April 19, 2019

An Unredacted Hack: Housing Spam Edition

Yesterday, my business email was hacked and it was more disruptive than I could have imagined. I received hundreds of emails from recipients who I know as well as texts and phone calls. And it isn’t over. I am still getting calls, texts and emails from recipients. As this propagates, I’ll bet thousands of people were spammed by my account in the 5 minutes it was active. More on that below.

The following message confused all of my contacts and has spread to other recipients I don’t even know. The following screenshot is what was sent – it looks like an attempt to harvest even more emails.

About five minutes after I was hit, a tech friend of mine called me after receiving the email to let me know and told me to change my password immediately. I did so and while talking with our tech people, I could see 5 emails a minute leave my outbox, each with about 80 names up until the moment my password changed and we added additional authentication and virus protection software.

Here is the most disturbing part – one of my contacts named “Valerie” replied to me with “Jonathan, is this real?” and my email account – the hacker – responded on its own, “Yes, Valerie, it is.” OMG. Here is a snapshot after I redacted her info:

Nearly 20-years ago I was playing a fresh copy of DOOM (possibly DOOM3?)

at home, marveling that I was playing online with others all across the world and not focused on the game itself. I had a slow dial-up connection and my total lack of eye-hand coordination made me no match for anyone. I never forgot this particular moment: At one point I was shot and was laying down watching others run around me. As I was about to come back to life, a player stood over to me and pumped a dozen rounds into me. Chills went down my spine much like yesterday when my account responded to Valerie on its own as I watched.

Afterthoughts on being hacked:

– Hundreds of people have called, emailed and texted me to let me know what happened and I can cheerfully conclude that most people in this world are nice and good – we too willingly focus our lives on the bad outliers.

– I never apologized to anyone that called me – it didn’t feel like something I did wrong and everyone will or has been hacked at some point in their lives. But I thanked everyone for letting me know.

– Never, ever, ever reply to an email you think is spam or click on something from a person you know when you don’t understand what it is or why you received it. Call or text them.

– Any social media or email account you control should be guarded with two-way authentication. Nifty passwords don’t cut it.

But I digress…

Elliman Reports Released: Q1-2019 Downtown Boston, Fairfield County CT and Greenwich CT

Douglas Elliman Real Estate, the second largest independent residential real estate brokerage in the United States by sales volume, published our research on these markets this week and the news on the housing conditions in the region was decidedly mixed. I’ve been the author if this expanding report series since 1994.

Here’s the breakdown by report:

Elliman Report: Downtown Boston Sales 1Q 2019

The report is broken down by condo and townhouse sales. This is our second quarter with a report release but while townhouse market conditions were robust, I noticed the year over year condo results was sharply negative. This result was caused by an unusual spike in closings in the prior year quarter, and the lion’s share was in a handful of buildings at the top of the market with mostly legacy contracts. We call these legacy contracts because the meeting of the minds between buyer and seller (developer) occurred years before the building was finished and closings occurred. While I won’t cherry-pick the data that goes into a report, I ran the numbers without sales in 3 buildings and got these results, side by side will full results that include the legacy sales:

The actual report results were unedited but overstate the decline in sales and prices form records set last year. Here are the modified results. I have done this in Manhattan before i.e. with and without the $238 million condo sale in Q1-2019, a decade ago with and without the mass closings at The Plaza and 15 Central Park West condos and before that with the $43 million penthouse sale at then-named AOL Time Warner.

“Price and sales trends showed stability after considering the year-ago surge legacy contract closings.*

*A year-ago, record prices and heavy sales volume were caused by a significant surge in high-end new development legacy closings, i.e., contracts signed 2-4 years earlier that distorted current trends. Q1-2018 closings were the highest first quarter number of sales in 13 years; Average and median sales price were skewed to records; average price per square foot was second highest on record. By the removal of three buildings with either a high volume of legacy contract closings or record pricing: 50 Liberty (49), Pierce Boston (58) and 10 Farnsworth (6) resulted in a more representative trend in comparison to the first quarter of 2019 that did not see the same surge in legacy closings. The published report does include legacy closings.

