- Confidence Surveys Track The “Now” While Sentiment Surveys Track The “Future”

- Survey Reliability Is One Step Below Actual Data And Subject To Bias

- Confidence, Sentiment Surveys Don’t Consider Recent Change In Rate Outlook

With so many surveys out there about how we “feel,” it can get a little confusing. The spike in mortgage rates and inflation, as well as the surge in housing prices over the past couple of years, has influenced many of us to do more swearing. Throw in a heated election-year political environment, and the frequency of f-bomb usage has likely surged. Because of this, I’ve grown more confident with the sentiment that more swearing will help me live longer. Two essential surveys track the way consumers feel about things: the Conference Board’s Consumer Confidence Index, which is more about the here and now, and the University of Michigan Consumer Sentiment Index, which is more forward-looking.

The reason I decided to write about this is that all of us see these two indices released in the news every month and probably don’t give either much thought. Since consumer spending represents nearly 70% of the U.S. economy, these indices are probably more relevant than we give them credit for. However, I think surveys are inferior to actual data.

I’m very curious whether either index will move significantly higher in the coming months after the pivot to lower interest rate expectations from the Fed that occurred in the past couple of weeks. In 2009, I wrote about this in my Matrix blog (the formatting has since broken), inspired by my friend and economist Jason Bram, who co-authored a paper on this topic back in 1997.

