Home Purchases Falling Apart At Record Rate

A Little More Than 1 In 8 U.S. Sales Contracts Blew Up In June, A Redfin Record

Elevated Mortgage Rates And Nervous Buyers Drove Blown Deal Jump

Pending Sales Don’t Fully Reflect Current Market Unless Able To Close

According to Redfin (as a national portal, I prefer their insights over Zillow), pending home sales blew up at a record rate of 14.9%. Blown deals correlate well with the Fed’s pivot to higher rates in early 2022. The idea here is that not only did more deals fall apart when rates began to rise, but they remained elevated at a consistent level all during the escalating interest rate period. This isn’t reflective of some sort of surprise causing buyers to withdraw. For much of the Fed pivot era, buyers already understood that rates were elevated and rising, unlike the initial quick change from the established low rate pattern that caught some buyers by surprise in early 2022.

Home Prices Pressed Upward Despite Interest Rates Stuck At Elevated Levels

Quick Aside I refer to interest rates as “elevated” rather than “high” because rates have not been historically high.

Rising prices are mostly due to the lack of inventory listed. It is as simple as that. Existing supply was sold off during the pandemic, and new construction, typically accounting for about 10% of any market, can’t make up the difference. Plus, new construction usually represents a premium product. Even if new construction tripled overnight, it’s not enough to counter the loss in existing supply to keep prices from rising.

When Contracts Blow Up, They Probably Shouldn’t Count

I get into this debate all the time with proponents of pending sale reports and how they are more accurate than closed sales because they are “fresher.” But when we see deals blow up, the buyer and seller don’t follow through, and the “meeting of the minds between buyers and sellers” never becomes finalized. While I agree that pending sales are more recent than closed sales, a bunch of credibility points should be taken away from a contract that never closes.

Getting rhetorical – New contracts reflect more current conditions, but if the deal isn’t finished, does it really reflect current conditions?

As I’ve said here on Housing Notes many times, the Fed kept rates too low for too long during the pandemic in terms of housing. The resulting distortion to the metrics is real.

High Mortgage Rates Dampen Affordability And Create Fewer Options For Buyers

Higher mortgage rates make credit conditions tighter, and with a weaker spring market than was anticipated, more deals fell apart because of the financial issues experienced by the buyer.

“With mortgage rates hovering around 7% and home prices continuing to rise, financing is a growing challenge for buyers, and this is beginning to impact a buyer’s ability to make it across the finish line,” said Lisa Sturtevant, Bright MLS chief economist.

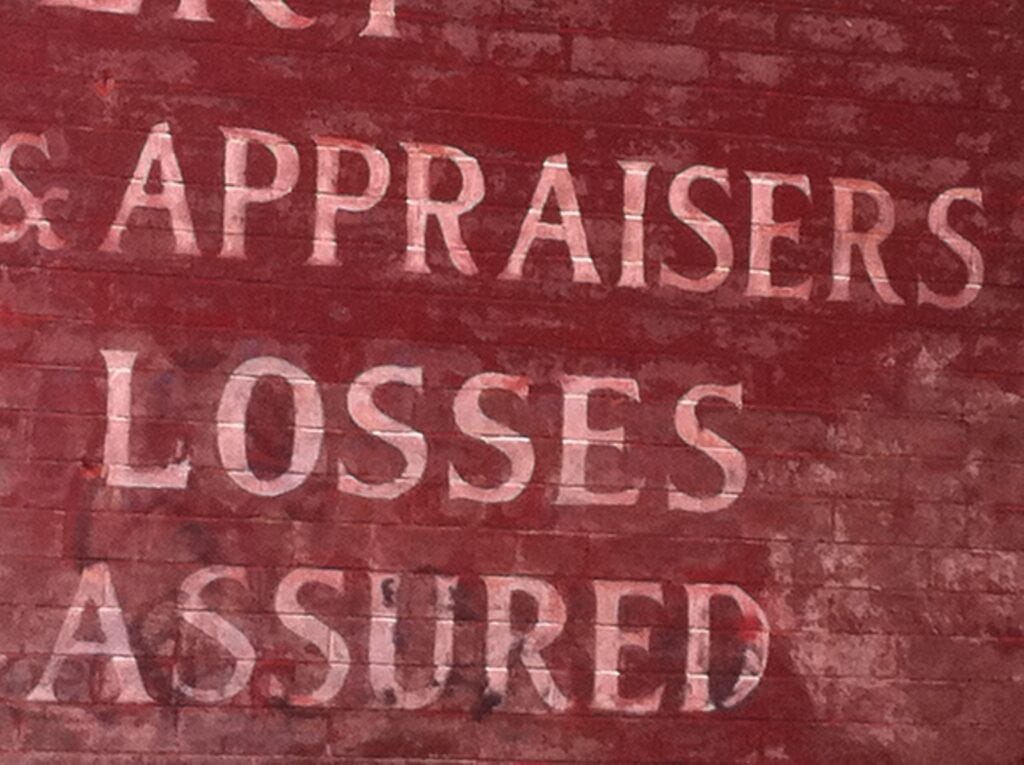

A Quick Appraiserville Newsflash

Since I don’t have my Appraiserville website up and running yet (who has time in this market?) I’m sharing a quick piece of news for appraisers. My phone blew up yesterday (like pending contracts), so I thought I’d share this item about the indictment of the former head of the West Virginia Real Estate Appraisal Board. I’ve written about his actions for quite a while. Apparently, he has some IRS problems, exposing him to over 100 years in prison.

Sage Advice When the IRS reaches out to shake your hand, saying, “I’m from the IRS, and I’m here to help you,” right or wrong, don’t question their intent.

Did you miss yesterday’s Housing Notes?

July 24, 2024

The Housing Market Can Be Murder

Image: Chat & Ask AI