Florida’s Stormy Weather Doesn’t Translate To A Stormy Market

Florida Housing Prices Continue To Rise As Sales Fall

Listing Inventory Is Rising Across Most Markets, Tempering Future Price Gains

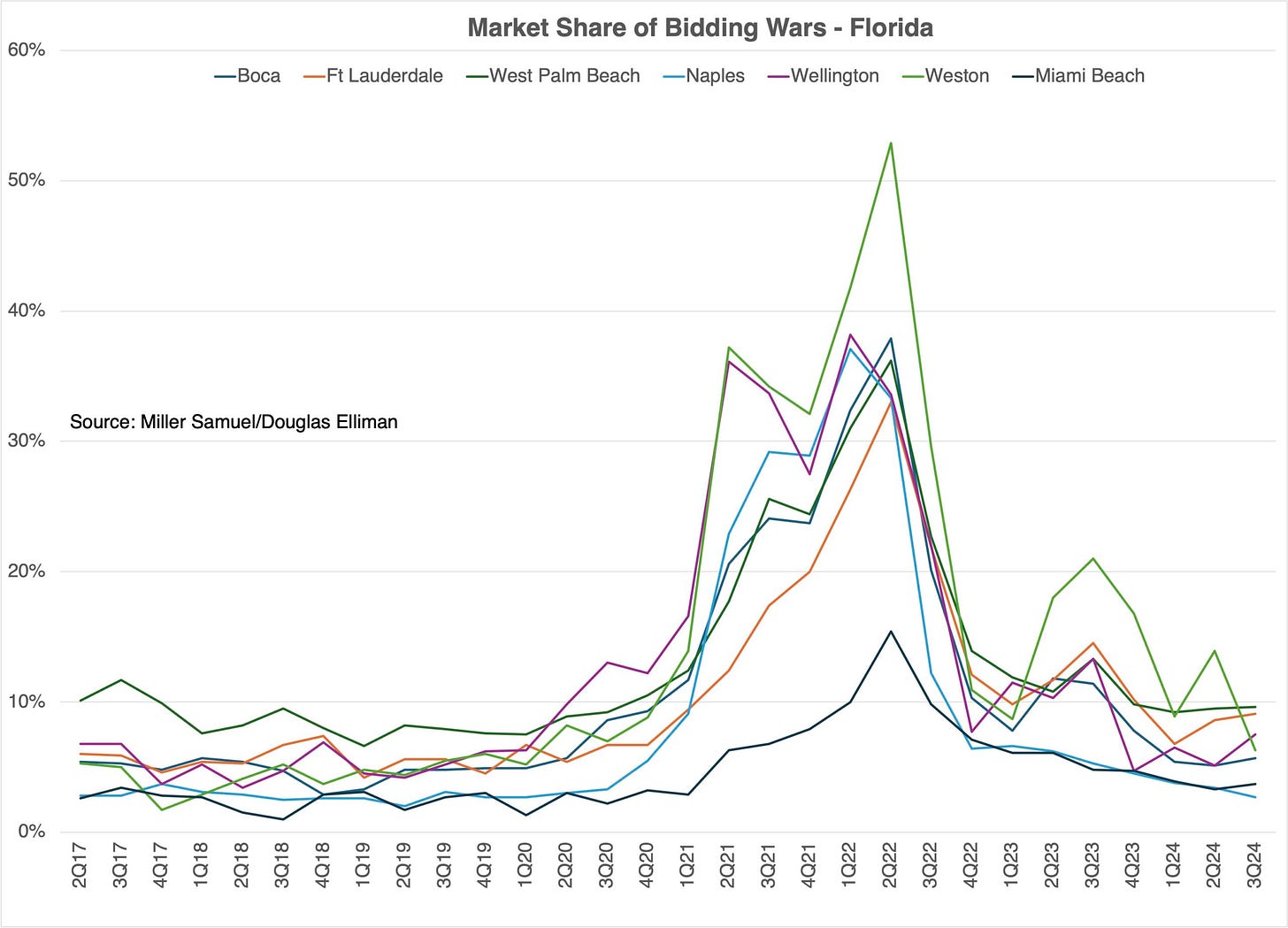

Bidding Wars Have Normalized After Surging In 2021-2022

Despite Hurricane Milton and the damage it caused, we released a slew of third-quarter Florida market reports for Douglas Elliman. They won’t reflect Milton’s damage, but in the aftermath of these types of storms, homeowners don’t sell at a discount. In fact, they usually don’t sell, and many rebuild. I’ve rarely seen price trends negatively impacted by Hurricanes. In fact, in a twisted, non-causal way, prices tend to rise afterward in aggregate because of the new or renovated housing that appears.

In general, the Q3-2024 Florida markets we cover are seeing the following characteristics:

With additional rate cuts expected by the Fed, an uptick in sales is anticipated in the coming quarters.

