Time to read [6 minutes]

Takeways

- The leading NYC mayoral candidate proposes a rent freeze for over 1 million rent-stabilized apartments, but more rentals are open-market and would not benefit.

- Freezing rent-stabilized rents pressures landlords to raise open-market rents to cover growing operating costs, likely fueling rent hikes.

- Strict rent controls and removed renovation incentives risk pushing NYC’s housing stock toward neglect and urban blight reminiscent of the 1970s and 1980s.

As we built our appraisal company, we invested all the proceeds in the business and didn’t buy our first home until our mid-thirties. My now-adult kids were younger than we had been when they became first-time homeowners. Homeownership isn’t for everyone, but it was for us. I lamented this on Bloomberg nearly twenty years ago [gift link], recalling, perhaps over-dramatically in retrospect, that we lived in a housing market dominated by homeowners. They had a picture of me sipping coffee on a low stone wall, looking very professorial (I can’t find the photo!) A couple of weeks ago, we released our research on the New York City rental market. The results were consistent with nearly every month in 2025. Rents are high. Rents are setting new records. Rents will remain high, but probably not set new records with mortgage rates slipping. These expensive conditions have made financial life more challenging for New Yorkers. But at the same time, wages are higher than pre-pandemic levels, taking some of the bite out of rent costs. Then the leading candidate for NYC mayor, arguably the second-most-powerful political office in the US, promised a rent freeze. It’s not the good news you might think it is.

What Rents Would Be Frozen?

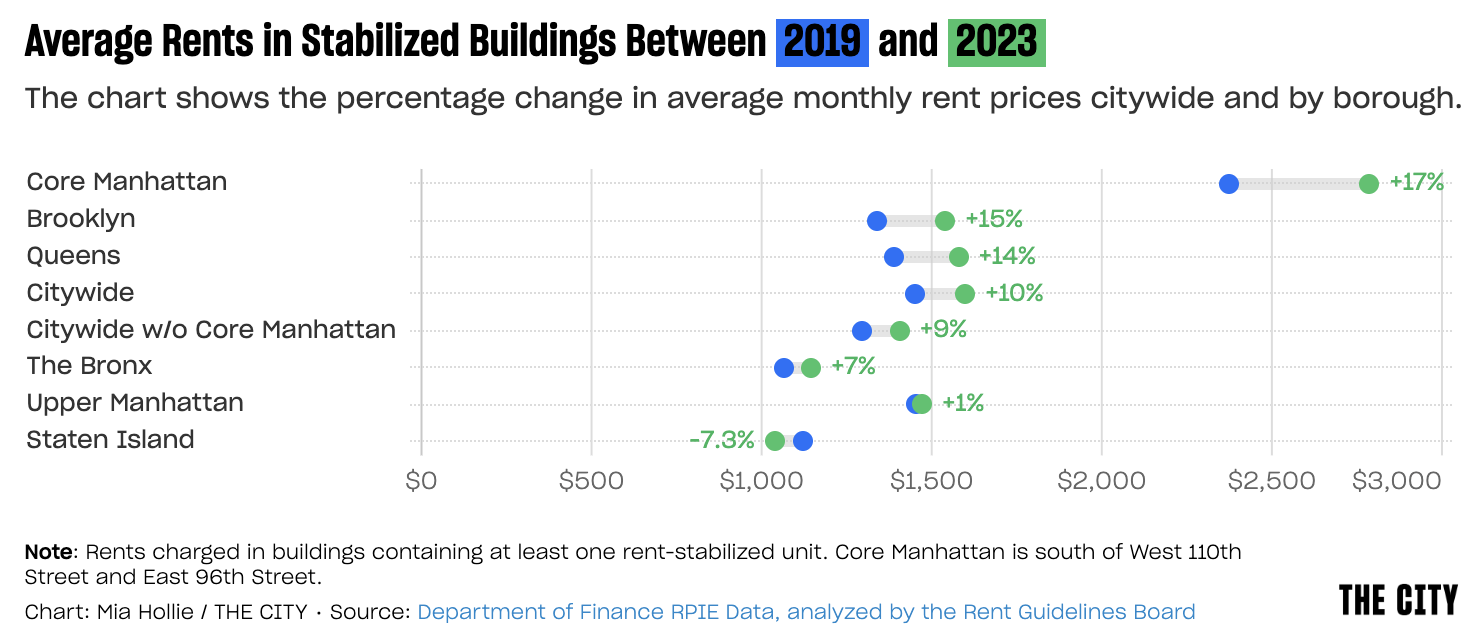

The likely victor in the NYC mayoral race deeply worries the real estate lobby. One of his platforms proposed rent freezes for rent-stabilized apartments. Core Manhattan rent-stabilized rents are up 17%, while open-market rents are up 28%. There is an excellent summary piece on the rent situation in The City: How a Rent Freeze for Some Tenants Would Fuel Hikes for Others. More than half of rental apartments are open market these days. There are over 1 million rent-stabilized apartments in New York City and at least 1.2 million open-market apartments.

About a decade ago, I was a Bloomberg opinion columnist and wrote about the hypothetical: Rent Control’s Winners and Losers [gift link]. It was a “what if” on what would happen if the state and city removed rent stabilization and rent control restrictions. Spoiler alert: Open market rents plummet, and rent stabilization or rent-controlled apartments rise. Here’s the chart we used in my column.

The rent-stabilized and open-market apartments are not separate. As I mentioned in The City article, if rent-stabilized apartment rents are frozen, landlords will collectively raise open-market rents. That’s because operating expenses are not restricted. Utility costs, real estate taxes, insurance, payroll, and other expenses all rise whether rents are frozen or not. If you drove the Cross Bronx Expressway like I did back in the 1980s (where Master Builder famously said (paraphrased) “To make an omelet you have to crack a few eggs”), you would have seen hundreds of abandoned apartment buildings as rent-stabilization growth was kept below inflation, so many landlords went bankrupt and walked away from their properties. My favorite reference for this was the background scenery in the Paul Newman movie “Fort Apache, The Bronx.” The city really looked like that when I moved here in 1985. I have vivid memories of the East Village in Manhattan during that time, where every other lot was a pile of rubble. With the 2019 rent law removing all incentives for renovating apartments, the housing stock is slowly slipping back into that condition.

Final Thoughts

Keep in mind that real estate, in one form or another, accounts for more than half of NYC’s tax revenue. The new mayor will likely gain control of the rent stabilization board by his second year to push for the freeze.

While a rent freeze may modestly ease costs for those in rent-stabilized apartments, it risks driving up open-market rents, already at record levels, and worsening the overall state of NYC’s rental housing stock due to economic pressures on landlords. The dynamic of rent-stabilized rents and open-market rents underlines the complex trade-offs of price controls.

The Actual Final Thought – This proposal was made with best intentions but is a loser.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come.

[Podcast] What It Means With Jonathan Miller

The Be Wary Of The Screams For RTO episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

October 21, 2025

A Less Than Basic 6-7 Primer On AI For Residential Real Estate, LOL

Image: Terminator 3: Judgement Day

Housing Notes Reads

- How a Rent Freeze for Some Tenants Would Fuel Hikes for Others [The City]

- The Richest Have the Rosiest Outlook. 62% Expect to Be Richer a Year From Now. [Mansion Global]

- Are wages keeping up with inflation? [USAFacts]

- Tariff costs to companies this year to hit $1.2 trillion, with consumers taking most of the hit, S&P says [CNBC]

Market Reports

- Elliman Report: Orange County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 3Q 2025 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Miami Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Sarasota County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Boca Raton Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 9-2025 [Miller Samuel]