- With The Collapse Of Mortgage Origination, HELOCS Have Surged

- HELOCs Enable Home Equity Withdrawal But Keep Low Mortgage Rate

- Lock-In Effect Has Been Powerful Source Of Distortion In Housing Market

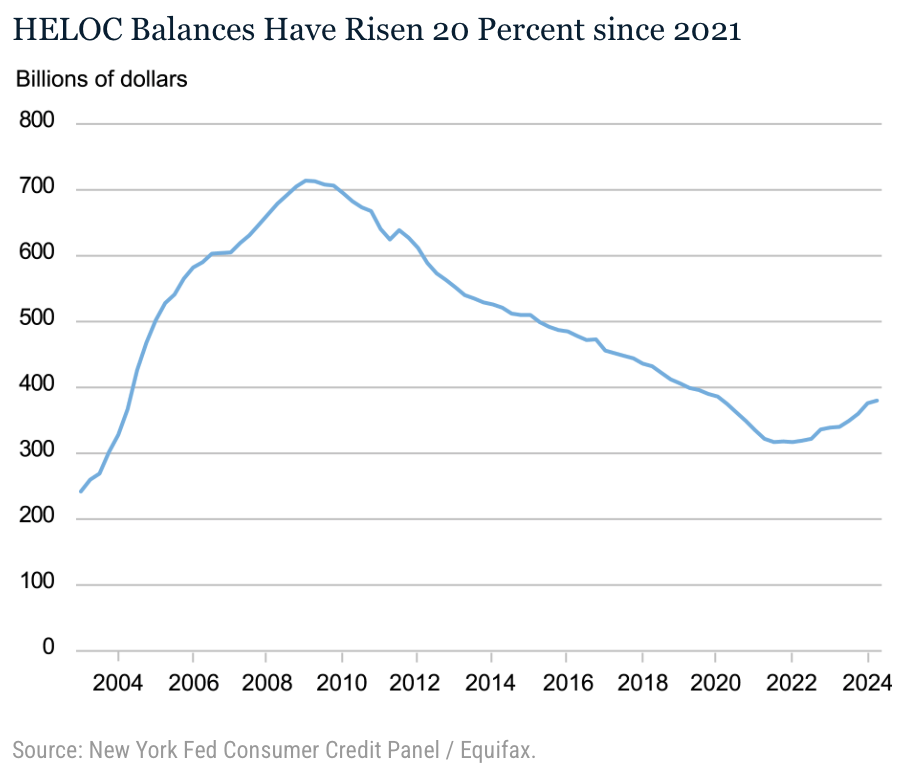

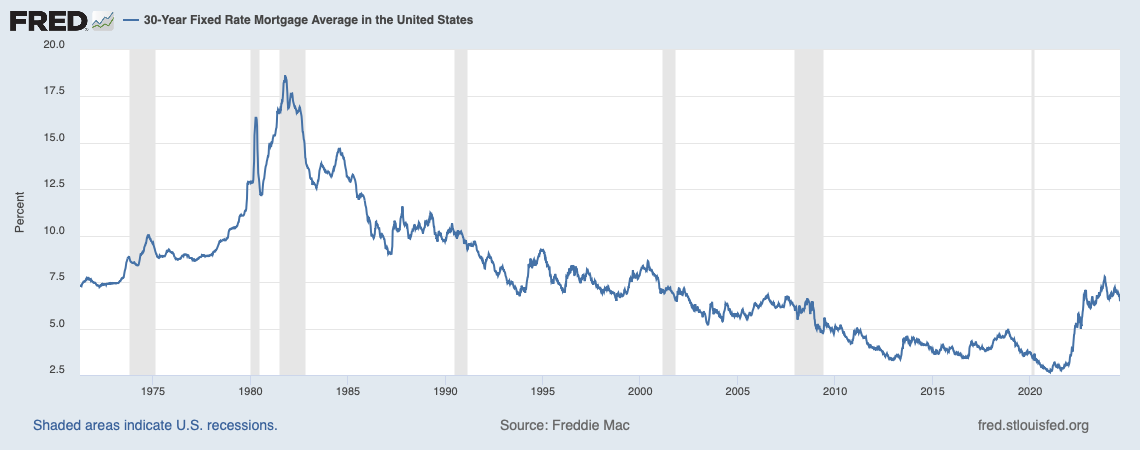

Mortgage rates fell to a fifteen-month low, but they still remain quite high compared to the prior twenty years. As a result, mortgage origination has collapsed, representing $374 billion in the most recent quarter after averaging $1 trillion per quarter from 2021 to 2022. Home equity lines of credit (HELOC) have jumped 20% since the end of 2021. Why on earth would HELOCS rise in popularity with higher mortgage rates after having fallen for 13 years?