Overall sales remain below year-ago levels, challenged by higher mortgage rates

Despite inventory gains, single family and condo prices continued to rise across the region

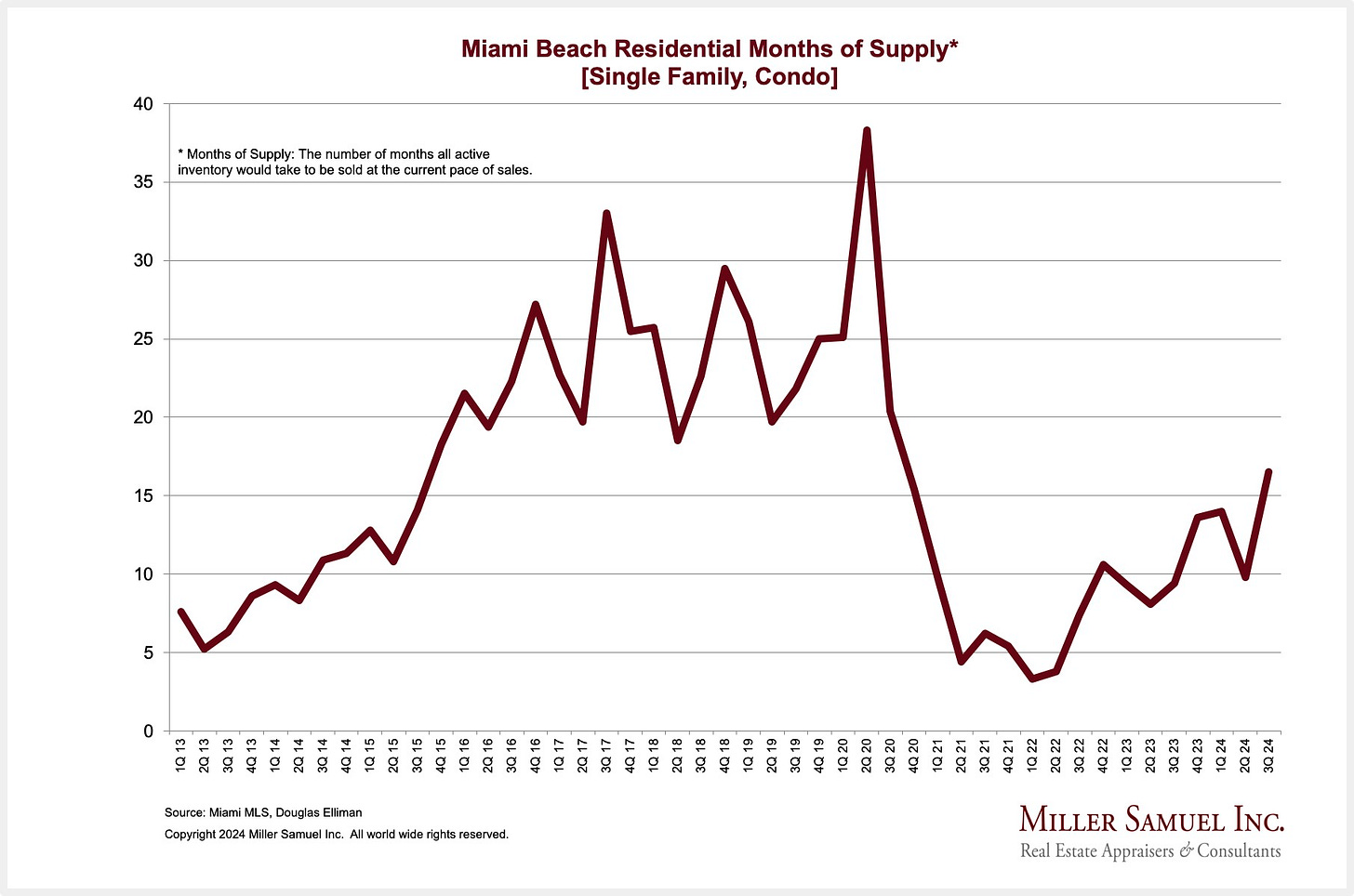

Annual increases in listing inventory continued, but in many markets, supply is still less than pre-pandemic levels (table below)

