Time to read [5 minutes]

- The Wealth Gap Is Expanding Rapidly

- The Top 1% Own 50% Of The Financial Markets

- Luxury Real Estate Is Likely To Fair Better Than The Remainder

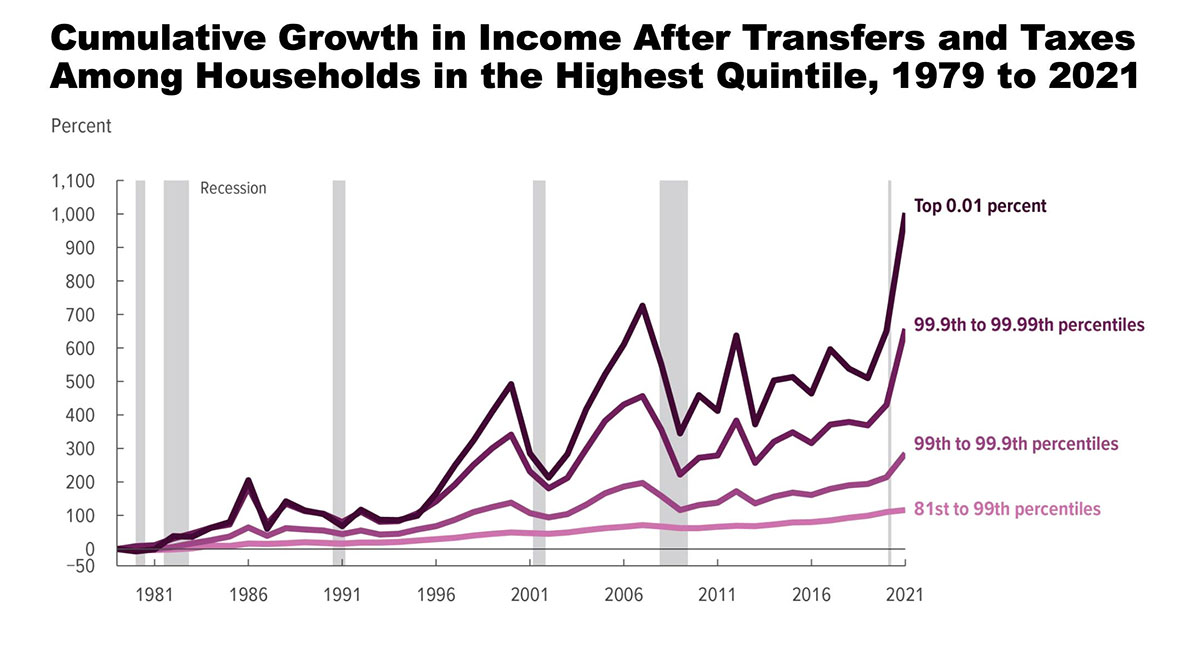

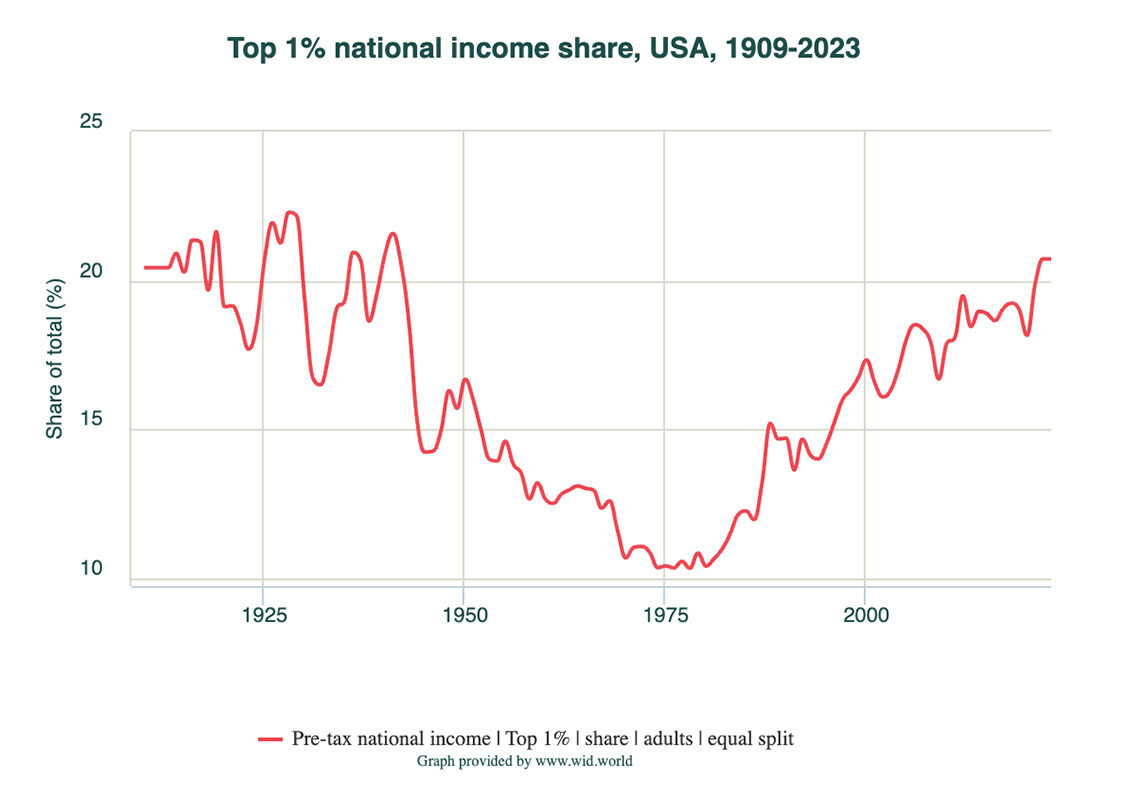

A while back, I wrote about how the outlook for luxury housing seemed better than for the remainder of the housing market. One of the drivers of its outsized performance was the expanding wealth gap, which is a generational change. It’s a “best versus all the rest” scenario, whether we like it or not. I promise not to delve into the billionaire phenomenon, as there is no need to idolize them as we often do in our society. In fact, the top 1% own 50% of financial markets. If you’re connected to luxury real estate and wondering how the future looks, it’s pretty good, and there’s no need to read any further. As I mentioned in my original post, the high end of the housing market will continue to outperform all other segments. However, if you’re curious, there’s a fascinating series by Nobel Laureate Paul Krugman at the Stone Center on Socio-Economic Inequality that, politics aside, begins to explain why. Not only is the gap spreading, but it is also widening within the wealthy. Back in 2014, I started tracking closed home sales above the $50 million threshold. Every month or so, I’d add an entry. Now I’m adding several each week as it’s becoming a job. I see this as growing tangible evidence of the wealth gap.

Some Key Factors

- The surge of inequality is a repeat of the era before WWII – it’s not a unique moment

