Time to read [8 minutes]

Takeways

- Despite predictions of steep declines after the 2024 NAR and Sitzer‑Burnett settlements, buyer‑agent commissions have largely held steady or risen, supported by research from the Consumer Policy Center and the Federal Reserve.

- Slower sales cycles have increased demand for agent expertise and full-service support, sustaining traditional commission structures even as direct buyer-agent agreements become more common.

- While agent fees remain stable, class action attorneys profited significantly, with Sitzer‑Burnett settlements from NAR and major brokerages totaling nearly $1 billion by late 2024.

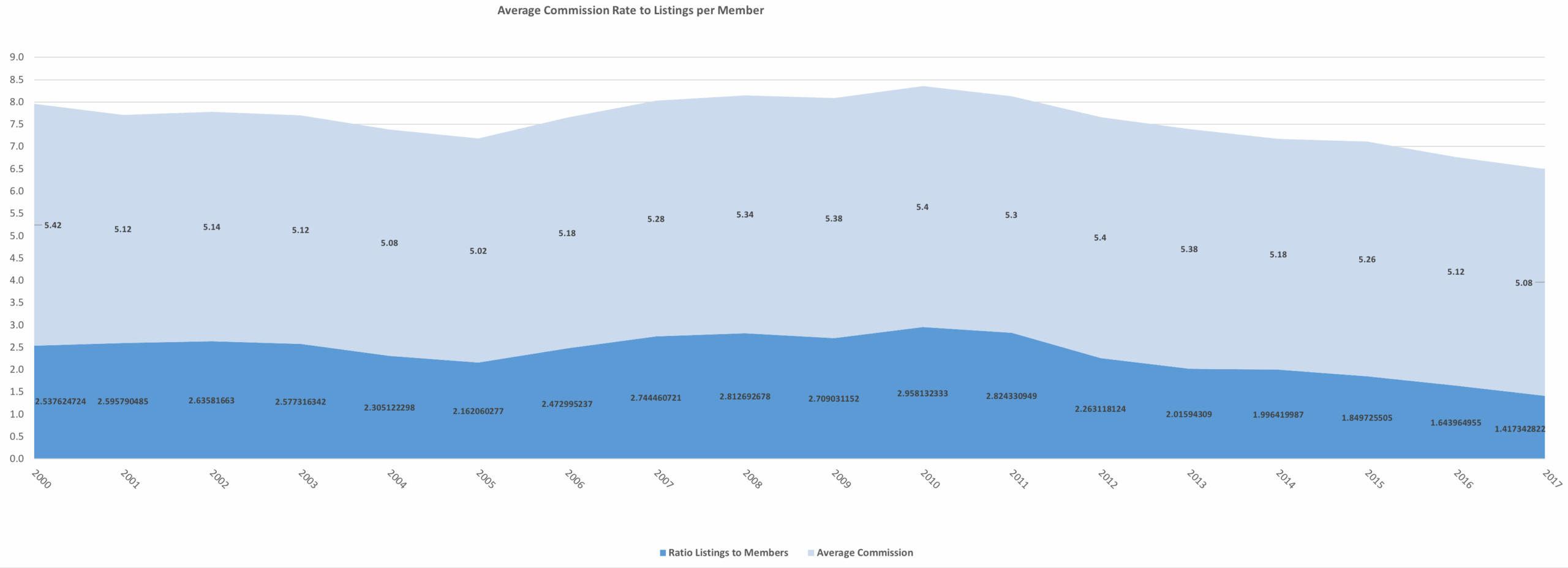

There was a great piece about buy-side agent commissions that seemed to confirm a “business as usual” environment right now. From Real Estate News: Buyer agents are asking for higher fees than they were 3 years ago. The Consumer Policy Center, an independent think tank, published a study this month: The Homebuyer Experience: Commissions and Contracts. August 17, 2024, was supposed to mark a 20% to 30% collapse in buy-side agent commissions after the 2019 landmark class action suit known as Sitzer-Burnett (lots of copycat cases, too) settled in March 2024. The federal government had a longstanding hunger to better align the person with the service they were paying for, which ran counter to NAR policy. Why should a seller pay for the buyer agent when that agent is working against the seller’s best interest? The industry took the NAR settlement to mean the inevitable end of buyers’ agents’ hold on the transaction, yet they were wrong. Real estate agents have been telling me that commissions have not materially changed as a result of the NAR settlement. And this makes sense, since the market has slowed significantly over the past three years, and slow markets tend to drive commission percentages higher because buyers and sellers need much more hand-holding. Back during the Great Financial Crisis, I remember seeing many listings with unusually high commissions as sellers sought to stand out amid higher inventory and greater competition. You can see the ebb and flow of commissions across various markets in this 2018 chart, which is worth expanding.

