Time to read [9 minutes]

Takeways

- Compass announced an all-stock acquisition of Anywhere (the industry’s largest legacy brokerage), a deal nearly tripling its sales volume while planning to maintain brand identities post-merger.

- The acquisition raises potential antitrust concerns due to Compass’s private listing network, which limits market transparency, reduces consumer exposure to information.

- Strategically, Compass seems to be focused on scaling its private listings ecosystem to strengthen control over commissions and posing a threat to Zillow.

We got the news this morning that the real estate brokerage industry’s Tesla is buying General Motors. My iPhone blew up with the news [gift link] that Compass had purchased Anywhere in an all-stock transaction. I did not see this coming, but I remember this. This morning, my colleagues across the real estate brokerage community chimed in to share their views. Some liked the idea, while others were concerned about a monopoly, and still others thought it wouldn’t change the industry. The deal is a merger, much like Zillow’s acquisition of Trulia more than a decade ago, where Zillow retained the Trulia branding due to consumer loyalty (think Mac vs PC). Corcoran’s CEO emailed her agents this morning, telling them that Compass plans to keep the separate branding once the regulators approve the deal in the latter half of 2026. Given the gutting of federal regulators by DOGE, the timing seems perfect. Although Compass will inherit a ton of debt, an unwieldy management structure, and an outdated business model, it will get a lot more listings to feed into its private network. Anywhere probably got a 100% premium (a wild guess) for their stock based on today’s performance of each company, but this is a long game and Compass may have already won.

Antitrust Risk From Size

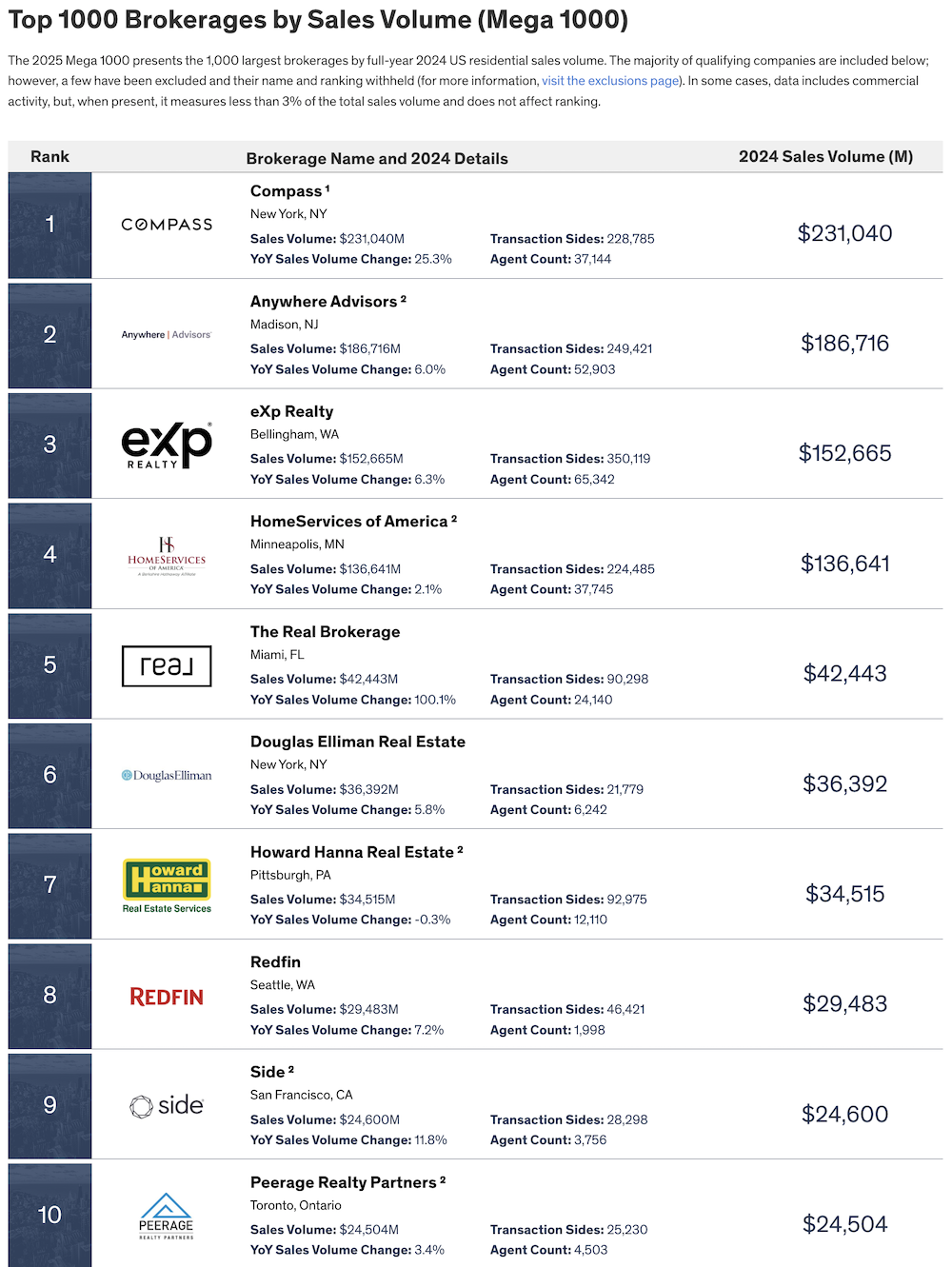

Using the 2024 sales volume list below, the combined forces of Compass and Anywhere are 173.6% higher in sales volume than the new second-place EXP Realty. Even though the newly formed leader would be nearly triple the size of the new second-place firm, this doesn’t seem out of the norm when we think about a decade ago, with NRT at the top, followed by Home Services and then a long drop to third place held by Long & Foster. Therefore I don’t think this issue would hold up the merger.

