- The China Trade Deal Will Likely Assure Mortgage Rates Remain Elevated

- Consumers Acclimating To Elevated Mortgage Rates, But Uncertainty Is Worse

- The Tariff Tantrum Took The Momentum Out Of The Spring Housing Market

When asked about the Tariff Tantrums that began a month ago, I’ve been describing them as “our uncertainty has uncertainty.” Companies can’t make plans. Corporate executives are giving two forecasts for 2025: with and without tariffs. Homebuyers, many of whom have been waiting for over three years for lower mortgage rates, are agonizing over whether to go through with the purchase anyway. Yesterday, I spoke at a real estate agent event on Long Island (which currently has the second-lowest level of listing inventory in history). I got a steady stream of attendee feedback that during the daily tariff policy announcements out of DC, homebuyers have been backing out of deals, and then re-engaging a few days later. While it is clear there remains a tremendous amount of pent-up demand for housing, it is mostly remaining on the sidelines, waiting for the right moment to take action. Tariff policy is becoming a bigger impediment to normalizing home sales levels than elevated mortgage rates.

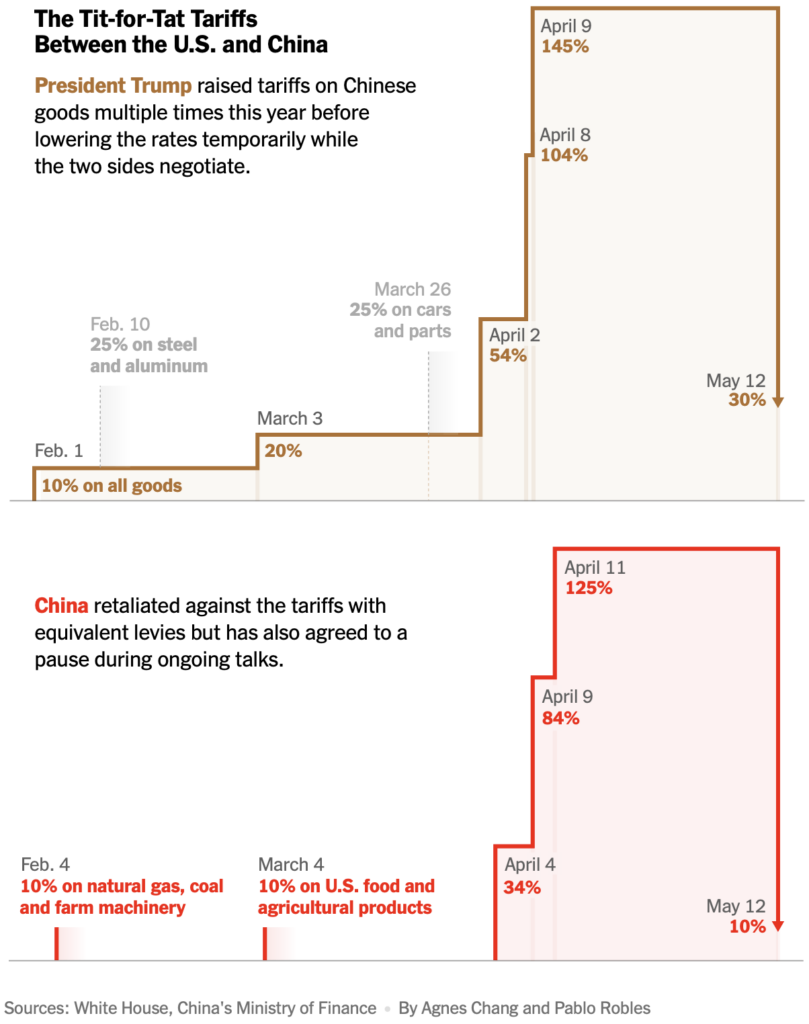

After all the back-and-forth tariff drama of the past month, the trade deal with China essentially brought nothing to the US economy but higher costs to the US consumer. Americans will now pay 30% more for Chinese goods than they did in 2024, and Chinese consumers will only pay 10% more for American goods in China. With 80% of the items sold in Walmart coming from China, they will now be priced up to 30% higher. The higher cost is the very definition of inflationary policy. This trade war has already cost the US consumer $2,800 per family for no credible reason. As economist Milton Friedman once said: “We call the tariff a protective measure. It does protect…It protects the consumer against low prices.“

And the current China trade deal is only valid for 90 days so that the US will go through this turmoil again before Labor Day. Any hope of this policy chaos boosting the US economy in the future is non-existent since no one sees the flurry of executive orders and non-action by the House of Representatives as structured to last beyond the current administration’s term. In order to invest, manufacturers need to believe there will be decades of economic stability with trade policy. Yet, investors, corporations, and consumers don’t know if there will be a policy shift tomorrow.