2025 Fed Study On Commission Rates

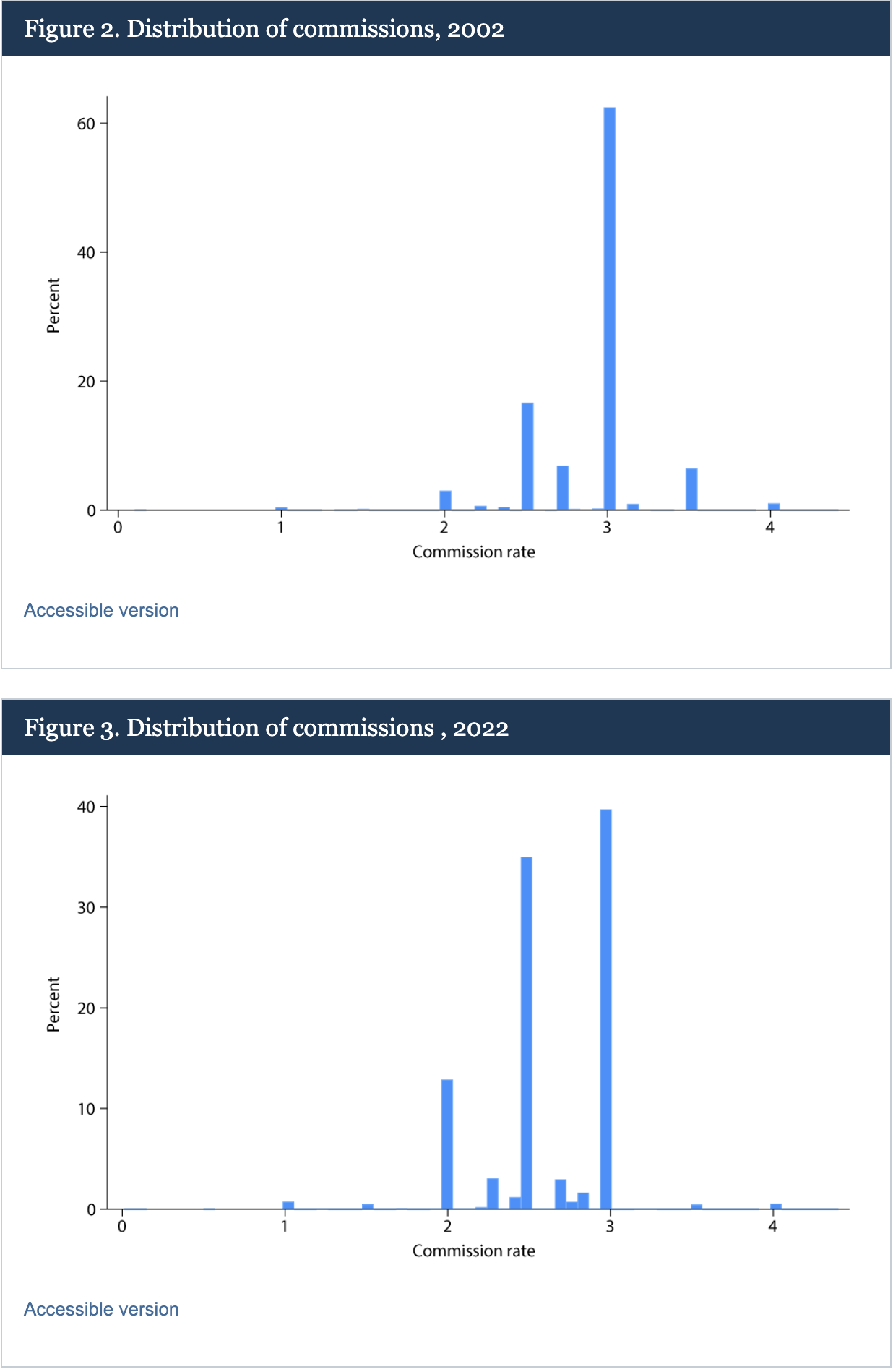

There is a fascinating commission analysis presented recently by the Federal Reserve that is worth reading: Commissions and Omissions: Trends in Real Estate Broker Compensation. The study illustrates the downward trend in commissions, while recognizing that prices have been rising. For a few months before I moved to NYC in 1985, I was a real estate agent in Lombard, Illinois, a suburb west of Chicago. The standard commission rate was 7%, and for $92,000, you could get a 3-bedroom ranch on a quarter-acre lot in a good school district (my first sale as an agent).

Usually, attempts to “automate” the real estate agent process occur in active markets where properties are easier to sell and attempt to take the agent out of the loop. Many startups deigned to reduce dependency on sales agents fail or stumble when the housing market shifts to weaker transaction volume. Remember Your Homes Direct (YHD), Purplebricks, and Knock? They all collapsed or repositioned their