- Most Existing Homeowners Have A Low Going-In Cost Basis And Are Paying Their Bills

- Tariffs Are A Policy Blunder That Will End Up Pushing Up The Cost Of Housing

- After All The Job Loss Expected From Tariffs, Mortgage Rates Will Probably Fall

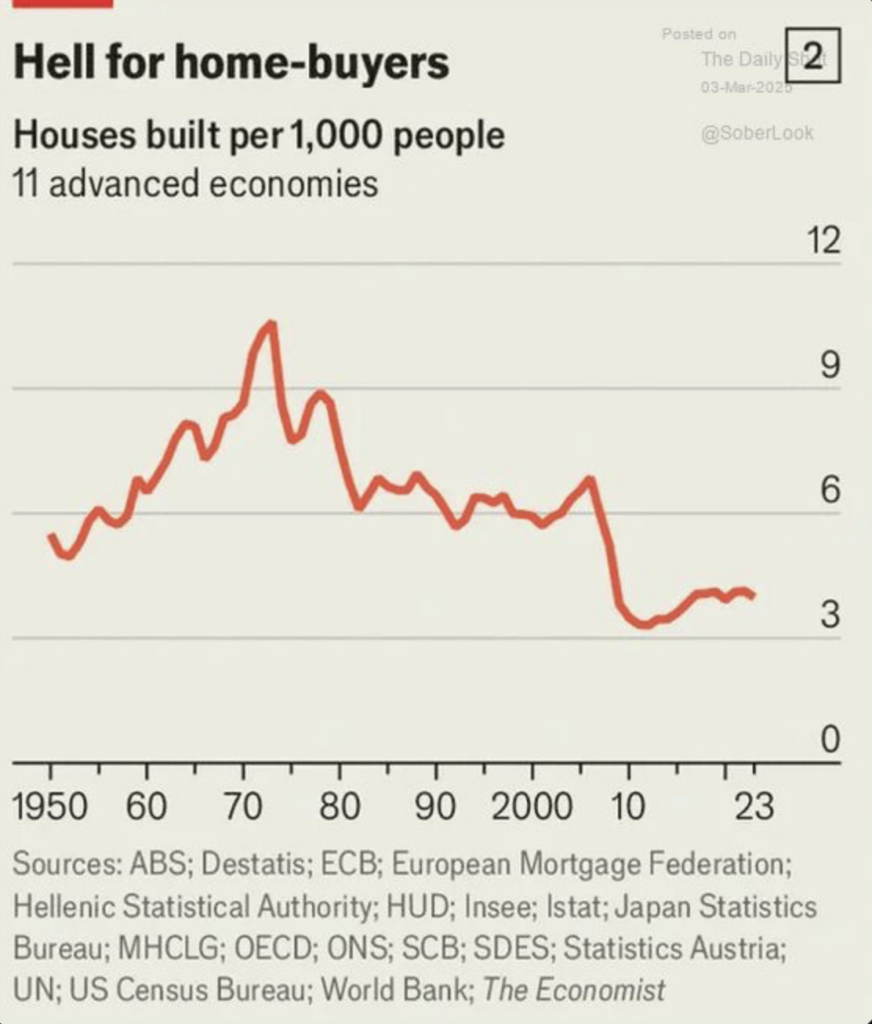

There’s a great article by Scott Galloway, a prolific book author and podcaster, on the crisis in housing. I’m a big fan of his Pivot Podcast with Kara Swisher. He clarifies that the problem is affordability, not housing itself. It’s a key component of the American Dream, yet the cost of housing has increased by twice the median household income over the past decade. He indicates that the housing market needs radical deregulation. Also, tariffs should make the USD stronger, which will further dampen international demand, a key source skewed to the higher end of the market, one of the current housing market’s bright spots. I hope you can appreciate how this economic detour into tariff-land chaos raises construction costs (and inflation), and according to the right-leaning Hoover Institute, the anti-immigrant policy stance raises labor costs, which is going to make to make new home costs even more daunting for would-be homebuyers. Galloway contends that the key culprit is our long term over emphasis on single-family zoning. While I agree with the over-emphasis on single-family zoning as the primary long-term problem, I don’t agree that it is the near-term reason for the affordability crisis. The amount of housing being created in developed countries hasn’t been adequate, like forever.