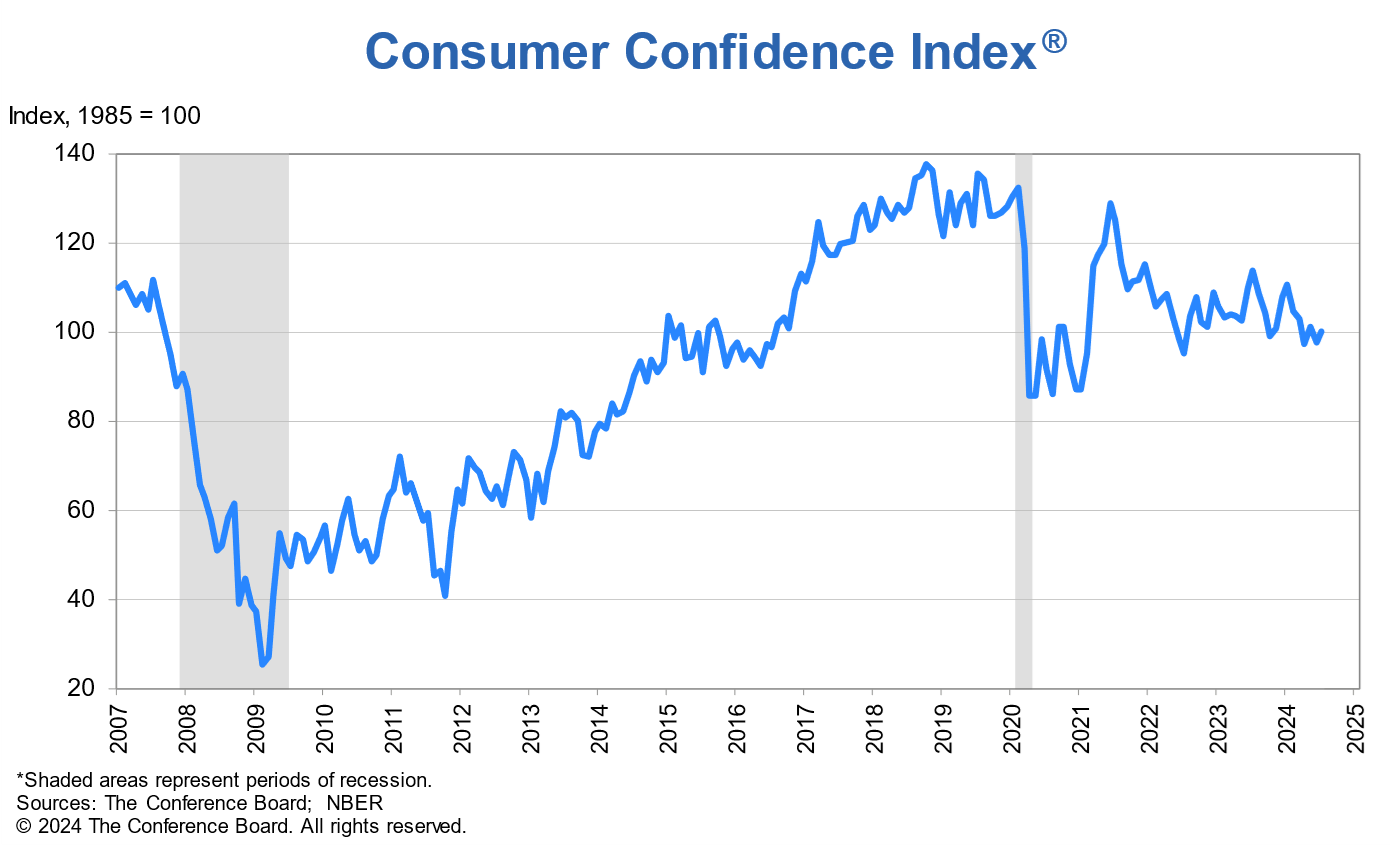

Conference Board’s Consumer Confidence Index (CCI)

The CCI measures what consumers are feeling about their expected financial situation. If they are optimistic, they will spend more, and if they are negative, their spending could lead to a recession or slow down. There is a slew of research on their website.

The CCI results measure how consumers view things closer to today.

The July result suggests that “Even though consumers remain relatively positive about the labor market, they still appear to be concerned about elevated prices and interest rates, and uncertainty about the future; things that may not improve until next year.”

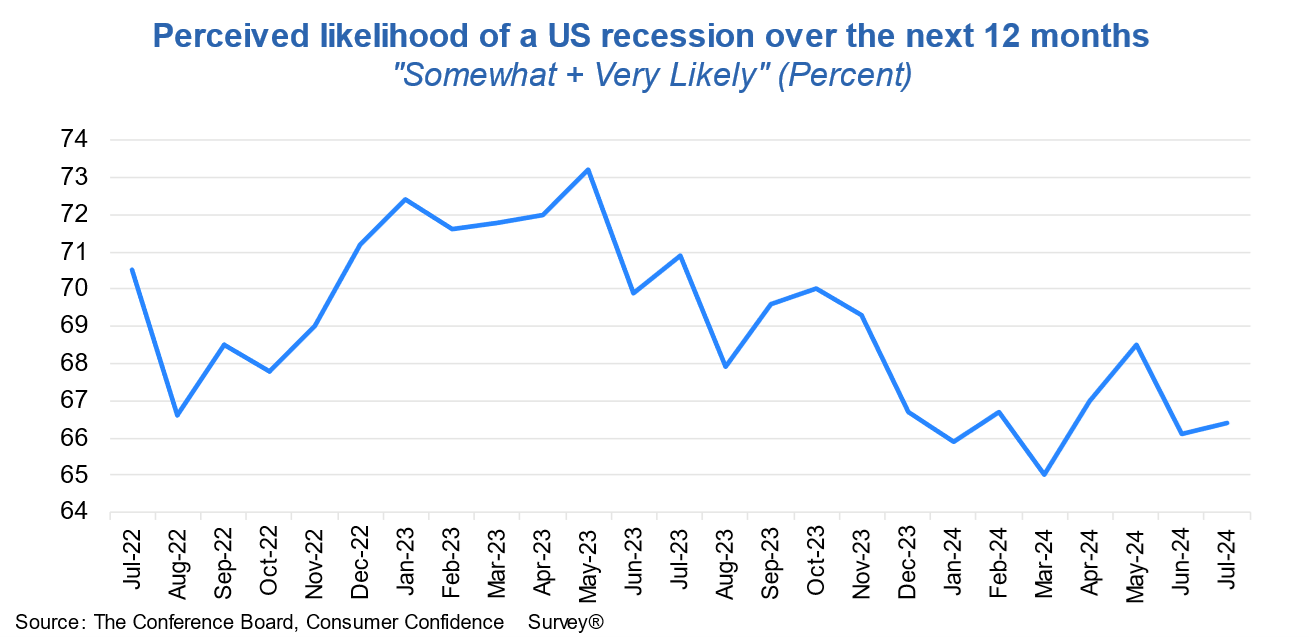

The Confidence Board has consumer surveys on a lot of other economic topics, including one that sees the odds of a recession at about 66%. In comparison, Wall Street sees a much lower probability of 20% (Goldman Sachs), and I’m going with Wall Street on this.

