Lets Not Cry About It: Mortgage Rates Might Not Drop Much This Year.

The Administration’s Call For The Fed To Cut Rates With Raise Inflation

The Administration Is Looking To Walk Back Tariffs To Save Face

Not Much Chance Of Big Mortgage Rate Drops This Year

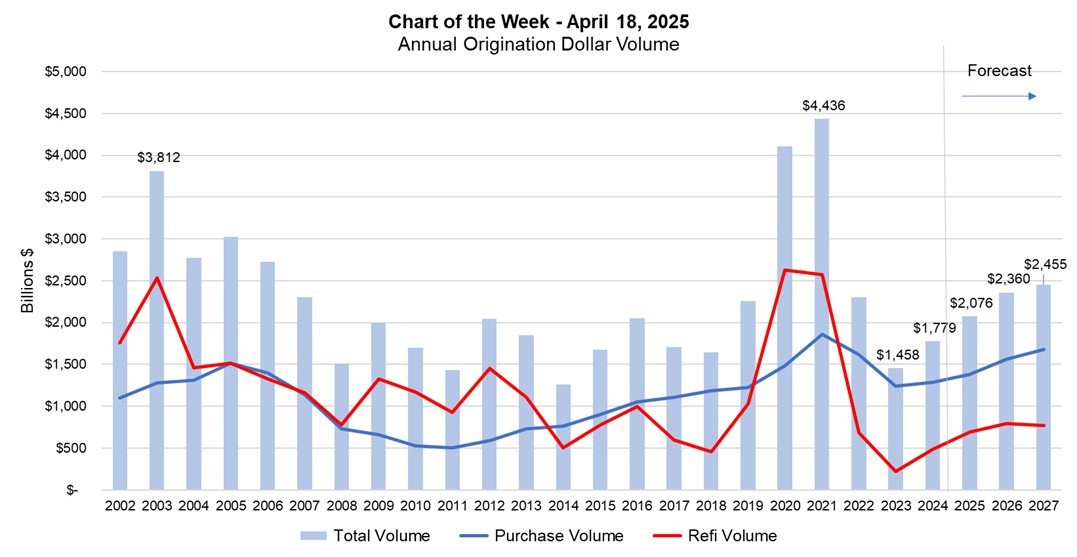

I haven’t talked about mortgage rates much in the past month, as the Tariff Tantrums have taken up all my bandwidth. Let’s set the stage for the outlook of mortgage rates: Tariffs are now 10x the levels of a year ago, the highest in a century, while recession odds have surged. If the current administration proceeds with the “all tariffs, all the time” initiatives, they should be thought of as an economic hand grenade, not a quick way to reshore manufacturing. The current level of pessimism towards manufacturing right now is unusually negative. Today, the Mortgage Banker’s Association (a trade group, so I’d be extra skeptical) forecasts higher purchase mortgage volume over the next 3 years. In my mind, that strongly infers lower mortgage rates are coming which means a lot more economic weakness is coming too.

Trump Looking To Walk Back Tariff Policy

It looks like the Trump administration is rethinking the “all in” tariff policy because it is not going well. As I like to say, what was thought to be an 8-dimensional chess match is really just basic checkers. The basic understanding that tariffs are a tax on the American consumer has been lost. It would assume he needs a fall guy to take the blame for this growing policy failure, and it looks like it is going to be current Fed Chairman J. Powell (a Trump appointee), whose term expires in 2026. He’s been a steady hand and remained fairly detached from Washington politics. Tragically, the administration is calling for the Fed to cut rates right now without understanding that this will bring in more inflation, which will raise mortgage rates – something the housing market does not need, and econ 101 clearly teaches us. The idea that there is a renewed focus on the Fed now suggests that the administration is looking for ways to walk back tariff policy. After all, tariffs are largely credited for making the Great Depression last longer.

