- Consumers who can afford to move, becoming tired of “waiting for the right time”

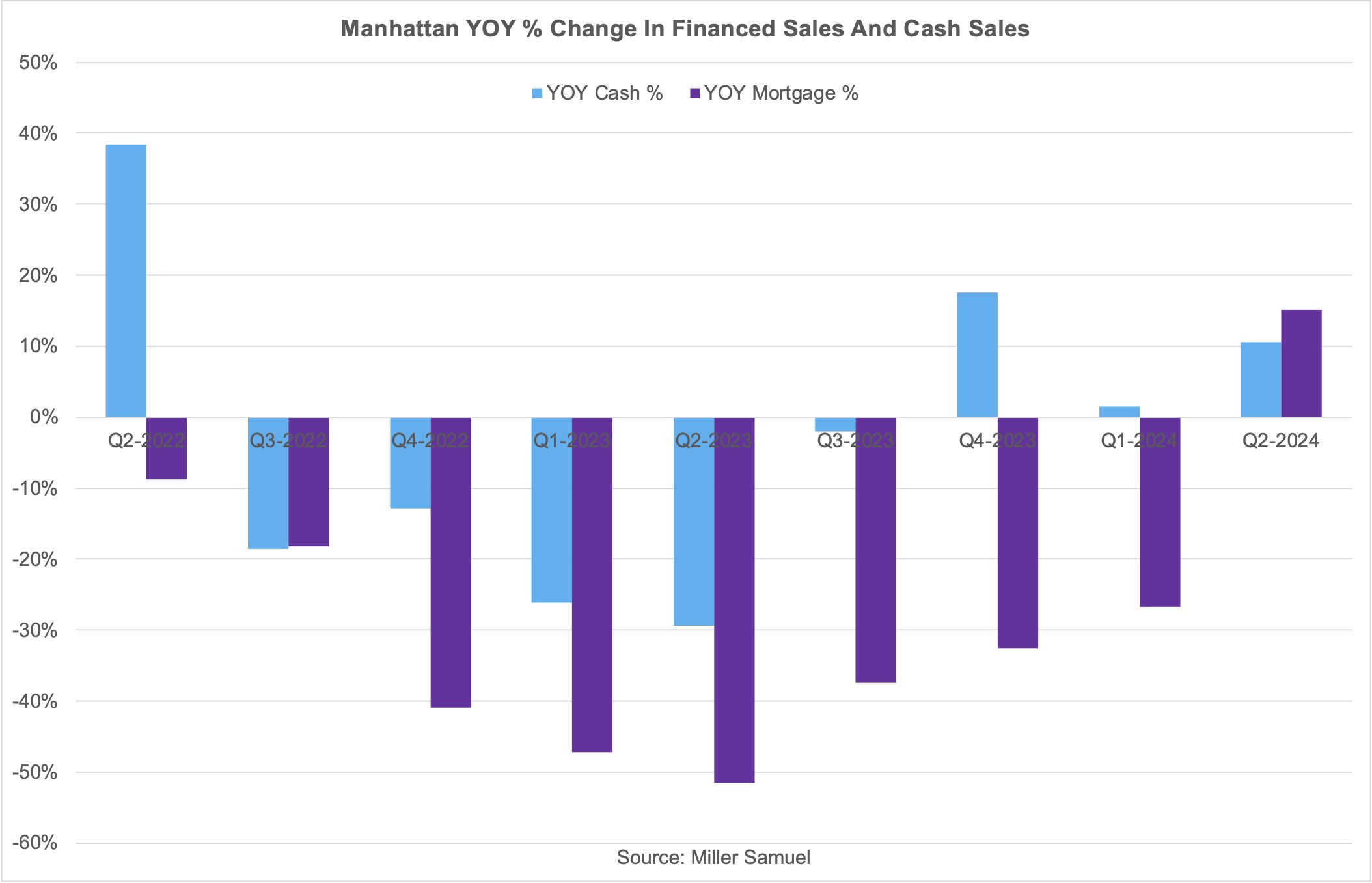

- Buyers less resistant to move: More sales and rising purchases by mortgage

- Seller less resistant to move: More listing inventory with more accurate pricing

It’s been about two and half years since the Fed began working to influence interest rates higher to tame inflation. For housing market participants, the steep ascent of mortgage rates (hey, it happens periodically such as a similar headline in 1968) makes it feel like a recession to market participants as I’ve mentioned here before. My favorite word this summer is “resolve” as in the resolve of buyers and sellers to stay put until rates fall has been weakening. We continue to see evidence of this consumer change in the market:

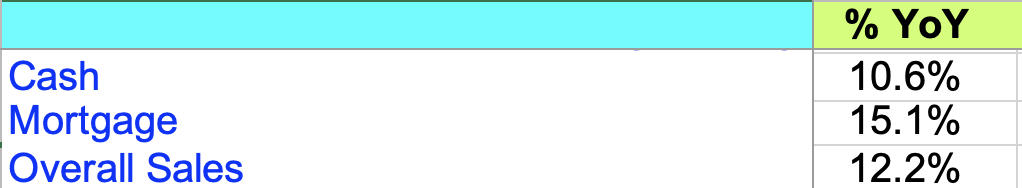

Buyer Resolve Is Weakening In Manhattan, we saw sales unexpectedly begin to rise in the second quarter. Perhaps this is a precursor to a national pivot to stable or rising sales as NAR’s non-seasonally adjusted home sales have been see-sawing up and down every month since the beginning of the year but NAR Existing Home Sales are up 1% year to date (see 3rd chart below). Most significant for the Manhattan market was that year over year financed sales rose more than cash purchases by units. It was the first time in two years that purchases with a mortgage rose faster than cash. The recent slide in mortgage rates in recent weeks wasn’t enough to impact closed sales for the quarter. This means that buyers who can afford elevated mortgage rates have grown tired of waiting. Think about waiting on a pizza delivery for 2.5 years.

