- The Disparity In The Quality Of Florida’s Housing Stock Is Expected To Widen

- The Long Term Challenge Is The Broader Cost Coverage Of Existing Homes

- Florida Has Some Of The Strictest Building Codes In The U.S.

At some point, the rinse-lather-repeat quest for flood insurance coverage is going to become nearly impossible without rethinking the system. Costs are soaring, yet FEMA rates are lower than they should be, significantly undercutting private insurance carriers. This practice encourages home construction in storm-prone areas, placing unnecessary risk on the shoulders of U.S. taxpayers. It is a reflection of the disjointed federal government effort to support the American Dream of homeownership. I’m all for the dream in principle – my sons have owned five houses already – but insurance challenges will continue to exaggerate the disparity of U.S. housing: new hurricane-proof housing stock versus the remainder.

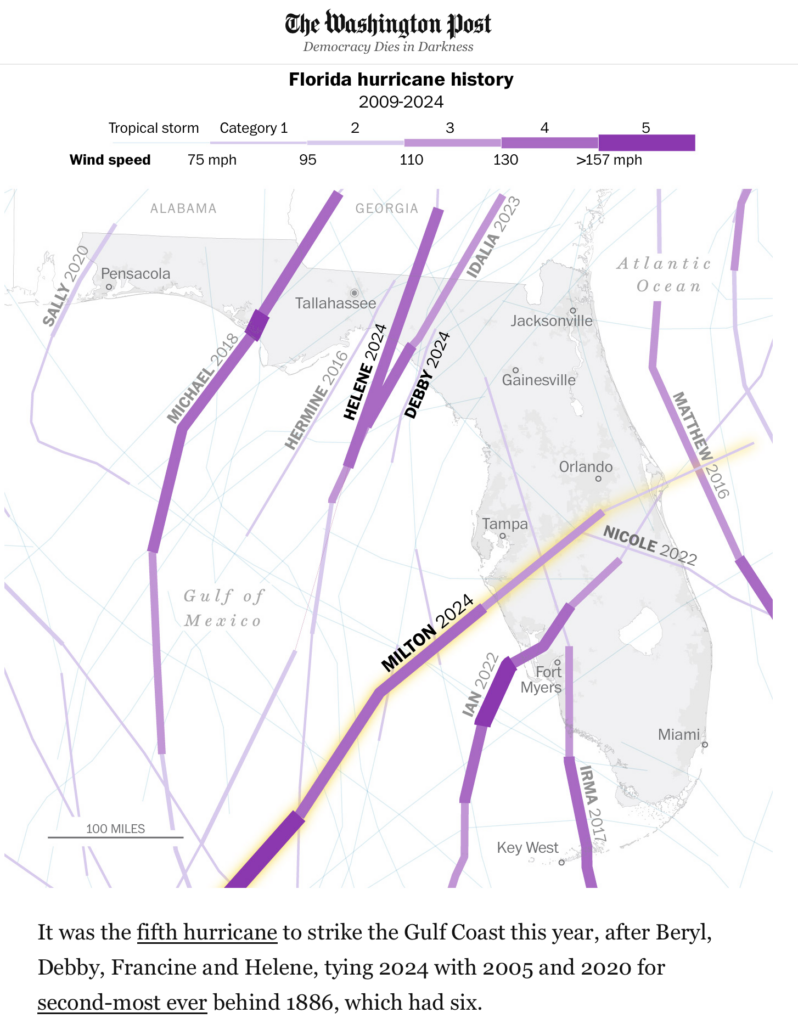

The current state of Florida’s insurance pool is being stretched to the limit, weakening the ability to back up insurance companies that offer coverage. Milton was forecasted to cause $100 billion in damage, but it looks like it may be as low as $60 billion, yet that isn’t “low.” We will probably see a surge (sorry) in hurricane-proof construction beyond the revamped building codes created in the state after Hurricane Andrew in 1992. The frequency and intensity of storms continue to expand each year, as it has for the past three decades. The higher rate of storms will further polarize the housing stock, with new construction standing up better against adverse weather conditions. In contrast, existing housing stock would continue to generate massive damage claims.

