- Bitcoin Prices Have Risen Faster Than Housing But Is Inherently More Risky

- The Volatility Of Bitcoin Makes It Less Reliable For Pricing A House

- The Fixed Supply Of Bitcoin Encourages Hoarding Rather Than Daily Use

I was doomscrolling my Instagram feed last night and stumbled across a Coinbase ad for homebuying that was quite compelling (if reality isn’t your thing). Coinbase is an exchange that enables consumers to buy, sell, store, and transfer Bitcoin and other cryptocurrencies. The ad showed how the amount of Bitcoin needed to buy a house was falling (because the price of Bitcoin has risen much faster than housing prices over the past fifteen years). Incidentally, most consumers confuse “Blockchain” with “Bitcoin,” which is analogous when comparing the Internet to email. Remember this gem from the early days?…(be sure to wait for it). In the early days of Bitcoin, I spent time collecting home sale transactions “made with Bitcoin” out of curiosity. Still, sellers of all of those properties used US dollars with last-minute conversions to various cryptocurrencies for social media hype. Then there is a Florida programmer who, in 2010, bought two large Papa John’s pizzas for 10,000 Bitcoins ($41 US dollars at the time). As of yesterday, those two large pizzas cost just over $1 billion (I hope he got more than one topping!) I thought I would cut through the hype and drill down to basics to more clearly think about Bitcoin in the context of housing. Here’s that Coinbase commercial below that got my attention.

Berkshire Hathaway Mocks Bitcoin

Their famous investors never saw the need of Bitcoin to the point of hilarity.

The Risks Of Using Bitcoin In Housing

- It has high volatility, so it is not very good for establishing housing prices

- There are no consumer protections – the federal government doesn’t know what to do with it yet – and there may be future tax liability as well

- Lack of any intrinsic value or value creation because it is primarily driven by speculation

- A fixed supply of 21 million Bitcoins encourages hoarding and not spending, so it isn’t widely used

- Criminals love it because of the anonymity

- Massive energy consumption to mine them, so it’s bad for the environment

The Arguments For Using Bitcoin (In General)

- No government control, decentralized, reduces the risk of asset seizure

- Anyone can access it anywhere in the world, especially the unbanked

- Immune to inflation and devaluation of currency

- Highly resistant to counterfeiting

- Transactions are transparent and verifiable

- Privacy – no personal information is needed

- Once a transaction occurs, the sender cannot reverse it (kind of like Venmo!)

Using Bitcoin In Real Estate

Most Bitcoin transactions are Bitcoin-to-Fiat Currency, but they are slowly making their way into real estate transactions. Fiat currency (US dollar) is government-backed but not by a physical commodity like gold. Pure Bitcoin purchases are still happening only on the margin.

- Commercial real estate seems to have a better use case, mainly when used with blockchain

- Fractional ownership and tokenization have a lot of potential because of the digital aspect of Bitcoin

- Bitcoin has been used as collateral for mortgages, but be wary of margin calls!

- There is tax risk with capital gains exposure since the IRS treats crypto as property, so all transactions are taxable events

- Regulation is slowly evolving and provides substantial future exposure to tax and regulatory risk

- It provides a new investor pool for real estate transactions

Final Thoughts

I remember when Bitcoin hovered around $10 circa 2012, and I thought about buying $100 worth for fun. But it was early on, and crypto exchanges weren’t prevalent. It all seemed so fly-by-night, so I never bought any and was worried about the legal stuff. Of course, in today’s dollars, that $100 risky investment would have turned into $10 million. Oof. Of course, it’s not healthy to focus on the “shoulda bought” scenarios, but this is precisely why I never share investment advice and tend to stick to housing market analysis. Ha.

Blockchain makes more sense in a real estate application than Bitcoin ever would. Bitcoin is too volatile to price assets like real estate. Residential real estate is the world’s largest asset class at about $535 trillion, while cryptocurrency is in the vicinity of $3 trillion. Cryptocurrency threatens to be a larger asset class, so at some point, they may become more interconnected. I tend to associate cryptocurrency’s future more with investors and speculation than I would see them used by potential homeowners saving for a downpayment.

The Actual Final Thought – Metal lunch boxes were the cryptocurrency of my childhood.

