Get Used To High Mortgage Rates And High Rents

Expectations Of Continued Inflation Remains Firm With Consumers

The Moody’s Downgrade Of US Credit Will Drive Interest Rates Higher

Rising Interest Rates = Rising Rents

Consumer perception of rising inflation has been growing since the beginning of the year. The tariff tantrums are inflicting far more damage to the US economy than any other country, and the full impact has yet to be felt by US consumers. The new tax bill that just passed the House will raise the federal deficit by 4.5 trillion dollars, and Moody’s just downgraded the ratings for US credit for the first time since 2017, losing full AAA status. All of these factors will keep interest rates higher for longer, meaning mortgage rates will likely hover at or above 7% for the foreseeable future, pushing more consumers into the rental market. The unforced error of the current administration’s alarmingly misguided tariff plan and proposed tax bill that raises US debt by trillions will drive rental prices higher as well.

New York City Rents Reach Records Again

Bloomberg’s story on the rental market [gift link] was a good take on the upward pressure on rents.

One of the stats I found interesting from our research on the NYC rental market last week involved listing discount, a metric that measures the percentage difference between the listing price and rental price during the period measured. For April, the Manhattan listing discount was -2.4%, or expressed another way, the listing discount was really a listing premium. The average listing price of all rentals in Manhattan was 2.4% below the average rental price across the market. We saw a little bit of that in 2024, but it is a significant amount in 2025 as elevated mortgage rates reallocate demand to the already tight rental market.

National Rents Continue To Rise

The number of markets where US renters need to make more than $100K has doubled since 2020. Rents are continuing to rise, up 30.4% from 2019, which is consistent with what I have tracked in our NYC research. According to Zillow, wages are up 20.2% over the same period, which has softened the impact of rent gains. But still, the inflationary theme lies over all consumers, which is why I continue to bring up economic policy coming out of Washington, DC, which has remained disconnected from the inflationary threat.

Final Thoughts

Consumers are reducing their stance of waiting for lower rates as perceptions of inflation clearly show they understand its not going away quickly. However, the problem with the current economic policy coming out of Washington is that it is largely inflationary and therefore disproportionately restraining housing demand.

