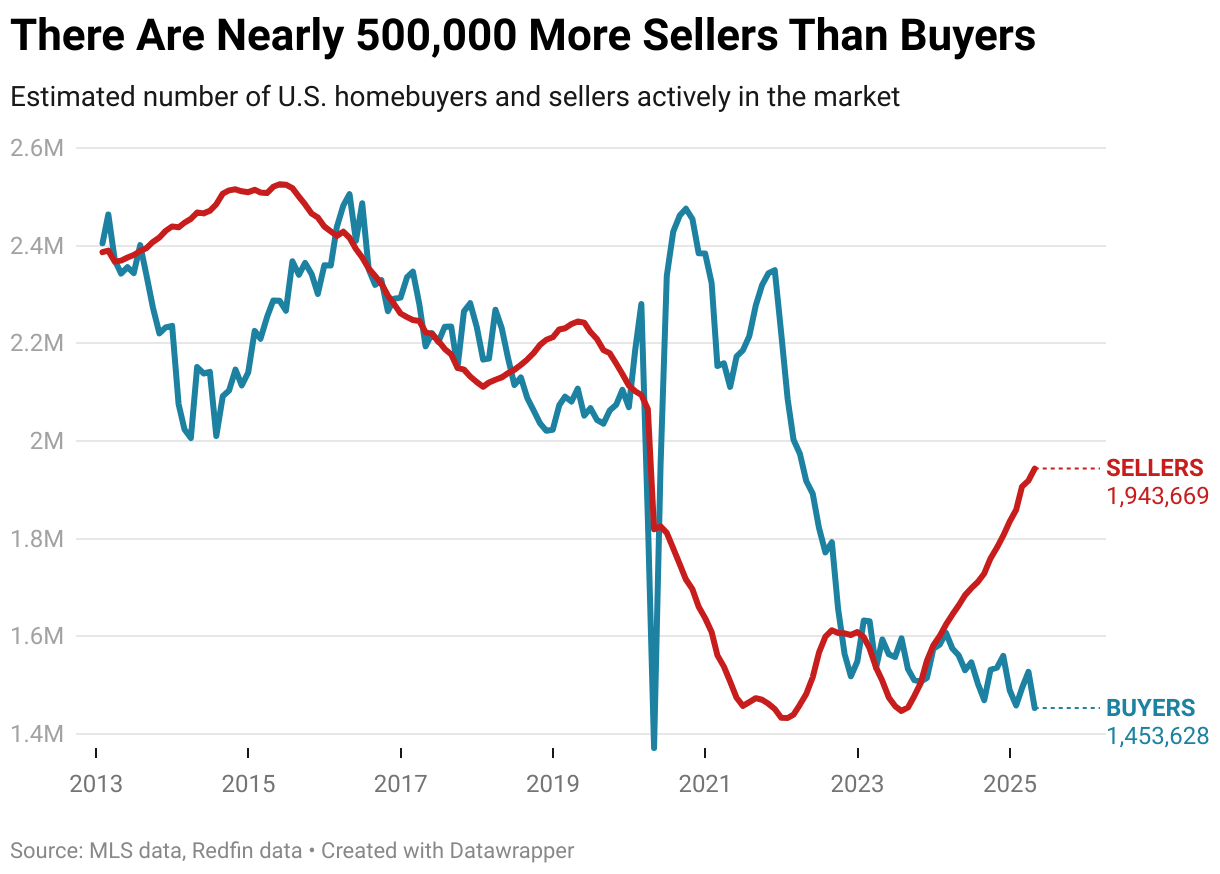

- A Redfin Study Says There Are More Sellers Than Buyers

- Redfin Is Crushing Zillow On Housing Market Conversation Nuggets

- The Study Doesn’t Consider Private Listings And Pent-up Demand

Redfin has a wiz-bang calculation to quantify how many buyers and sellers there are. I will break their effort down and point out a few problems with it. They tend to get more ink because they are more negative in their story angles given the uncertainty in the market. Quick aside: Have you noticed how Redfin has replaced Zillow as the provider of housing market conversation nuggets (some would label them as “junk stats.”)?

How To Calculate Buyers And Sellers

To calculate the market participants, Redfin did two things to convert transactions into people:

- Sellers = number of available listings

- Buyers = pending sales and adding an estimated time until they close

What’s Missing From The Redfin Math

- Compass has pushed for the use of private listings, and many other firms are following this practice. As a result, this growing number of private listings isn’t counted in the total inventory.

- Pending sales are harder to capture completely than closed sales so they will tend to be under-counted.

- With low unemployment and a potential stoppage of the tariff tantrums out of DC (wishful thinking), sales would surge quickly, even with high mortgage rates.