Let’s back up a minute to fill in the blanks…

The New York Federal Reserve’s Liberty Street Economics blog always has interesting stuff to read for wonks and non-wonks, including a recent post in particular: Mortgage Lock‑In Spurs Recent HELOC Demand.

As a reminder, mortgage rate lock-ins have become a key characteristic of the U.S. housing market over the past year. Those who now enjoy a 3% or 4% mortgage rate have been hesitant to list their homes for sale because they become buyers paying double the mortgage rate to get less for their money. Housing prices generally haven’t fallen much and, in fact, are rising in many markets because supply remains constrained (some markets more than others). FHFA, the regulator over Fannie Mae and Freddie Mac, issued a terrific white paper on the lock-in effect that is worth reading: The Lock-In Effect of Rising Mortgage Rates.

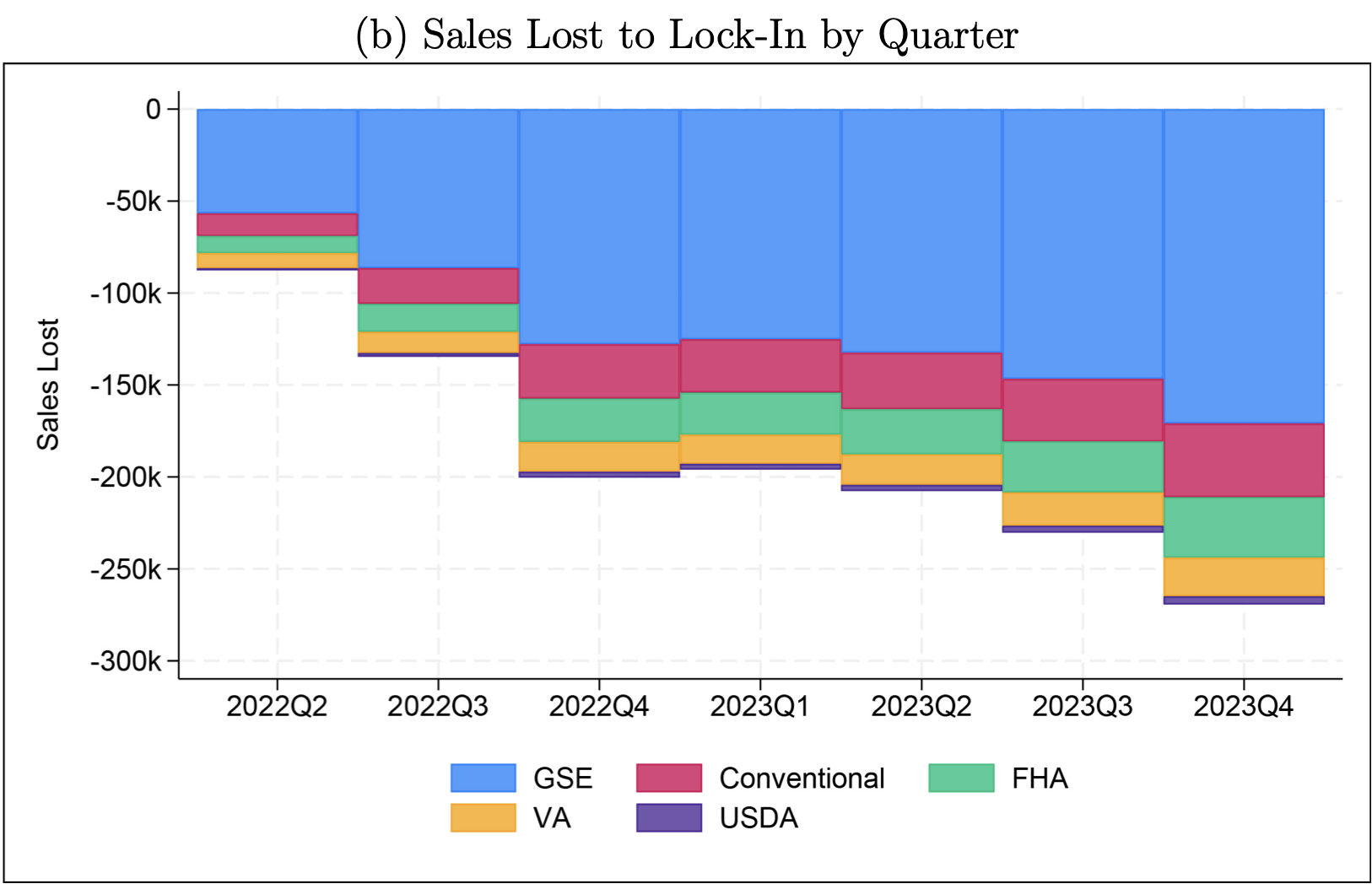

The surge in mortgage rates due to the lock-in effect restrained sales significantly because of the collapse of listing inventory and the drop in affordability. The amount of sales lost during each quarter was staggering during the last two years.

Homeowners Walking Around With Lots Of Home Equity

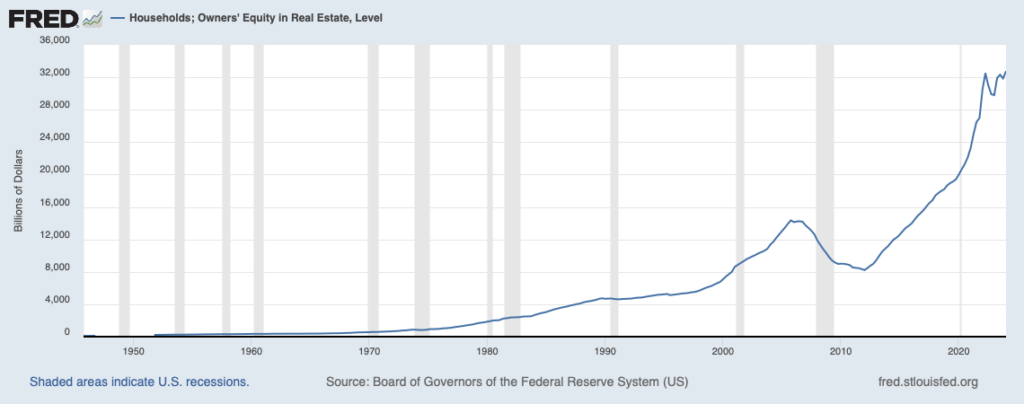

With the surge in housing prices came the surge in home equity. This is a stark difference from the housing bubble era, where foreclosures and short sales were a huge phenomenon. That’s because home equity did not rise nearly as much then as it did in this cycle.

Drop In Cash-Out Refinances Explain More HELOCs

The cost of getting a mortgage has risen due to higher rates, and so has the cost of obtaining a HELOC. About 60% of mortgages were refinanced by early 2022, when the Fed pivot occurred before rates were pushed steeply higher.

