Yes, we are.

But I digress…

Manhattan Co-op Sales Fall During Federal Election Year

For the past decade, I’ve been observing a pullback in sales in the summer of an election year and then a release in sales after the election into the new year, no matter the party or the candidate. I was speaking about this to Sylvia Varnham O’Regan at The Real Deal Magazine, and she asked me to prove it empirically.

So I did.

Her article: This is how presidential elections really affect home sales lays it out for the Manhattan market.

My methodology:

– The data set was co-op based because they account for 74% of the apartment market and doesn’t have the wild fluctuation of contract versus closing date because of condo new development lags.

– We don’t have all the contract dates for co-ops, but for those we do, they have been remarkably consistent at around 90 days. That 90-day average was applied to all the closing dates to reverse-engineer contract dates.

– Contracts for even and odd years were compared: Even years represented federal election years, including midterms.

The results compared federal election years to non-federal election years, finding that beginning in June of an election year, sales were progressively weaker than their non-election year counterpart. The most significant difference occurred in September during an election year with a 12.7% weaker sales market than a non-election year. Beginning in November during an election year, sales overpower their non-election year counterpart, with the release of pent-up demand occurring well into the following spring.

No More Broker Fees? – When An Article Title Gives Marching Orders To Tenants To Not Pay The Commission

There was an explosion heard ’round the city when the New York Times article on Wednesday proclaimed: Surprise for New York Renters: No More Broker Fees

And immediately, the “No More Broker Fees” SEO-friendly headline traveled across nearly all media outlets. There was no warning because the real estate lobby and the state legislature have an oil and water relationship. The news made its way to the deal level almost immediately as tenants were about to sign leases and were confused. Do they “violate the law by paying a commission?” Can they “save a bunch of money legally by not paying their broker?”

A google search shows how widely the Wednesday NYT was followed verbatim.

The Wednesday article “Surprise for New York Renters: No More Broker Fees” was followed up with “Brokers’ Fees Fallout: Renters Are Jubilant, but Agents Are Reeling” on Thursday with the photo caption:

…as if tenants will now be getting a service for free. The problem with the titles in these two articles is they suggest that all real estate brokers are a key problem with apartment affordability – that they are somehow complicit. In reality, there will be no savings to the tenant, just a pivot on who pays for a real estate agent’s service. I will explain.

Guidance ≠ New Law

First of all, the “guidance” issued by the New York Department of State is a clarification on the rent law issued last year. This NOT a new rent law. DOS provided their opinion and I would expect a significant amount of new litigation in short order to get clarification, just like the litigation already pending.

The disclaimer in the above guidance clearly shows that it is not intended to provide legal advice:

The information offered below should not be used in lieu of seeking appropriate legal advice and is

not intended to answer general questions by private landlords, cooperative boards, or

condominium boards regarding the Acts. This guidance is subject to change and licensed

professionals should frequently visit this page for important updates based on future

interpretations of the Acts by the courts.

And where was REBNY? Where was NSAR? These lobbying groups and others, as well as all real estate firms, were blindsided by the New York Times’ exclusive headline.

Here are some observations in the political battle between Albany and the real estate industry that literally accounts for nearly half of New York City’s fiscal budget and the new political majority in Albany that is focused on tenant relief at the expense of the real estate industry.

– There are ‘bad actors’ in the real estate industry but not all landlords and developers are bad as is inferred by Albany’s statements and actions.

– There are politicians that act in bad faith but not all are bad. In this case, I believe there was a good faith effort to pivot away from the large upfront costs.

– Real estate agents are hard-working people that provide a valuable service and make a modest living. They shouldn’t be stereotyped in a disrespectful “anti-tenant” way as has been done here.

– State politicians have shown little understanding of economics in their actions over the past 12 months which will mean higher taxes for all residents of New York City, especially because the population is declining.

– NYS politicians need to see NYS as competing with other states now, especially after SALT.

– The NYC real estate lobby has zero influence in Albany.

No Free Lunches

Albany wants the burden of commission costs shifted to the landlords but as we know in economics, there is no free lunch. This action will drive all rents higher because landlords will have to recoup the fees paid to agents to rent their apartments. Who in Albany really thinks that tenants will get a service like schlepping tenants all over the city to find an apartment if the sales agent can’t be paid a commission? The Statewide Housing Security & Tenant

Protection Act of 2019 and the Housing Stability & Tenant Protection Act of 2019 have already eliminated all the upside of being a landlord so why would the landlords be able to absorb that additional cost? Of course not. Rents are going up as a result of market forces, this time from these government actions.