Pent-up Demand Is Not Accounted For

Generalizing the entire US as a “buyers” market is not a good idea. That is why this story seemed to go viral. For example, markets such as Long Island is not a buyers market, with 52.3% of the sales closing for more than the listing price in the first quarter, and they have been above the 50% threshold for at least ten quarters in the past three years. The Redfin report clearly identifies that market as one of the stronger areas. Southern California is in the same boat and so is Chicago and much of the US north of the Sun Belt.

Bidding wars are prevalent in the Northeast, which highlights what is missing from this methodology: pent-up demand. If 6 potential buyers are bidding for a property in a market with low supply, then they are undercounting the maket by 5 buyers.

Final Thoughts

Redfin’s proxy of one sale = one buyer is wildly under counting the total number of buyers given how much of the US has inadequate supply and how potentially misleading this analysis is. This analysis is built for a stable market and not for a deeply polarized market that we are current experiencing with supply specifically.

It is clear that Redfin continues to be a creative generator of housing insights and they can be problematic like the one I’ve explained here. Redfin has clearly taken Zillow’s place in the junk stat space as media scrambles for clicks. It will be interesting to see if Redfin will sustain this lead after the merger with Rocket Mortgage is fully complete.

The Actual Final Thought – Buyers might as well “Jump” but more slowly.

Forgetting All My High School French

I was interviewed by BFM Business recently, a French news channel. They translated a small portion of the segment into French at the 38′ 30″ mark. Cela m’a fait me demander pourquoi j’avais besoin de prendre des cours de français au lycée. Click the image below or the link to hear the broadcast.

Here’s My Podcast: What It Means

The latest episode is a click away as well as the podcast feeds for all the “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Podcasts That Capture My Attention

I listen to a lot of podcasts. So I thought I’d try sharing what I listen to every Wednesday or as close to the middle of the week as I can get. Some recommendations have nothing to do with the economy or the housing market but most hint at how to research or break down complex problems.

- Hard Fork is a NYT podcast about the future that is already here. Love it!

- Bloomberg Radio host Barry Ritholtz interviews – always engaging stuff.

Did you miss the previous Housing Notes?

Housing Notes Reads

- The U.S. Housing Market Has Nearly 500,000 More Sellers Than Buyers—the Most on Record. That Will Likely Cause Home Prices to Fall [Redfin]

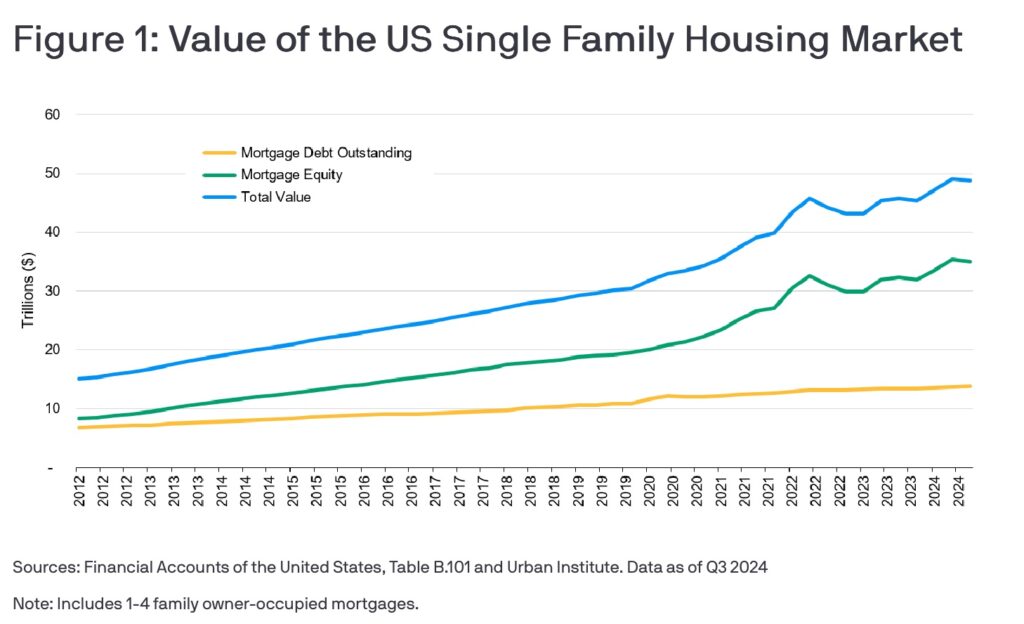

- Obsession with the 2007 housing bubble [Sacramento Appraisal Blog]

- The Heavy Lift to Implement GSE Reform-Recap-Release: Market-Improving Reforms [Furman Center for Real Estate and Urban Policy]

- Highly Unusual Divergence in US-EU Inflation Outlook [Apollo Academy]

- As Sales Flatten, Homeownership Loses Luster for Some [Banker & Tradesman]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)