Expect Rate Cuts to Start in September “…the Fed will likely start cutting interest rates in September, and continue cutting each meeting until Q3 2025.” Wow. That means a strong 2025 home selling environment with higher inventory from lower rates and higher sales from lower rates.

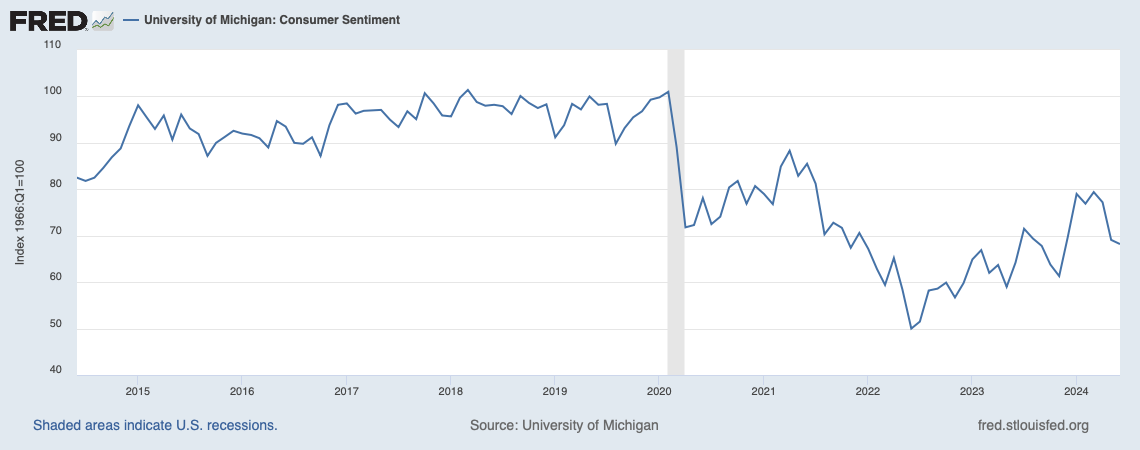

University of Michigan Consumer Sentiment Index (MCSI)

The MCSI measures how consumers feel about the economy, personal finances, business conditions, and buying conditions, as well as prospects for longer-term growth. While sentiment cratered from late 2021 through early 2022, it has been recovering during this period of rising interest rates.

The results measure how consumers view things in a more forward-looking way.