As a result, tenants may very well pay about the same rent total over the course of the year. While tenants don’t pay the upfront, their monthly rent will be higher – in fact, the entire market will likely see higher rents as a result of this law. Tenants can’t play landlords against each other because all landlords are in the same boat now.

And what about Streeteasy? They are charging $6 per day for rental listings and taking 35% of the commission off their “leads” program. Without commissions, could we see a surge in the per day listing cost? I’m not sure but with the whole rental process in chaos, anything is possible. I would think that Streeteasy is going to scramble and significantly expand its relationships with landlords to make up for the loss in revenue.

2018 Was A Year To Forget

– Federal “SALT” Tax

2019 Was A Year To Remember To Forget

– New Mansion Tax

– Transfer Tax Increase

– New Rent Law

What about 2020? (with a wild guess about the odds)

– (100%) Massive litigation will continue against new rent law and interpretation of the new “guidance”

– (50%) A revised pied-a-terre tax might be re-jiggered in order to pass but could effectively end all new development

– (10%) A massive revision of the existing property tax law

– (5%) Force landlords who lost all upside to their investment from the 2019 rent law to sell to building tenants first.

The Anti-Development Mantra Is Expanding in NYC

After years of heavy new development volume post-financial crisis, neighborhood activists are getting better at stopping them. NIMBY is one of the key sentiments behind the pushback against the creation of any new housing that is possible with the current economics. Any new residential development is incredibly expensive and the city needs the revenue, but that’s not always in the neighborhood’s best interest. This terrific New York Times piece shows how brutal the battle really is: The People vs. Big Development.

[click on image to see photo gallery]

The zoning lot conceived to create this new building was mind-blowing:

