Cash Is King, Or Queens

Manhattan cash buyers account for two-thirds of all home sales, higher than normal

U.S. cash buyers in metro areas account for four in ten sales, more than typical

The share of cash buyers fluctuates with mortgage rates

Who would have thought that so many people had so much cash? The phrase “Cash Is King” from the late 1800s, was popularized in more modern times by the former CEO of Volvo during the 1987 stock market crash. When the phrase is used today, it infers a weakness or distortion exists in the economy. Even at a home purchase level, it is usually a workaround to gain a negotiation advantage when the market is weak or distorted.

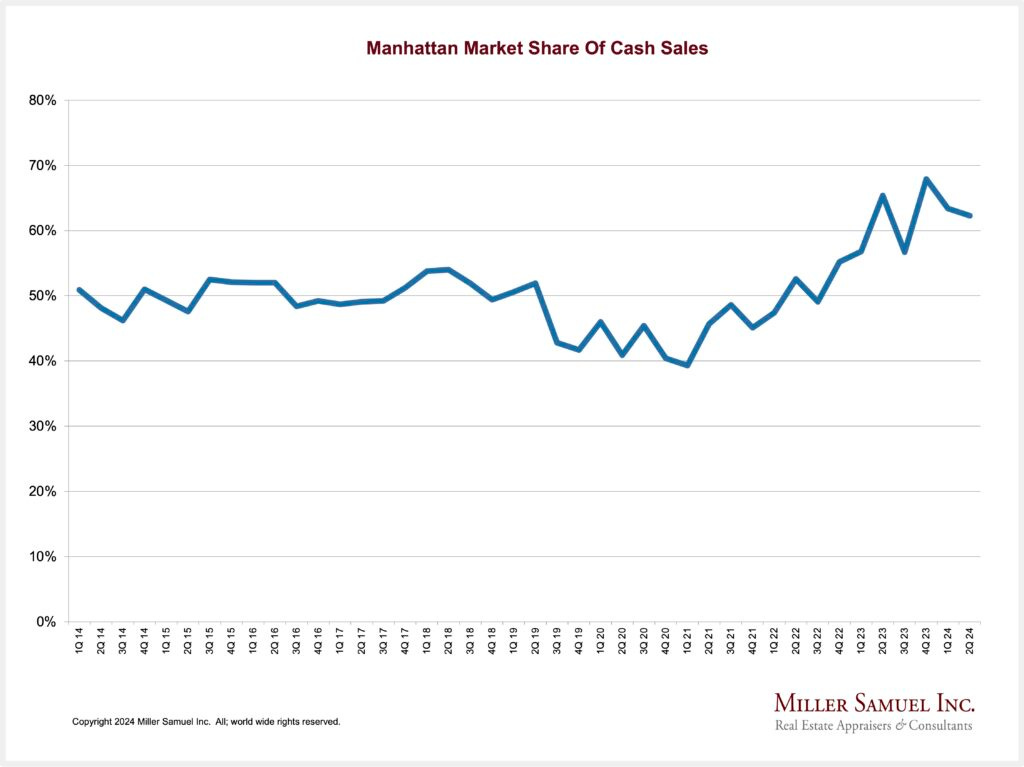

The share of cash buyers in Manhattan has been unusually high since the ’22 Fed pivot to higher rates used to tame inflation. Surging mortgage rates restrained sales activity, even for consumers who aren’t as dependent on interest rates as others. This recent cash trend is probably here to stay for only as long as mortgage rates remain elevated. I believe that because when mortgage rates were on the floor leading into and during the pandemic (2019-2021), mortgage rates fell below trend.

Cash Really Is King, When Times Are Tough

In times of crises, we often refer to the phrase “Cash is King”. This saying gained popularity after Pehr G. Gyllenhammar, CEO of Volvo, used it after the global stock market suddenly crashed in 1987.

The New York Times/The Upshot had a great piece on cash sales in Manhattan sourced by data analytics firm Marketproof and U.S. analytics by data aggregator ATTOM. What I loved about the piece was how it illustrated that cash buyers are not exclusive to the guy wearing a bowling hat in Monopoly.