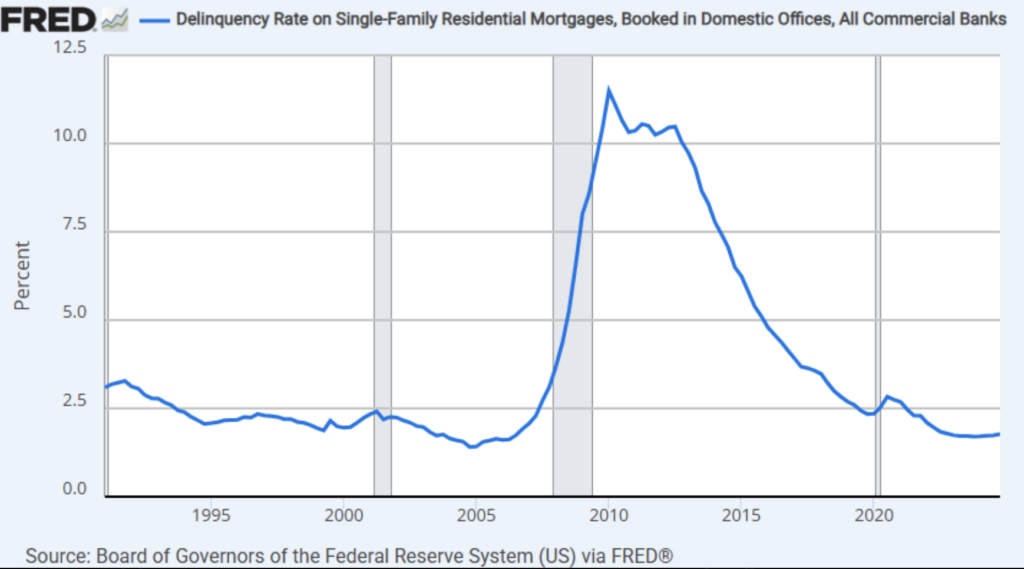

Less Affordability But Foreclosures Are Low

While the primary issue of the housing crisis is affordability, the amount of distressed real estate remains very low. Homeowners are keeping up with their payments because their initial investments are significantly lower than those of current buyers. I can always spot the posers in my social feeds when they misrepresent the current state of housing by suggesting there’s widespread distress. There isn’t. Most existing homeowners enjoy low mortgage rates, and wages remain above pre-pandemic levels, although they have decreased slightly in recent years.

Why Did The Affordability Crisis Recently Explode?

As I often say, the Federal Reserve kept interest rates too low for too long from 2020 to 2021, and the existing inventory was wiped off the face of the earth (ok, I’m exaggerating, sort of). Typically, existing inventory accounts for about 90% of supply, and new construction accounts for about 10% of supply. I make this point all the time. If new construction were magically tripled overnight, it still wouldn’t create enough supply to meet demand.

While building more new products is clearly important, it tends to be the wrong kind of housing – luxury or high-end housing because land prices remain relatively high, and with tariffs, housing material and labor costs are expected to rise during this not well-thought-out tariff situation in which we find ourselves currently trapped. Higher costs are not going to solve the affordability crisis. Duh.

How This Might Play Out

Average US home price growth is slowing nationally, with some regions seeing softer pricing trends (with extremes like Austin), and some areas will see firmer price growth (nearly everything not in the Sun Belt).

Thought pieces like Galloway’s are helpful because they get everyone thinking about long-term solutions. However, we probably need shorter-term fixes first. There are no obvious ones unless I start thinking about the tariff strategies being employed right now in the current administration, which will cause hundreds of thousands of future layoffs when fully executed.