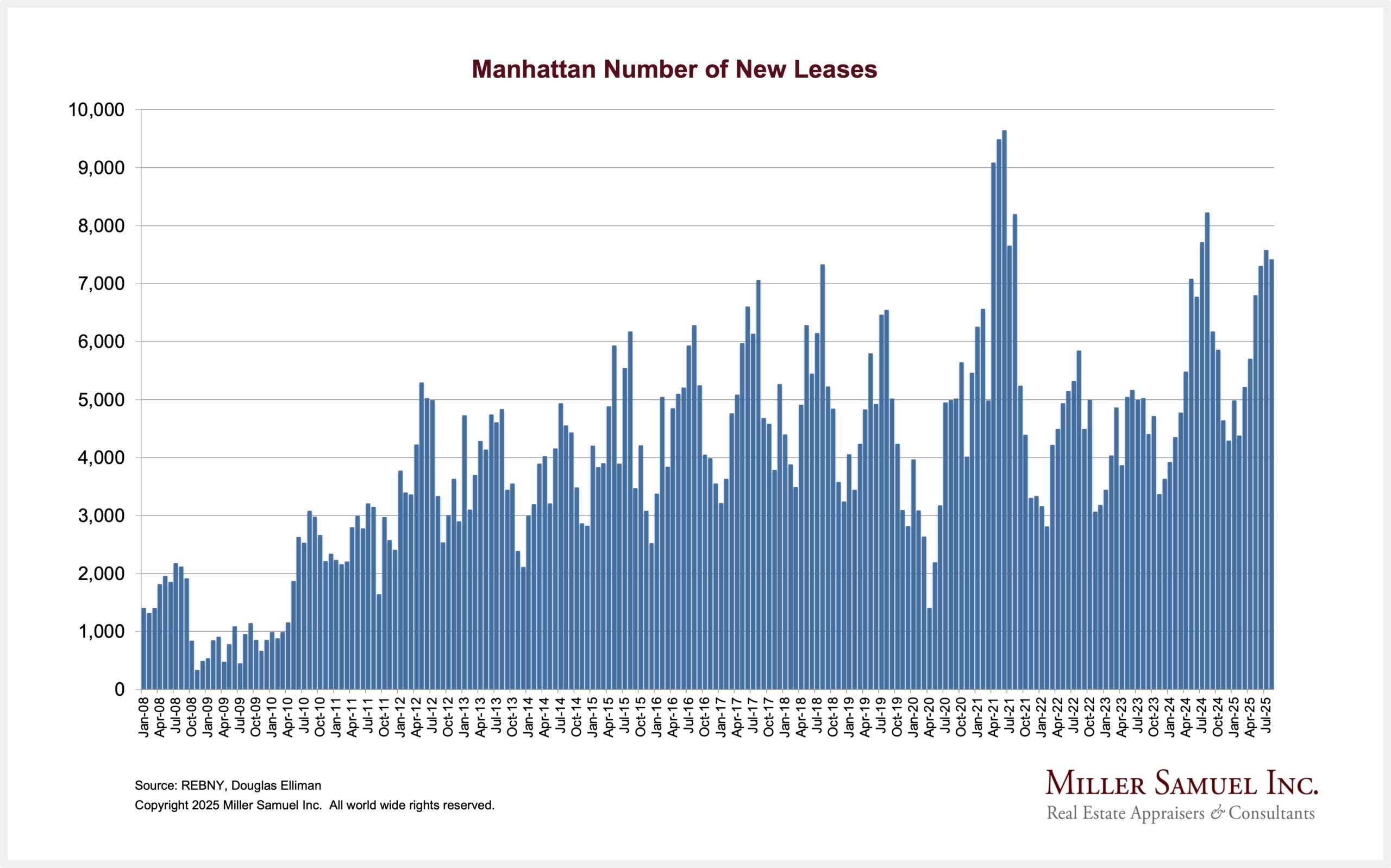

Getting Graphic

Our favorite charts of the week of our own making

Len Kiefer‘s Chart Handiwork

Upcoming Speaking Events

Headed to Boca next week!

Appraiserville

(For earlier appraisal industry commentary, visit my old clunky REIC site.)

When USPAP Tries To Do What The Courts Should Do

I perused the latest copy of USPAP and saw a new definition on the list: Misleading.

While I appreciate the attempt by TAF to create clarity and their hard work, and appraisers need standards to operate by and USPAP should be that standard, the addition of this word to the list is symbolic of over-regulation.

“Misleading” as a word is a qualitative term and the courts will determine whether something is “intentional” or “unintentional.” In Webster’s dictionary, the word “mislead” already has a negative connotation.

“to lead in a wrong direction or into a mistaken action or belief often by deliberate deceit”

With this USPAP change, appraisers should immediately be less responsive to clarifications requested by banks for obvious clerical mistakes. In other words, if the appraiser made an “unintentional” error that could reverse the meaning of a particular description, they were – by USPAP definition – misleading and that was a violation.

Why would an appraiser ever make a change in their report going forward that was requested by an underwriter? Appraising involves human beings and human beings make mistakes and we need some flexibility. What if a “comma” was missing that changed the interpretation of the description that was made? With this new definition of “misleading,” it doesn’t matter whether the appraiser unintentionally made the error or intentionally made the error. An overzealous soul could go after the appraiser for being misleading but that would be determined by the courts anyway. This new definition is just inviting problems and not protecting the public trust.

This reminds me of the idea behind appraisal standards, to begin with. Making standards more detailed and specific every two years doesn’t make appraisals more accurate or more trustworthy. There is a point where doing things like this devolve into busywork and is not helpful to the profession or the consumer. This is why I believe that USPAP should be updated no less than every five years.

I respectfully request that TAF removes this definition in the next edition and any other qualitative definitions that should be determined by the courts. Otherwise, I am going to propose new definitions for words starting with “The” “A” and “With.”

OFT (One Final Thought)

Couch surfing aside, I’m not a surfer even though I grew up on the beach in Delaware. A few years ago I read Barbarian Days: A Surfing Life by William Finnegan, the winner of the 2016 Pulitzer Prize for Autobiography and developed a new-found appreciation and respect for the sport (even though there is no way I will take it up). There really is something about the search for the perfect wave that the book is able to convey.

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons) and someone forwarded this to you, or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be more rentable;

– You’ll be more grass-roots;

– And I’ll be misleading.

Brilliant Idea #2

You’re obviously full of insights and ideas as a reader of Housing Notes. I appreciate every email I receive and it helps me craft the next week’s Housing Note.

See you next week.