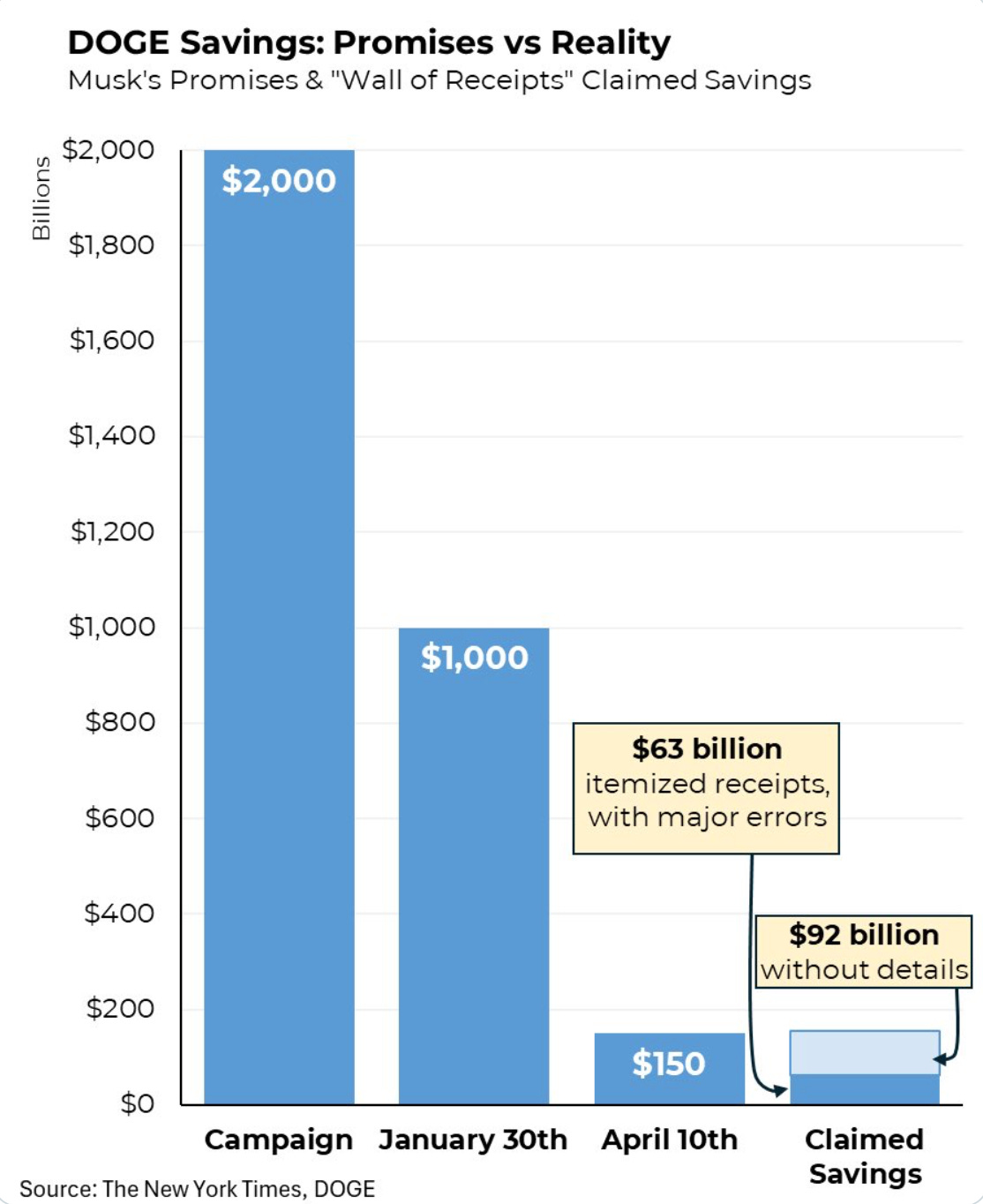

DOGE Saving Have Been Nominal

The administration promised tariffs would flood the U.S. with revenue, but the administration is currently learning that belief would defy basic economics. The same applies to Musk’s DOGE efforts. The much-touted cost-cutting effort has actual results that have been incredibly nominal relative to the size of the federal budget so the economy is not going to be rolling in money as suggested (without factoring in the big tax cut expected for the wealthy.)

