Time to read [4 minutes]

Takeways

- Tariffs are hurting the economy: Weaker job market and rising household costs, with key prices up sharply.

- Fed rate cut likely: 90% chance for a 25 basis point cut, lowering recession odds and keeping mortgage rates steady or lower.

- Housing outlook unclear: Mortgage rates are already dropping and housing demand is rising, but tariffs keep prices high.

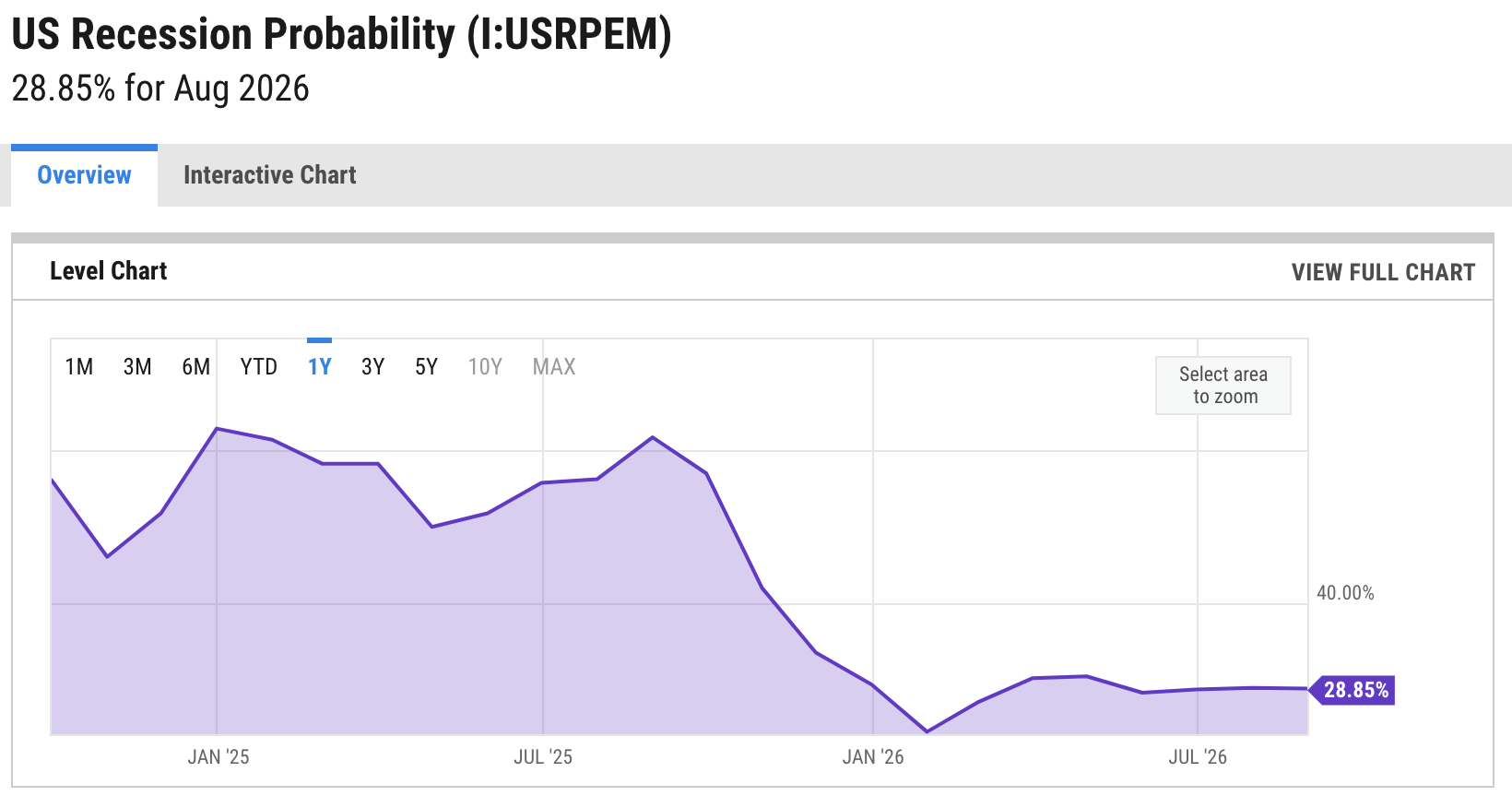

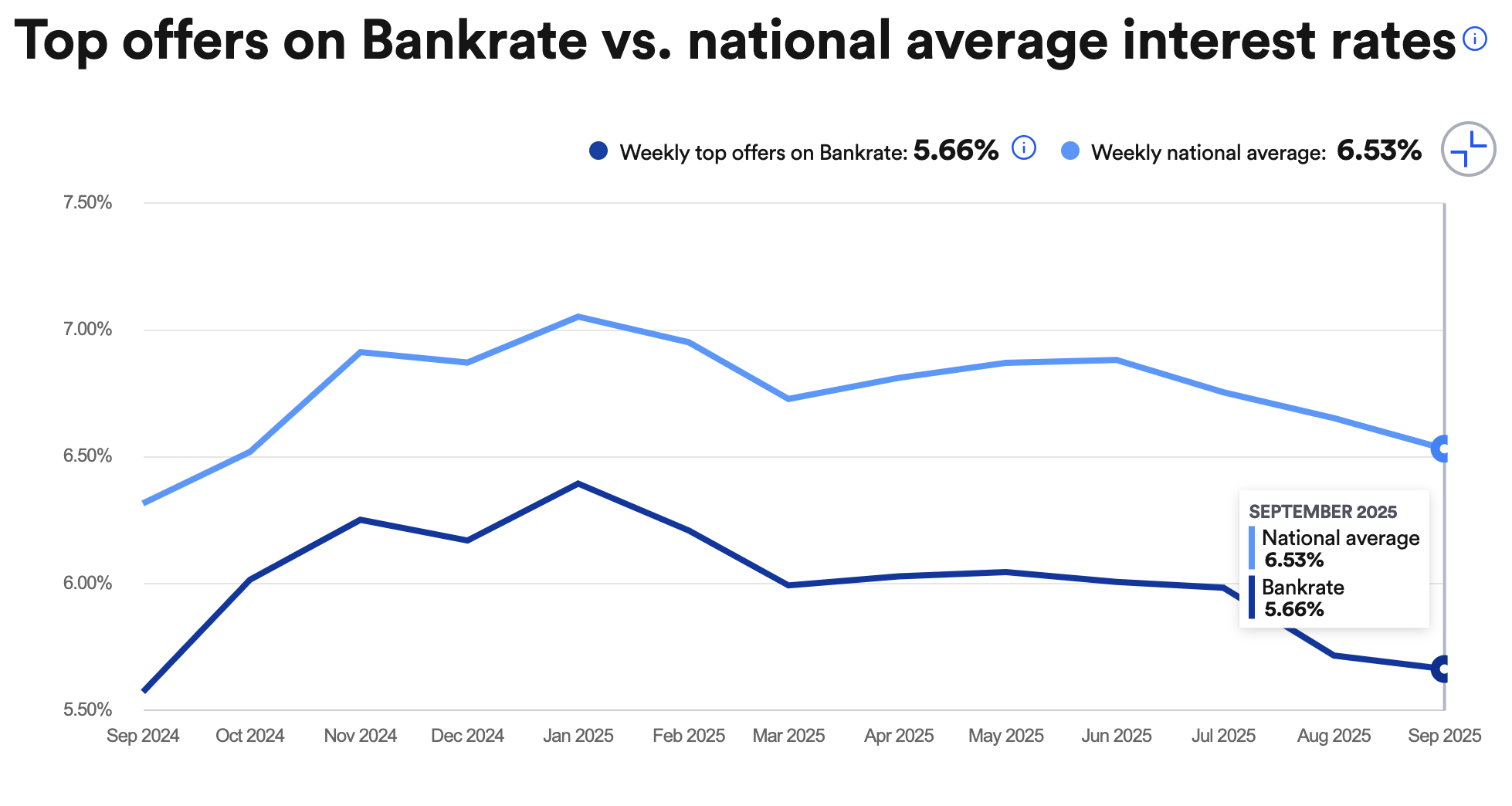

Mortgage rates have been sliding, thanks to the newly realized economic damage of the US tariff policy via the very weak jobs market. It’s been a short while since I spoke about the US efforts to promote a tariff policy that lacks even a basic understanding of what a tariff is, a tax on the US consumer. The US Appeals Court has already ruled the current tariff plan unconstitutional, but the case is on appeal. Over the past couple of weeks, evidence of the severe economic damage caused by the tariffs has begun to take hold, with more dreadful job numbers. Even billionaire Ken Griffin is critical of tariffs. The probability of a Fed rate cut of a 25 basis point cut is now 89.8% for September 17, and a 50 basis point cut is 10.2% (and rising), suddenly slicing the odds of a recession by half in just the past month. Still, a lot of our housing market future is dependent on whether or not the tariffs remain in place. Nearly all the billions of tariff revenue touted is coming from you and me in the form of higher consumer prices, with an additional household cost of $2,600 to $4,900. Since January, meat prices have been up 8%, coffee is up 80%, and housing prices are up 4% nationally, accounting for roughly two-thirds of total inflation. In other words, it’s probably never been more challenging to understand the housing economy, so I’ve been doing a lot of research. Mortgage rates are returning to where they started a year ago, and the probability of a recession has plummeted.

The Moment Of Truth

But as Housing Notes is all about, well, housing, and falling mortgage rates should gin up demand, especially the pent-up type that’s been sticking around for the past 3-4 years. Of course, if rates continue to fall as they have over the past few weeks, then prices will continue to rise, as we learned over the past five years.