Jonathan J. Miller, CRP, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Advocate Says Pied-a-Terre Tax Would Hurt All Co-ops and Condos [Habitat Magazine]

- Brokers’ Fees Fallout: Renters Are Jubilant, but Agents Are Reeling [NY Times]

- The People vs. Big Development [NY Times]

- Surprise for New York Renters: No More Broker Fees [NY Times]

- New York Landlords, not tenants, must now pay rental broker fees: state [The Real Deal]

- Opinion | Let’s Quit Fetishizing the Single-Family Home [NY Times]

- San Francisco Painted Lady sells for over asking, even though it needs a complete restoration [SF Gate]

- Choosing Green: Deciding Where to Live in Manhattan [Mailchimp]

- StreetEasy Blasted by Douglas Elliman Over Manual Entry [The Real Deal]

- Manhattan’s Luxury Housing Slowdown Has Hit Co-Ops the Hardest [Bloomberg]

- Dear Ms. Demeanor: Should I rat out my neighbor's kids for making a mess by the trash chutes? [Brick Underground]

- Boston parking lots slated for redevelopment highlight growing trend [Curbed Boston]

- Will upzoning neighborhoods make homes more affordable? [Curbed]

- State Sen. Zellnor Myrie to Propose Tenant Takeover Bill [The Real Deal]

- High-income renters drive Chicago apartment boom [Chicago Business]

My New Content, Research and Mentions

- U.S. Real Estate Market Shows Symptoms of Coronavirus Effect: What You Need to Know [The Telegraph]

- U.S. Real Estate Market Shows Symptoms of Coronavirus Effect: What You Need to Know [SF Gate]

- Why An Appraisal Is An Important Part of the Process When Buying or Selling A Home [Ask An Appraiser]

- Multiple Factors Drive Prices Downward – NYC Luxury Market Takes a Dip [The Cooperator]

- How tax cuts negatively impact California and New York but reduce homelessness [Washington Times]

- This is how presidential elections really affect home sales [The Real Deal]

- Presidential elections affect real estate market, expert says [Fox Business]

- How Presidential Elections Really Affect Home Sales

- Editor's Note: Déjà Vu All Over Again [The Real Deal]

- New York Real Estate News [The Real Deal]

- Manhattan Luxury Condo Market Sparks New Anxieties [The Real Deal]

- “The One” sale al mercado: la casa más cara de Estados Unidos por $500 millones [La Opinión]

- Con precios por las nubes, es cada vez más inaccesible comprar una casa en Manhattan [La Opinión]

- New York Sees Biggest Home-Building Boom in Years [Wall Street Journal]

- Với nửa tỷ USD, đây có thể là ngôi nhà đắt nhất nước Mỹ [Dantri]

- La Noticia en el Momento que Sucede – SALE A LA VENTA LA CASA MÁS CARA DE EU! [Noviter]

- Sen. Brad Hoylman Demands Jeff Bezos Pay Pied-A-Terre Tax [The Real Deal]

- ¿Por cuánto se vende la casa más cara de Estados Unidos? [El Observador]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan Decade 2010-2019 [Miller Samuel]

- Elliman Report: Manhattan Townhouse 2010-2019 [Miller Samuel]

- Elliman Report: Venice + Mar Vista Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Malibu + Malibu Beach Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Aspen + Snowmass Village Sales 4Q 2019 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Miami Coastal Mainland Sales 4Q 2019 [Miller Samuel]

Appraisal Related Reads

- An open letter to homebuyers [Ryan Lundquist/Sacramento Appraisal Blog]

- What is the Due Diligence Period? [The Hank Miller Team]

- The Cosmic Cobra Breeding Farm? [George Dell, SRA, MAI, ASA, CRE]

- 6 Reasons Appraisers Are NOT Needed [Tom Horn/Birmingham Appraisal Blog]

- Not getting distracted by outlier sales [Ryan Lundquist/Sacramento Appraisal Blogs]

- AMC Celebrating One Million Appraisal Orders Sucker Punches Appraisers [Appraisers Blogs]

- What Affect Will Offerpad Have on Birmingham Home Values? [Tom Horn/Birmingham Appraisal Blog]

- Class Valuation Fits Squarely Into the Low Life Company Category [Appraisers Blogs]

- WRE Surveyed Appraisers Say NO to the Bifurcated Model [David Brauner/Appraisers Blogs]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)