Time to read [5 minutes]

- Resales At Billionaires’ Row Have Been Lackluster

- The Super Tall Luxury Market Never As Deep And Wide As Once Thought

- This Super Luxury Market Came To Life During The Perfect Credit Storm

Vacation Week Note – Hurricane Erin

Both yesterday and today, my vacation town, Rehoboth Beach, turned cooler, dark, windy, and rainy, which forced my wife and me to do a lot of shopping. We didn’t mind since we both love colder weather – after all, we went to Antarctica for our 40th last year. Housing Notes will be a quick one today because I need to go out and buy more saltwater taffy.

But I digress…

I remember the early moments of Billionaires’ Row just as the label was beginning to stick. My first thought was about the word “row,” which I first interpreted as having a “fight” to own the biggest and most expensive homes. For years, I described this submarket as “the world’s most expensive bank safety deposit boxes where you placed your valuables and rarely visited.” Kathy Clarke’s must-read book for anyone inside or outside of New York real estate, “Billionaires’ Row,” and I’m only mentioned in the index a dozen times. Ha. Well, now The Real Deal presented a terrific recap on how resales in five representative buildings are doing, The highs and lows of reselling on Billionaires’ Row.

The Buildings And TRD’s Conclusions:

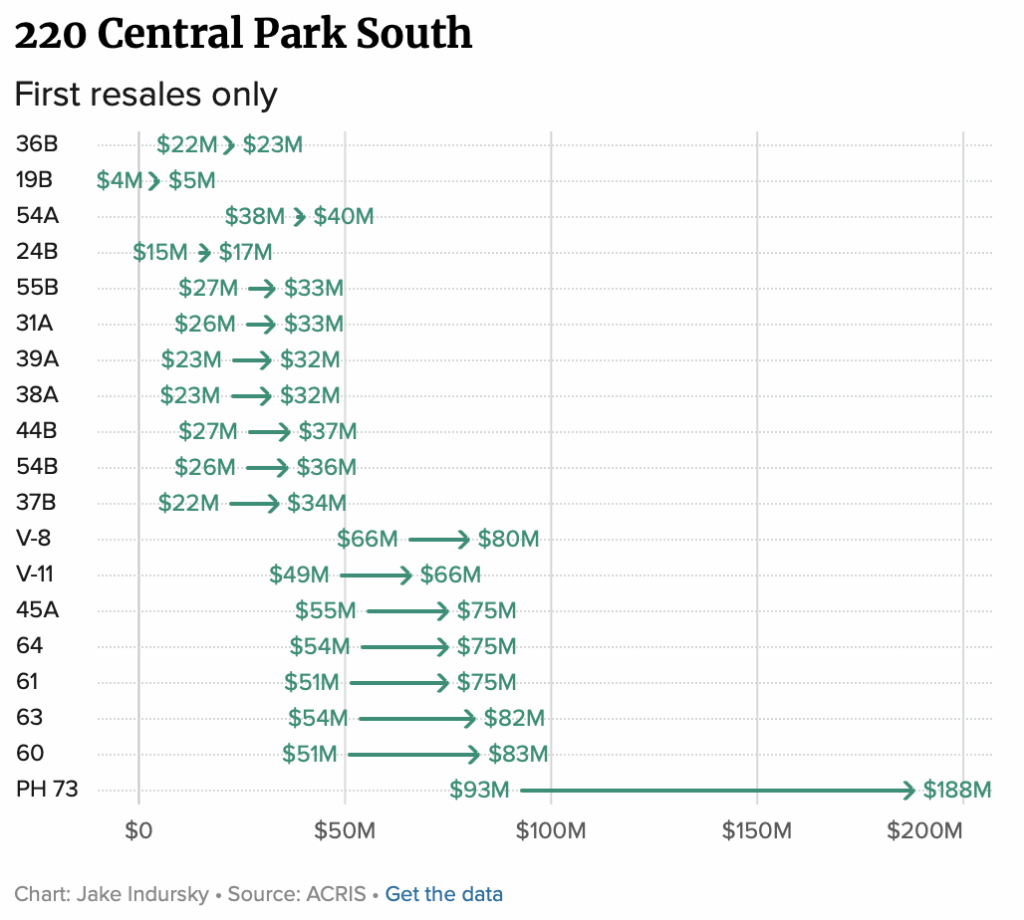

- 220 Central Park South +43%

- 432 Park Avenue +2.3%

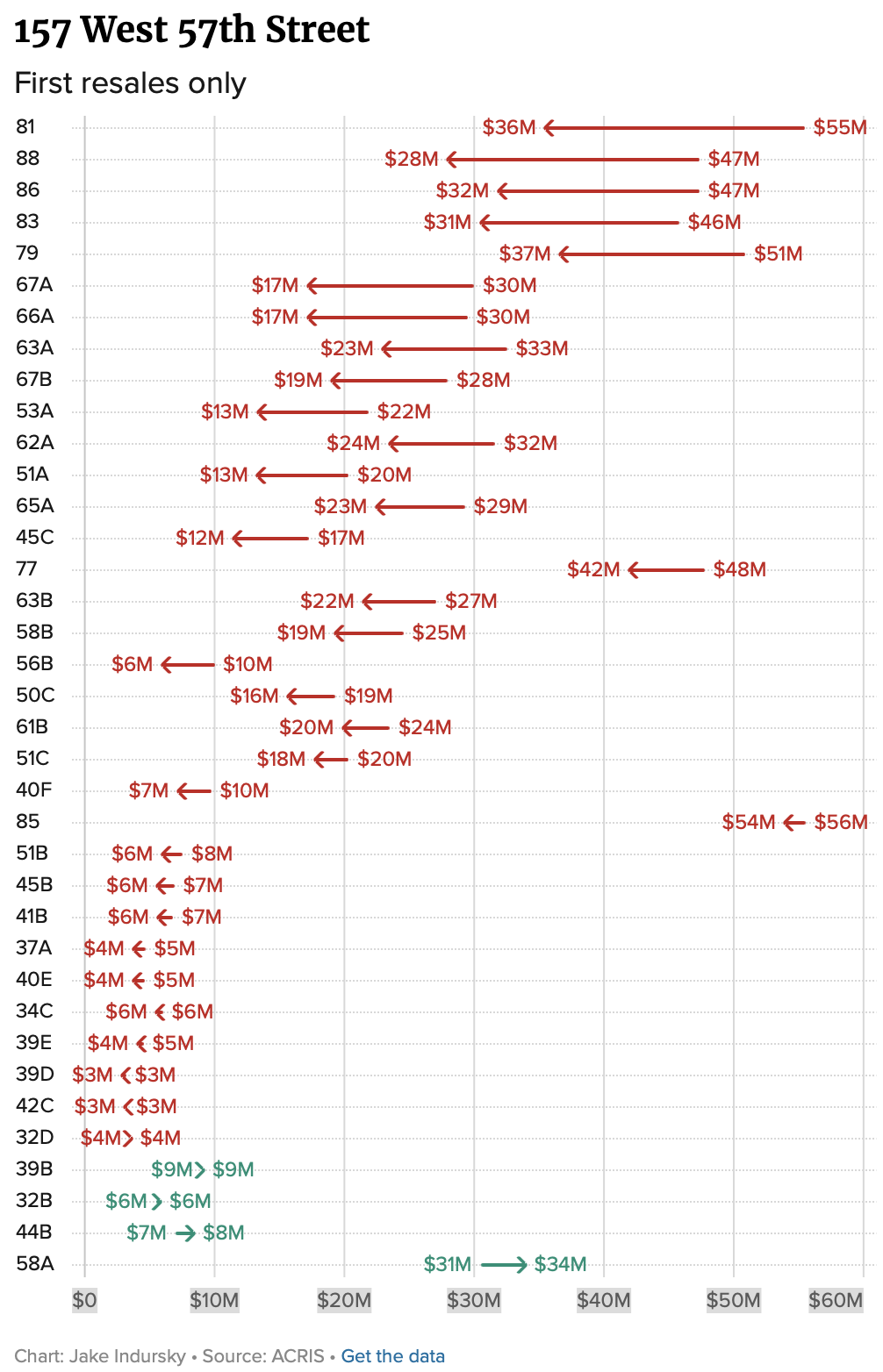

- 157 West 57th Street – 24.2%

- 111 West 57th Street -16.6%

- 217 West 57th Street – 9.7%

The following images show the two buildings that performed best and worst in their study. The article conveys some very clever visuals. The others can be found in the article.

Why Did This Phenomenon Occur?

The super tall market was never as wide and deep as initially thought. And kleptocracy played a role, too, before FinCEN stepped in to clamp down on the abuse of LLCs.

I said this in the TRD piece: “This was a moment in time that has passed, and this submarket will be around for a long time, and there will be other buildings built, but the frenzy that the market experienced is unlikely to be repeated.”