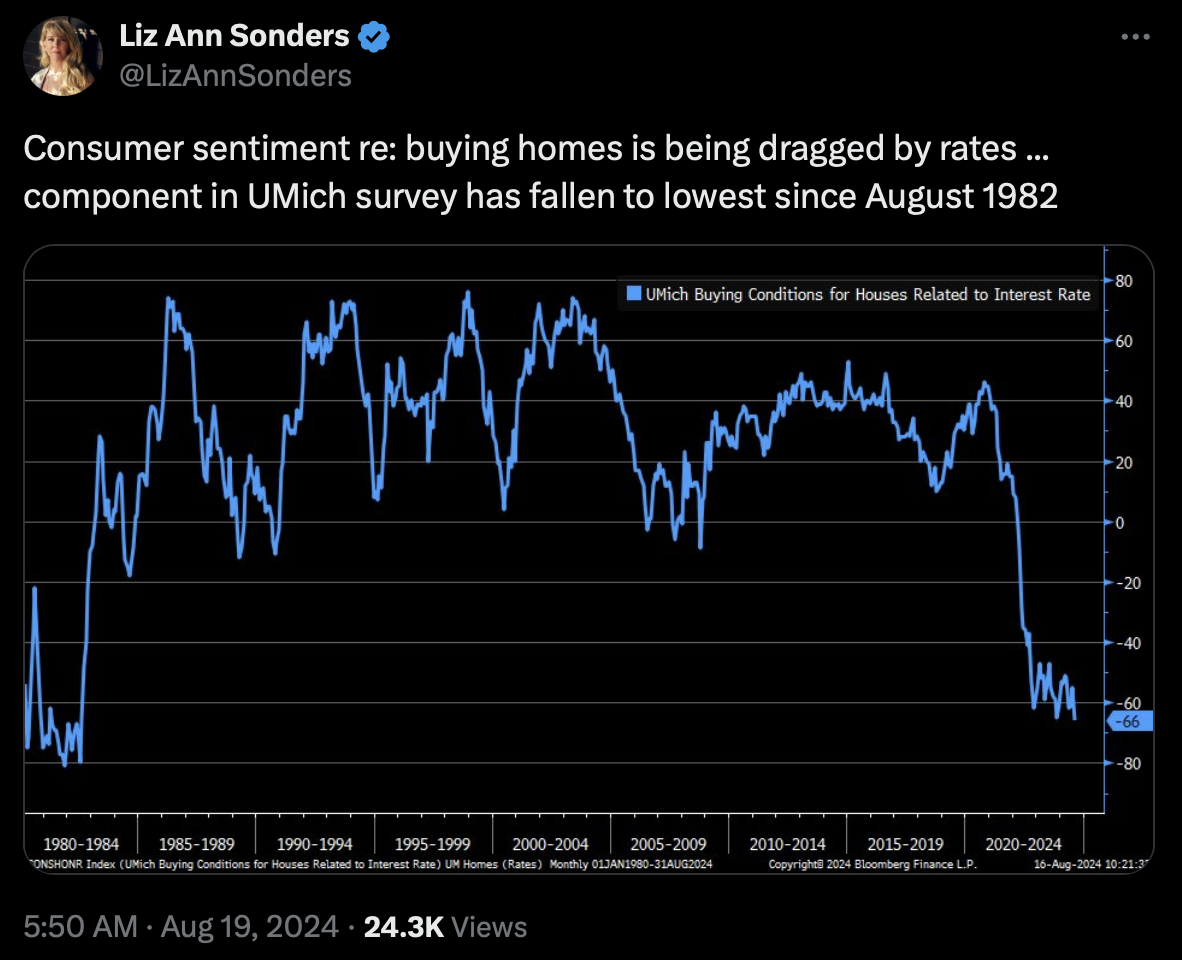

Yet in the context of buying homes, sentiment has plummeted to 1982 lows. I suspect the consumer outlook for lower rates this fall is not reflected in the available results quite yet and could be offset if the economy deteriorates a lot more (justifying more rate cuts).

