Time to read [7 minutes]

Takeways

- The Surfside tragedy exposed the danger of underfunded condo maintenance and led to passage of Florida’s Building Safety Act

- Developers initially viewed these aging buildings as buyout opportunities for teardown and redevelopment, but the Florida Supreme Court strengthened holdout owners’ rights

- Developers now face elevated legal and financial risks, while owners of aging condos remain stuck between rising special assessments for safety compliance and fewer viable redevelopment exits

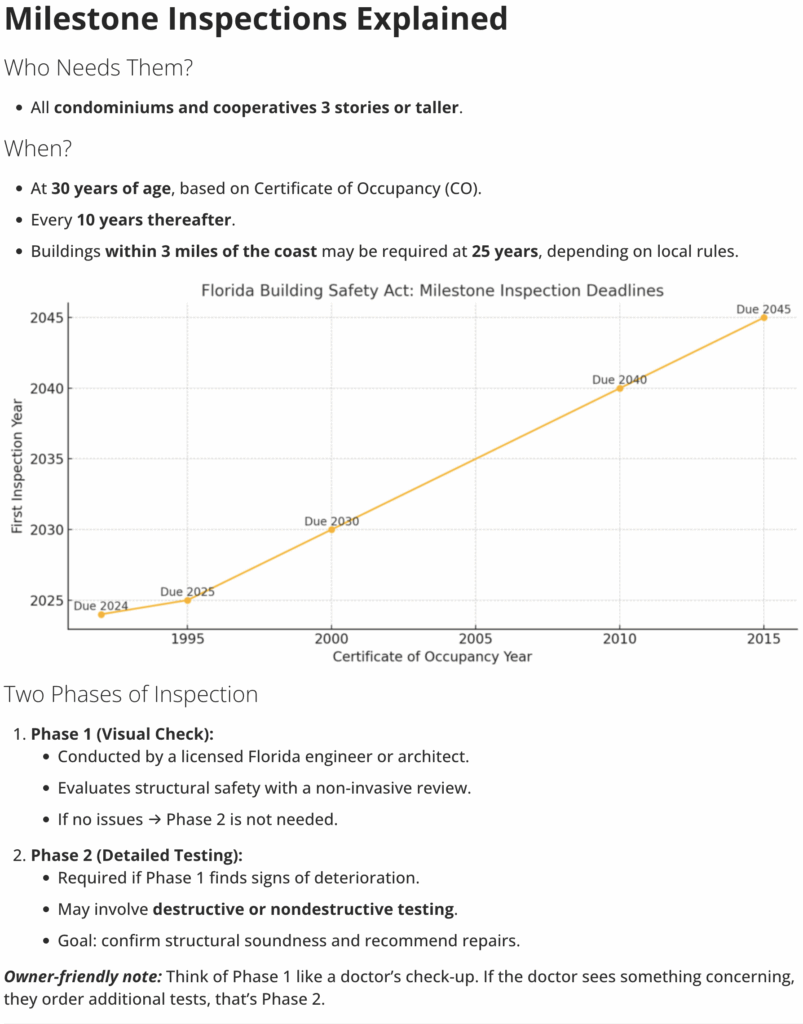

[There is a lot of Florida market stuff shared here so buckle up.] After the Surfside, Florida Champlain Towers collapse more than four years ago, older condominiums have been the focus of a new development opportunity. As a reminder, the tragedy occurred because retirees on fixed incomes who sat on condo boards got to decide whether to spend money on real safety issues or keep monthly charges low—an incredible conflict of interest when human lives are at stake. Many condo associations kicked the safety can down the road, and tragedy eventually ensued. Shortly after Surfside, condo laws were significantly tightened by state and local governments, including the introduction of the Florida Building Safety Act in 2021, at least a dozen buildings in South Florida were deemed unsafe, and many more required urgent mediation. The implementation of a strict set of milestones was introduced (see confusing chart below). To developers, who play the long game, this represented an opportunity to build, buying out condo owners in older projects and tearing them down as the market shifts to favoring new development. However, after this week’s Florida Supreme Court Decision, condo terminations will get a lot more expensive and probably much less likely to occur.

The Supreme Court Of Florida Decision

The October 14, 2025 Florida Supreme Court decision TRD Biscayne LLC et al., v. Angelica Avila, et al., denied Two Roads Development’s appeal in the Biscayne 21 case. The decision is likely to have a significant impact on condo developers across Florida. The court sided with holdout owners, reinforcing their protections and limiting how far developers can go to terminate older condo buildings for redevelopment without substantial owner buy-in. Even though a developer may own a large block of units, they can’t force the termination of the condo without unanimous consent (all unit owners) if those were the original rules. A minority of unit owners have become more empowered to stop a condo termination.