Each time I have done this in other markets, there may be some brokers out there who see reports like mine as damaging the market, especially new underwriting for more developments. That’s actually a false old-school assumption and a residual of the gatekeeper mentality. In the underwriting process, legacy contracts are outed in appraisals by requiring their contract dates – this is the standard operating procedure. The same goes for individual appraisals on mortgages.

Transparency is always the best way to approach market report or there is zero credibility in future research.

Here are a few charts with the legacy data from our chart gallery:

_______________________________

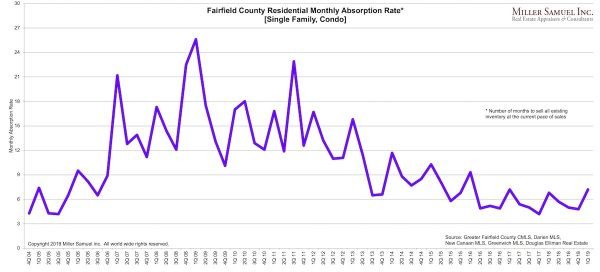

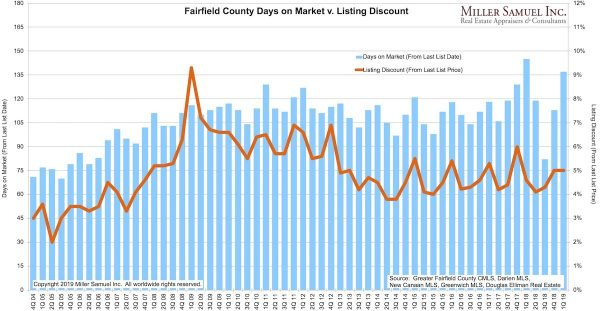

Elliman Report: Fairfield County Sales 1Q 2019

“The market continues to indicate a shift in the overall sales mix to smaller properties.”

– The average sales size has declined year over year for seven straight quarters

– Number of sales decreased year over year for the fifth consecutive quarter

– Listing inventory expanded year over year for the second straight quarter

_______________________________

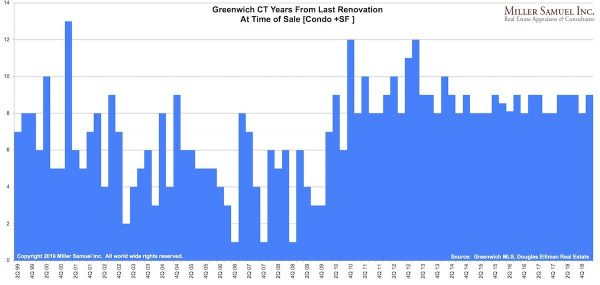

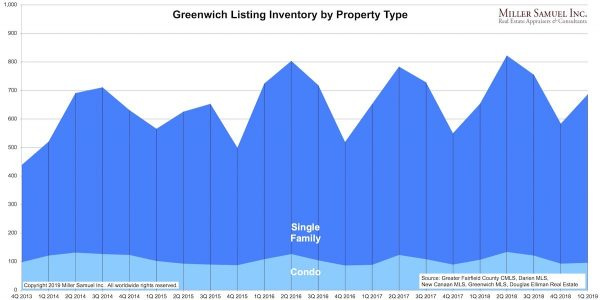

Elliman Report: Greenwich Sales 1Q 2019

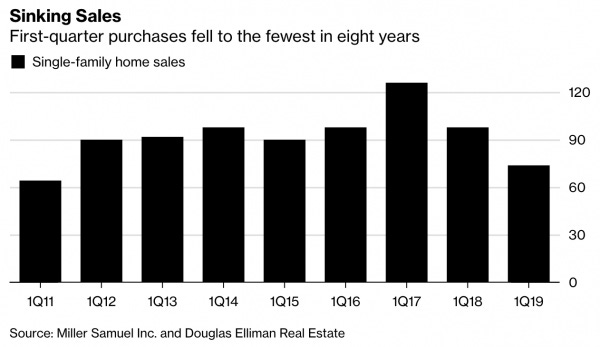

First of all, some Bloomberg charts!!! Click on either of them for the article.