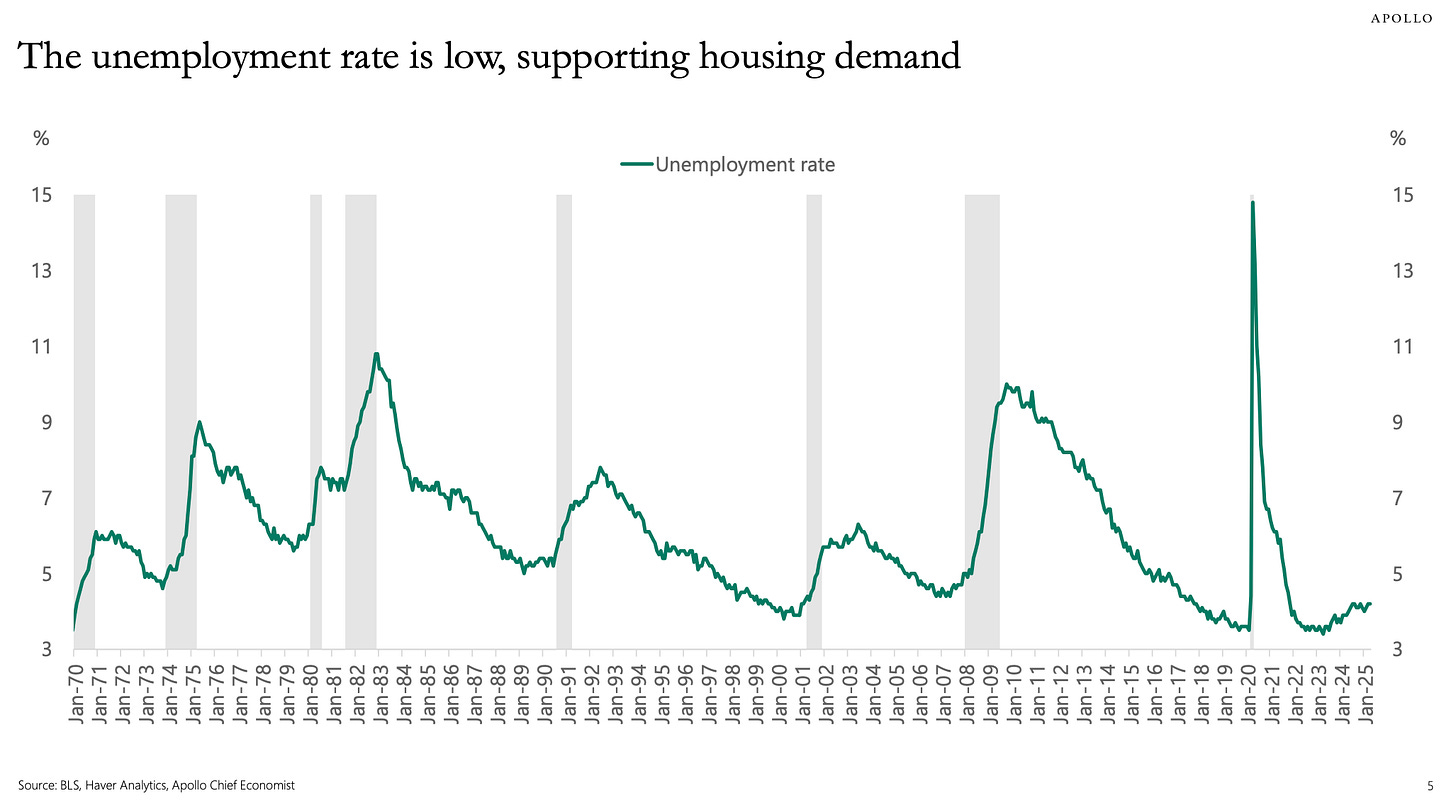

Pent-up housing demand is significant so the direction of interest rates can create a surge in actual demand in the flip of the switch looking at Apollo’s summary:

The Actual Final Thought – Phone books, when they were around, can tell the story although I can tell a story too without a cape.

Here’s My Podcast: What It Means

The latest episode is a click away as well as the podcast feeds for all the “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

May 12, 2025: Appraisal Institute Continues To Cover Up Its ‘Wildly Inappropriate Behavior’

Good for you for this frank discussion.

Oh, please, dear Pheonix! We cannot survive on Zestimates!!

I think people under estimate the power of their voice. All it takes is one member to call for everyone resignation on Paula’s LinkedIn post and all the sudden the floodgates open and Craig’s position becomes untenable. These people are so out of touch, it’s insane. Not stepping down, not taking questions or making public appearances.

Please keep fighting the good fight and know how many of us appreciate your notes…

Wow. I admire your vocalness …..and I have been around long enough (45 yrs) to relate to your entire perspective. When I started, the appraisal profession and the MAI designation were highly respected…your thoughts and commentary are spot on.

I have enjoyed reading your posts for a long time. It is bothersome to me to learn more about the AI from you than I do from AI.

I’m a bit surprised you’ve not chimed in about the apparent AI involvement including by the past CEO and Executive leadership, courting the AMC industry while messaging something quite different to our membership (JM: actually I did and have been doing so for years in many posts when it pertains to enabling AMCs).

Is that your opinion or a fact? (JM: presumably this is about my views on the devaluation of appraisal designations – its common sense and real world observation)

I enjoy reading your informative emails so I want to help you by clarifying: Cynthia Chance was the CEO, not the president. (JM: Fixed! Thanks!)

Did you miss the previous Housing Notes?

May 15, 2025

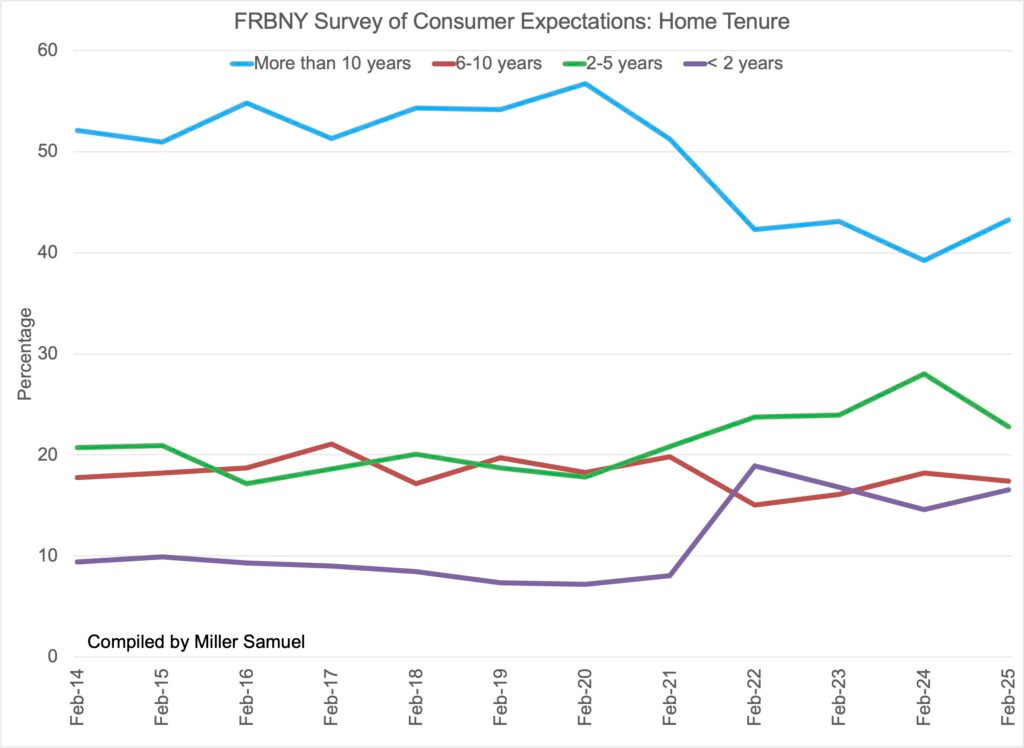

12 Years: The Average Stay Of A NYC Homeowner

Image: Me