The form of a condo termination might include:

- Bulk purchase of all the units

- Optional (owners get an offer they can’t refuse)

- The cost of maintenance is prohibitively high to continue occupancy

After the necessary crackdown on safety procedures, I suspect that the higher costs, along with compliance with new safety laws, would ordinarily lead to more condo terminations. But after the decision, it that means more projects will get stuck in limbo as a few holdouts are now empowered to stop the process. This court decision reduces the likelihood of the success of condo terminations. The aftermath of this decision for developers who want to acquire a building and owners who wish to relieve themselves of the financial strain is that there will be fewer condo terminations.

What Do Unit Owners Do Now That They Stopped Condo Termination?

The winners of the Supreme Court decision are probably in a state of limbo:

- The condo building can’t be demolished or converted

- The condo unit owners maintain their property rights

- The developer will be forced to repair the building and bring back displaced occupants

- The holdouts that won the case will likely seek damages from the developer

- This form of development will probably drop sharply as the risk exposure for developers has risen dramatically

- The values of the individual units will probably fall sharply.

Florida Market Conditions

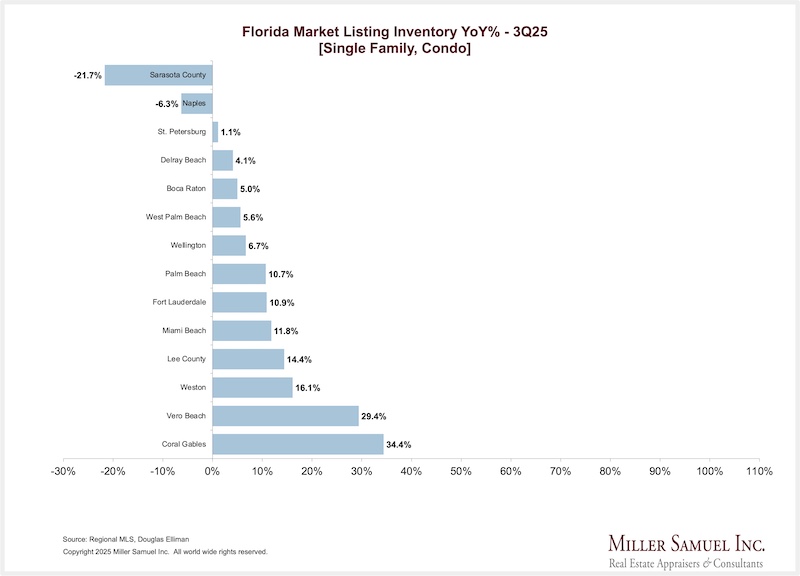

Elevated mortgage rates have slowed condo sales and increased listing inventory, similar to most of the US housing markets. The majority of the 14 housing markets we cover for Douglas Elliman are seeing listing inventory expand, but at a slower rate.

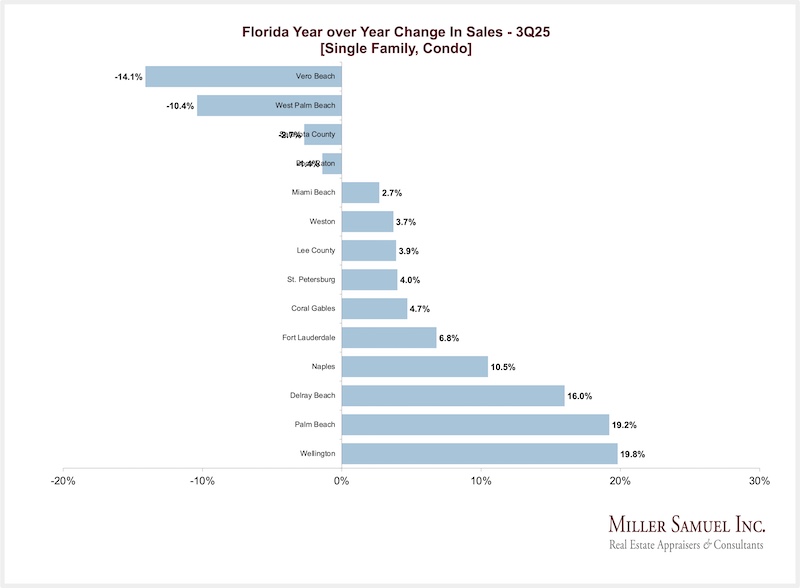

The majority of the 14 housing markets we cover there are seeing sales grow year over year.