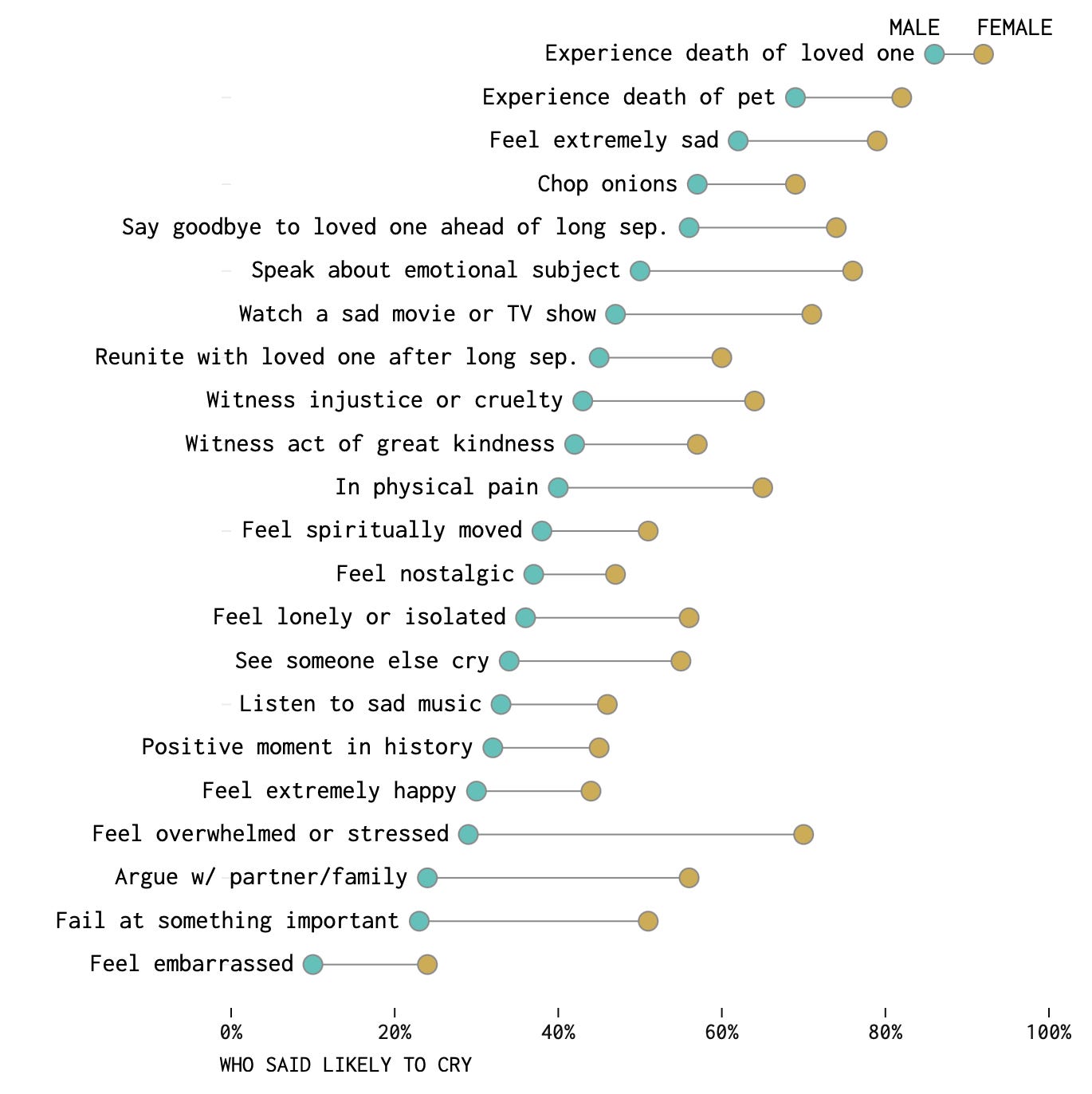

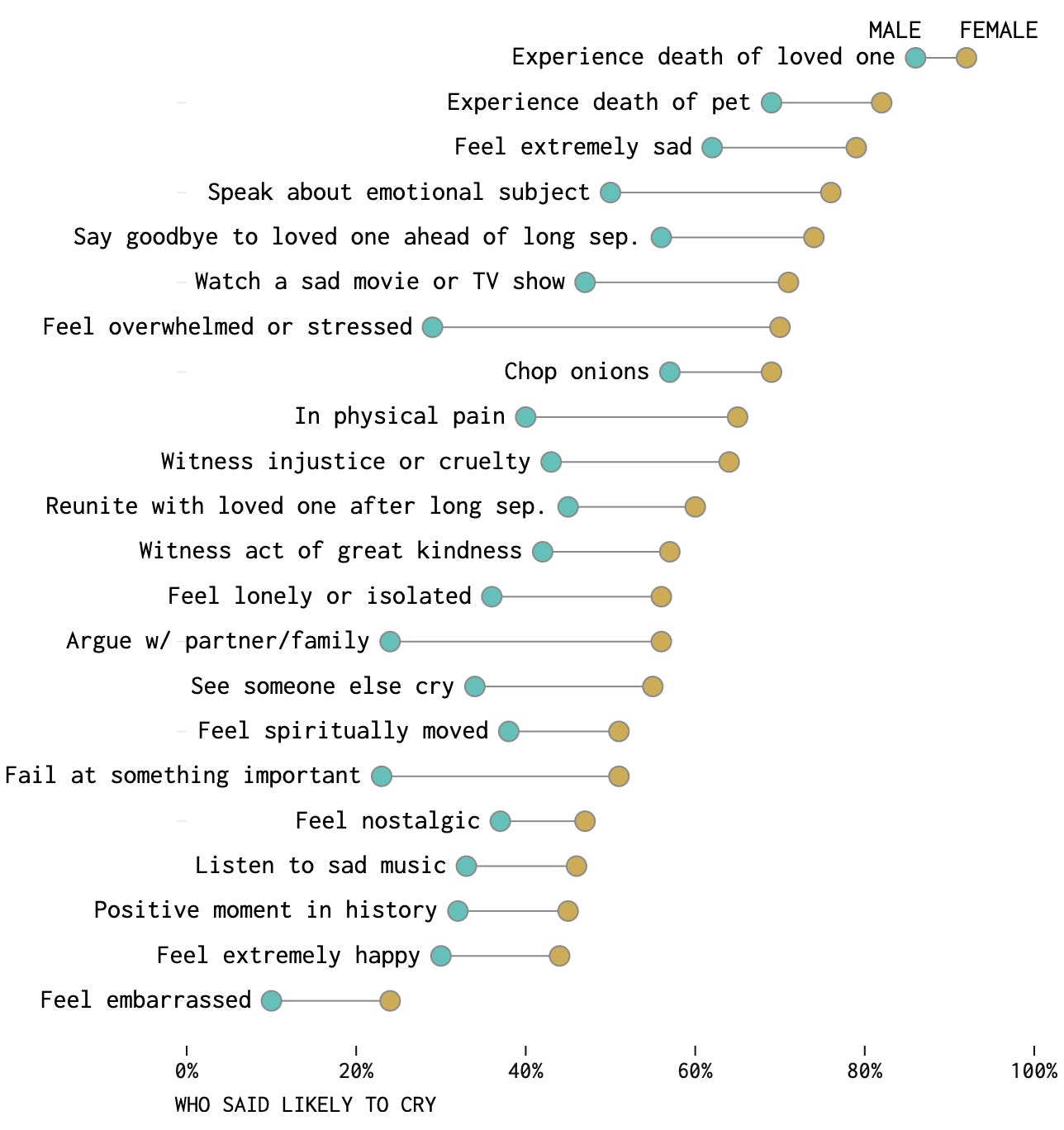

Let’s Not Cry About High Mortgage Rates

Flowing data has some great images about why we cry.I don’t see mortgage rates or the affordability of housing on the list, so I would probably group both under the category “feel overwhelmed or stressed.”

