Time to read [7 minutes]

- Tariff Damage To The Economy Is Evident From Significant Job Loss

- Job Loss Has Been Significant Since Implementation Of Tariff Policy

- The Odds Of Lower Mortgage Rates Soon Just Got Better

For the past few months, we’ve been waiting for tariffs to impact the economy adversely, but have been scratching our heads as the hard data have shown pretty solid economic numbers…until now. We saw empty ships from China in US ports, college graduates struggling to find jobs, and the labor participation rate at nearly a three-year low, while the president continues to threaten the world with tariffs to counter trade deficits. Now tariffs are being applied to countries that have a trade surplus, contradicting the explicit economic sales pitch used for tariffs. Nearly all the touted revenue generated from the US tariff policy is paid by Americans, so those billions claimed to be collected by our government are actually being paid by you. Here’s how bleak the job picture looks, which could lead to lower mortgage rates.

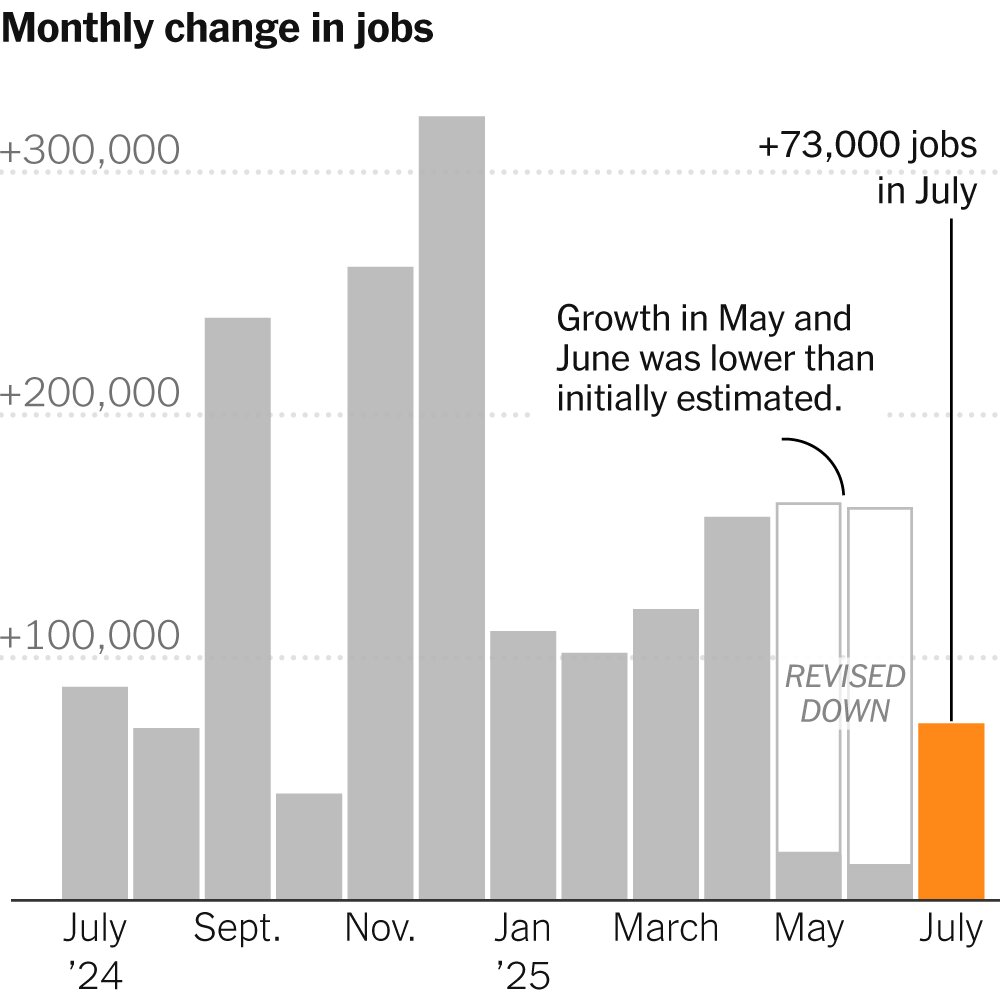

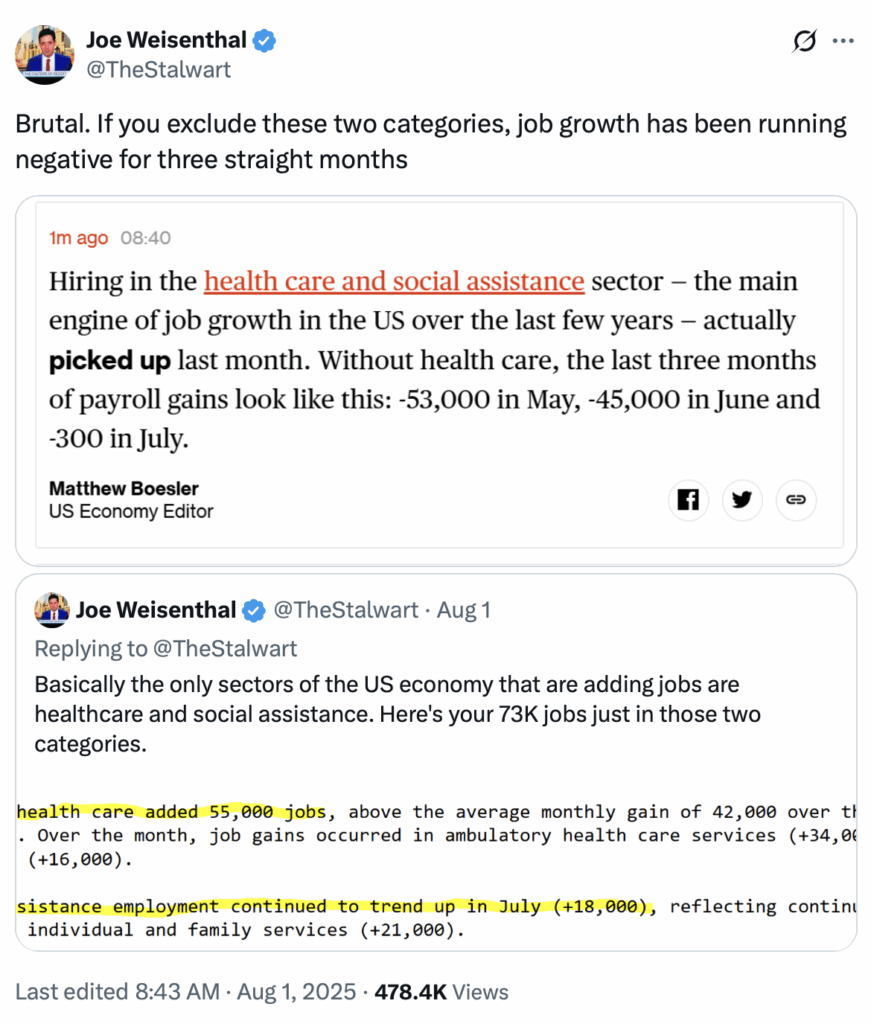

Now we finally see weakness in the data. The July jobs report revealed that the economy has been very weak since at least May, following data revisions. The jobs report showed how much the Tariff Tantrums were damaging the US economy. To counter this messaging, the president decided to fire the head of the independent agency that produced the July jobs report to control the narrative. This firing will damage the credibility of federal economic data in the future, but will ultimately fail to hide the weaker trends developing in the economy. The president’s focus has been on lowering interest rates to reduce the cost of the One Big Beautiful Bill (OBBB), with significant criticisms directed towards the Fed chair.

But how can economic data be trusted going forward if experts are quickly removed when the president doesn’t like the results? Given the downward job revisions of May and June, as noted in the chart above, I wouldn’t be surprised if July is revised downward if that’s even possible in the new world. It is important to note that tariffs were implemented in early April, which pushed a robust economy off the rails by May.