“Condo sales continued to surge as single-family sales reflected a pronounced decrease.”

– Single-family sales fell to the lowest first-quarter total in eight years

– Single-family average sales size fell for the third consecutive quarter, pulling down price trends

– Condo sales surged in three of the past four quarters

– The sharp drop in the luxury threshold reflected the shift away from the high-end of the market

– Luxury listing inventory reflected large gains in supply for three straight quarters

Market Report Gauntlet: Q1-2019 South Florida

We released a slew of market reports and the news wasn’t as robust as the prior quarter. We are in a choppy period of the new tax law. Miami Beach and Boca appeared to be the standouts.

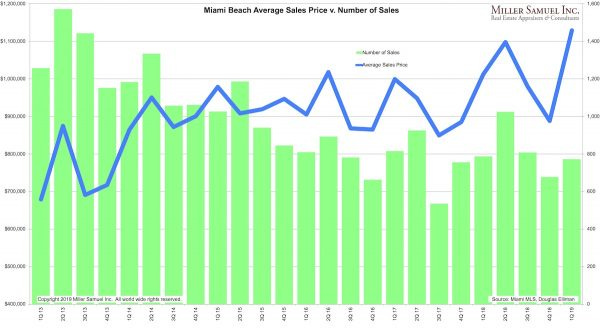

Elliman Report: Miami Beach + Barrier Islands Sales 1Q 2019

Elliman Report: Miami Coastal Mainland Sales 1Q 2019

Elliman Report: Fort Lauderdale Sales 1Q 2019

Elliman Report: Boca Raton 1Q 2019

Elliman Report: Royal Palm/Boca Raton 1Q 2019

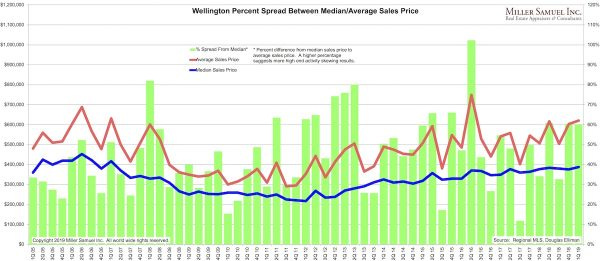

Elliman Report: Wellington Sales 1Q 2019

Elliman Report: Delray Beach Sales 1Q 2019

Elliman Report: Palm Beach Sales 1Q 2019

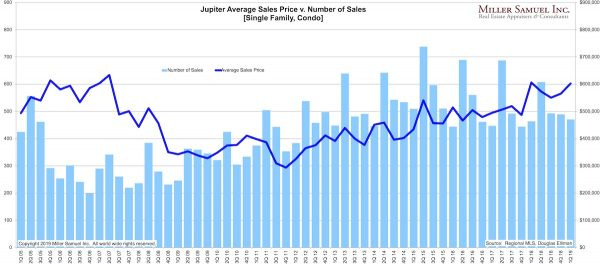

Elliman Report: Jupiter + Palm Beach Gardens Sales 1Q 2019

…from one of the Douglas Elliman releases I contributed to:

An overall assessment of the South Florida markets shows price trends edged higher but sales slipped and inventory edged a little higher this quarter.

Overall price trend indicators in Miami Beach moved higher than year-ago levels as the number of sales slipped. Marketing time jumped as older inventory was sold off and listing inventory slipped. In Miami Coastal Mainland, median sales price rose year over year for the eighteenth consecutive quarter, and sales declined annually for the first time in three quarters.

In Fort Lauderdale, condo price trend indicators slid year over year with a decline in average sales size. Luxury condo pending sales signed in the quarter surged over the same period last year. Single-family luxury median and average sales price moved higher as marketing time stabilized.

In Boca Raton, condo and single-family price trend indicators rose year over year as sales slipped for the first time in three quarters. Luxury condo price trends surged year over year partially due to the jump in average sales size.