Final Thoughts

To bring this back to housing, this economic period of uncertainty will keep mortgage rates elevated or even push rates higher. This trade deal with China ends up:

- Doing nothing to strengthen the US economy

- Alienating our trade partners, risking our favored nation status

- Applying a 30% tax on the American consumer, which is massive

- With another tariff policy chaos scenario in 90 days

- Giving the administration nothing left to negotiate for better terms

- Keeping mortgage rates elevated as tariffs are inflationary

However, the challenge to the housing market right now is less about high rates and more about the uncertainty we all face about the economy. It’s as simple as that. “Higher for Longer” is the economic reality for today. Consumers are adapting to the higher rates, but it’s hard to adjust to the daily tariff pronouncements coming out of DC.

Ending the narrative of future “empty shelves” as we saw during COVID by coming to a temporary deal with China is probably better for housing than plunging into a deep recession with lots of job loss.

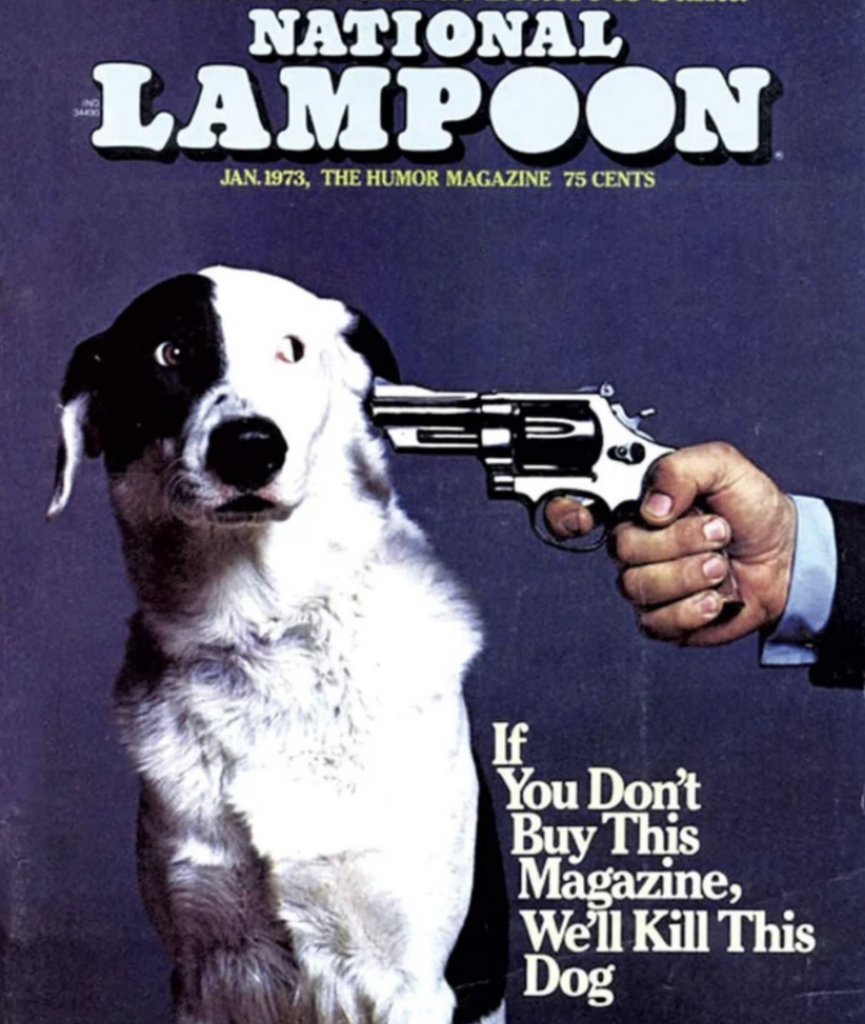

The Actual Final Thought – The tariff negotiations of the past month remind me of an old cover of National Lampoon. The recent saber-rattling has been an attempt to negotiate from strength, but because there is no real plan, the administration has no position of strength.

Here’s My Podcast

Episode 4 is out! I spoke at a real estate event yesterday, and I sincerely appreciate all the positive feedback I received on my WIM podcasts. I’m trying to get into a rhythm and record these weekly. The plan is to do these at 10 am ET every Tuesday going forward.

The latest episode of What It Means.