Antitrust Risk From Private Listings

Compass believes they need to go big or go home (pun intended) to thrive. As I have written about Compass in the past and have met directly with Robert Reffkin on this issue, the Compass core business model of building a private listing network (also known as the 3-Phase marketing plan) systematically disenfranchises buyers by intentionally withholding market information from them. Robert mentioned that he was in constant communication with decision-makers in Washington regarding the private listing concept, and they were okay with it. In fact, he encouraged me to write about our meeting on this topic. In our conversation, it was apparent that Robert meant what he said and believed private listings were justifiable. Where I disagreed was that complete transparency is necessary for an even playing field in many consumers’ most significant transactions of their lives. Metrics like days on market are needed to derive price discovery for both parties, which is why we have consumer protection laws. A Wall Street analyst once told me that their colleagues were wondering when the litigation would start, stemming from buyers not being exposed to marketing time information, and from sellers learning that only a couple of people had seen their listing. Compass adamantly maintains that the seller has the right to market their home as they choose (to which I qualify with “even if it means misleading the buyer on the largest transaction of their lives”). I understand his point, but it leaves me uncomfortable with the uneven playing field for consumers and adds another layer of reputational damage to the real estate brokerage industry by systematically reducing transparency.

With all the recent DOGE cuts, regulatory enforcement in Washington has been neutered. Compass couldn’t have picked a better time for this move.

More Double Dips With Fewer Public Listings

Duh. Compass will be able to add a lot more private listings to its network as it suddenly surges in scale. This growth may understate public listing inventory across most housing markets. By hiding information, private listings enable listing agents to more readily control both sides of the commission because they control the deal. The legal exposure to those agents from dissatisfied buyers and sellers down the road should result in a lot of additional litigation against agents. Agents should think about lawyering up.

Who Will Compass Poach Agents From Now?

Compass is an industry disruptor by capital and has been effective at poaching top talent from all the legacy firms and paying signing bonuses while consistently denying that they do that. They’ve also gobbled up many firms in their quest for growth. Compass will represent the lion’s share of legacy brokerage firms with the Anywhere purchase, so agents of those firms are no longer poachable. Ha. This merger provides a stern warning to all the boutique brokerage firms that they need to align with a large firm to keep up with Compass in terms of offerings to new agents.

Fee Splits Will Compress

I suspect that with Compass as an emergent monopoly, agent fee splits will collapse fairly soon after finalization of the deal, as the quest for profitability becomes more urgent. If Compass reengineers Anywhere to their method of operation, the cost seems problematic. Both firms have limited profitability using completely different business models. Agents will ultimately see more minor fee splits and won’t have other firms to play off to push fee splits higher.

Zillow Killer

Assuming the regulators allow the merger, I assume Compass will turn off all the feeds to Zillow and Realtor.com on “Day One” like Realtor.com once did to Zillow. Zillow becomes a shadow of its former self or shuts down. NAR is already losing credibility and relevance, and Zillow has sided with NAR.

Final Thoughts

This deal confirms Compass knows what they want – more private listings as a path to consistent profitability. A modern firm with a limited history of profitability, acquiring a debt-laden older firm with small margins, is clearly a move to gain more private listings through scale. The greater sales volume won’t significantly expand profitability, given the cost of retooling required. The only answer to the industry upheaval is more forms of private listings with a higher ratio of double dips.

The Actual Final Thought – Double Nickels On The Dime is a famous 1984 punk album by the Minutemen and one of my favorites. The title was poking fun at one of the band members who drove exactly 55 mph on the highway in his Volkswagen Beetle, making fun of Sammy Hagar’s “I Can’t Drive 55” song. “The title means fifty-five miles per hour on the button, like we were Johnny Conservative,” as an analogy of Compass acquiring Anywhere. I was listening to this album all last week, as I read Corporate Rock Sucks: The Rise and Fall of SST Records.

Upcoming Past Presentations

I had a terrific conversation with Roberto and John last week on the state of housing. They asked good questions and I tried to convey my answers with as much clarity as I could in a market that is really confusing for consumers. And from the listener count on their Youtube channel, the conversation seemed to resonate with their audience. Click on the link above or the image below to replay the broadcast.

Upcoming Presentations

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

September 15, 2025: Thinking About Closed College Campuses For Non-Student Housing

- Interesting. Have thought about this for a while. So which schools are vulnerable to enrollment issues? Which schools will thrive? What does this do to the likes of PBSA? White elephants?

- Interesting idea. Will be interested to see if it is useful.

- how you’re seeing the overlap between higher ed and housing and real estate

[Podcast] What It Means With Jonathan Miller

The Ugly Signs Can Be A Good Thing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- Real estate brokerage Compass to buy rival Anywhere in $4.2 billion deal [Reuters]

- Real estate brokerage Compass to buy rival Anywhere in $4.2 billion deal [NBC]

- Brokerage Giant Compass Agrees to Acquire Rival Anywhere for $1.6 Billion [Wall Street Journal]

- Compass to acquire Anywhere, creating world’s largest brokerage [Real Estate News]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 8-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 8-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)