Cash buyers are floating near record highs in both Manhattan and across U.S. metro markets. Just for fun, Brooklyn saw a 46.3% share of cash buyers in June.

Are Home Purchases Made With Bags Of Cash?

And why do buyers purchase with cash?

A cash buyer doesn’t need a mortgage, bypassing the higher cost due to the spike in mortgage rates over the past two and a half years.

Cash buyers can move more quickly than purchasers using a mortgage, can use favorable terms in negotiations, and best of all, close quickly.

Because cash buyers don’t need anyone’s approval, as a bank requires for a mortgage that involves underwriters and appraisers.

Cash buyers have more negotiating power on prices in a tight market.

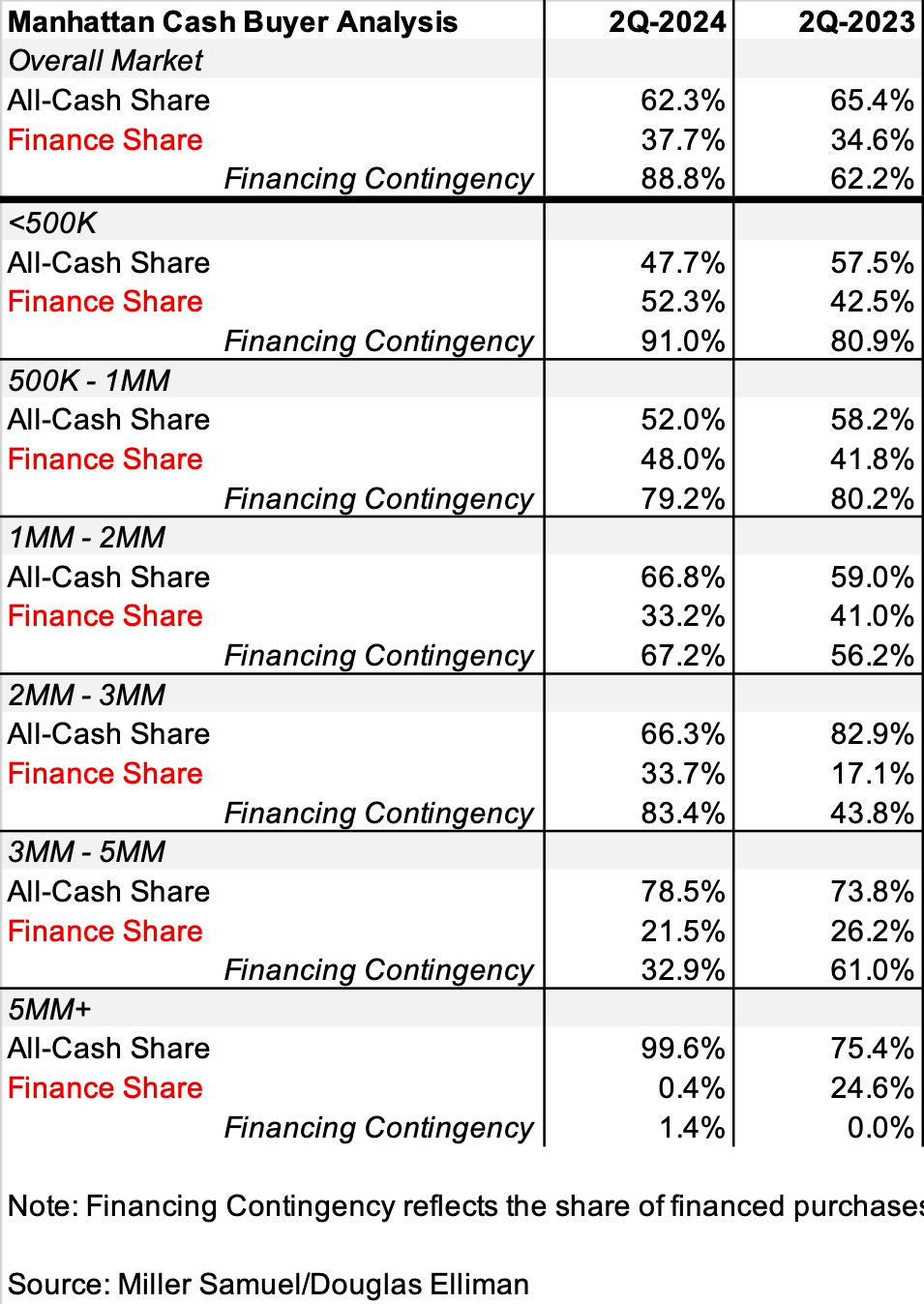

In Manhattan, the probability of a cash buyer rises with higher purchase prices as illustrated in Marketproof‘s data in this useful NY Times illustration..

How do cash buyers pay with cash?

Buyers show up with suitcases full of Grover Clevelands, promising a quick closing. Rarely, although I have heard of a few stories in Manhattan by Russian buyers before Putin invaded Crimea in 2014.

A Wall Streeter or tech titan was compensated with a significant bonus and used it to purchase a home. I periodically hear these folks on my commuter train trying to one-up each other extolling stories of purchasing $125,000 cars with their AMEX cards to get the points. Oof.

The buyer is a foreign national who uses cash for the payment. In a more typical scenario, they obtained a loan abroad and transferred the cash into the U.S. to purchase a home.

Buyers sell and use the equity for the entire purchase, especially now as Baby Boomers are retiring and downsizing (like me!)

Buyers extract cash from their financial holdings such as stocks and bonds.

Contingencies For Financed Purchases Are Rising

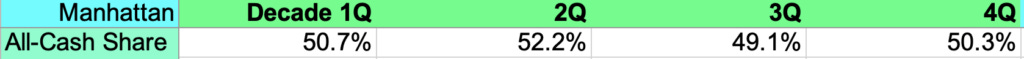

