Inland Hurricane Insurance Coverage Was Ignored Or Maladjusted

Helene Hit Seven States Hard But Only 0.8% Of Inland Homes Had Coverage

Many, If Not Most, Can’t Afford To Rebuild After The Storm’s Flood Damage

Many More Fatalities In Storm’s Path North Of Florida

Helene, one of the biggest hurricanes in 50 years, brought renewed focus on flood and disaster insurance. Of the seven states hit by Helene, 21 percent of the homes in coastal counties had flood insurance, but only 0.8% of the homes located within inland counties had flood insurance. Homeowners’ insurance policies essentially don’t cover floods, and many homeowners can’t afford both types of coverage. FEMA dominates coverage through its National Flood Insurance Program, and homes that flood once every 100 years (1% chance per year) are required to have coverage if they have a mortgage. (Speaking of disasters, I wrote this post on the commuter train into Manhattan and forgot my reading glasses).

I took the above photo of a house on stilts overlooking Long Island Sound, near my previous home in Connecticut, after Hurricane Sandy in 2012. Every other house in the neighborhood was raised to the average mean flood level to qualify for flood insurance coverage. Those who didn’t raise their homes likely couldn’t afford to since the flood insurance only covered a modest amount of the cost of rebuilding.

The above photos are a stark reminder of what inland flooding looks like. I think most people assume that flooding only occurs on the coast and don’t have enough or any coverage.