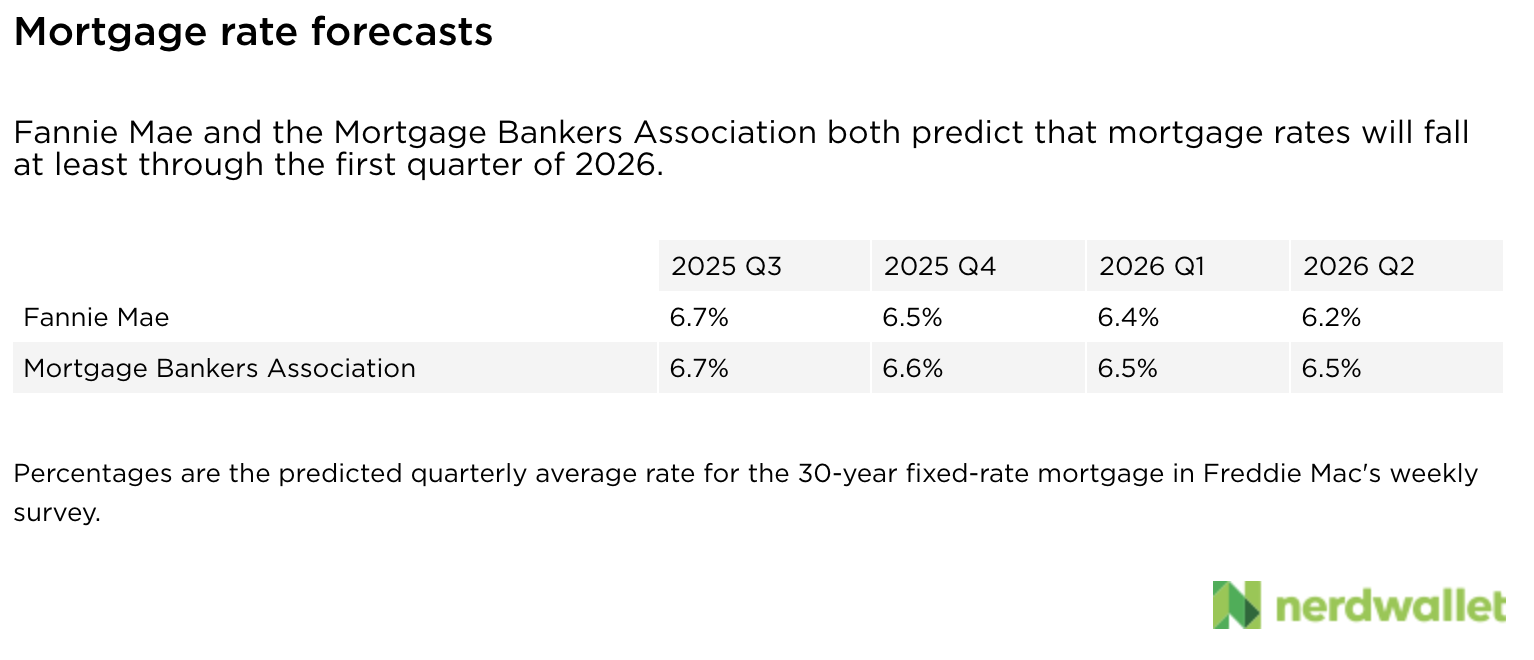

The Fed will likely cut rates a week from today, but the outlook for a significant drop in mortgage rates seems limited. However, mortgage rates are already below what Fannie Mae and the Mortgage Bankers Association have forecast, so I’m hopeful we continue to see modest mortgage declines.

Final Thoughts: I Finished My Homework

It’s nearly a full-time job to keep track of the housing market turmoil and confusion, mainly because the key agitator, tariffs, has no underlying belief system behind it which I find frustrating. However, mortgage rates could drift lower after next week’s Fed cut, unlike last September when mortgage rates rose after the Fed cut.

The Actual Final Thought – Understanding the current economy comes down to two choices. And it’s ok to chew bubble gum while you do your homework.

Upcoming Presentations

• September 16, 11 am ET / In-Person =================================

• September 18, 3 pm ET / Zoom ====================================