Although our research showed Manhattan cash purchases peaked in Q4-2023 at 67.9% and the share of cash buyers remains historically elevated, the smaller share of finance buyers is seeing a lot more mortgage contingencies. In the following table, during the second quarter, cash buyers represented more than 60% of purchases for the fourth of the five past quarters while the quarterly average since 2014 has been 50.5%. But what is additionally interesting is that of the 37.7% of buyers who financed in Q2-2024, 88.8% of them purchased with a finance contingency, up sharply from last year when it was 62.2%.

Are Cash Purchases Seasonal?

I’m not quite sure if seasonality for cash buyers is a thing. However, in Manhattan, the second quarter from April to June has shown the highest share of cash buyers over the decade at 52.2%. Perhaps because the spring selling season represents an uptick of buyers coming out of the winter doldrums and one of the highest sales periods of the year, the greater frenzy might raise the probability of more cash buyers.

Do Some Locations Experience More Cash Sales?

Location concentrations of cash sales probably occur where higher-priced transactions are clustered but not exclusively as many might think. The following Manhattan map with amazing Marketproof analytics, shows us that cash sales seemingly exist at all price points and locations in the borough. While our analysis in the table I presented earlier shows a higher probability of cash buyers at higher price tranches, it is important to remember that cash sales occur at all price points not just the high end. I think that was the overarching point made in that New York Times piece. When real estate market observers think of a cash buyer, they usually assume it’s a Park Avenue, Fifth Avenue, or Billionaires Row high end location when it’s not.

Conclusions And Cashing Out Of This Post

Sorry, but I needed at least one Dad-joke headline here.

My biggest takeaway from writing on this topic is that an increase in cash buyers suggests a weakened, distorted, or damaged economy. Manhattan cash buyers have maintained a relatively consistent ratio of 50% for cash buyers over the past decade until mortgage rates surged a few years ago, incentivizing more buyers to pay cash.

Not everyone has that cash, but those that have it are using it.

Did you miss yesterday’s Housing Notes?

July 8, 2024