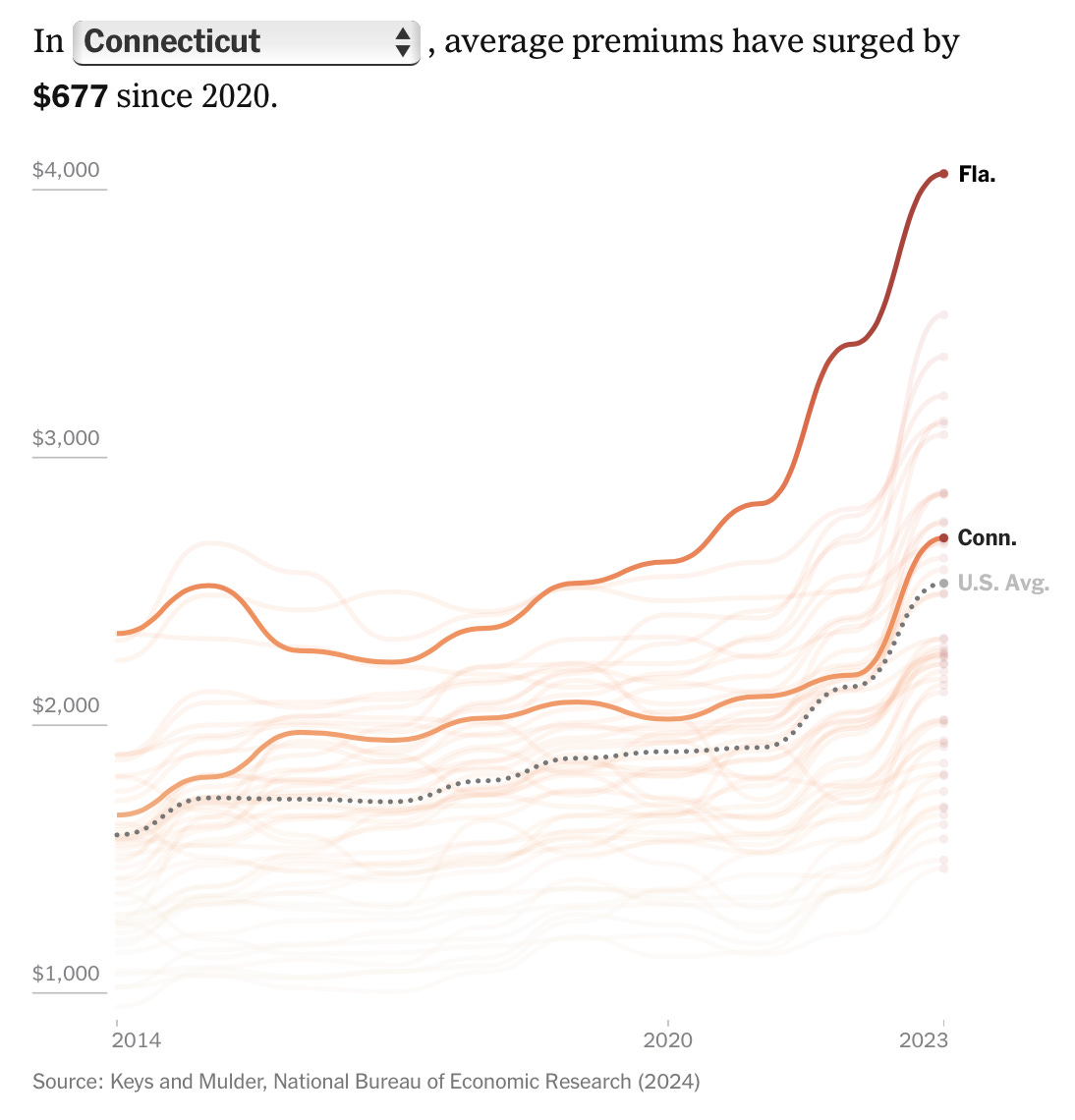

Flood Insurance Costs Are Surging, And Coverage Is Often Limited

While Florida coverage costs are the highest, my state of Connecticut and most others have seen costs surge since 2020. New York County (Manhattan) has seen insurance costs surge 87.3% since 2020.

To Fight Costs, A Scapegoat Is Born

60 Minutes broadcast a story about insurance adjusters who became whistleblowers to expose the disservice insurance companies were providing to their clients: Whistleblowers claim insurance companies shortchanged some Florida homeowners after Hurricane Ian. A flood insurance adjuster estimated the cost to repair a flood-damaged home at $231,368.57. The flood insurance company dropped the coverage to $15,469.48 without a reason and did not tell the adjuster. The family was angry at the adjuster, who had no idea his claim estimate was doctored. Apparently, this practice is common. Click on the image to see the recent 60 Minutes episode.

This sounds familiar. As an appraiser during the housing bubble, banks or mortgage brokers who didn’t like the credit condition of a borrower or something about the house would often tell the denied applicant that the appraiser came in too low and killed the deal, even though the appraiser didn’t. Based on my conversations with my local colleagues this happened hundreds of times that we knew about. I can only imagine how many times it actually happened.

Moving Into The Storm Path

One of the by-products of the WFH movement has been increased migration patterns into more exposed locations. High cost housing markets like New York and California have been losing residents to the sunbelt like Texas and Florida which are higher risk locations. The New York Times’ recent visualization piece (gift link) Where Americans Have Been Moving Into Disaster-Prone Areas is quite overwhelming.

After Hurricane Ian in 2022, Swiss RE issued a fascinating report Ian revisited: Disentangling the drivers of US hurricane losses that:

“found that the same storm would have been far less catastrophic — and expensive — if it had struck decades earlier. The biggest reason: Many more people, homes, businesses and other assets were now in the hurricane’s path.”

Final Thoughts On Stormy Weather

I have no idea if this TikTok nighttime meme post-Helene is real, but it reminds me of that well-traveled North Korea nighttime meme a few years back.

We are slowly learning a few things about hurricanes.

The frequency and severely of extreme weather is rapidly increasing

Insurance companies are being pressed on costs, writing down claim estimates

Coverage is getting a lot more expensive, and companies are dropping out

Inland hurricane damage is a massive addition to coastal damage

The WFH movement has relocated millions of people into harm’s way

On a lighter note, I have some different “stormy weather” songs to enjoy:

The Pixies (fave)

Did you miss yesterday’s Housing Notes?

October 3, 2024

Homeownership Is Not A Given And It Can Be Taken

Image: ChatGPT