[Podcast] What It Means With Jonathan Miller

The latest episode [Finding Certainty] is just a click away. The podcast feed can be found for all three platforms we use here:

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

June 15, 2025

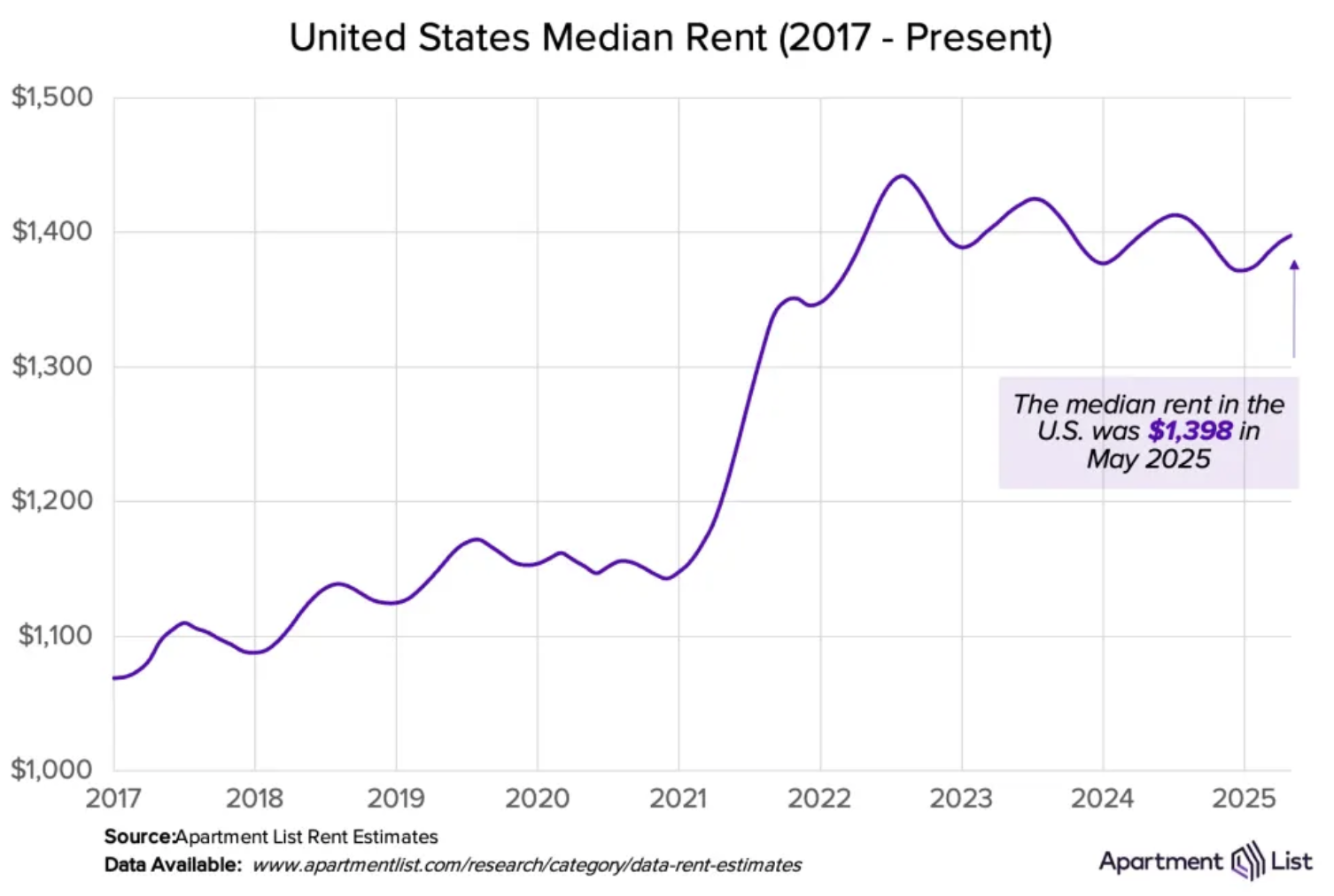

Understanding Rising NYC Rental Prices Isn’t Exactly Brain Surgery

Image: Apartment List

Housing Notes Reads

- In More Metros Than You’d Think, Suburbs are Now More Expensive Than the City [Planetizen]

- Private Real Estate Listings Ignite Fight Over How US Homes Are Sold [Bloomberg]

- 6 Luxury Real Estate Markets Where the Ultra-Rich Are Buying in 2025 [GOBankingRates]

- Businesses are raising prices after tariffs, even on unaffected goods [Axios]

Market Reports

- Elliman Report May 2025 Manhattan, Brooklyn and Queens Rentals [Douglas Elliman]

- Elliman Report: Florida New Signed Contracts 5-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)