- Home insurance costs are heavily influenced by how tough the state regulators are

- Relationships between cost and risk of the location are becoming disconnected

- Insurance such as protection against wildfires, is now unavailable in some markets

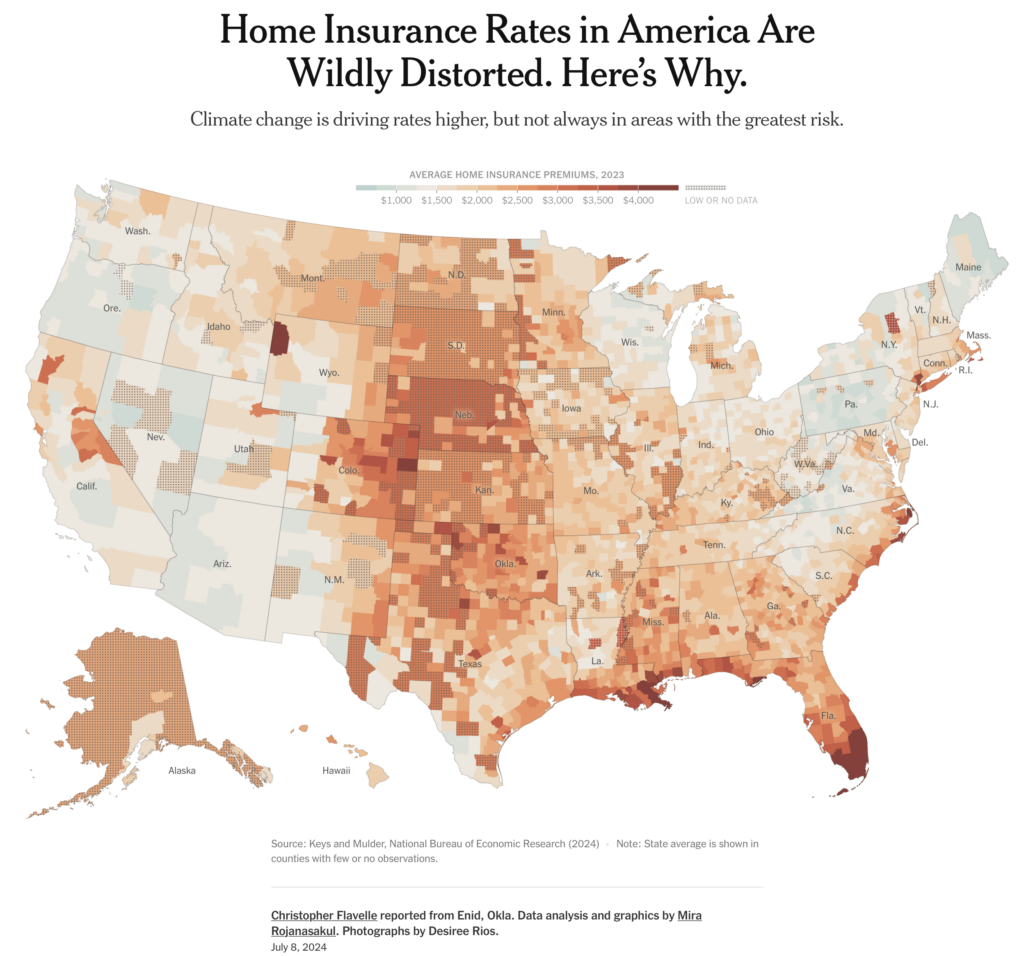

The spike in mortgage rates over the past two and a half years has heightened attention on the cost of homeownership. Homeowner’s insurance premiums are surging and to many, the relationship between risk and the cost of housing doesn’t seem to make sense.

There was a blockbuster New York Times front-page story on homeowners insurance that looked at premium size, location, and where the areas of highest risk are. When a New York Times headline includes one of my favorite words “wildly” then you’d better pay attention.

