Luxury Second-Home Markets Remain Unscathed And Are Selling Quite Well. Thank You.

The Outlook For Luxury Sales In 2025 Is Better Than The Remainder Of The Market

Cash Buyers, Higher Wall Street Compensation, Strong Financial Markets

High-End Trump Bump Observed In Palm Beach Housing Data

When we think of housing markets, primary versus secondary, the latter contains the higher risk. If a homeowner runs into financial problems, they tend to try to save the primary residence first. Yet, in a market subject to higher mortgage rates and robust financial markets, that doesn’t seem to be the case. The Hamptons, a luxury housing market on the eastern end of Long Island, New York, has been joined at the hip with NYC’s Wall Street for several decades. Since the pandemic, listing inventory has been a rare commodity and sales are surging. Bonus compensation is expected to be generous this year. Palm Beach has come into its own as the “home” of record-priced single families and is seeing a surge of high-end sales.

Hamptons Sales Surging, But Supply Is Limited

Our Q4-2024 Hamptons Report was published today, showing that sales surged 76.2% year over year as the market struggled to normalize after a few years of low activity, hampered by a severe lack of listing inventory. Fourth-quarter sales were similar to the fourth-quarter average for the decade. Wall Street is joined at the hip with the Hamptons and the NYC securities industry is anticipating large bonuses after a few years of lackluster compensation (relative to previous years). The additional compensation is expected to translate into more sales at higher numbers in 2025 for NYC. Cash buyers have accounted for more than 60% of sales over the past two years while mortgage rates surged after averaging about 50% for the past decade.

Palm Beach High-End And The “Trump Bump”

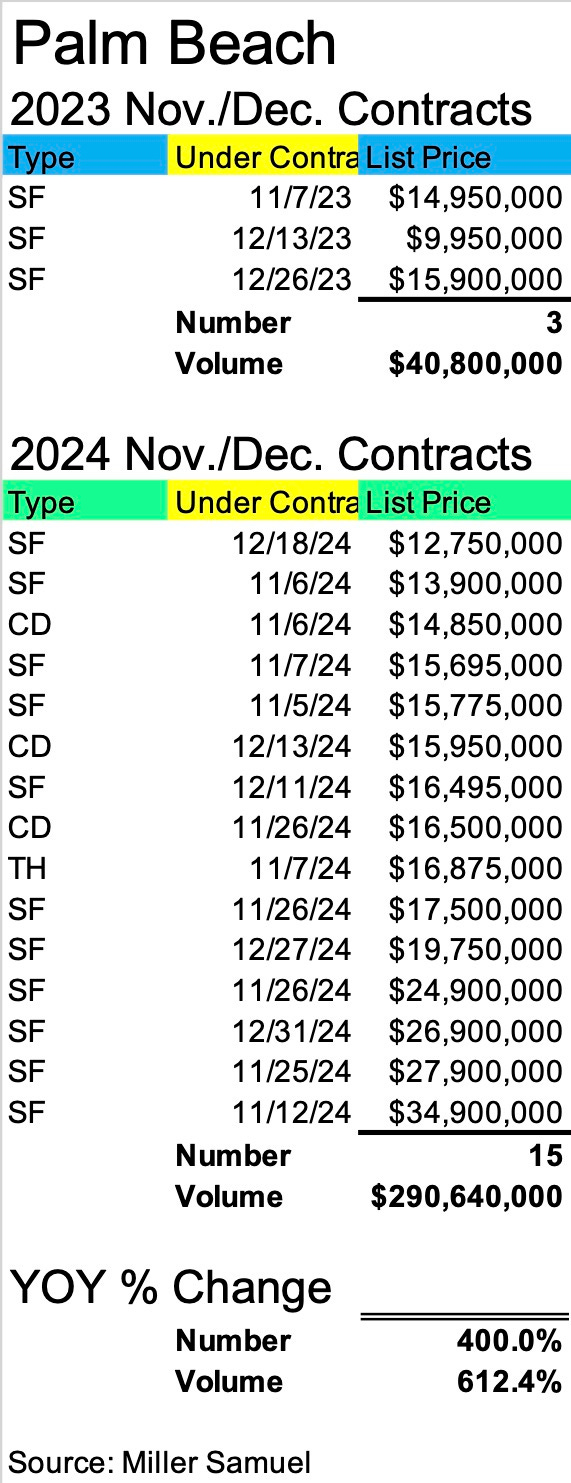

To get a sense of the change in the market, using the data compiled in the recent Q4-2024 Palm Beach Market Report I authored, contracts signed at $10 million or higher in November & December of 2024 versus 2023 were compared. The surge in high-end sales activity was significant after the election:

The number of contracts at or above the $10 million threshold was 400%, and the dollar volume was up 612.4%. The New York Post wrote about my findings. Of course, this is the third time in four months that the tabloid has obsessed with the topic, likely because the new president lives there. They relied on Knight Frank, then used a local agent, and then relied on my data observations (the third time was the charm!)

Final Thoughts

The wealthy can rely on financial markets to pull out equity for real estate purchases, so mortgage rates impact them less. The Hamptons and Palm Beach are enjoying record-setting prices, partially enabled by limited supply. By definition, more modestly priced second home markets are subject to more risk in this market as their demand was goosed by record low mortgage rates a few years ago. This pattern doesn’t seem to apply to high-end housing markets.

With overall consumption down, the next generation of home buyers might be more clear-headed to generate more wealth. Ha.

Did you miss the previous Housing Notes?

January 21, 2025

Let’s Rethink Housing Construction In Areas Prone To Wildfires

Image: Grok