Single-family sales in Delray Beach slipped for the first time in six quarters as listing inventory expanded for four quarters. Condo price trend indicators haven’t declined in thirteen straight quarters.

In Wellington, condo median sales price increased annually for the tenth straight quarter. Single-family price trend indicators all rose year over year for the fourth consecutive quarter.

In Palm Beach, condo sales rose annually for the fifth consecutive quarter to the second highest market share recorded. Single-family price trends showed mixed results as sales fell to their lowest first-quarter total in seven years.

Single-family median sales price moved higher for the second straight month. Condo sales rose year over year for the third consecutive quarter in Jupiter. In Palm Beach Gardens, single-family sales slipped for the third time in four quarters as all price indicators rose. Condo median price slipped year over year for the first time in 27 quarters.

New Federal Tax Law Slowed The Housing Market

The New York Fed published a study on the housing slowdown and how the 2017 federal tax cut played role in it. Here was part of my take. Spoiler alert: Mortgage rates fell and the market still slowed.

Here’s a good explainer by Marketplace.

And now for the counterpoint by White House Council of Economic Advisers Chairman Kevin Hassett who used “Zestimates” to do his research. If you know how the Zestimates work (they track prices and are only within 5% of actual value 50% of the time) and how housing markets work (sales fall 1-2 years ahead of prices), then this observation is stunningly uninformed. Good grief.

Ivy Zelman Talks About the U.S. Spring Housing Market

My friend and legendary Wall Street housing analyst Ivy Zelman of Zelman & Associates discussed the outlook of homebuilders in the U.S. single-family market. The chart shows the expanding use of concessions. Click on the image to watch the video.

Appraiserville

(For earlier appraisal industry commentary, visit my old clunky REIC site.)

The New York State AMC Law Goes Into Effect

The NY State Coalition of Appraisers wants you to to know that there is a new AMC law coming into effect at the end of the month and REVAA doesn’t like it.

Last December New York State Governor Andrew Cuomo signed Senate Bill S9080 into law, effective at the end of this month.

REVAA‘s biggest concern is that it requires all valuations to be performed by appraisers AND invoices must be attached to the report so the consumer knows what the appraiser was paid.

This is groundbreaking for our industry. Let’s hope that the word spreads and the consumer is finally protected!

There are lots of goodies here – just a couple of samples:

4. Act without just cause to withhold or threaten to withhold timely payment for an appraisal report or for other valuation services rendered with such appraisal report or services provided in accordance with the contract between parties;

(c) Requiring an appraiser to prepare an appraisal report or valuation service under a time frame that such appraiser believes, in their professional judgment, does not afford such appraiser the ability to meet all the relevant legal and professional obligations including USPAP requirements. Notwithstanding the foregoing provisions of this paragraph, all appraisal reports should be completed within a reasonable timeframe and appraisers may not unnecessarily delay completing appraisal assignments;

(d) Prohibiting or inhibiting communication between the appraiser and the lender, a real estate licensee, or any other person from whom such appraiser, in their professional judgment is relevant;

(e) Requiring the appraiser to do anything that does not comply with USPAP…

AMCs Need To Turn To Consumers To Survive

After reaching the point where there was no more room to gouge appraisers to drive profits higher, more and more AMCs are in trouble or have become “former” AMCs. Last year when appraisers fought back with logic to counter the false “appraisal shortage” narrative, it worked. Appraisers have already given up 50% to 70% of the mortgage applicant’s appraisal fee and there is no more left for appraisers to give up. There never was an appraisal shortage, there was merely a shortage of appraisers willing to work for 50 cents on the dollar. Our industry hit our limit.

The opportunity that consumers provide is the future of appraising.

I’m involved in Phil Crawford’s “Get My True Value” effort which is an organic marketing machine for appraisers who don’t know how or don’t have time to market to consumers. It’s exciting to see it take off.

And you can see this consumer angle taking off in other efforts which are repurposing the AMC concept to something else – I just got this email and know nothing about them – they are going after lender work, not consumers, but notice their anti-AMC pitch.

We are in the wild west right now and the AMC legacy is no longer relevant to those who want to make a living and love being an appraiser.