business models after failing to replace real estate agents. Redfin started that way as well. Compass has said they intend to reduce dependency on real estate agents in the future. Think about the brokerage industry panic when Opendoor was at its peak and was seen as poised to replace most full-service brokers, but it is now a shadow of its former self. Or Zillow Offers relying on its Zestimate product rather than agent pricing, only to hurtle into closure with enormous losses. Most of these models emerged when the sales market was experiencing high volume, but failed when the market cooled and participants needed a higher level of personal service that real estate agents provide.

Sides: The Language Of Commissions

Every home sale has two sides.

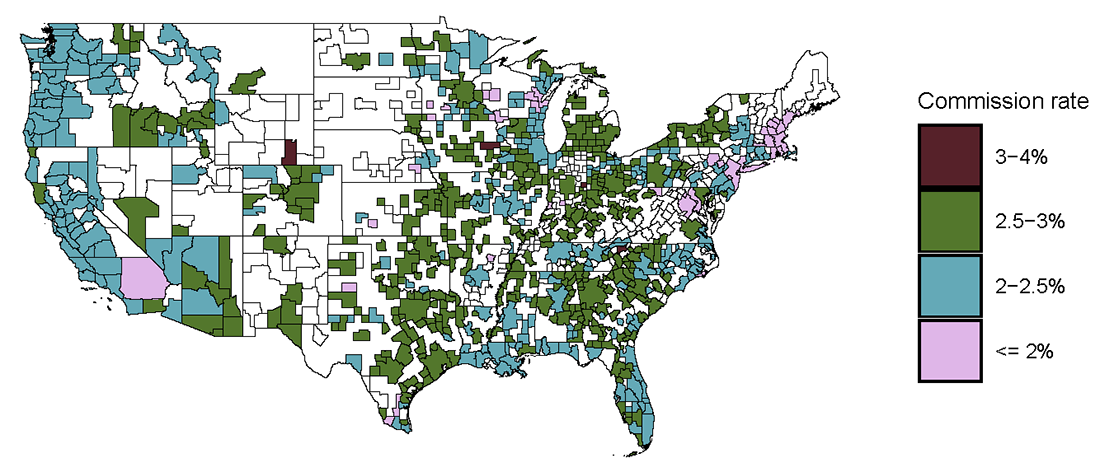

The following map from the Fed study illustrates commission rates back in 2022, before the 2024 NAR settlement. These commissions represent the “sides” of a transaction, buy-side and sell-side agents, in the language of the real estate brokerage industry.