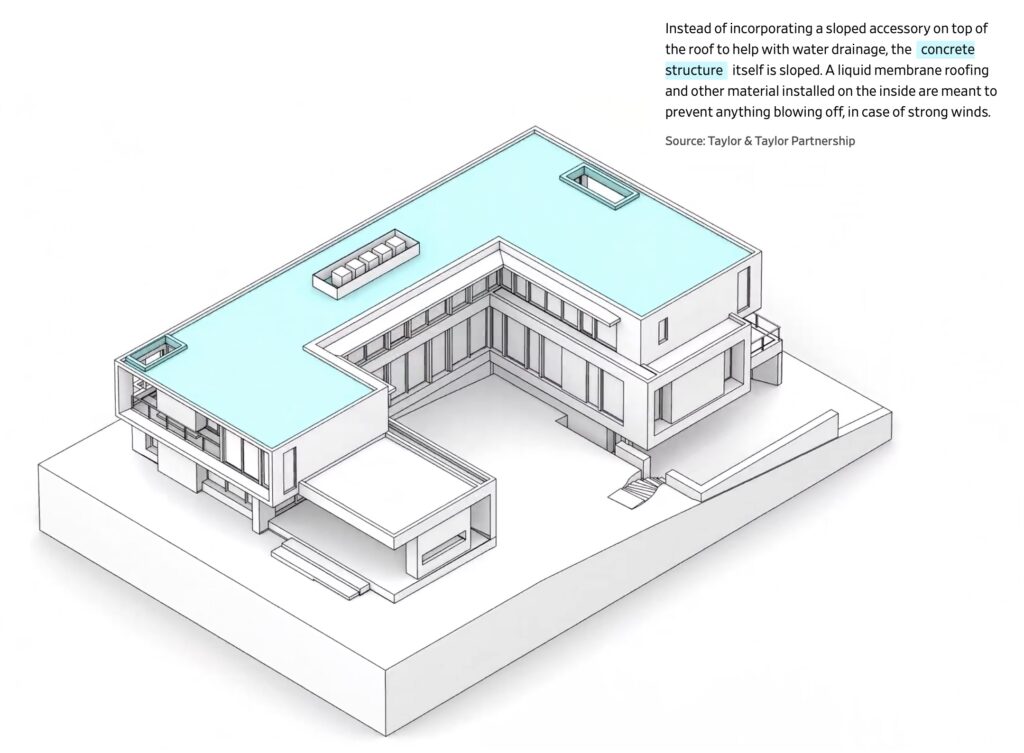

The Wall Street Journal has an interesting piece on this potential new construction solution: The Quest for a Hurricane-Proof House. The article has an interactive graphic presentation of its construction.

The reality of this scenario is that single family homes built to withstand more hurricanes will have to skew towards luxury to be able to withstand the added construction costs. The real challenge to the state will be the millions of single family homes built with standard stick construction at grade level. Think about the Surfside condo disaster a few years ago and the competitive set of 40+ year-old condo buildings. Price trends and demand have already weakened within that submarket relative to the remainder. I have family that lives in a 30-year-old condo development on the ocean side of Florida that is comprised of cinderblock construction with hurricane-proof windows and sliding doors. Ramped-up building codes after 1992’s Hurricane Andrew battered Florida vastly improved the ability of new construction to withstand hurricane conditions.

“Hurricane Andrew in 1992 was the catalyst for stricter building codes mandated statewide one decade later. The storm’s destruction of South Miami-Dade showed that many of the razed homes were shoddily built under weak standards. Now, structures in Florida must be able to withstand winds of 111 mph and higher, while Miami-Dade and Broward buildings must hold steady against winds of at least 130 mph. In the Keys, homes must be built to withstand winds of up to 150 mph.”

I’m not sure luck has much to do with future hurricane damage. Public officials need to make their own luck.

Final Thoughts

An increase in the frequency and intensity of hurricanes to hit Florida has been rising and is expected to continue. That’s the real impact of climate change on the housing market, and banning the phrase won’t stop it. While Florida has one of the strictest building codes in the U.S., the value and cost disparity between existing housing stock and new construction will continue to expand.

“Well this club is formed then!“

Did you miss yesterday’s Housing Notes?

October 10, 2024

NYC Rental Prices Slide, But Our Spidey Sense Is Not Seeing ‘Deals.’

Image: ChatGPT

Housing Notes Reads

- The Quest for a Hurricane-Proof House [Wall Street Journal]

- Shouting Fire in a Crowded Theater – The Big Picture [Ritholtz]

- Average Rent in the US – Rental Market Trends [Apartments.com]

- NYC Apartment Renters Get a Break But Bargains Remain Elusive [Bloomberg]

Market Reports

- Elliman Report: Brooklyn Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 9-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 9-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)