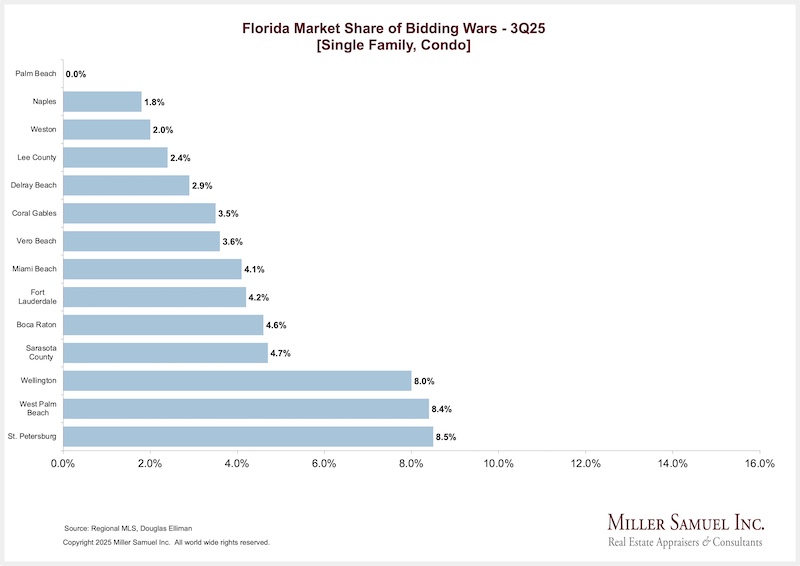

Bidding wars in the 14 markets are normalizing. Just a few years ago, the market share of buyers paying more than the last asking price was many multiples higher than it is now, which is what happens when supply re-enters the market.

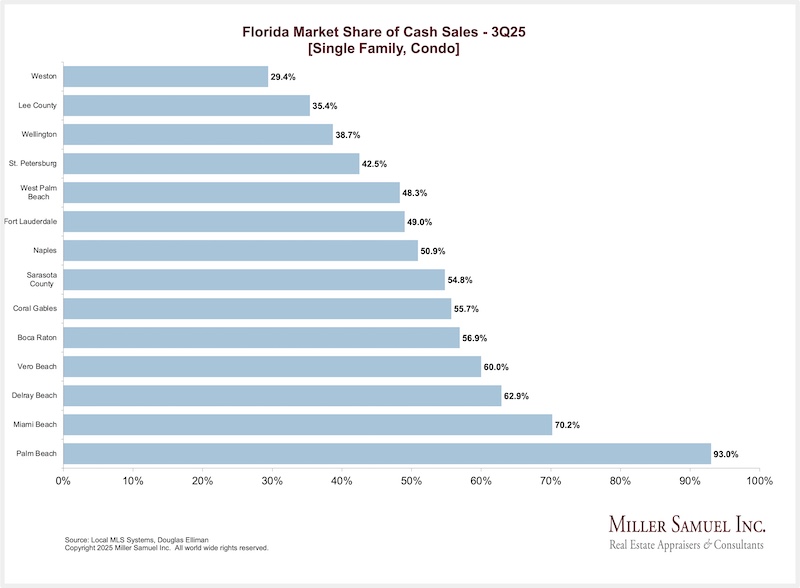

Cash is still king in Florida, but not at record levels. These purchases are a way to navigate around elevated mortgage rates rather than having an advantage over competing buyers for the property (see chart above).

Underperforming Miami Condos

The Real Deal published a terrific analytical piece at the end of August: Are these Miami-Dade condo buildings underperforming? Incidentally, I see the long-term outlook for Miami housing as a continued shift to more luxury product. Our research shows that the sales turnover of condos built in the past decade is double the rate of the older housing stock.

