- Fannie & Freddie Are Essential For The Homebuying Process By Expanding Capital For Mortgage Lending

- The GSEs Did Not Learn Their Lessons From The Moral Hazard Of The Financial Crisis

- The GSEs Maintain A Cultural Arrogance That Will Get Them Into Trouble If Freed From Conservatorship

First of all, Happy Thanksgiving to all my readers! Early in my career, I learned that certain costs never go down, namely taxes and conforming loan limits for mortgages. While in danger of going full wonk here on the day before Thanksgiving, conforming loan limits are the point where a conventional mortgage (purchased or guaranteed by the GSEs: Fannie Mae & Freddie Mac) becomes a jumbo mortgage and out of the purview of the GSEs (and the lower mortgage rates they enable). Their rates are lower largely because they enjoy the implied backing of the US government despite the GFC lessons of moral hazard after being taken into conservatorship. It has been my experience that the GSE culture has an embedded arrogance, much like Zillow. It’s been fascinating to see how the GSEs operate as an entity beholden to both the shareholders and the taxpayers. Here is an example of that behavior.

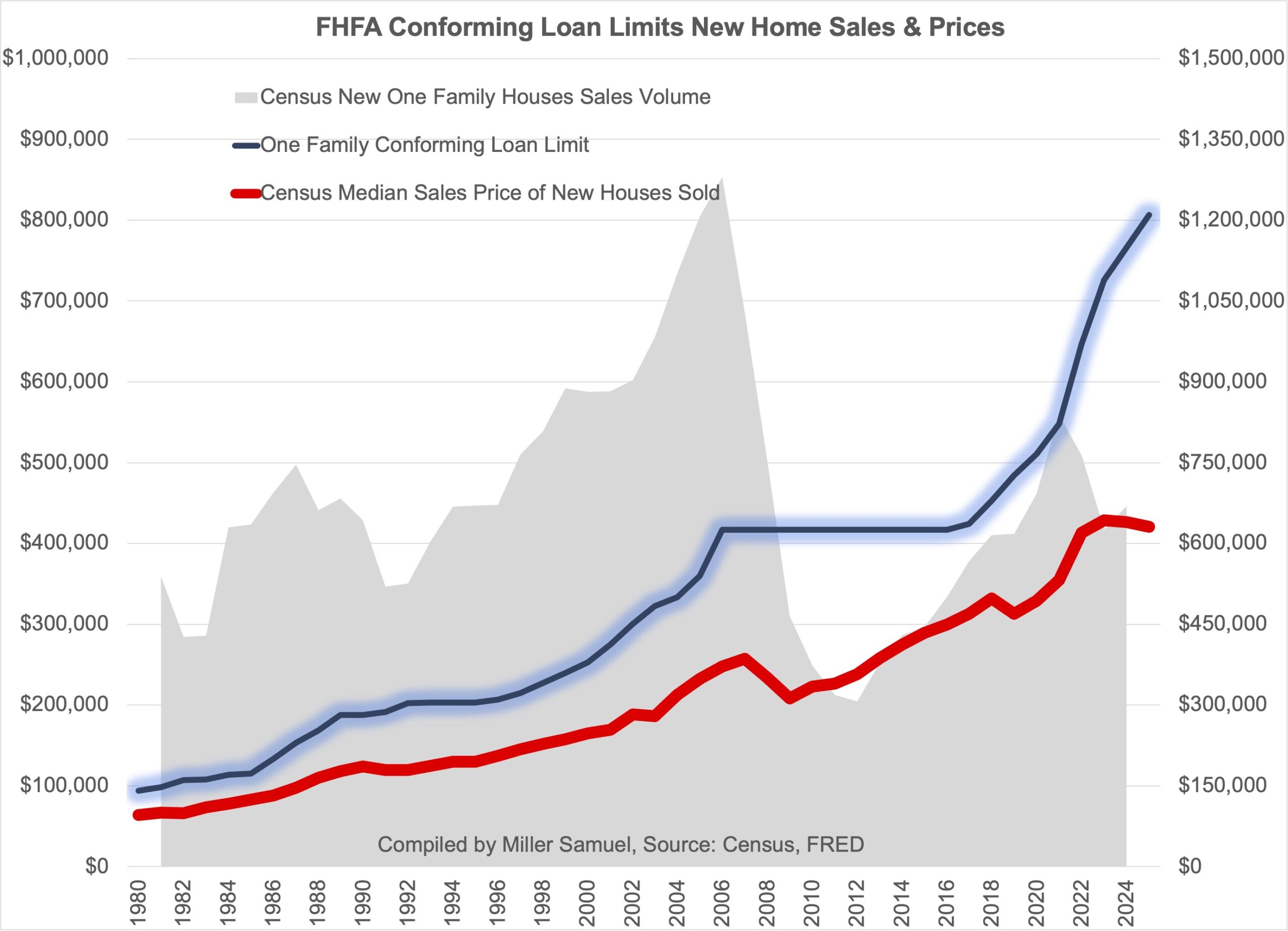

The following chart tracks the conforming loan rate (blue), the median sales price of new home sales (I picked “new” because of their higher prices than existing, and their deeper history), and new home sales volume (gray).

When a mortgage is less than the conforming loan limit, Fannie and Freddie will purchase or guarantee mortgages submitted by banks – in doing that, they free up capital for banks to issue more mortgages. They essentially enable mortgage lenders to have more liquidity.

The Bigger The Conforming Loan Limit, The More Revenue Upside For The GSEs

The 2008 Housing and Economic Recovery Act (Subprime), the GSEs then had to raise the conforming loan limit by the annual increase of the average sales price of a home in the U.S. What is fascinating about this law is that the conforming loan limit remained flat for more than a decade instead of falling. I don’t doubt they complied with the technical details of the 2008 law, but there was no pushback from the GSEs. Why? It is clear that using average sales price as the indicator skews the home price numbers higher than the overall market performance, unlike median sales price. I’ve been told by several DC insiders that before 2008, Fannie Mae had virtually every public relations firm on retainer. That’s how they got into trouble. Within the 2008 law, I’ll bet there was a lobby to change the median sales price to the average sales price to get higher growth in the conforming loan limit. For the past twenty years, the high-end of the market generally outperformed the remainder, overstating average sales price. You can see the massive surge from 2020 in the conforming loan limit.

It is clear from the chart that mortgage volume collapsed during the GFC but enjoyed a smaller spike during the pandemic. Note the spike in the conforming loan limit since the pandemic of 2020 – the spread widens substantially – but the gap has been widening for decades. The concept of lower loan limits, when prices fall, has never been entered into FHFA’s calculation.