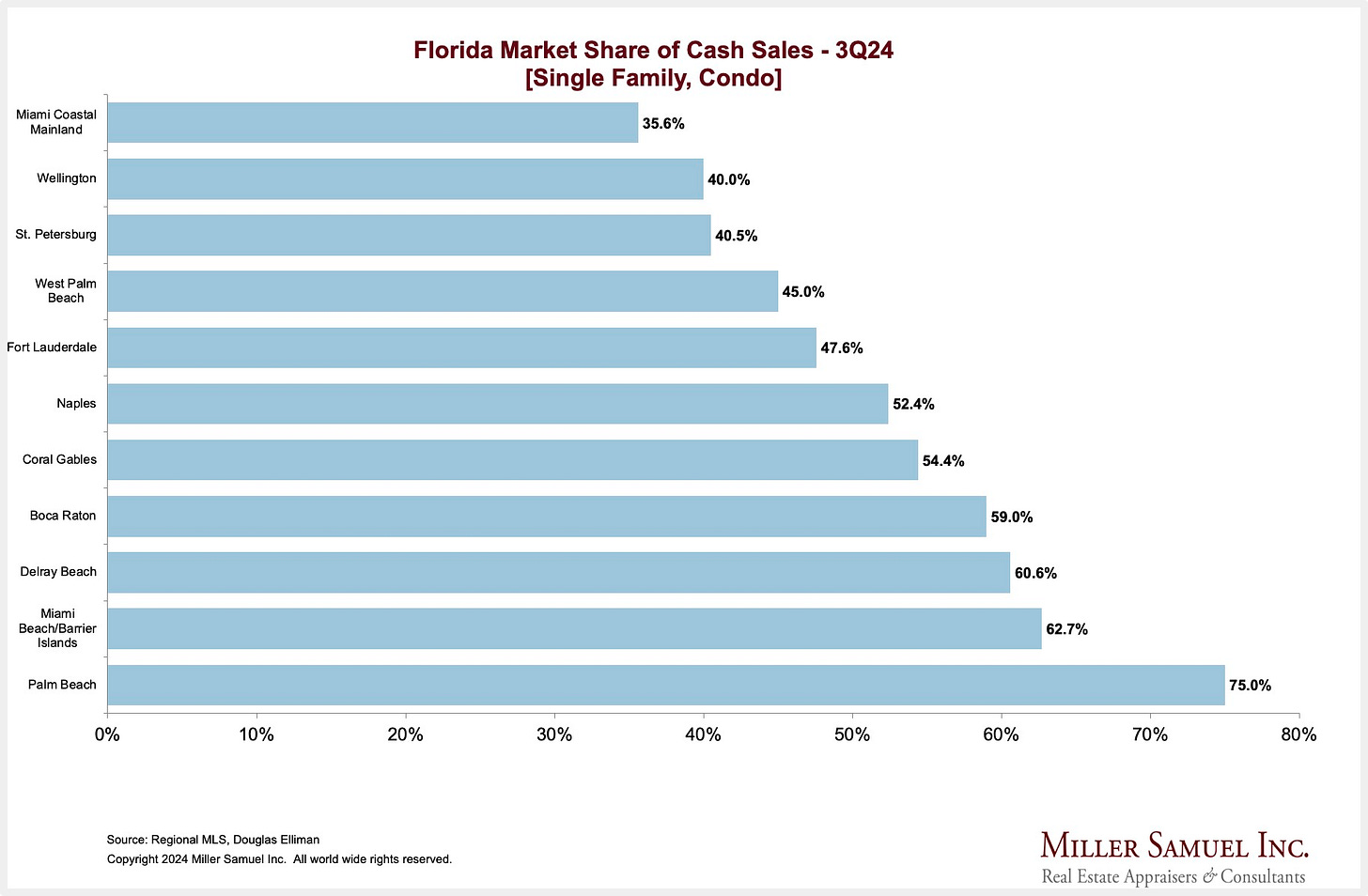

All-cash sales continue to be a significant characteristic of the market, incentivized by elevated mortgage rates (chart below)- Bidding wars (purchase price exceeds listing price) remain consistent across the region despite inventory gain (chart below)

Listing Inventory Is The Key Florida Metric

There has been a lot of misleading information on social media, such as the cesspool, now known as “X,” that talks a lot about the surge of listing inventory in Florida. These look like big gains in supply:

The following table of some of the markets we cover shows the YOY surge in supply, but most of the markets have less inventory than five years ago before the pandemic. Inventory, when presented alone, is quite misleading.

Bidding wars, our proxy for closing prices that are above the last listing price, have been normalizing after a surge that came out of the pandemic. This also explains why the percentages appear high for annual listing inventory growth – the starting point was from a near-record low level. My go-to saying is going from “1” to “2” is a 100% increase, but it’s still only an increase in one listing.

Listing inventory needs to be paired with sales to tell the story accurately.

Florida Has Sunshine And A Lot Of Cash

Coming out of the foreclosure crisis fifteen years ago, the market share of cash buyers tended to be elevated as banks were jittery about lending in a speculative market full of carpenters and nurses flipping condos. The market has matured since then. However, the spike in mortgage rates over the past several years has influenced many to pay cash, largely through equity draw-downs in the financial markets. Cash purchasers tend to skew towards the higher end of the market, and some of that correlation is apparent in the following chart.

Final Thoughts

Florida housing markets continue to see annual price increases. It’s been that way for at least five years. Single families outperforming condos on price right now, but that seems largely dependent on the idea that condo sizes that were selling have come down quite a bit since the 2021-2022 market frenzy.

The recent flurry of hurricanes and challenges with flood insurance and homeowners insurance has raised concerns about the longer-term outlook for the Florida housing market. However, I suspect that some of that is hyperbole. However, access to flood insurance remains vital to the continued viability of the housing market there.

It’s the fall market, so lower pressure on the market is real.

Did you miss Friday’s Housing Notes?

October 16, 2024

We Love To Chillax In Our Homes More Than Before

Image: ChatGPT