Time to read [5 minutes]

Takeways (powered by Perplexity)

- Private mortgage lenders fill the gaps left by traditional banks

- Technology-driven private lenders provide faster underwriting and closings

- The growth of private mortgage lending opens new opportunities for reputable appraisers

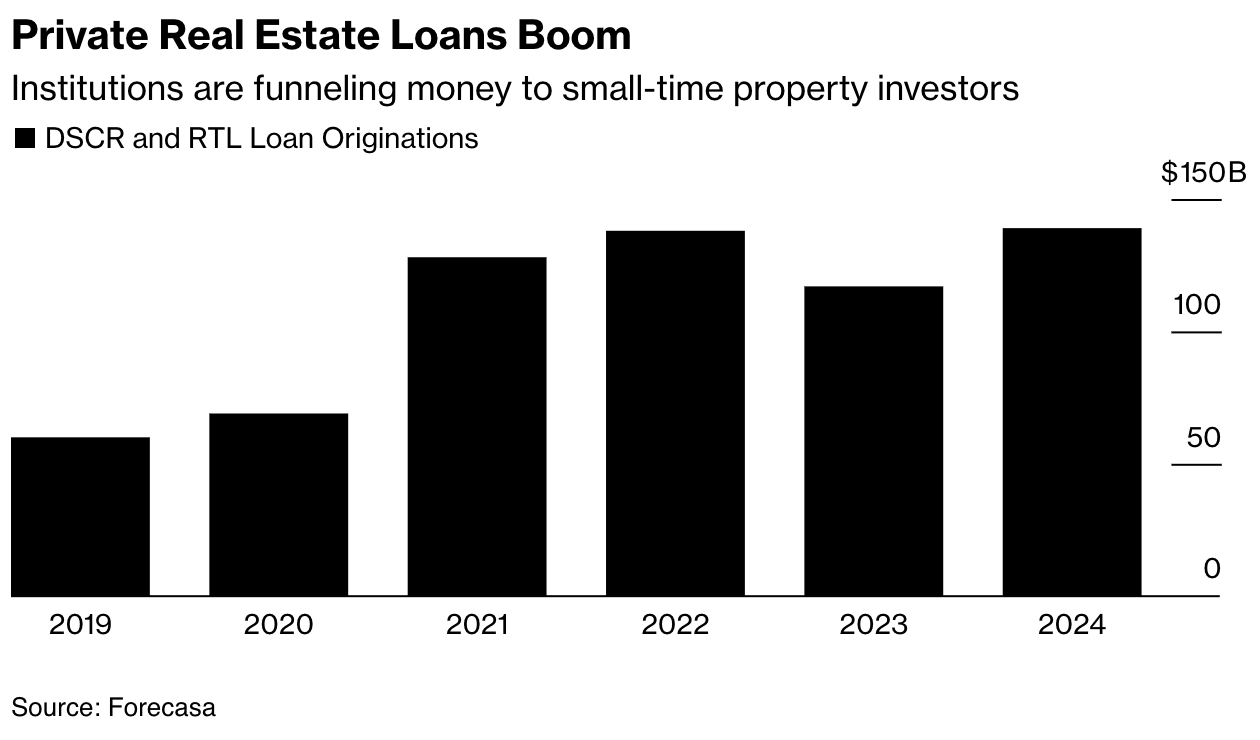

As I’ve written about in the past, private mortgage lending (not to be confused with private banking) has been a path taken by Wall Street to profit from a tight credit lending environment. I remember all those commercials in the 1970s to the 1990s by Yankee great Phil Rizzuto shilling for hard money lender The Money Store. The key differences between hard money lenders and traditional mortgage lenders are that the former focuses on shorter terms and the asset itself, often distressed. Traditional lenders tend to offer longer terms and place greater weight on credit quality. Private lending is Wall Street’s new term for hard money lending, which is booming today. My appraisal profession has been enjoying the new opportunity, but knowing Wall Street, those who thrive likely need to be morally flexible given the low level of regulatory oversight. As this Bloomberg piece, “Bad Mortgage Loans in Baltimore Send Wall Street a Warning” [gift link], suggests, in its breakneck growth, the industry is facing the reality of overinflated property valuations.

Baltimore Is Rife With Lending On Inflated-Values

And I’m not talking about the lawsuit where the Baltimore appraiser won his case after being accused of low-balling because of racial bias. The opposite scenario is quite prevalent. Bloomberg did a deep dive on the growing problem with private mortgage lending in Baltimore [gift link]. My experience working with Wall Street is that there is very little oversight, and appraisers who are morally flexible can thrive until the market turns. Wall Street has emphasized low fees and quick turn times, and guess what? This practice will likely lead to problems in the future. What makes this a bigger issue is that private mortgage lending doesn’t rely on credit, but rather on the hard asset value.