High-Cost Markets Like NYC

Certain markets a designated as high-cost, where the conforming loan limit exceeds 115% of the median sales price of the local county, the limit can be set up to 150%.

GSEs Don’t Think Anyone Needs To Look Inside The Houses They Financially Back

I’ve got a lot to say about this topic and will be explored in a future post. But it’s quite surreal and reflective of the organization’s arrogance. If they are risk averse under receivership and went into receivership because of ineptness at assessing risk, it suggests that if they are brought out of receivership there will be a lot more bad behavior.

Final Thoughts

The GSEs provide a valuable function in the home buying process, by freeing up capital of mortgage lenders. Think of housing as local and mortgages as national as rates don’t vary dramatically by location. FHFA missed the bad decisions of the GSEs several times in history. They continue to act like they are a private enterprise. There are a lot of issues we’ll be exploring in their bad behavior in the new year.

The GSEs or more than a bunch of silent letters.

Did you miss the previous Housing Notes?

November 25, 2024

Image: ChatGPT

Housing Notes Reads

- How the Trump administration could impact the appraisal industry [Housingwire]

- Thanksgiving dinner is historically affordable this year [NBC News]

- Harry Macklowe’s $2B conversion of One Wall Street to luxe condos has been a bust for the billionaire [NY Post]

- Brick Underground on Instagram: "If you have a reverse commute and are shopping for a new apartment, you may have just crossed all of Manhattan below 60th Street off your wish list. Or maybe you own an apartment Downtown, a place you’re preparing to sell. You may be crossing your fingers and hoping that the cacophony of gridlock will improve sometime after midnight on January 5th. That’s when a new $9 toll for passenger cars goes into effect for vehicles entering Manhattan below 60th Street, thanks to a revamped version of congestion pricing reinstated by Governor Kathy Hochul. The goal of congestion pricing is to “unclog our streets and reduce pollution” and support the MTA’s capital plan to upgrade mass transit, Governor Hochul said. Fees from the plan are expected to pay for $15 billion in mass transit improvements, including upgraded signals on six subway lines, an extension of the Second Avenue subway to East Harlem, accessibility improvements like elevators at more than 20 stations, and hundreds of new electric buses. For buyers, sellers, and renters, congestion pricing adds a new and largely unknown factor. Brick heard from brokers about the potential impact the plan could have on real estate deals. Click the link in our bio to read what congestion pricing means for real estate. #congestionpricingnyc #nyccongestionpricing #congestionpricing #nycrealestate #nycapartments #nycbuyers #nycsellers #nycnews #nycmta" [Brick Underground on Instagram]