- Globalization played a role but is not enough to explain it

- Rise in technology can’t fully explain it

- The Role of Power over government probably played a large role

Globalization Doesn’t Explain The Wealth Gap

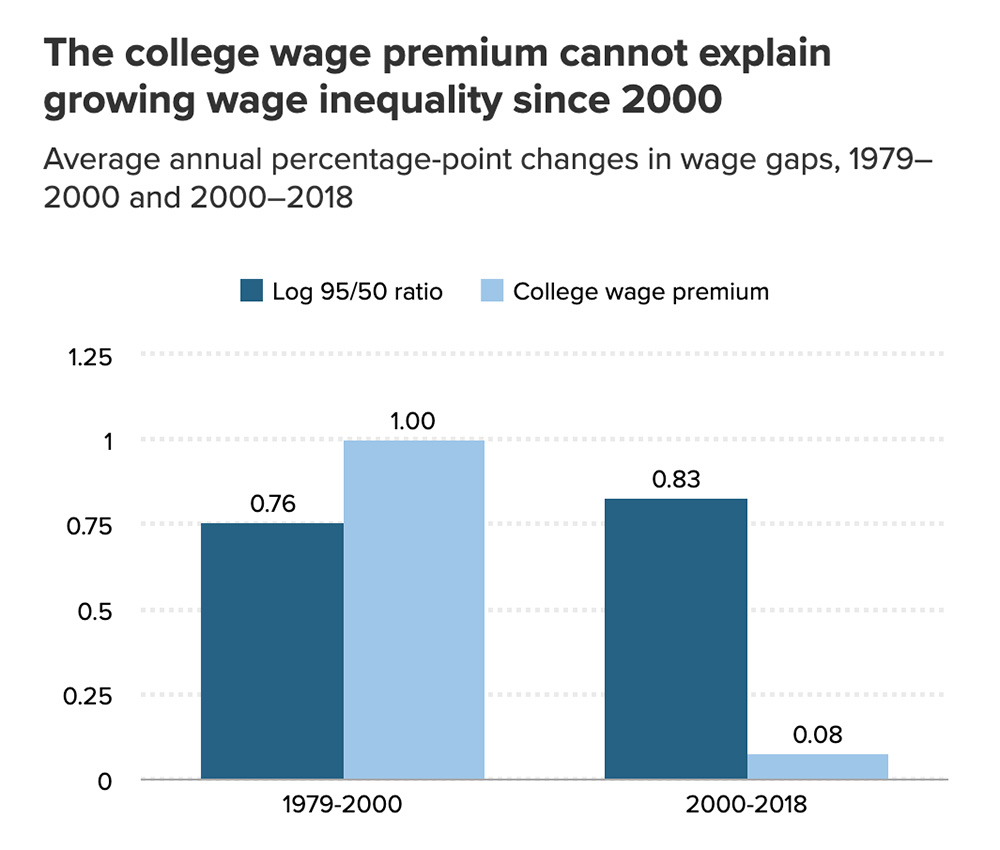

Krugman says: “Standard international trade theory says that importing goods made by blue-collar workers while exporting goods whose production requires many workers with college degrees reduces the demand for less-educated workers while increasing the demand for more-educated workers, increasing wage inequality. And there’s no question that this happened. The question instead is how much it contributed to the story of rising inequality.”

At first glance, a college education could be an explanation for the wealth gap, except that the college premium ended around 2000. This pattern aligns with the recent conversations about reevaluating the cost-benefit of a college education. The cost, through effortless access to credit without restraints, has ballooned the cost of college, wiping out the return on investment for a degree.

Final Thoughts

I didn’t want to lose my readers by going into too much detail, some of which is too wonky for me. It was fascinating to learn that the significant shift to technology in manufacturing after 1980 doesn’t explain the wealth gap, and the premium for a college education after 2000 has also evaporated, so neither of these factors explains it. My big takeaway from all my reading on this topic is that we don’t fully understand why this is happening, other than it’s probably through government policy. What we do know is that the gap continues to expand, and high-end housing will continue to be the beneficiary.

The Actual Final Thought – Within the super luxury housing market, some billionaires are still borrowing. Ha.

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Sort Of Live From Hurricane Erin episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- The highs and lows of reselling on Billionaires’ Row [The Real Deal]

- Manhattan apartment hunters face record rents and bidding wars [Business Times]

- More pain for Big Apple renters as prices surge again — and there’s no relief in sight [New York Post]

- Experts weigh Fannie-Freddie merger prospects [National Mortgage News]

- Manhattan rents continue to shatter records [Crain's New York]

- Bidding Wars Spike for Rental Apartments in Manhattan Amid Scant Supply [Mansion Global]

- Manhattan rents continue record-breaking summer streak [The Real Deal]

- Manhattan median rent hit $4,700 in July, the fifth record in six months [Brick Underground]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)