“As of May, 24% of homeowners with mortgages now have a current interest rate of 5% or higher,” Andy Walden, vice president of ICE Research and Analysis, said in a statement. “As recently as two years ago an astonishing nine of every 10 mortgage holders were below that threshold.”

Bloomberg

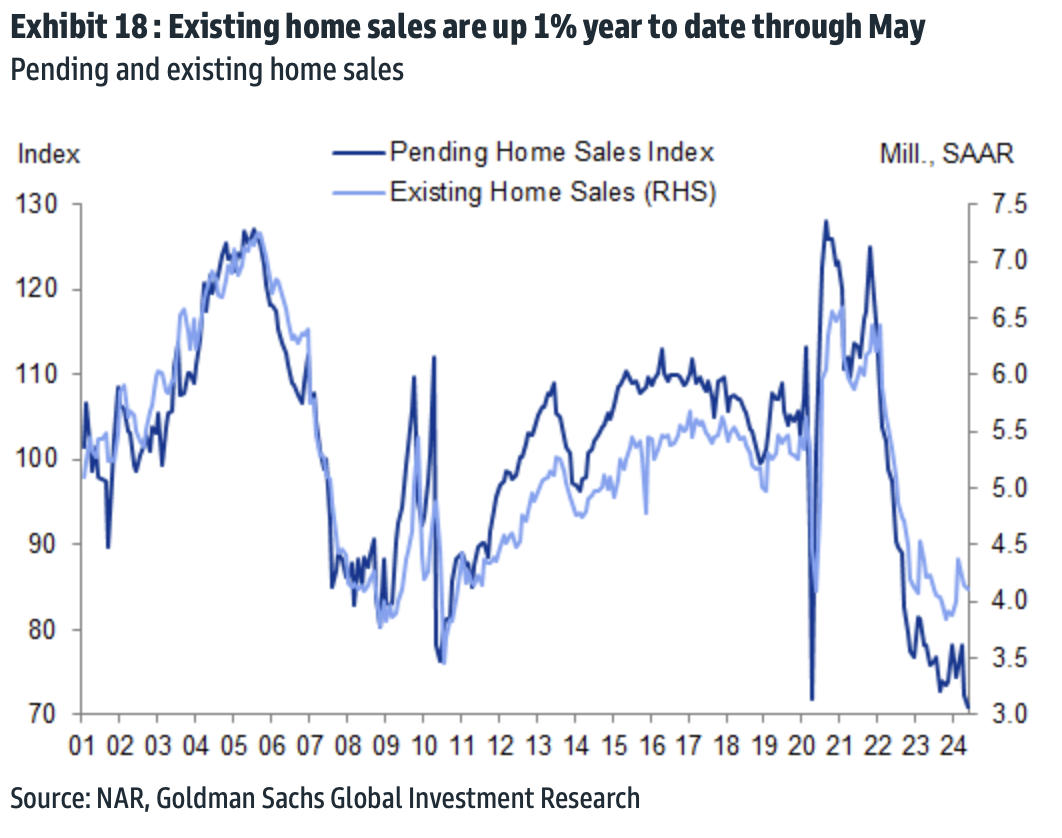

Seller Resolve Is Weakening The lock-in effect kept listing inventory restrained initially, but supply is now steadily expanding everywhere (some markets more than others) from record lows. The average mortgage rate held by homeowners has been rising over the past several years, gradually reducing the impact of the lock-in effect as evidenced by rising inventory. Sellers who can afford to be buyers have grown weary of waiting for a rate cut and many assume rates will fall somewhat to enable refinancing over the next several years.

Before portraying current listing inventory gains as surging like a runaway freight train as some are suggesting and is growing true in some specific markets, supply remains a challenge, nationally. The following image provides some perspective on inventory.

For the Manhattan market, we are beginning to see more accurate pricing for listings that sold during the quarter as sellers start to get in tune with actual conditions.

Meanwhile, about 27% of the deals in the second quarter came after at least one price drop, down from roughly 35% in the previous four quarters.

Bloomberg

And while I find the act of quoting others quite lame as many who do that could probably come up with something better themselves (I make the exception with song lyrics), I can’t help myself here in the loosely translated moral of the story: Pink Floyd’s “Ticking away, the moments that make up the dull day.“

Did you miss yesterday’s Housing Notes?

July 1, 2024

Housing Notes Reads

- Manhattan co-op and condo deals increase for the first time in two years [Brick Underground]

- Manhattan Home Sales Unexpectedly Rise as Buyers Cave on Rate Cuts [Bloomberg]

- Shift Occurring in US Housing Market as Mortgage Lock Loosens Up [Bloomberg]

- Manhattan is now a 'buyer's market' as real estate prices fall and inventory rises [CNBC]

- BOE Open to August Rate Cut, Sticky Services Prices May be Key: Davies [Central Bank Central]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)