Market Reports

- The certainty of uncertainty [NY Times]

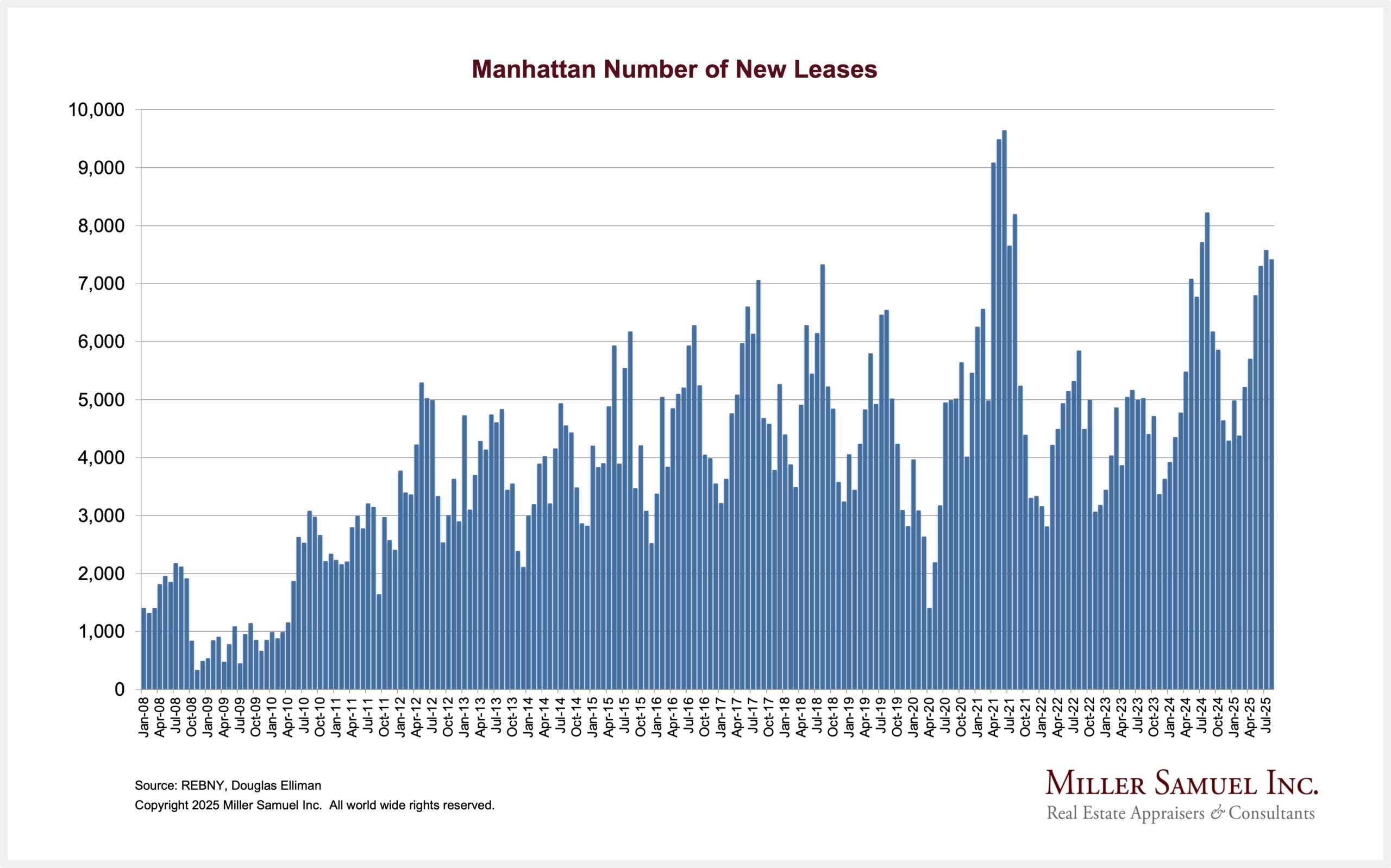

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)