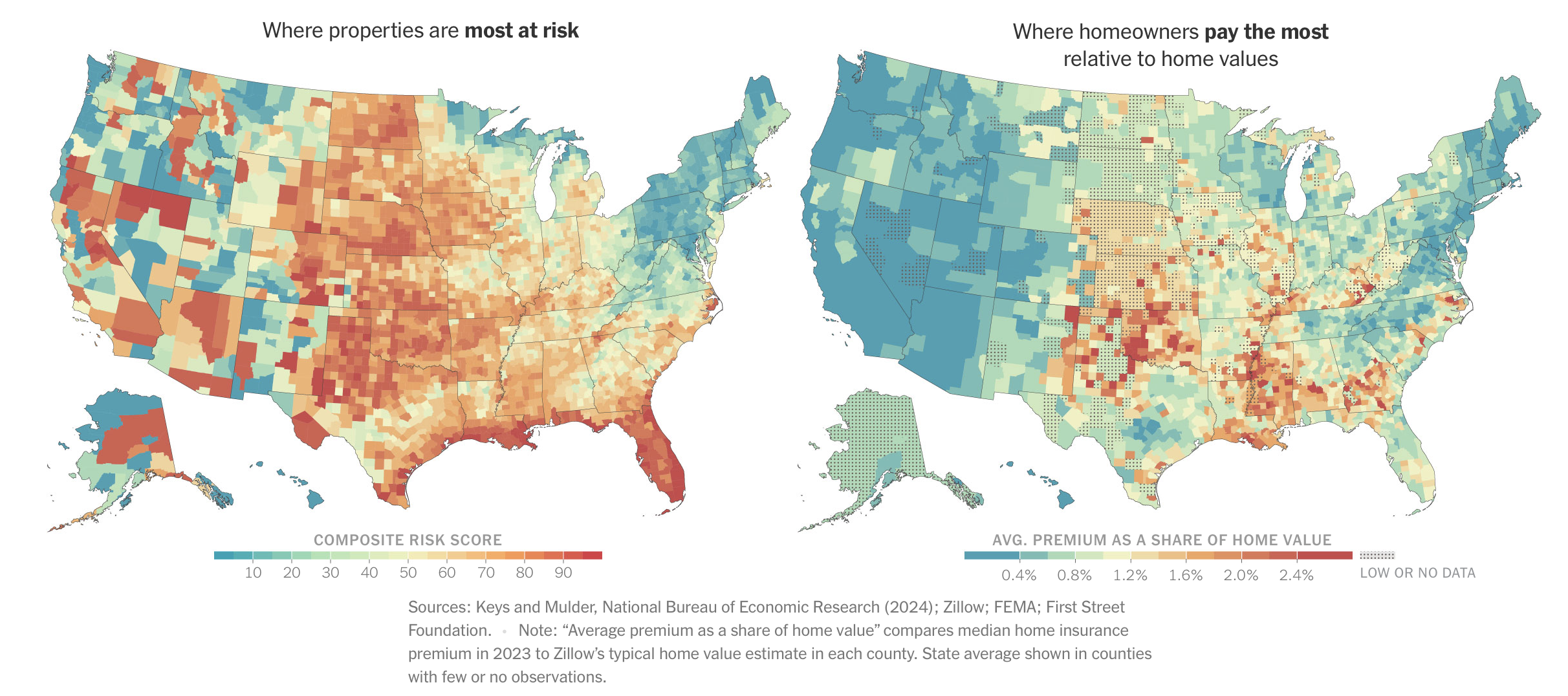

The areas with the highest risks, don’t pay the most for their home insurance.

Higher premiums are being charged in states where regulators apply less scrutiny to requests for rate increases, compared with states where officials question the justifications offered by companies and try to keep rates low, the research shows.

New York Times

While higher-cost homes cost more to replace than lower-cost homes, the study looked at the cost of insurance relative to the cost of homes. This is where the distortion appears. And there is a lot of new data showing premium costs are rising rapidly.

But in California, which suffered through more than 7,000 wildfires last year, the typical homeowner in many ZIP codes paid premiums as low as .05 percent of home value. By contrast, in parts of Alabama, Oklahoma, Louisiana and Texas, the average homeowner faced home insurance premiums greater than 2 percent of the value of local homes.

New York Times

But Wildfire Insurance Coverage Is Disappearing

Over the last year and a half, there have been a lot of insurance discussions in the Los Angeles region about the inability of homeowners to obtain wildfire coverage on their homes, specifically in areas at risk like Malibu.

The insurance market in California is heavily regulated at the state level. Insurers are largely forbidden from using forward-looking models to price insurance risk, or from factoring their own rising reinsurance costs into the price of their consumer insurance products.

Hollywood Reporter

Climate Change Is An Insurance Thing

The before and after photos of this Nantucket home over 26 years are shocking.

The headline of this recent article screamed at me: Our home was worth $2m. We were forced to sell it for a tenth of that. After looking at the before and after photos, I think I understand why someone would pay $200,000 for a home that is likely going out to sea in about two decades. That price works out to about $10,000 per year which seems reasonable as an annual lease rate for the location – assuming the erosion rate doesn’t accelerate. The hard part is going into this deal knowing the home has a finite ending and there is no passing it along to their family.

Final Thoughts

The rising cost of home insurance is being made more critical given the spike in mortgage rates over the last two and a half years and the higher frequency of weather events.

Please answer this question for me: Why does FEMA encourage housing locations in high-risk areas by subsidizing the premiums so much that the private sector can’t compete?

Did you miss yesterday’s Housing Notes?

July 15, 2024

World’s Worst Kept Housing Market Secret: Real Estate Reality Shows Aren’t

Image: Chat & Ask AI

Housing Notes Reads

- Property Insurance and Disaster Risk: New Evidence from Mortgage Escrow Data [NBER]

- L.A. Homeowners Are Finding it Harder to Secure Wildfire Insurance [LA Mag]

- California's home insurance crisis: What went wrong, how it can be fixed and what owners can do [LA Times]

- As Insurers Flee Some of California’s Wealthiest Areas, Homeowners Are Left Holding the Bag [Hollywood Reporter]

- FEMA is being sued for making flood insurance too expensive—and too cheap [GovExec]

Market Reports

- Elliman Report: Brooklyn Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 6-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)