“The problems in Baltimore seem to revolve around appraisals that were improperly inflated, which is particularly dangerous in this corner of the mortgage market because loans are done based on a property’s potential cash flow or future sale price.”

Possible solutions include sharing more information among lenders to avoid borrowers, appraisers, and title companies with poor track records.

Why Private Mortgage Lending Is The Next Thing

Private mortgage lending is designed to fill the gaps left by banks, which often have more restrictive lending policies for borrowers. Real estate investors and homebuyers who don’t qualify for traditional mortgages have been going this route. These lenders are more technology-driven, which translates into faster underwriting and, therefore, are able to offer faster closings. Fix and flip, bridge loans, and new development lending are part of the growth story of this segment.

The segment growth is uncharted territory in the long term, but it is an alternative or additional avenue of development for the housing industry. It also seems like an opportunity for appraisers (reputable ones, that is) in this contrarian housing story.

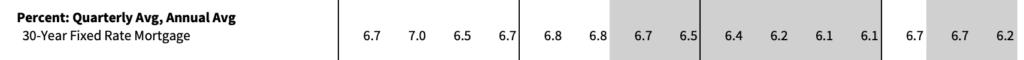

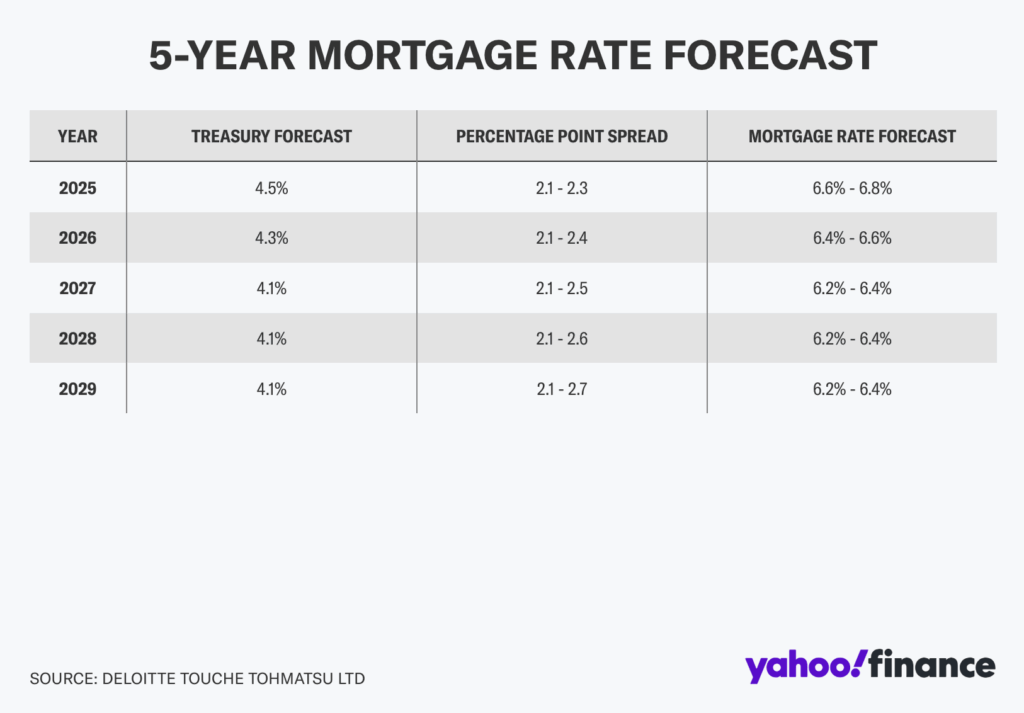

Mortgage Rates Will Probably See Modest Change

At this point, forecasts for lower mortgage rates don’t include anything below the 6% threshold, which would fuel a housing boom. Here are some rate forecasts from Fannie Mae and Deloitte.

Final Thoughts

Private mortgage lending is fulfilling a niche not served by traditional mortgage lenders. Despite the initial and obvious problems of over-valued properties as seen in Baltimore, I would think Wall Street will figure out this issue to keep this revenue opportunity alive.

The Actual Final Thought – Sometimes another version of the old stalwart can be just as good. Man, I loved this show as a kid.

Upcoming Pontifications

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Winner’s Curse episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Monday Tuesday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

August 29, 2025: The American Dream, Whip It Good

- You should be writing for Rolling stone magazine. Keep em coming.

- Forgive me if I missed a mention of “Devo” (2024) – The New Netflix Documentary. We have lived through some interesting times

August 25, 2025: Bidding Wars And The Winner’s Curse

- Great piece as all of your Notes are!!

- And if price was only based on what the last sale or comparable is, Rolls Royce would never sell a car! 4 tires and a steering wheel come in all price ranges!

Did you miss the previous Housing Notes?

Housing Notes Reads

Market Reports

- Elliman Report: New York New Signed Contracts 7-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2025 [Miller Samuel]

- Elliman Report: Long Island Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants