Time to read [6 minutes]

- It’s Looking Like No Rate Cut Today, But More Than One Cut In The Fall

- Mortgage Rates Aren’t Directly Tied To The Fed Cut. Big Cuts Are Inflationary

- Hedging Real Estate Is A Tall Order, But Non-Fat Dry Milk Is Cake

The Chicago Mercantile Exchange (CME) is a marketplace for derivatives (options and futures contracts). For those obsessed with interest rate direction, the CME provides the odds of a Fed decision to cut, hold, or raise rates at each FOMC meeting. Of course, those decisions aren’t directly connected to mortgage rates, so if the Fed cuts rates prematurely or by too much, mortgage rates may go up. Still, we in the real estate industry tend to obsess about the Fed’s influence over mortgage rate direction. Back in the aughts, I was the spokesman for Radar Logic, a now-defunct startup brought down by the GFC that tried to enable investors to hedge housing by providing daily spot pricing. After all, investors can hedge many assets against a market downturn, such as cheddar cheese, non-fat dry milk, insurance, weather, frozen orange juice (Eddie Murphy and Dan Akroyd in the movie’ Trading Places’), coffee, sugar, cocoa, lumber, wool, potatoes, litigation outcomes, and more. Yet, we can’t hedge against the world’s largest asset class, residential real estate, in a world of increased volatility. A friend of mine owned an options trading company years ago, and he invited me to the trading floor before open outcry trading became automated, where people in various colored jackets with big tags screamed numbers in a pit (just like ‘Trading Places’), and it was intense. Riding up the elevator to the trading floor, someone in a pale blue (I think) colored jacket said, “I need to have a good day, my mortgage payment is due.” Good grief. I couldn’t live like that!

In fact, the S&P/Case Shiller offers a suite of housing market indices and was built to enable the hedging the housing as an asset class. Still, it never got traction largely because they didn’t seem to understand the nuances of residential housing, such as the 6 month lag of its indices, that it only provided one data point per market per month, that it treated all price tranches in a market the same, that there was no difference in market behavior by size, and portals like Zillow easily predicted the results. The Case-Shiller index continues to be covered by business news outlets but it attracts only a handful of trades per month, which is insufficient for it to be relied on as an index.

But I digress

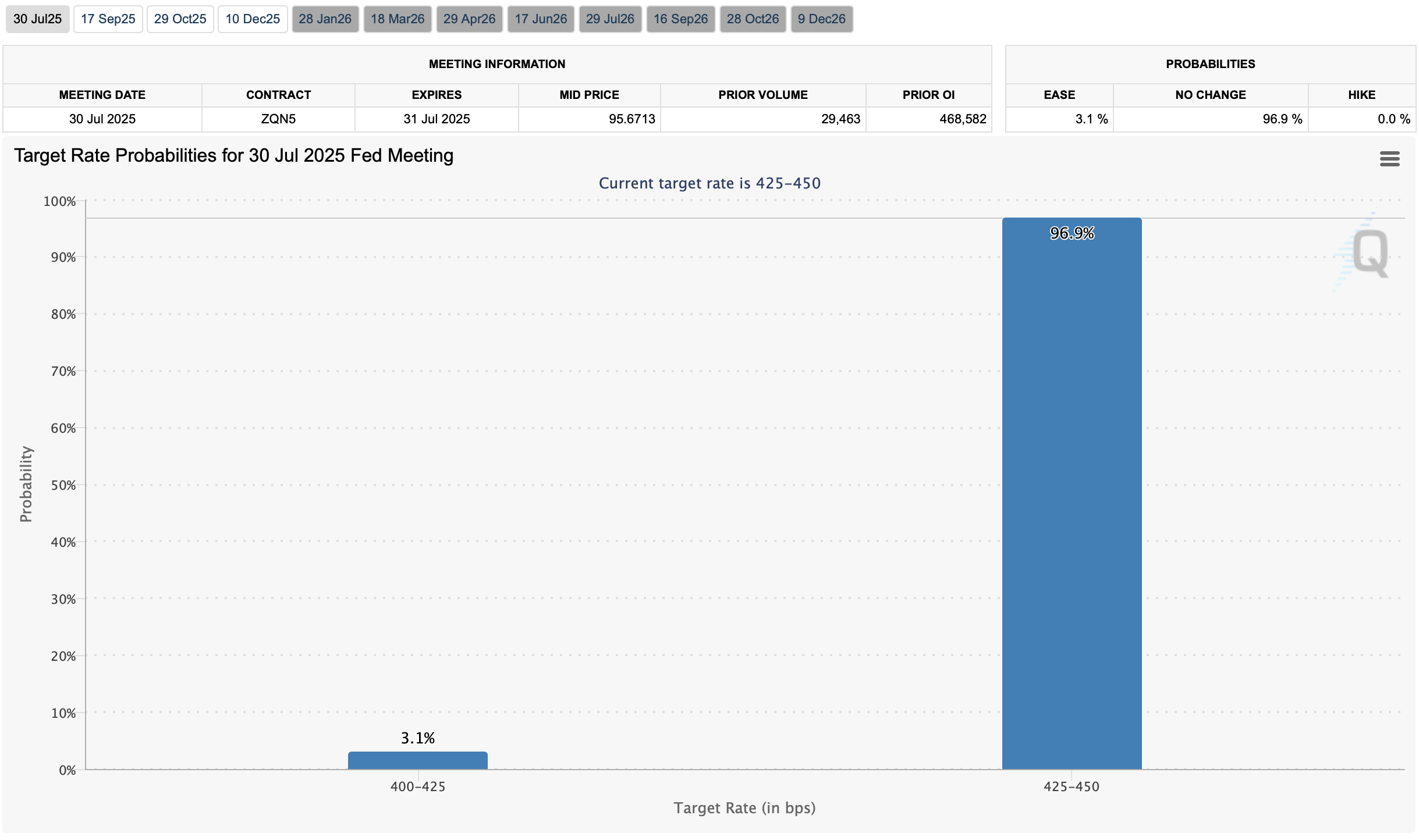

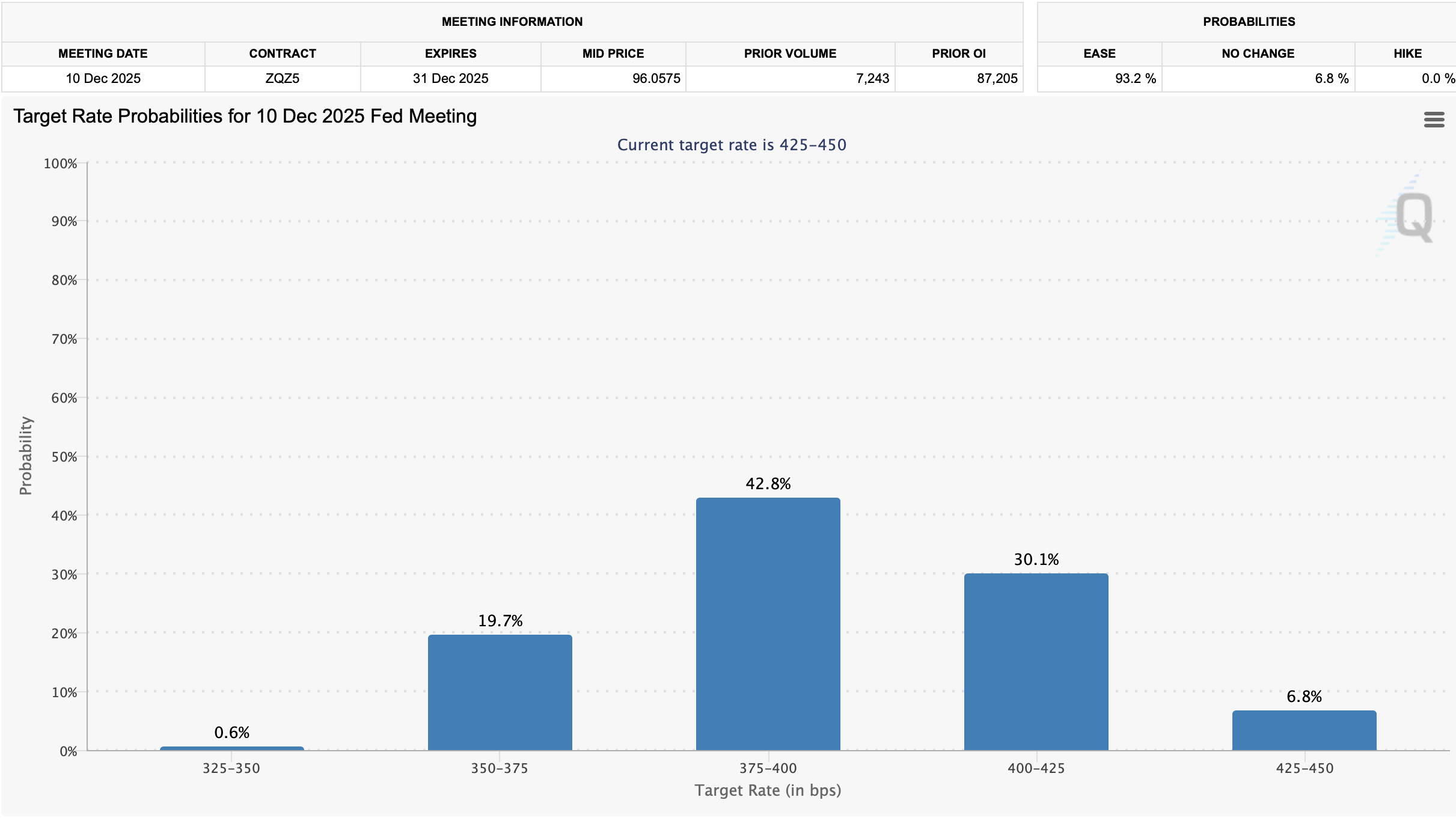

96.9% Odds For No Rate Cut Today

The Federal Open Market Committee (FOMC) is meeting today exactly when this newsletter goes out and will discuss whether they will cut the federal funds rate. The rate predictions at CME come from trades of 30-day Fed Funds futures contracts (see screenshots below from CME). The president’s threats to fire Fed chair Powell, who Trump appointed as FOMC chair in his first term, and his recent bullying behavior and direct pressure to cut rates have been ignored by the markets. The markets seem remarkably unimpressed by all the saber-rattling and think the FOMC will keep rates where they are (see first chart below). I see a rate cut right now as stoking inflation and keeping mortgage rates stuck where they are or even pushing them higher. Trump has said he wants a 3% rate cut, which would be wildly inflationary and probably push mortgage rates higher. He is keen to cut rates to reduce the interest cost of several trillion dollars being added to the national debt from the “One Big Beautiful Bill. Because inflation at 2.7% is above the 2% Fed target, it seems unlikely that the Fed will cut today, but it is definitely leaving room for a few rate reductions this fall as tariff policy moves to the front of the economy.

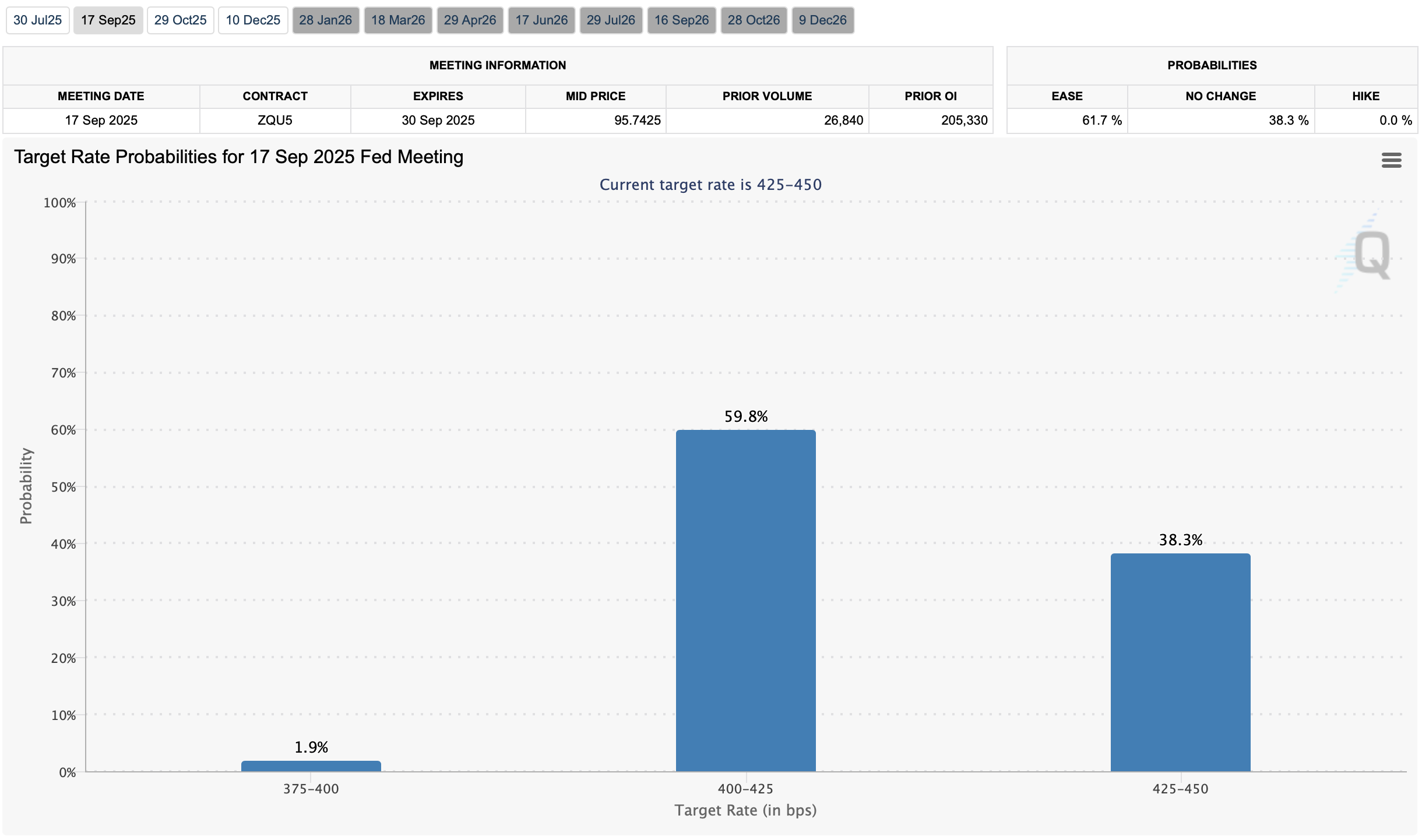

61.7% Chance Of Rate Cut In September

A 25-basis-point cut is expected, with the addition of a potential 50-basis-point cut.

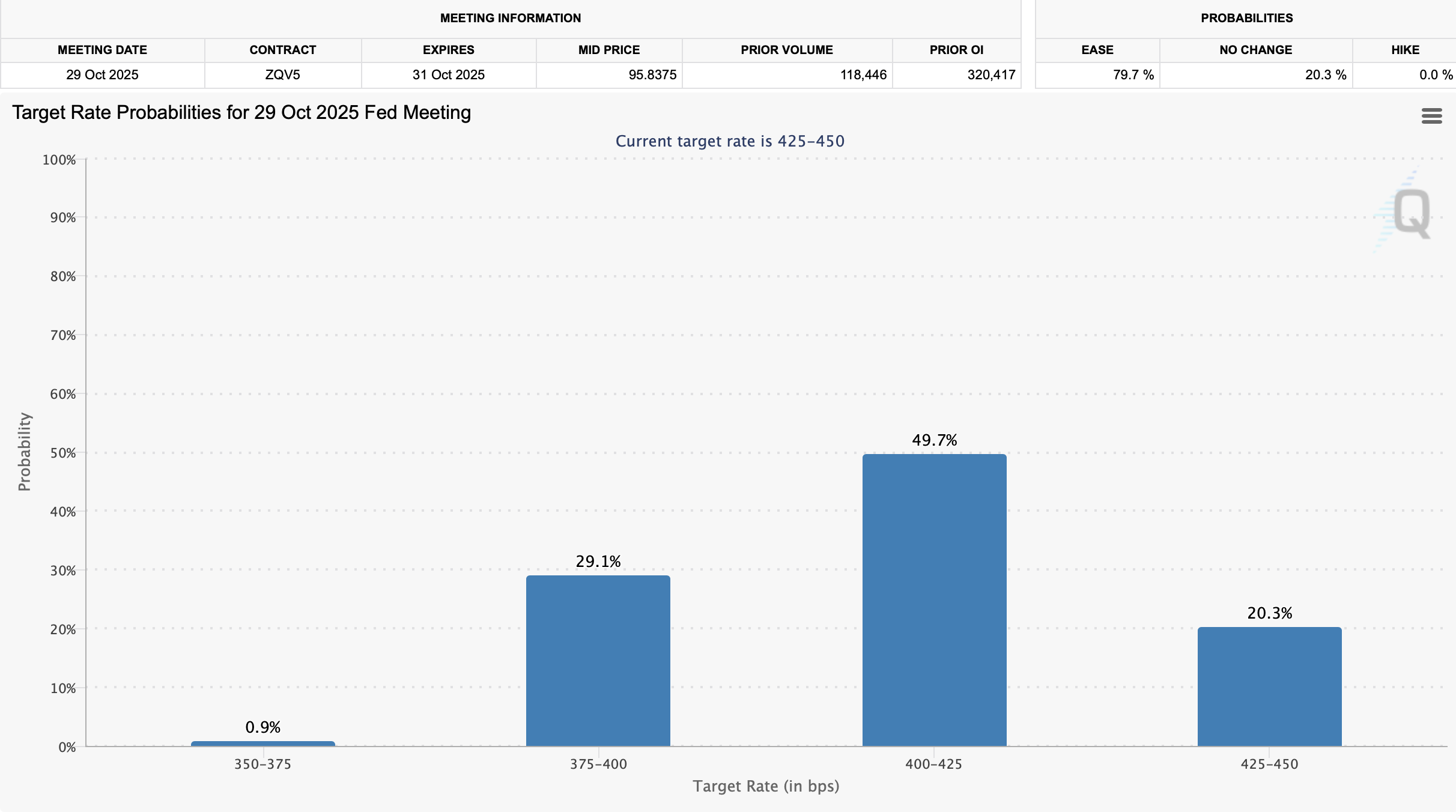

79.7% Chance Of Rate Cut In October

The odds are growing that between now and then, the federal funds rate will be as much as 75 basis points lower.

93.2% Chance Of Rate Cut In December

The odds are growing that between now and then, the federal funds rate will be as much as 100 basis points lower.

Final Thoughts

The odds that mortgage rates will slide later this year are rising, but this is primarily dependent on the near-term impact of tariff uncertainty, which hasn’t hit at full force yet. The lack of adverse impact as anticipated this fall is probably why the Fed is pushing back on cutting rates right now.

The CME has recently created a futures index that tracks the 30-year conforming rate mortgage. That would be more helpful in understanding future rates than tracking the fed funds rate, but the new index hasn’t gained traction yet. The bottom line is that, barring a black swan event, mortgage rates could be somewhat lower this fall, but not significantly so. That’s better for housing, but without a meaningful drop in mortgage rates, home sales are going to remain underwhelming in the national context.

The Actual Final Thought – While I’ve been called this periodically by colleagues, I’ve never been called “Oswald.”

[Podcast] What It Means With Jonathan Miller

The From Ground Leases And Walk-Ins To The Blizzard Of Oz episode is just a click away. The podcast feed can be found for all the platforms we use:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

July 28, 2025

Abused For Years, The Zeigeist For Real Estate Appraisers Might Be Changing For The Better

Image: Jonathan Miller

Housing Notes Reads

- Text – S.1635 – 119th Congress (2025-2026): Appraisal Industry Improvement Act [Congress.gov]

- Fannie Mae, Freddie Mac Are Likely to Remain in Conservatorship, Pulte Says [Barron’s]

- Senators Say Appraisal Regulator 'Chaos' Risks Undermining Real Estate Markets [Bisnow]

- 💼 Out of Office? [Highest and Best]

Market Reports

- Elliman Report: Long Island Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Hamptons Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: North Fork Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)