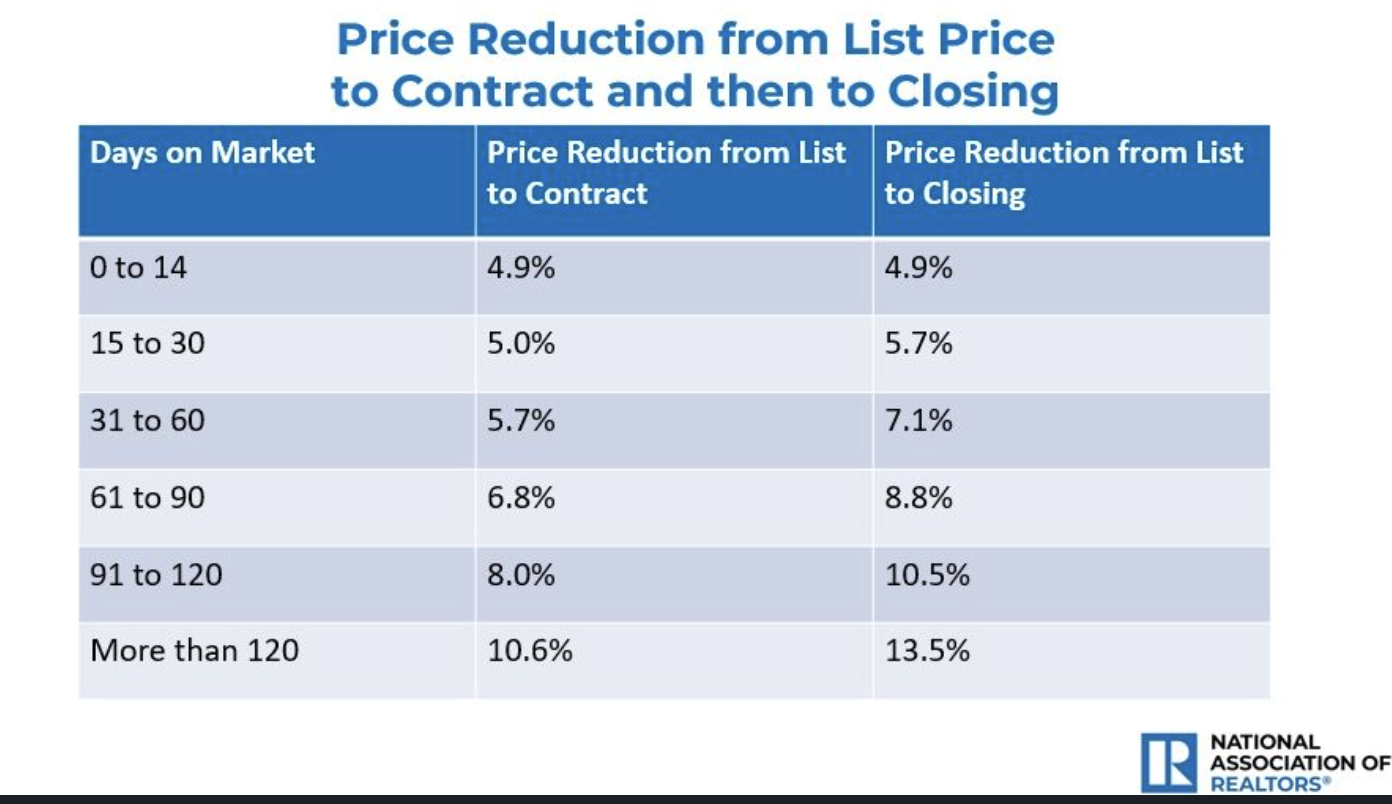

That Real Deal piece outlined how to understand whether a new development was slowing down:

- Prolonged days on market, often segmented by repeated de-listing and relisting attempts.

- Discounts between the original asking and the final sale prices are available.

- Poor construction quality, location concerns, or inefficient floor plans can be issues in some instances.

- A high proportion of investor-owned or renter-occupied units affects building stability and perception.

- Increased maintenance or HOA fees, sometimes 50-60% higher over a short period, which can deter potential buyers.

As I teach my grad students, transactional trends change earlier than the impact on prices, and only one of the above observations mention prices, which is why these signs are so useful.

Final Thoughts

In response to the Surfside condo collapse, Florida enacted strict new safety laws requiring regular structural inspections and mandatory reserve funding for repairs in all aging condominium buildings. These measures aimed to prevent deferred maintenance by ending the practice of waiving critical repair reserves, but the reforms have led to higher costs and special assessments for owners, many of whom are on fixed incomes. Developers initially saw older condos as redevelopment targets, yet an October 2025 Supreme Court ruling now empowers owner holdouts to block terminations, making buyouts much harder and riskier. As a result, owners of many aging Florida condos are stuck with escalating costs and fewer options for redevelopment or sale, especially amid a housing environment loaded with uncertainty and elevated mortgage rates.

The Actual Final Thought – Now, that the condo termination has been 86’d (terminated) this review of past history seems appropriate and perhaps he won’t be back.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come.

[Podcast] What It Means With Jonathan Miller

The Be Wary Of The Screams For RTO episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?