- After Weakening Rents Since The Summer, Prices Are Rising Again

- Rising Mortgage Rates Are Pushing Would-Be Buyers Back Into Rentals

- The Housing Market Distortion From Rising Rates Is Confusing Consumers

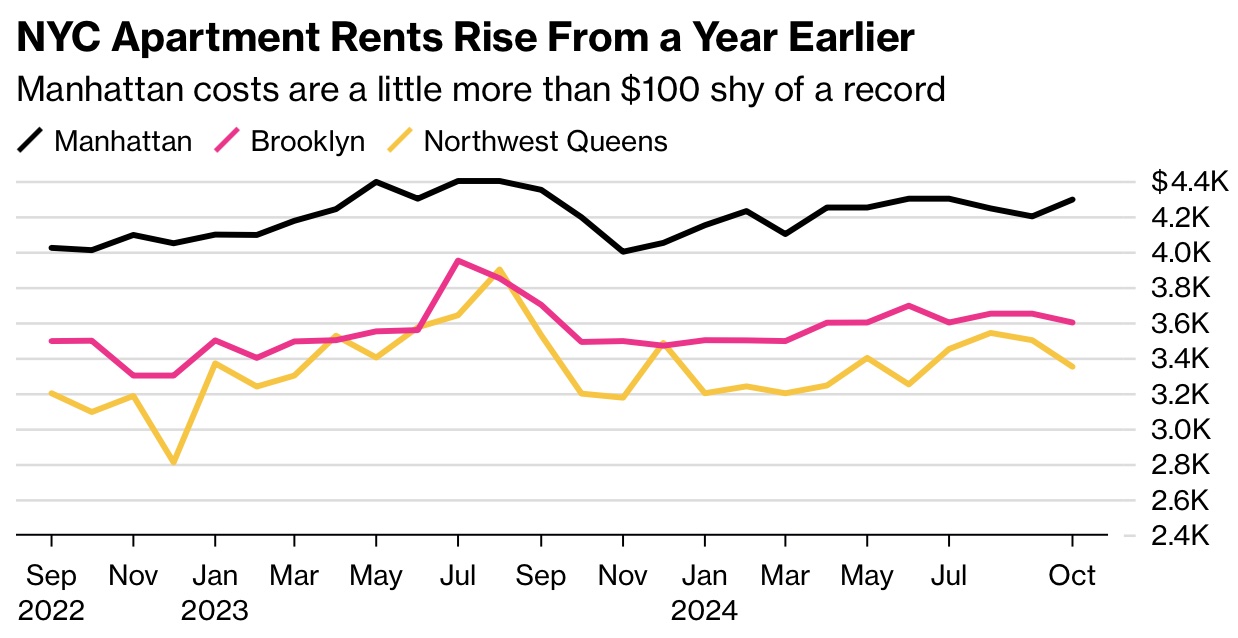

It was a pleasant summer for New York City tenants while it lasted. After months of flat to declining rents, the Fed rate cut of 50 basis points in mid-September did perhaps the opposite of its intended purpose – raise rents. Rising mortgage rates tipped renters thinking of purchasing into staying put. It will be interesting to see the results of our NYC contracts report in the first week of December. Monthly rental prices for the three New York City boroughs covered in our report increased year over year for the first time in at least four months.

Why Are Rents Beginning To Rise Again?

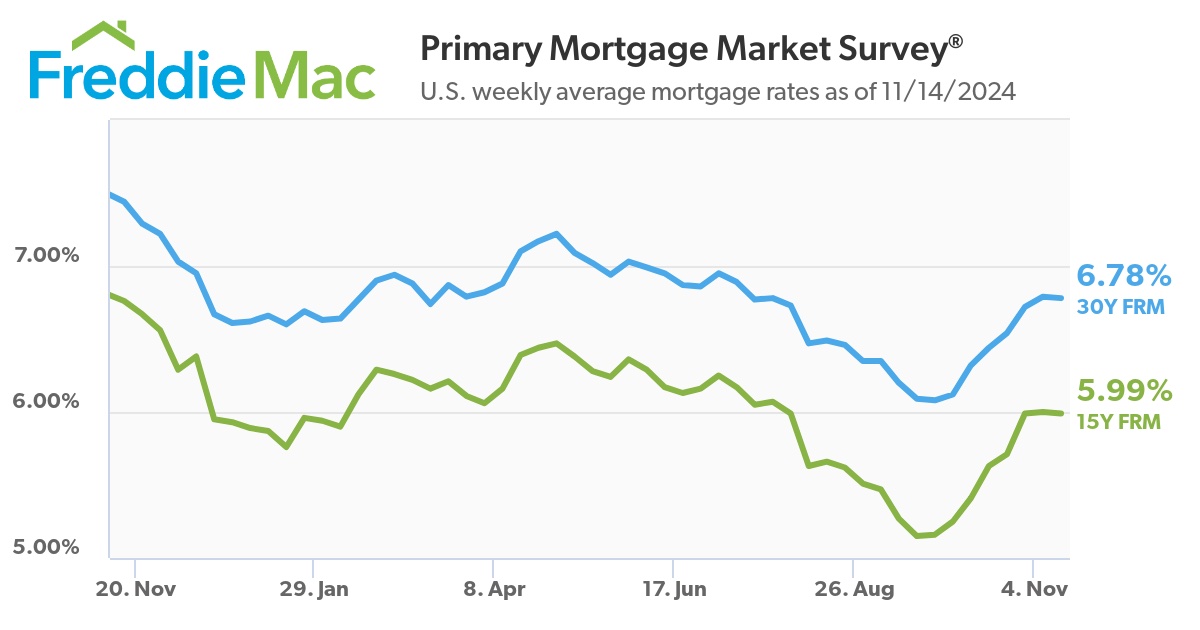

When mortgage rates rise, it reduces the affordability of a home purchase, and some would-be home buyers are pushed into the rental market, driving rents higher. The incoming presidential administration has the use of tariffs as its economic policy centerpiece which is highly inflationary. Thirty-year mortgage rates have been rising for the past 6 weeks, approaching 7% after nearly falling to 6% in early September. The Fed cut rates by 25 basis points last week and the 30-year fixed seemed to level off. I suspect the idea of mortgage rates falling much more seems less likely. However because consumers have been waiting for two and a half years for lower mortgage rates, they may be running out of patience and that’s why newly signed contracts in NYC have been up sharply every month from July through October.

Rental ‘Key Fees’ Are Kaput?

The long-time practice of New York City tenants paying commissions to brokers when they approach a landlord for an apartment to rent was just ended by the NYC Council.

The Fairness in Apartment Rental Expenses, or FARE, Act was approved by a vote of 42-8 with no [abstentions], enough support that Mayor Eric Adams wouldn’t be able to torpedo the effort. The bill requires landlords who hire real estate agents to pay the agents’ fees themselves instead of passing them on to tenants.

Wow, FARE is the most important acronym in the NYC housing market right now. Like the national situation with the NAR settlement, the focus of the government has been on the user of the services to pay the commission. However, this is less clear in a rental transaction. Opponents such as the real estate trade group Real Estate Board of New York (REBNY) are strongly against the law because they say it will raise rents. That is true since the landlord will charge higher rents to cover their obligation to pay the listing agent the commission. But the tenant won’t have to pay the commission upfront. Unless I am missing something, the total cost to the tenant will likely not change but the law will reduce the tenant’s burden by spreading out the effective agent commission through monthly rent over a year or two rather than having the tenant make one big payment to the agent on top of a security deposit and first month’s rent.

I’d appreciate feedback from the NYC real estate agent community to share why they agree or disagree with me on this point. The law is expected to go into effect this summer and rental prices are expected to move higher in the coming months to reflect this new law.

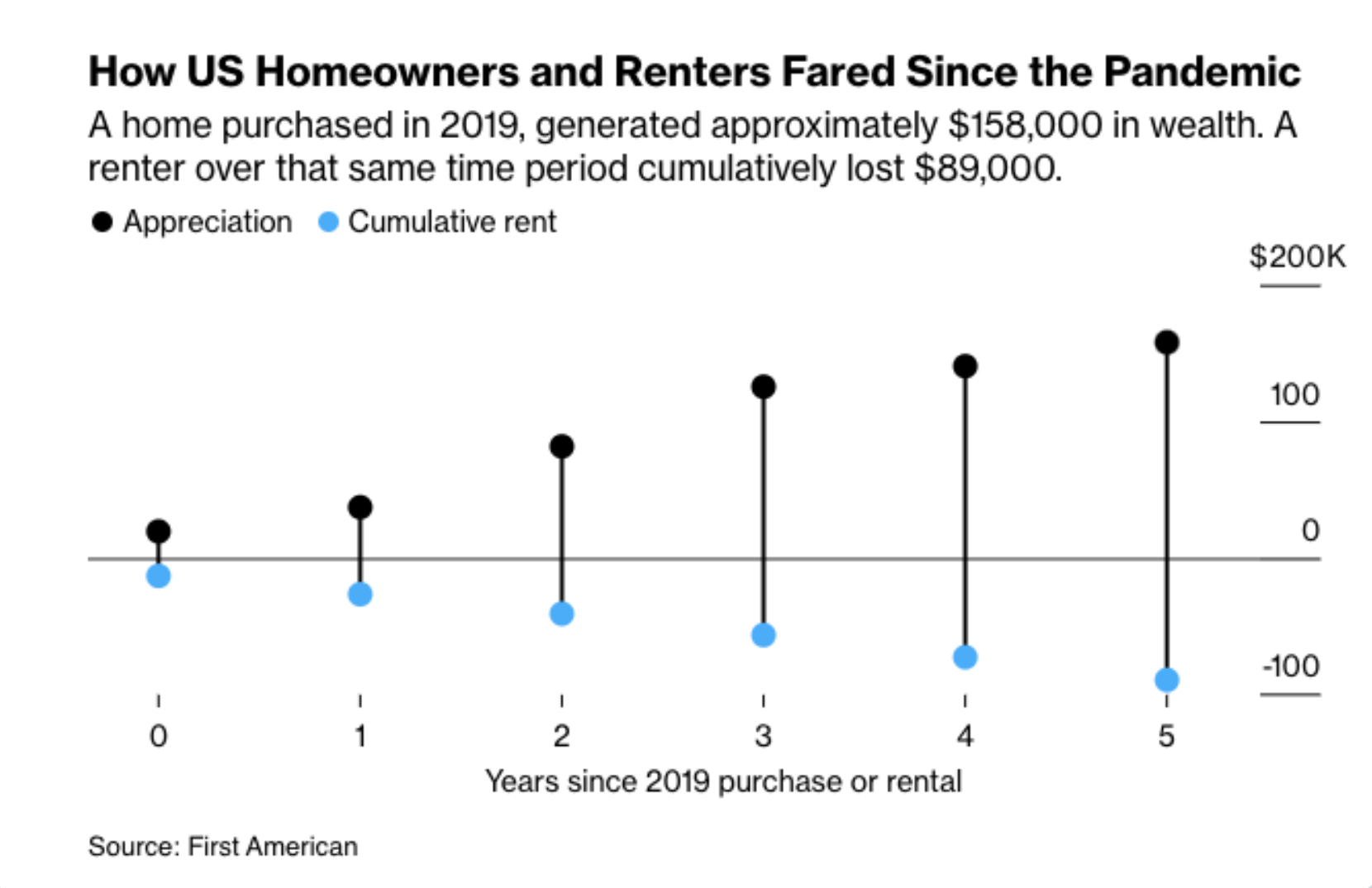

Buy-side Crushed Rent-side Since 2019

According to a First American study, renters during the pandemic era missed a historic opportunity for wealth generation if they did not purchase housing.

People who took advantage of historically low US interest rates to buy homes right before the pandemic have seen their wealth grow by about $32,000 annually over the last five years — even when taking the cost of home ownership into account.

Once A Tech Darling, Opendoor’s Value Plunges

Despite the early strength of the housing market since the pandemic, Opendoor still hasn’t figured out how to make a profit. I remember reading all the swooning over this firm early on and even saw them make an impressive presentation in Dallas. Some were predicting iBuying would account for half of all home sales and national firms like Redfin and Zillow joined the party only to pull back when they lost a lot of money. It was quite telling to see Zillow Offers shut down because they relied on their Zestimates too much which is notoriously inaccurate (don’t get me started). I think the real estate brokerage industry severely undervalues its expertise and contribution to the home buying process such as negotiation and pricing. I often wondered how Opendoor, which was developed in a period of rising home prices, would do when the housing market performance was distorted by higher mortgage rates. We now have the answer to that question:

It’s the third time in the last three years that Opendoor has enacted significant layoffs; more than 1,000 employees were affected by the cuts in 2022 and 2023.

Shares of Opendoor opened on Tuesday at $1.83. The stock has declined 57 percent year-to-date and 83 percent all-time.

Final Thoughts

When I first sat down to write this post, I thought it would be about the NYC rental market – the housing market distortion from higher mortgage rates is more than just about rising rents. NYC just passed a law that changed the way commissions are paid likely inspired by surging rents. Home buyers are enjoying record home equity and recent homebuyers are probably thankful they bought when they did but it is creating a higher barrier between renting and homeownership. Opendoor is finding out how tough it is to make a profit with the pop in mortgage rates, having yet to figure out how to make a profit. With inflationary policy and higher national debt expected in the new administration, mortgage rates are less likely to fall significantly which will keep the pressure on rents.

The past five years have been one of the most volatile real estate environments in my 40-year professional career. So much negativity around the space exists although I suspect there will be more sales volume in 2025 as consumers are sick of waiting for lower mortgage rates. And I just learned this: California doesn’t corner the market on brush fires. Manhattan just had one!

Did you miss the previous Housing Notes?

Housing Notes Reads

- Ken Griffin sells remaining Faena House condo for $11.2M [The Real Deal]

- Want to Meet a Millionaire? Best Chance Is in San Francisco Area [Bloomberg]

- Ken Griffin Sells Record-Breaking Chicago Penthouse at 44% Loss [Wall Street Journal]

- The Secret to Selling a $100 Million Mansion [Wall Street Journal]

- Income Growth Outpaces Household Borrowing [Liberty Street Economics]

- ‘An Absolute Mess’: Brokers Assess the Shift in Fees [NY Times]

- The Trump Luxury Bump [Curbed]

- Manhattan Apartment Rents Rise to Highest Level Since July [gift link – Bloomberg]

- City rents creep back up as housing market stays competitive [Crain's New York]

- Manhattan apartment rents rise to highest level since July [Business Times]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2024 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Long Island Sales 3Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 3Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)