Currently, the tariff/trade wars being announced have given rise to very damaging retaliatory tariffs by long-term allies like Canada, Mexico, and Europe. The 2024 US economy has been one of the strongest in our history and now, by beating it to a pulp with random tariff implementations or threats of them without awareness of retalitory tariffs has revived worries about inflation and a potential recession. Unemployment has been the lowest on record, but aside from the chaos and questionable legality of DOGE layoffs, the private sector is following their lead, and layoffs are rising. US employer layoffs rose 245% to the highest total since July 2020. It’s getting crazy out there, and no one with a straight face can logically explain why we are implementing tariffs, aside from them being – and I kid you not, presented as our God-given right. While that’s true, we have the right to issue tariffs, and we can also walk in front of fast-moving traffic.

One outlier prediction is a 75% chance for a recession in three months. As I was writing this, Ontario Canada just retaliated by raising electricity prices to 3 US states by 25%. Again, we are seeing some truly bizarre economic policy be implemented to our own detriment.

Final Thoughts – The Possible Bright Side Of Truly Bad Economic Policy

If we get past inciting trade wars with long term friends and partners for no real economic reason and that it significantly raise the possibility of a recession, I start to think that this will bring down mortgage rates faster than letting time pass. I’ve broached this point in a recent post.

Excessive housing demand was cut off at the knees in early 2022 with the Fed pivot to higher rates and consumers have been waiting for interest rates to fall. I believe decline in interest rates that would come with all the job loss from a self-inflected recession will result in a super-charged demand environment for housing. While that’s good for the real estate economy, it is going to make housing even more expensive as listing inventory remains inadequate. If this happens, we’ll probably see lower mortgage rates in the back half of 2024.

The Actual Final Thought – We can’t figure out an ending to this economic damage reminds me of this.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

March 7, 2025: Housing Notes Reaches Its Tenth Anniversary While DC Is A Gray Area.

- A fun Housing Notes today, Jonathan.

- Mr. Miller, I have enjoyed your writings for several years. When I was in the business I did something similar to your report and suppied it to all the banks, government agencies, appraisers and news organizations. It never ceased to amaze me how “protective” people or brokeragers were of market information. I use to be a source for the federal reserve for this district, they always commented that i was the only one to share information with them. It will be interesting to watch how the markets respond to the turmoil caused by the present administration. Please keep up your excellent Information. Have a great weekend

March 3, 2025: Seat Time, Not Acquired Knowledge, Seems To Be The Currency Of Real Estate Continuing Ed.

- THANK YOU…..Seriously between you and Erik Enquist with The Real World series you both are saying in print what I grumble about in my head – Now to say outloud on social media……

- Good Morning Jonathon! Always a Good Read! Agreed on the mandatory CE requirements. Painful to sit through the narrated voice and unable to speed up the process. You are in good company. However, the revenue stream received will not change the process.

- Excellent CE article.

- You are right on when it comes to CE. I refer to it as: “Serving my time”. Truly ridiculous.

- Thank you Jonathan. The system penalizes real, hands-on training in favor of regurgitated outdated “appraisal process.” State pay-your-fee approvals cost overwhelms quality in favor of volume.

- I can relate to your recent post because I’ve been taking a lot of classes lately and look to be taking more very soon as I try to upgrade my license. It costs about $7,000 to get one class approved in every jurisdiction in the US. Ridiculous.

- Dear Jonathan, My frustrations with the CE options for RE professional are many. We RE professionals are at the frontlines, helping our clients execute some of the most important and financially significant decisions of their lives – shouldn’t we demand higher standards? I have been at this for over 2 decades and the environment is in constant flux – we should be better prepared. OK…I too am done whining. Thank you for listening.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Firms’ Inflation Expectations Have Picked Up [Liberty Street Economics]

- Project 2028: Housing [No Mercy / No Malice]

- Scott Galloway sends strong message on home buying, housing crisis [TheStreet]

- The State of Luxury: How to navigate a slowdown [McKinsey & Company]

- Are Home Values About to Fall? It Depends on the Location [Wall Street Journal]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)