Swearing To Our Confidence And Sentiment In Home Values

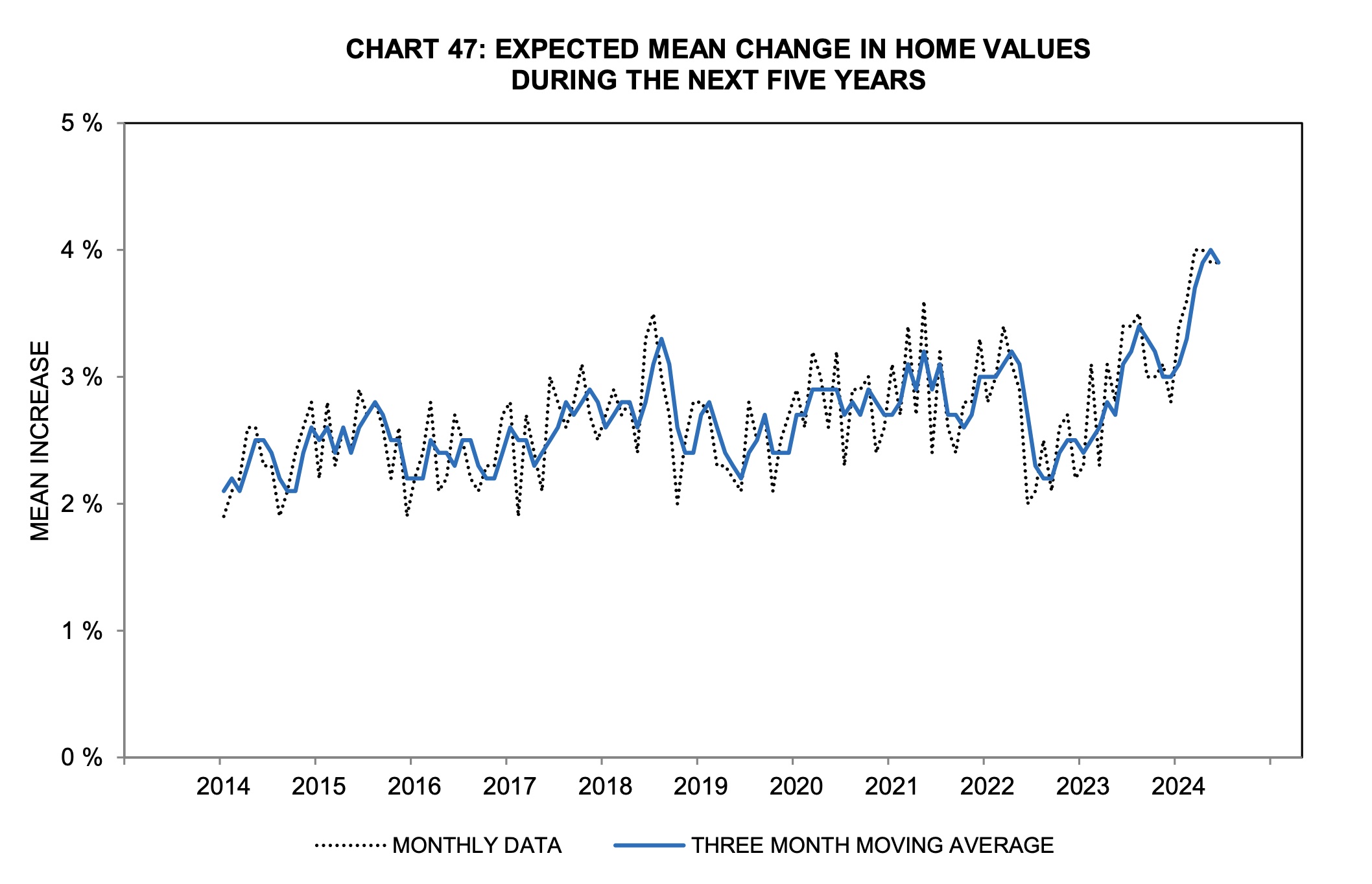

Despite the spike in mortgage rates, consumers think home values will rise a lot over the next five years (as shown in the chart below). Perhaps that’s with the expectation that interest rates will continue to fall in the coming year. The survey shows value increases since mortgage rates began to surge in early 2022. Fascinating.

The Confidence Board and University of Michigan surveys are just that, surveys, which are less reliable than hard data. Still, they are helpful in filling in the gaps of information we need. Surveys are challenging to do because there are so many potential risks for bias, but both of these indices have a long legacy.

I’ve gone on this wonky tangent because the sudden pivot in Fed rate cut expectations over the past two weeks bodes well for housing market sales volume this fall. As I mentioned earlier, the sudden change came after the yen carry trade financial market turmoil out of Japan that refocused concern about the risk of a U.S. recession. (Wow, I can’t believe I strung a sentence together that included “yen carry trade.”)

It is important to remember that swearing alleviates pain. This National Institute of Health (NIH) study actually used f-bombs to make the point. Here’s the logic: Rising mortgage rates and housing prices have induced a lot of swearing, which I can attest to. From there, it’s only a hop, skip, and jump to say that rising home prices have given potential home buyers more self-confidence and strength.

Did you miss yesterday’s Housing Notes?

August 19, 2024

7 Reasons To Avoid The Housing Listicle: Consumers Need To Breakup With Them

Image: Chat & Ask AI

Housing Notes Reads

- The power of swearing: What we know and what we don’t [Science Direct]

- Frankly, we do give a damn: improving patient outcomes with swearing [NIH]

- How Japan’s Yen Carry Trade Crashed Global Markets [Foreign Policy]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)