The following two charts show how commissions as a percentage have declined over time (because prices are rising).

Study: Since NAR Settlement, Buy Side Commissions Are Rising

From the CPC study: “By the second decade of the twenty-first century, many critics believed that the most practical and effective way to introduce price competition for broker services was to completely separate (“untie,” “uncouple,” “decouple”) seller and buyer commissions so that sellers and buyers would compensate only their own agents.”

- The 2024 settlement eliminated mandatory buyer-agent compensation offers on MLS listings, enabling price competition.

- It required buyer agents to secure signed agreements with buyers that outline how the agent will be compensated before showing properties.

- These measures freed sellers from paying buyer agents and encouraged direct negotiation of compensation between buyers and their agents.

What the survey indicated:

- Despite the 2024 class action settlements removing barriers to price competition, commission rates among buyer agents remained essentially unchanged, with some agents even increasing rates as a risk premium.

- Two-thirds of buyer agents were willing to negotiate lower rates when pressed by sellers, and many also expressed flexibility in offering short-term or terminable contracts to attract cautious buyers.

- To achieve genuine price competition, the report recommends separating buyer and seller compensation and enabling buyers to finance agent fees through mortgages, thereby creating transparency, negotiation leverage, and alignment with international norms.

Final Thoughts

Despite expectations that the 2024 NAR settlement and related class actions like Sitzer‑Burnett would trigger a 20–30% drop in buy‑side commissions, research shows the opposite: buyer‑agent fees have mostly held steady or even risen compared to three years ago. The Consumer Policy Center’s recent study and a Federal Reserve analysis confirm that, despite regulatory shifts meant to “decouple” commissions and foster price competition, the housing market slowdown has kept pressure on agents to provide more support, pushing compensation upward. Many agents now negotiate directly with buyers through signed agreements. Still, in practice, traditional commission structures remain in place, reflecting past cycles in which weaker markets, such as during the 2008 crisis, rewarded more hands-on service. Meanwhile, attempts to automate or replace agents, from Purplebricks to Zillow Offers, have failed in low-volume markets, underscoring how personal expertise continues to anchor commission stability.

But the class action lawyers in these cases did very well. In the Sitzer-Burnett case, the total settlement fund from the NAR, HomeServices, and other major brokerages reached nearly $1 billion as of late 2024. Reportedly claimants received about $900. Oof.

The Actual Final Thought – What buy-side agents have been saying.

