- Housing Markets Following An Adverse Event Tend To See Rising Prices

- LA’s Rebuilding Effort Will Be Hampered By Slow Permitting And A Broken Insurance Industry

- Property Vultures The Swoop In For Deals Are Probably On The Margin

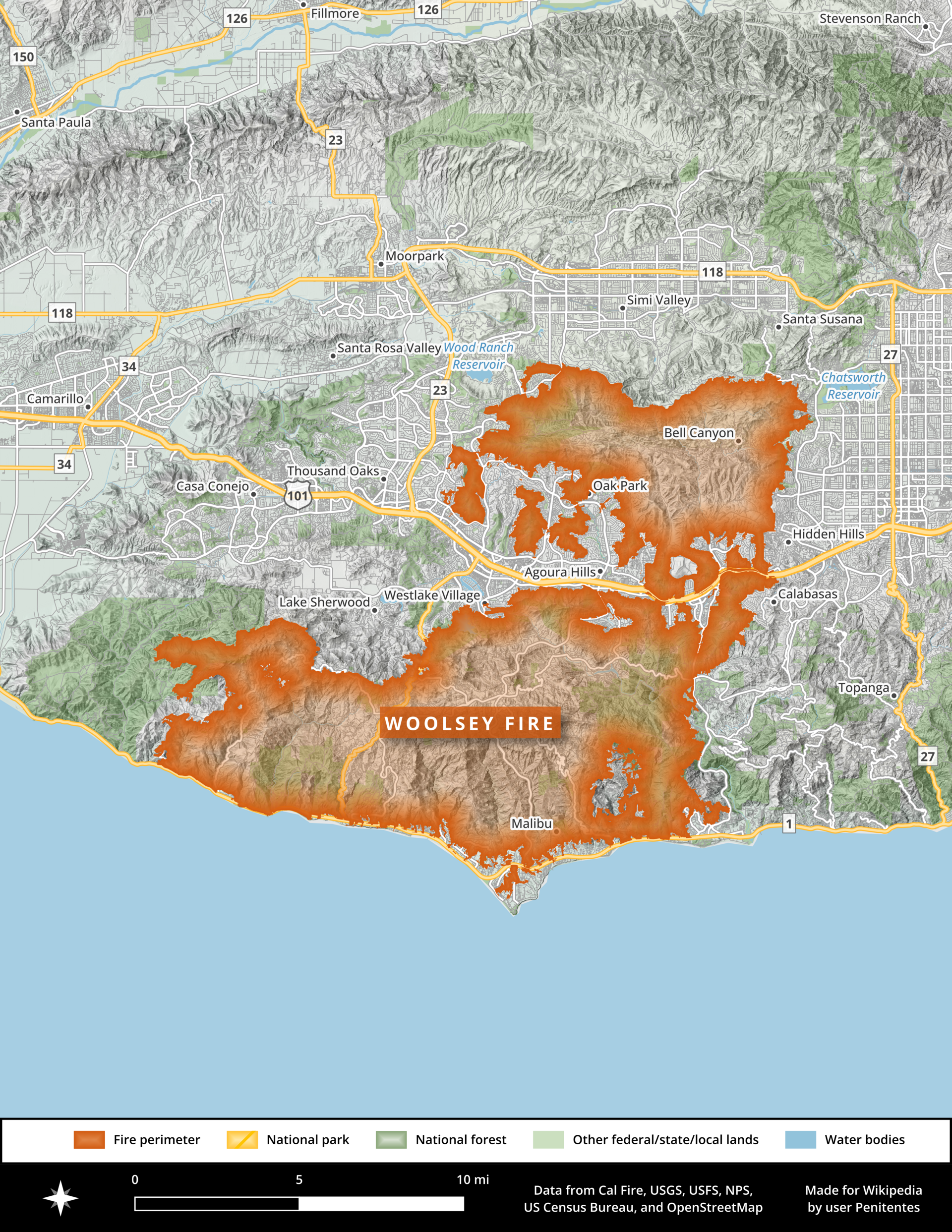

A housing market after a catastrophic event such as a fire, flood, tornado, or significant tax event tends to pause with much fewer sales. Yet, prices usually don’t collapse or even decline. I said before that I observed this in the aftermath of Superstorm Sandy. There is usually an embedded optimism to rebuild and start over. Of course, with the LA wildfires, the issue is really about fixing the insurance industry, but I think there is also an assumption baked into the market that it will be addressed. Perhaps the biggest short-term issue that must be fixed is the length of time it takes to get a building permit – an appraisal friend and colleague in Southern Cal told me there are still homeowners trying to get LA building permits from the Woolsey Fire in 2018!

