- First Street Shares Its Climate Risk Data With Redfin, Now Zillow

- Climate Risk Data Is Evolving To Be More Understood By The Consumer

- Measure Of The Climate Risk Impact On Individual Properties Becomes Empirical

The people who brought you the wildly inaccurate but ubiquitous Zestimate will introduce a climate risk threat score to be associated with a property address. They are using data from First Street, which has been modeling climate risk for years. I suspect the results will be initially inconsistent across the US, but they are distributing this knowledge on a large scale. Incidentally, Redfin already has this feature, but Zillow has added a mapping capability with this new feature. I think the feature has the potential to be an essential tool in the home-buying process (appraisers get ready to measure the impact on pricing). Climate risk is becoming a much more critical locational amenity with the increase in frequency and intensity of climate events.

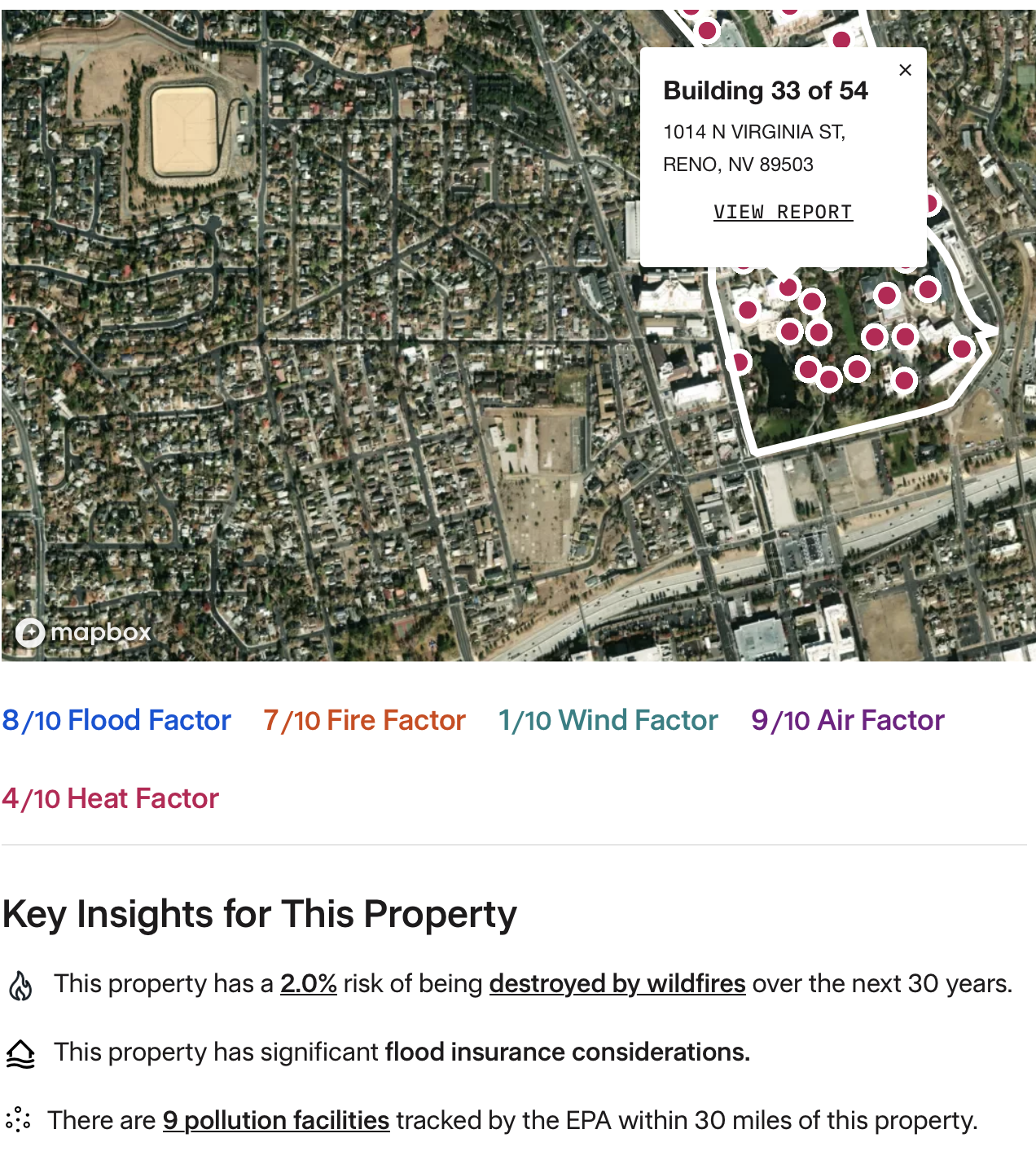

I think First Street is going to become a household name to consumers after this recent burst in visibility to a company that has been around for years. Take some time to explore their website. Here’s a screenshot of the information that can be culled from specific properties. This property has a 2% risk of being destroyed by wildfire in 30 years. Wow.

Social Awareness On Climate Risk Rising

In 2023, Zillow commissioned a survey that indicated 80% of homebuyers consider climate risk. The climate scores focus on the following risks:

- flooding

- wildfires

- heat

- air quality

- wind damage

It’s hard to argue with the following point being made if the data presented is generally accurate:

“Climate risks are now a critical factor in home-buying decisions,” Skylar Olsen, Zillow’s chief economist, said in a statement. “Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions.”

Accepting New Ideas Can Be Hard

Back in my days on the Trulia Industry Advisory Board from 2005 to 2014, I marveled at the way the founders were able to introduce new features steadily. I remember when Trulia introduced foreclosure data to their website from data aggregator RealtyTrac, later acquired by ATTOM. The brokerage firms on the committee were from all over the U.S., and the leaders were impressive individuals. Nearly all were adamantly against the introduction of that new type of data out of concern about tainting the perception of data quality. At the next meeting six months later, when the foreclosure data was added anyway, the next new feature was introduced to the site. No criticism was offered on the addition of the foreclosure data talked about previously, presumably because the brokerage firms had time to get comfortable with it. Greater market transparency is always a good thing – it just takes some stakeholders longer to process the change.

Final Thoughts

The acceptance of this new climate risk data point is going to be dependent on the accuracy relative to the properties it is associated. The data will be another metric for consumers to consider, as they already have metrics such as crime data, walkability scores, and schools. Given the weather volatility of late, this is more about the natural evolution of housing data to create greater transparency.

To my chart fans, I’m sorry I don’t have a Venn diagram for you today, so here you go.

Personal note: As I’ve mentioned before, I was on the Trulia industry advisory board before they had a website, all the way to their acquisition by Zillow. I no longer have shares in the company, but I always feel the need to share that tidbit since I have been savagely critical of the Zestimate for a decade. Zillow only shares First Street’s results and has an excellent reputation.

Did you miss Friday’s Housing Notes?

Housing Notes Reads

- Should You Trust Zillow’s Climate Risk Data? [Heatmap News]

- Zillow introduces First Street's comprehensive climate risk data on for-sale listings across the US [Zillow]

- More New Listings at Major Climate Risk Now Than Five Years Ago [Zillow]

- The Standard for Climate Risk Financial Modeling [First Street]

- More than 80% of home shoppers consider climate risks when looking for a new home – Sep 5, 2023

- Zillow will now show climate risk data on home listings [WaPo]

Market Reports

- Elliman Report: St. Petersburg Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 3Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Boca Raton 3Q 2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 9-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)