Following the great financial crisis (GFC), consumers’ access to credit was severely damaged, and access to financing was impaired, leading to an increased reliance on cash. Global wealth surged, prompting many wealthy consumers to seek capital preservation, both domestically and internationally, for investing in significant assets. Commercial banks were licking their wounds from bad lending decisions during the housing bubbles, as Wall Street and sovereign wealth funds were hungry for higher returns. At the same time, engineering methods and building materials enabled the creation of “super talls” that were double the height of existing 50-story high-rises.

Hence, Billionaires Row. Its core is 57th Street, from Park Avenue to Eighth Avenue, extending south to 53rd Street and north to Central Park South.

Final Thoughts

Demand for these super luxury units has been on a building-by-building basis. 220 Central Park South set the standard for resales while One57, the first on the block, was punished in the resale market. Super luxury is a new category of high-end property and should not be thought of as simply higher-priced luxury housing. We’ll continue to see sales prices in the stratosphere, but not at the transaction density of a decade ago.

The Actual Final Thought – Developers on Billionaire’s Row have to have this song playing in their head all the time.

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The My Implicit Guarantee episode is just a click away. Podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

August 15, 2025

Rental Trends Are Incremental, Yet New Policies May Be Incidental If Not Accidental

Image: Jonathan Miller

Housing Notes Reads

- The highs and lows of reselling on Billionaires’ Row [The Real Deal]

- Manhattan apartment hunters face record rents and bidding wars [Business Times]

- More pain for Big Apple renters as prices surge again — and there’s no relief in sight [New York Post]

- Experts weigh Fannie-Freddie merger prospects [National Mortgage News]

- Manhattan rents continue to shatter records [Crain's New York]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)