Monday On Tuesday Mailbox Highlights

Here’s my attempt to share interesting Housing Note readers commentary…

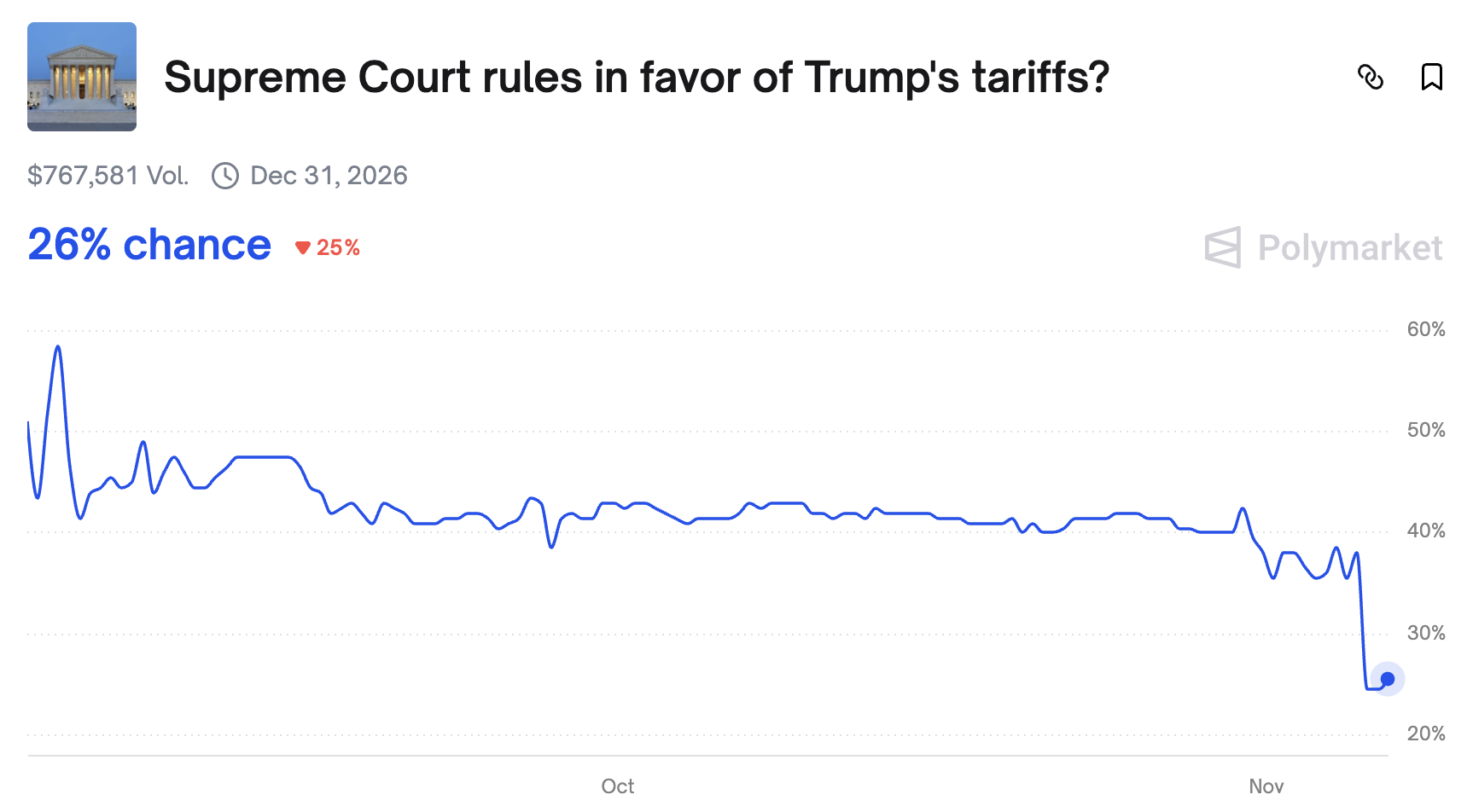

November 6, 2025: Tariffs May Be Repealed, Causing Mortgage Rates To Drift Lower

Commenter (with AOL address) Jonathan: I don’t agree!! I am for the tariffs!! Also, I don’t like it that you are pushing this idea! President Trump has done a wonderful job establishing these tariffs!! Stop spreading this propaganda!

My response I appreciate your passion for the topic. Thanks for sharing your opinion but that means you are against the constitution and are in a cult – you just don’t realize it yet – please turn off cable news asap and try critical thinking. Nothing personal.

Don’t just take my word for it. Listen to the oral arguments of the case in front of the Supreme Court right now: Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc.

November 4, 2025 NYC Housing Wealth Exodus Only In Headlines and Hearsay

Commenter Hi Jonathan, that was a good, refreshing post. As a Miami (and NY) licensed broker I’ve been beating the Miami drum because I’d definitely like some more buyers to move down here but NY definitely isn’t going out of style anytime soon. I just hope they don’t make it even harder for real estate owners to operate buildings by passing even more regulation and control…

Home Value Lock, Powered By StreetMatrix

The StreetMatrix housing index platform that we have created powers the Home Value Lock product that Josh Altman talked about today. We are fortunate to have Josh join our team.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come!

Did you miss the previous Housing Notes?

Housing Notes Reads

- Buyer agents asking for higher fees than they were 3 years ago [Real Estate News]

- Commissions and Omissions: Trends in Real Estate Broker Compensation [Federal Reserve]

- Real Estate Commission Litigation [REL]

- Tariffs Likely To Be Overturned… [The Big Picture]

Market Reports

- Elliman Report: Florida New Signed Contracts 10-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2025 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2025 [Miller Samuel]