Housing Prices Rise As Sales And Inventory Fall

There is a 2024 study in Landscape and Urban Planning: Climate change and real estate markets: An empirical analysis of the impacts of wildfires on home values in California that indicated that the effect on housing prices in neighborhoods impacted by wildfires wasn’t statistically significant.

I have observed that as destroyed or severely damaged housing is replaced by new construction, housing prices in that location have the potential to rise because the housing stock is upgraded. Perhaps on the margin, there will be low sales made by buyers with cash. Middle and working-class locations such as Altadena in LA were already in the process of gentrification, and perhaps the wildfire damage would accelerate the process (gift link). The hard reality is that housing in that neighborhood will become more expensive precisely because of the wildfire damage.

California’s most significant housing challenge, aside from climate change, has been partially caused by its attempts to restrain insurance coverage costs, which is driving out insurance carriers. Here’s an interesting summary.

Rental And Sales Inquiries In Related Locations Surge

A friend sent over this clip about LA residents making inquiries to NYC brokers. I’m also hearing about Orange County and other California locations where real estate agents are seeing a lot of inquiries out of Los Angeles. It’s going to be a long-haul process.

Manhattan Congestion Pricing Starts, Streets Clear

Yesterday, I got a call from a local television station asking for housing data showing the impact of Manhattan’s congestion pricing that went into effect on January 5th. Drivers have to pay $9 to go south of 60th Street, and all the funds are going to the MTA to support public transportation. The public conversation about the tax in local media has been primarily focused on complaints by drivers coming into the city. I believe that if there were an adverse impact on housing, it would take many months to show an effect on the rental market and a year or more to impact the sales market. Housing prices move slowly. Tenants generally sign 1-2 year leases, and owned housing is a slow, lumbering transaction. I don’t expect a noticeable housing impact except for a related amenity like public parking, where someone who parked in the 50s might shift to the 60s, pushing those prices a little higher. And, of course, subway maintenance efforts would probably make life a little easier for NYC’s rat czar.

Of course, there will be an impact on the cost of deliveries, operating small businesses, and many other things. However, maintaining the public transportation network, one of the most far-reaching in the world and NYC’s most significant asset for residents, has been strangled by WFH, and ridership is down. Maintenance of the transportation system seems like an all-or-nothing affair.

After all the complaining about the collapse of the city, the congestion pricing program seems to be working. Car traffic is down, so pollution is expected to decline, improving the residential quality of life for residents. However, the estimated 7.5% decline in car traffic seems incredibly conservative.

Final Thoughts

Land appreciates, and improvements depreciate. The vultures trying to buy damaged LA properties for very little will not dominate the market because most of the value is in the land, and the wildfires didn’t destroy the land value. LA property owners will likely rebuild but with the inherent belief that the permitting process and the insurance industry will be fixed soon to enable the process. Manhattan’s congestion pricing program will help the MTA maintain the transportation network, which is a key amenity for residents.

Here’s a good take on how emergency workers handled the LA wildfires versus armchair experts on the internet.

Did you miss the previous Housing Notes?

January 15, 2025

Looking On The Bright Side Of Life For Housing, The Wall Street Comp Will Be Higher

Image: Grok

Housing Notes Reads

- Fire-Ravaged Altadena Attracts Real Estate Vultures Eyeing Deals [Bloomberg (gift link)]

- New York City Welcomes Congestion Pricing With Fanfare and Complaints [NY Times (gift link)]

- What Happens When Your House Burns Down and You Still Have a Mortgage? [WSJ]

- The Armed Homeowners Defying the Rules of L.A.’s Burn Zones [WSJ]

- Where Does L.A.’s Luxury Home Market Go From Here? [WSJ]

- These Stations Have the Most Rats in the New York Subway [Untapped Cities]

- Exclusive | One of America’s Priciest Home Listings Hits the Market for $285 Million [WSJ]

- Fifth Avenue co-op trades for $54M [The Real Deal]

Market Reports

- Elliman Report: Wellington Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Boca Raton Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 4Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 4Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 12-2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Queens Sales 4Q 2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 12-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 4Q 2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 12-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)