Some Sectors Dominated The Jobs Report

Why this jobs report was so bad that firing the report preparer won’t keep the weakness hidden…this is probably good for housing if mortgage rates drop.

Lower Mortgage Rates May Come Earlier Than Expected

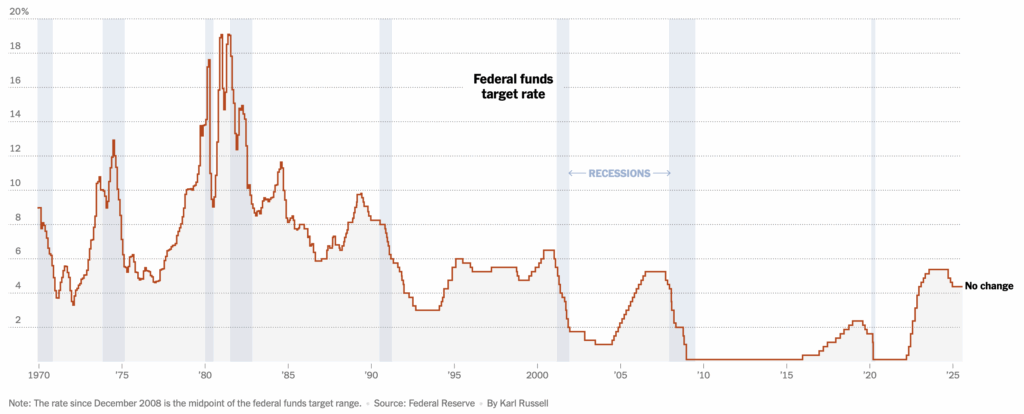

What does all this job market hand-wringing have to do with the housing market? With the July jobs report, everyone woke up at the same time about how quickly the US economy is deteriorating. With the Fed holding rates firm last week [gift link] and this new data showing how damaging tariffs have been to the economy, we may see mortgage rates slip more quickly after remaining stuck at a consistent level for about three years. Ironically, about this time last year, something called the Yen Carry Trade blew up, giving the expectation that mortgage rates were going to fall soon. They didn’t, but this time the eye-opening was related to fundamental economic conditions rather than a niche Wall Street trade.

While the Federal funds rate isn’t linked directly to mortgage rates, it can influence them. Before the July jobs report opened everyone’s eyes, the concern was that an early or excessive rate cut would spike inflation. The just-documented deteriorating job conditions now suggest there is a greater probability of lower mortgage rates by the end of the year. The way this can work is that worried investors move from stocks into bonds. The move pushes bond prices higher, which lowers yields. Mortgage rates are tied to bond yields, and lower mortgage rates would be helpful to housing volume if unemployment doesn’t surge.

The President’s Tariff Powers Don’t Exist

My friend Barry Ritholtz wrote a “banger” (his description!) of a post on the legal battle being waged by 12 states and several small companies against the president in the case V.O.S. Selections, Inc. v. Trump. According to the US Constitution, only Congress has the authority to implement tariffs. Framers of the Constitution didn’t want one individual to have the power that the president assumes he has, and is behaving the way he has. Back in May, the plaintiffs won their case to stop the tariffs from being implemented, but the administration immediately appealed, and the appeals court granted a stay. Both parties presented their cases in court in late July as part of the appeals process, and early feedback suggests the courts are not in favor of the president’s interpretation.

Over time, while Wall Street reacts to the Tariff Tantrums, it has learned to have a more “muted” response after their initial introduction last April. If the plaintiffs win on appeal, I’ll bet the financial markets will love the ruling.

Final Thoughts

We are living in a frustrating economic period that is damaging our relationships with nearly every country in the world, including our closest allies and trading partners and we will pay for it in the coming decades. Our bad behavior will have long-term consequences, potentially lowering our standard of living. The new scenario unfolds with higher prices resulting from the tariffs, which in turn reduce the buying power of the American consumer. Lower wages and a lower GDP will also be a reality in a peak tariff world.