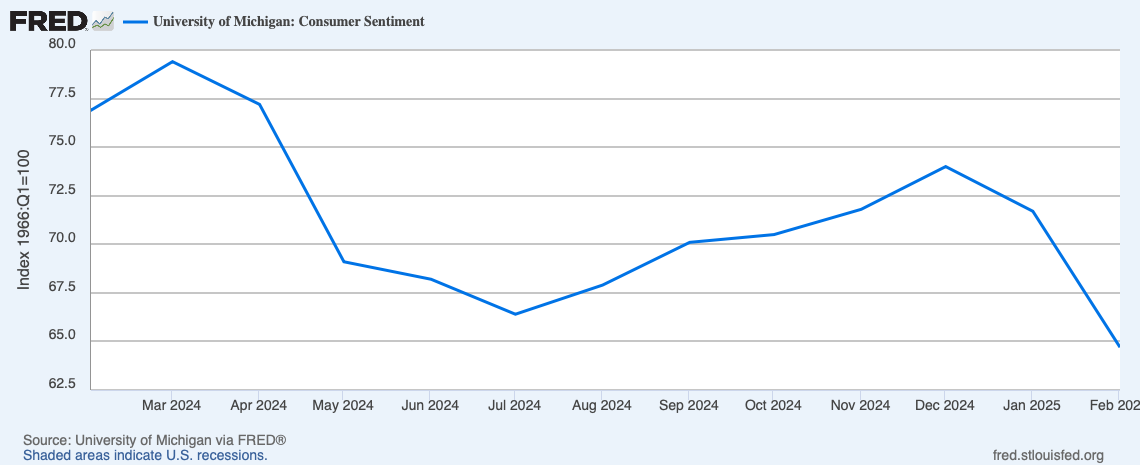

We are seeing the soft indicators like consumer sentiment drop and the odds of a recession rise. These are all favorable conditions for lower mortgage rates eventually if the current tariff policy is scaled way back as the economy continues to buckle under the heavy load of uncertainty I’ve conveyed here in the past couple of weeks.

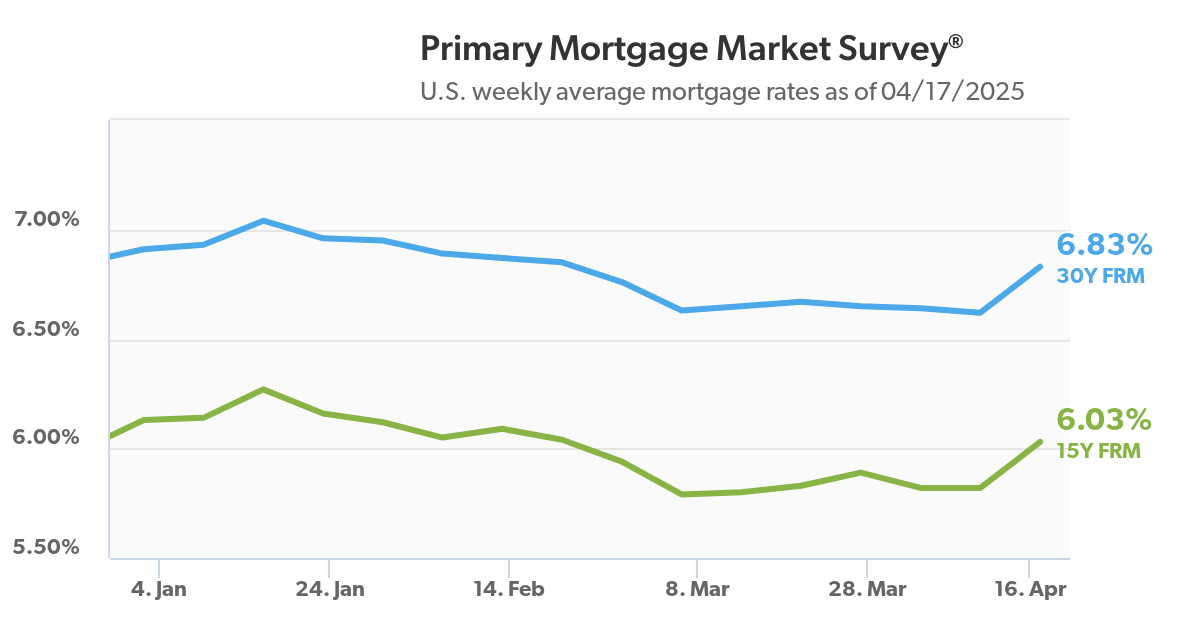

To be clear, I don’t think mortgage rates will fall sigificantly this year, with or without tariffs (but who really knows?) With the economic insanity of the past few weeks, mortgage rates are rose slightly.

Final Thoughts

I can’t wait until this Tariff Tantrum era ends (wishful, I know) because it is dominating my thinking, mainly because it is all so dumb and its potential for economic damage is significant. We’ve already destroyed 80+-year-old relationships with all of our allies, and that alone will translate to higher inflation in our economy.

The administration is starting to look at ways to pull back from this policy stumble if they can save face. If that happens, I suspect mortgage rates will begin to slide. But of course, who knows???

The Actual Final Thought – I literally have none today. Tariffs are exhausting.

Did you miss the previous Housing Notes?

April 17, 2025

Amid Housing Economy Confusion, Perhaps Compass Is Purchasing BHHS After All?

Image: Gemini