Time to read [5 minutes]

- Starbucks’ Manhattan store closures reflect corporate strategy and lease flexibility, not weakening local housing markets, which remain marked by rising prices and rents.

- Specialty grocers and retailers like Starbucks, Whole Foods, and Trader Joe’s do not cause gentrification; they identify and enter areas already trending upward.

- These companies succeed by anticipating future neighborhood affluence and aligning store locations with expected housing growth rather than initiating it.

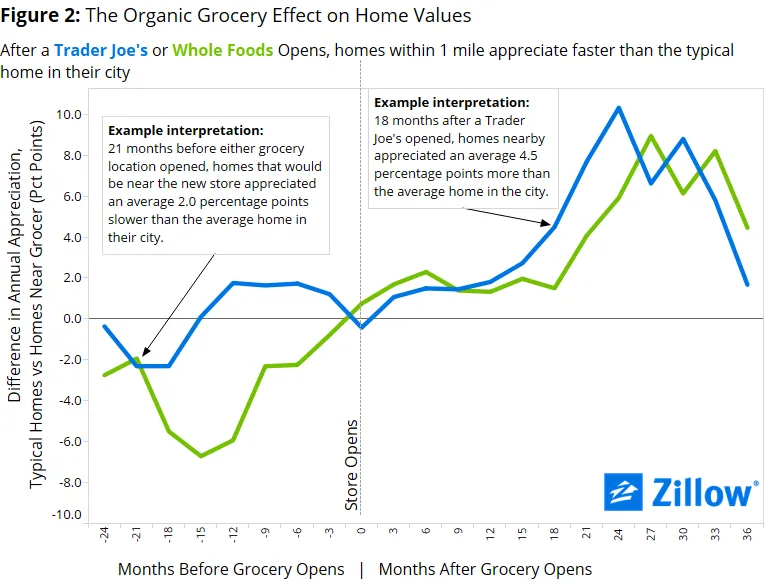

Cause and effect keep getting turned on their heads. In 2007, Johnson Economics found that the presence of a specialty grocer increased rental values by 17.5%. Trader Joe’s and Whole Foods (nicknamed “Whole Paycheck”) were key drivers of this. I secretly assumed that those grocers commissioned such a study as a diabolical marketing ploy, but that was not the case. Their assistance to neighborhood growth continues to be conveyed as “build them and a new housing market will be created” but it is more accurate, as shared by a Whole Foods executive to say that gentrification as described in this excellent Bloomberg piece [gift link] ‘”was well on its way by the time we showed up,” he said, “I guess we sort of helped the process along.”‘ I wrote about this phenomenon back in 2006 (excuse my broken blog), relying on a 2005 New York Times piece titled “A Destination for Serious Eating” [New York Times]. Even Yelp data has been analyzed in this space. So why write about old news? This Realtor.com headline, “Hundreds of Starbucks Stores Are Shutting Down—Here’s How It Affects Home Values Across the U.S.,” suggests that Starbucks and other specialty stores drive housing prices, even though they serve more as a barometer. The screaming headline infers that if a Starbucks closes, neighborhood rents and sales prices will fall. No, that’s not what this research indicates. Here’s an old chart that best illustrates the [pick one] Starbucks, Trader Joes, Whole Foods, Aldi “Effect:”

Starbucks Is The Moby Dick Of Retail

I previously shared some trivia on where Starbucks got its name.

There has been a lot of coverage of Starbucks’ corporate weakness and the bringing in of a CEO savior this past year. I have noticed an unusual number of Starbucks opening and closing in Midtown. A recent Commercial Observer article on Starbucks’ retail strategy sheds some light.

- They are closing 25 Manhattan stores as they refocus the company

- New leases often include five-year sales exits by sub-lease arrangement clauses and termination provisions

- Flexibility to either exit or reassign the lease

The closure of their Manhattan stores isn’t a sign of weakness in the local housing market. Rising sales prices and high rents characterize current Manhattan conditions.

Be sure to add Wegmans to the specialty store list!

Final Thoughts On Cause And Effect

I probably come across as whining and “splitting hairs” here, but I tire of misleading headlines about housing. Coverage suggests that a Starbucks can open in a barren wasteland, but shortly thereafter, multi-family properties enter the neighborhood at a rapid clip, along with new single-family homes. And when they leave, the neighborhood becomes a barren wasteland again. The brilliance of Starbucks, Whole Foods, and Trader Joe’s is that they are good at identifying up-and-coming neighborhoods (gentrification). That means the location will see its residents become more affluent. Coverage of these new stores suggests they mark the start of a neighborhood revitalization. These are sophisticated companies that look into the future. However, their moves don’t start a neighborhood trend, rather they are early adopters of new trends to capture the upside. These companies are more about being good at anticipating future housing growth patterns to make realistic assumptions about whether new neighbors can afford their prices.

The Actual Final Thought – Imagine if RATM did this in a Starbucks?

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come!

[Podcast] What It Means With Jonathan Miller

The Be Wary Of The Screams For RTO episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- How a Rent Freeze for Some Tenants Would Fuel Hikes for Others [The City]

- The Richest Have the Rosiest Outlook. 62% Expect to Be Richer a Year From Now. [Mansion Global]

- Are wages keeping up with inflation? [USAFacts]

- Tariff costs to companies this year to hit $1.2 trillion, with consumers taking most of the hit, S&P says [CNBC]

Market Reports

- Elliman Report: Orange County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)