OFT (One Final Thought)

Sometimes getting more eyeballs on a property doesn’t help sell it, or does it? We’ll find out in May when this property goes to auction.

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons) and someone forwarded this to you, or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be hacked;

– You’ll be a two way authenticator;

– And I’ll opt not to apologize.

Brilliant Idea #2

You’re obviously full of insights and ideas as a reader of Housing Notes. I appreciate every email I receive and it helps me craft the next week’s Housing Note.

See you next week.

Jonathan J. Miller, CRP, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

Rent Guidelines Board issues conflicting NOI data for regulated apartments [Pincus Co]

Strictly living room: ‘breathtakingly horrific’ Sydney real estate ad goes viral [Guardian]

CAR: “California home sales moderate in March” [Calculated Risk Blog]

The tax overhaul’s impact on the housing market? It’s complicated. [Marketplace]

Is Trump’s tax law helping or hurting the housing market? [Marketwatch]

West Coast Homebuyers Get One Benefit From Sales Slowdown [Bloomberg]

College Kids Are Living Like Kings in Vancouver’s Empty Mansions [Bloomberg]

What Retail Recovery? Malls Under Pressure as Stores Close [Wall Street Journal]

Real estate sector proposes changes to fight money laundering [Vancouver Sun]

‘Flintstone House’ owner countersues Hillsborough, alleges racism [Curbed]

The Sustainability of First-Time Homeownership Liberty Street Economics [NY Fed]

‘China’s Manhattan’ Borrowed Heavily. The People Have Yet to Arrive. [NY Times]

My New Content, Research and Mentions

Secondary Cities in the U.S. That Are Prime Real Estate Investment Opportunities [Mansion Global]

Report: Rents In NYC Hit Record Highs As Albany Mulls Reforms [Gothamist]

Downtown Boston condo prices, sales drop annually in first quarter 2019 [Curbed]

South Florida resi sales fell in Q1: Elliman [The Real Deal]

Fairfield sales fall as buyers shift toward smaller homes [The Real Deal]

Miami Beach’s Luxury Market Gets a First-Quarter Jolt [Mansion global]

Wealthy Greenwich Home Sellers Give In to Market Realities [Mansion Global]

Tommy Mottola Sells Greenwich Estate for 25% Off [Wall Street Journal]

Live for Free in This Unloved Luxury Condo Tower [Habitat Magazine]

Recently Published Elliman Market Reports

Elliman Report: Downtown Boston Sales 1Q 2019 [Miller Samuel]

Elliman Report: Jupiter + Palm Beach Gardens Sales 1Q 2019 [Miller Samuel]

Elliman Report: Miami Beach + Barrier Islands Sales 1Q 2019 [Miller Samuel]

Elliman Report: Fort Lauderdale Sales 1Q 2019 [Miller Samuel]

Elliman Report: Royal Palm/Boca Raton 1Q 2019 [Miller Samuel]

Elliman Report: Miami Coastal Mainland Sales 1Q 2019 [Miller Samuel]

Elliman Report: Fairfield County Sales 1Q 2019 [Miller Samuel]

Appraisal Related Reads

It’s just NOT a cash market like it used to be [Sacrament Appraisal Blog]

The booming FLAT market & rate addiction [Sacramento Appraisal Blog]

Is The Agent Liable If No Appraisal Is Done? [Birmingham Appraisal Blog]

https://legislation.nysenate.gov/pdf/bills/2017/S9080 [NY Senate]

Clear Capital unveils active, nationwide Modern Appraisal Program [PR Newswire]

In Real Estate, Sometimes Less Is More [Cleveland Appraisal Blog]

Extra Curricular Reads

How Much Slower Would the U.S. Grow Without Immigration? In Many Places, a Lot [NY Times]

What an Olympic medalist, homeless in Seattle, wants you to know [Seattle Times]

How the Boston Marathon Messes With Runners to Slow Them Down [Wired]

Are Humans Fit for Space? A ‘Herculean’ Study Says Maybe Not [Wired]

Helvetica, the world’s most famous typeface, gets a makeover [Fast Company]