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Ugly Signs Can Be A Good Thing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

September 8, 2025

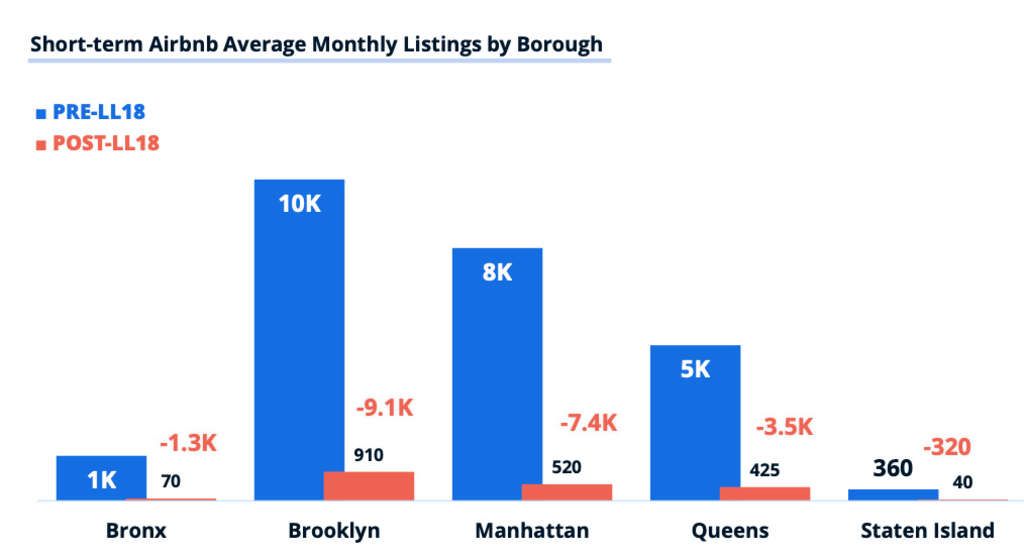

Two Years Later, Airbnb Law In NYC Solves Privacy, But Not Affordability

Image: Airbnb

Housing Notes Reads

- US Housing Outlook [Apollo Academy]

- Trump’s Commerce Secretary Loves Tariffs. His Former Investment Bank Is Taking Bets Against Them [Wired]

- How CEOs are responding to geopolitical uncertainty [McKinsey]

- State of U.S. Tariffs: September 4, 2025 [The Budget Lab at Yale]

- DealBook: Griffin vs. Trump [via New York Times]

- Mortgage rates plummet to new 2025 low on anemic jobs report [Inman]

- ‘It's Just a Mess:' 23 People Explain How Tariffs Have Suddenly Ruined Their Hobby [404 Media]

- Job growth revised down by 911,000 through March, signaling economy on shakier footing than realized [CNBC]

- What are the biggest drivers of inflation in the past year? [USAFacts]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)