In the near term, Tariff Tantrum damage has already been documented in the latest job report, which will probably pull mortgage rates lower, perhaps into the low 6s by year-end.

I hope that the court decision will find the current tariff policy unconstitutional – early signs suggest this will happen. Such a decision would remove the tariff chaos and its associated higher costs, and remove significant uncertainty from our housing market lives. Pardon me for saying, but this all seems so unnecessary and dumb.

The Actual Final Thought – Did I tell you I love the Oxford Comma? Not just because it is a great Vampire Weekend song, but it also keeps you from from telling everyone you’re eating the dogs in this fake mag cover…

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The From Ground Leases And Walk-Ins To The Blizzard Of Oz episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- Might Tariffs Get "Overturned"? [The Big Picture]

- Trump Escalates Fight With Brazil, Taking Aim at Its Economy and Politics [NY Times]

- Tracking Trump’s Tariffs: Rates for China, the E.U. and More [NY Times]

- Fed Holds Rates Despite Internal Divisions and Political Pressure [NY Times]

- New Bill: Senator Raphael G. Warnock introduces S. 2322: Appraisal Modernization Act [Quiver Quant]

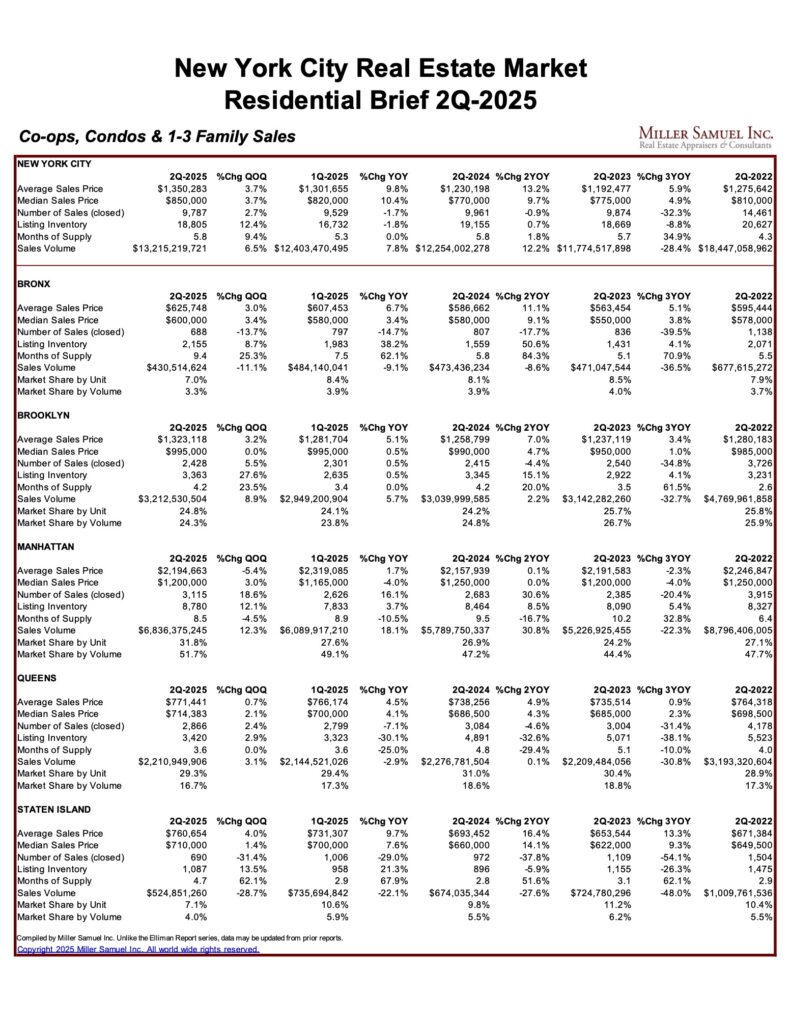

Market Reports

- Elliman Report: Long Island Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Hamptons Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: North Fork Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Los Angeles Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Orange County Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)