Here are the podcast feeds for previous episodes of “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

May 12, 2025

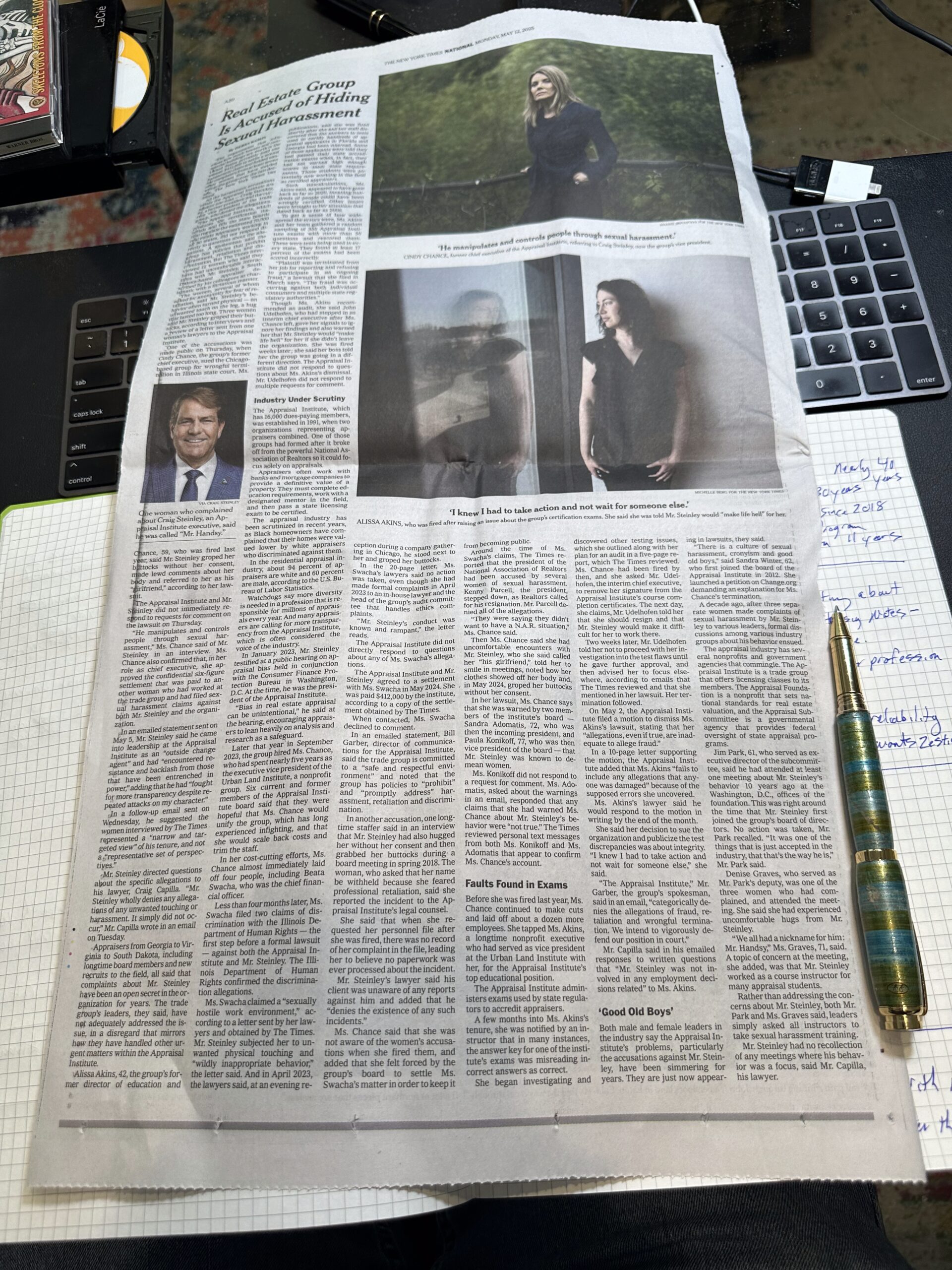

Appraisal Institute Continues To Cover Up Its ‘Wildly Inappropriate Behavior’

Image: Me

Housing Notes Reads

- Bullard: Fed Could Start Cutting Rates by September If Tariff Uncertainty Eases [ Kathleen Hays via Substack]

- Level Up, Lauderdale [Highest & Best]

- Tariff timeline with China, so far [FlowingData]

- V.P. of Real Estate Group Will Step Away After Harassment Claims [New York Times]

- What Was Once a Challenge 'Has Become Largely an Impossibility' – Study: It Takes 31 Years to Save for a Down Payment in NYC [Cooperator News]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)