In order to extract equity out of their homes after the pandemic era’s upward surge in housing prices, cash-out refinances were the more popular route and had been for years. However, there was a period during the housing bubble when HELOCs staged a minor comeback because there were seemingly little to no rules on their issuance. That’s all been tightened up now.

Cash-out refinances were a much easier decision to make when mortgage rates were falling (for nearly four decades).

When mortgage rates began to surge in 2022, the lock-in effect chilled cash-out refinance volume, and consumers began to pivot towards HELOCs. Yes, HELOCs are more expensive than they were three or more years ago with higher rates, but obtaining one doesn’t require giving up that sweet, low mortgage rate from the pandemic era.

HELOCs provide homeowners with an alternative way to extract that housing wealth—and enable them to retain their lower-rate first mortgage. Given record levels of home equity and the undesirability of cash-out refinancing, one may actually wonder why we are not seeing a larger surge in HELOC originations.

New York Federal Reserve

Final Thoughts About The Walking Bacon Opportunity

The lesson learned here from the New York Fed study is that the mortgage rate lock-in effect that resulted from the spike in mortgage rates over a short period has been a powerful market force. It restrained supply and modified consumer behavior quickly. Consumers changed their behavior to access their home equity via HELOCs over cash-out refinances because they remained focused on not losing that amazingly low mortgage rate.

Important: Being able to keep a low mortgage rate but still be able to withdraw home equity can be explained through bacon (as most things can).

Did you miss yesterday’s Housing Notes?

August 8, 2024

Manhattan Rents Peaking, Poised For Weakness, As Fed Policy Ready To Pivot To Sales

Image: Chat & Ask AI

Housing Notes Reads

- Mortgage Lock-In Spurs Recent HELOC Demand [Liberty Street Economics]

- Homeowner Equity Rises Across the United States [CoStar]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]