgot to mention that yesterday, Miller Samuel turned 38 years old. In the fall of 1986, on our first day open for business, we didn’t have an office or business cards. There were no mainstream email services or websites. Our family was spread out over three Manhattan rental apartments, one on the Upper East Side and two on the Upper West Side of Manhattan. My 1,000 square foot 2-bedroom with a balcony on the 22nd floor of a new doorman rental building overlooking Central Park cost a whopping $2,800 per month. We were armed with new Macintosh computers, copy machines, fax machines, HP-12Cs, and dot-matrix printers in each apartment. We developed our appraisal software as a Macintosh-only company, before they were thought of as business machines. Then I blinked, and after personally inspecting about 8,000 Manhattan properties, it’s suddenly 2024.

But I digress…

Our market study on third-quarter Manhattan sales is out today, as well as our September New Signed Contracts report for New York City, and they need to be stitched together to tell the story.

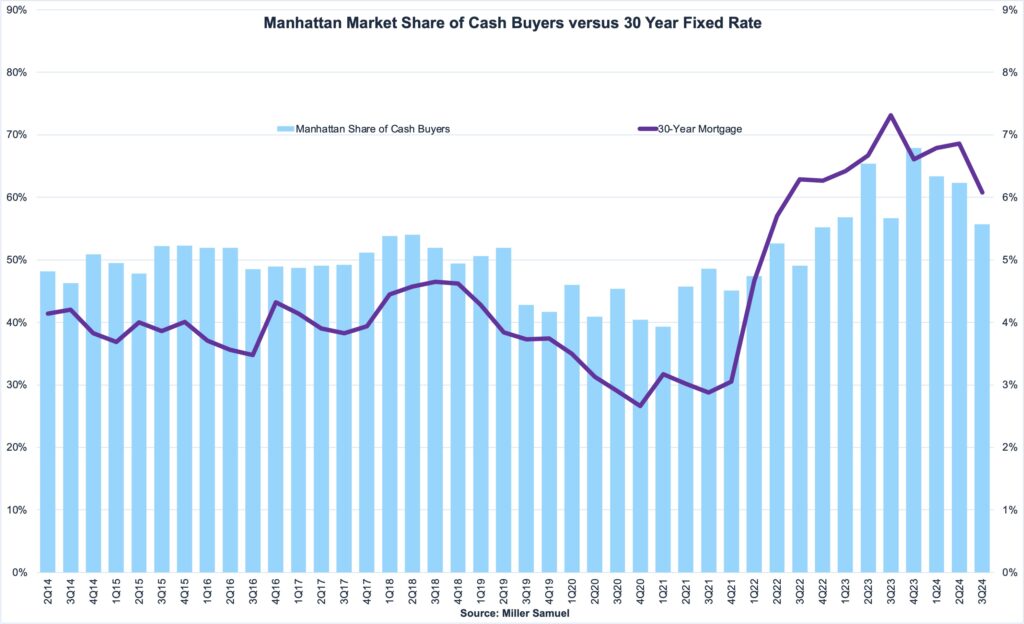

Share Of Cash Sales Wane As Mortgage Rates Fall

For the last decade, Manhattan cash sales have averaged 50% of all co-op and condo sales while mortgage rates averaged 4.4% over the same period. During the pandemic, when mortgage rates dropped to the floor, the cash sale market share fell to decade lows in the low 40s as mortgage origination volume surged. After all, who can resist free money, no matter how much money you have? I haven’t looked at this closely as a U.S. phenomenon, but I suspect its a similar pattern. Bloomberg goes all in on this point in their coverage of our report: Manhattan Homebuyers Are Starting to Favor Mortgages Over Cash.

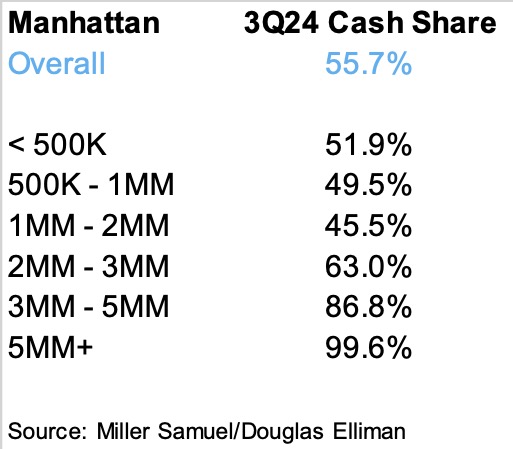

The cash to mortgage shift shows the drive to purchase housing is not solely dependent on mortgage rates from those with higher incomes or wealth. The following table shows the probability of a cash buyer moves higher with price.

September Contracts Continue To Surge

Even though Manhattan saw a modest year over year 2.5% dip in closed sales during the third quarter, new signed contracts surged annually for the third straight month, up 18% in September. For the uninitiated, a “new” signed contract is defined as a contract that was signed during the month that was reported (September) and is not cumulative. A cumulative contract example would be a contract signed in June that hasn’t closed yet – it remains a contract until it closes. That way we are looking at the most recent available actions by consumers. The down side to this is that a certain number of contracts blow up (don;t close). I estimate that’s about 20% of contracts in our market but varies over time.

AN ASIDE

Urban Digs: Awakening from Market Hibernation with Jonathan Miller

Did you miss yesterday’s Housing Notes?

October 1, 2024

Leaning By Two Feet, The $100 Million Fix For San Francisco’s Leaning Tower May Have Worked

Image: ChatGPT

Housing Notes Reads

- 🛫 Hangar Games [Highest and Best]

- Remote work to blame for rise in housing prices [BLS]

- Awakening from Market Hibernation with Jonthan Miller [UrbanDigs]

- Voice of Appraisal E267 MELTDOWN? [VOA]

- Pace of Home Sales in San Francisco Drops [SocketSite™]

Market Reports

- Elliman Report: Florida New Signed Contracts 9-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 9-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 3Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)