- Wall Street Is Getting Big Bonuses For The First Time In Three Years

- High-End Housing Continues To Be Favored In The Current Economy

- AI Will Replace Some High-Comp Securities Industry Jobs

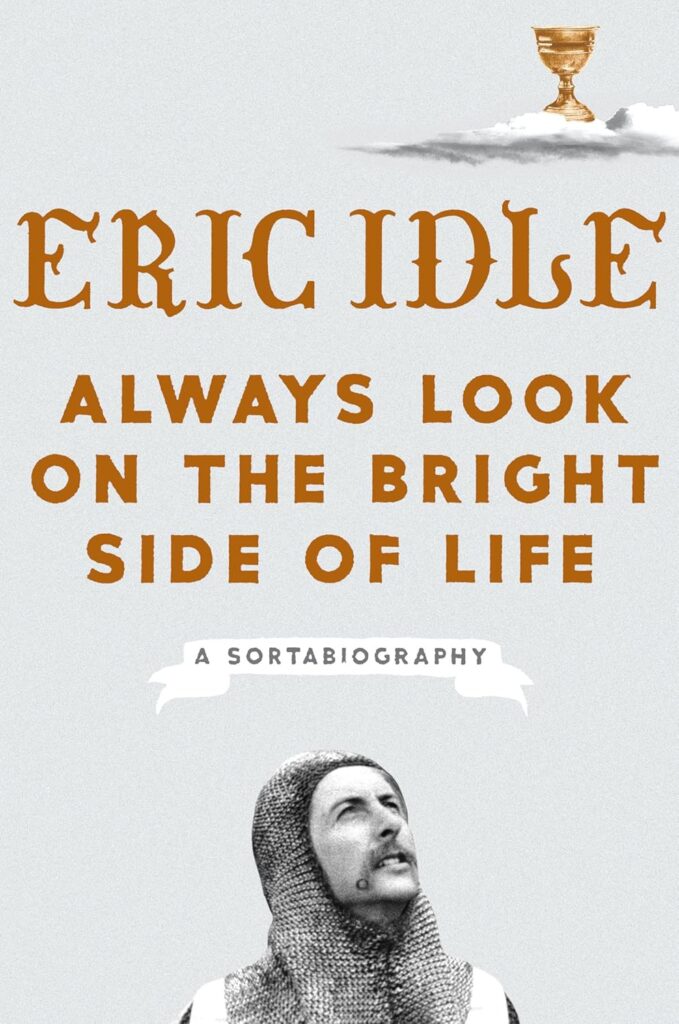

I’ve always been a Monty Python fan and can talk for hours about Spam. Back in the summer of 1975, on a 5-week foreign study trip in Europe, as a fourteen-year-old, I did the most British thing ever. Riding a double-decker bus to see the movie Monty Python and the Holy Grail was pure bliss. Later in life, lots of dragging my wife to see their films ensued, such as The Meaning of Life and even the Broadway show Spam-a-lot.

Why go into such detail about my fascination with Monty Python? The phrase “Always Look on the Bright Side of Life” aligns with the outlook for Wall Street compensation this year (sorry). Admittedly, I am very early on this topic since the New York State Comptroller’s report on the securities industry compensation won’t be released until March. Although Johnson Associates teased the current year’s outlook last August, the comptroller’s report is the benchmark, and I’ll write about that in March when it is released. Here is their securities industry update from last October. However, there have been reports of some hefty compensation coming to the industry (gift link) after two years without growth.

At Morgan Stanley and larger rival JPMorgan Chase & Co., bonuses will rise more than 10% for traders, people familiar with their deliberations said. And for JPMorgan’s investment bankers, bonuses will rise roughly 15%.

Why Does Wall Street Compensation Matter To Housing?

The average employee in the securities industry is among the most highly compensated in New York City in the private sector and presumably around the U.S. The higher compensation dovetails with the expectation that the higher-end of the housing market will outperform the remainder of the market over the next several years if the financial markets and interest rates remain elevated.

What’s Not Good About Wall Street Compensation?

In a retrospective moment of irony, I remember their record compensation just before the beginning of the global financial crisis in 2008, presumably as payment for destroying housing markets across the globe.

The current salad days of bonus comp provide us only with a short-term outlook. NYC may need to rely on other higher-wage sectors like tech and bioscience to replace some of Wall Street’s smaller contributions. AI is expected to enable Wall Street to shed 200,000 jobs over the next 3-5 years. I don’t know how the cuts will be spread out among the tranches of wage earners, but there will probably be fewer of them helping drive higher-end real estate. I don’t mean to sound dramatic here since AI will only impact about 3% of Wall Street’s workforce. I’m just placing a marker in the timeline.

Final Thoughts

This economy fails to disappoint when we speak about unemployment and wages. While readers of my Housing Notes may not wholeheartedly agree with me, I do try to look at the bright side of life. Right now I feel I am being tested while walking in the middle of the road.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Wall Street Banks Poised for Biggest Boost to Bonuses in Years [Bloomberg (gift link)]

- 🌞Not Your Grandpa's Boca [Highest & Best]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 12-2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Queens Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 12-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 4Q 2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 12-2024 [Miller Samuel]