Time to read [5 minutes]

- Public Confusion Still Reins Over The Direction Of Housing

- High Rates Are Being Kept High Because Of Significant Uncertainty

- Long Island Is A Proxy For The National Housing Condition

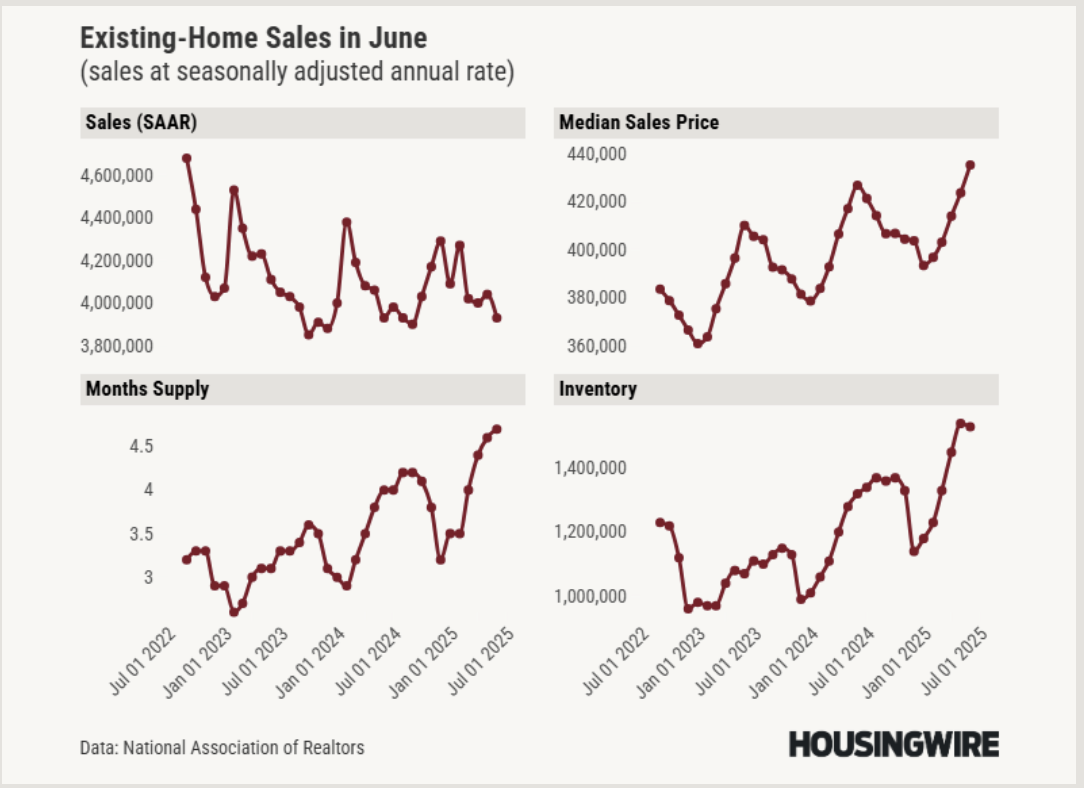

I’ve been doing an unusually high amount of public speaking lately and have run out of dad jokes. The takeaway at the beginning of each event is remarkably consistent: a lot of confusion about the state of the housing market. After all, existing home sales are down [gift link], but prices are up. New home sales are up, but new home prices are down. The number of renters in the suburbs has doubled over the past five years. Mortgage applications have been increasing, yet cash sales are also rising. It’s all explainable in terms of individual characteristics, but throwing them all into the same bucket is confusing. And the random chaos of current federal economic policy exacerbates the situation.

Mortgage Applications Rising Yet Rates Are Stuck

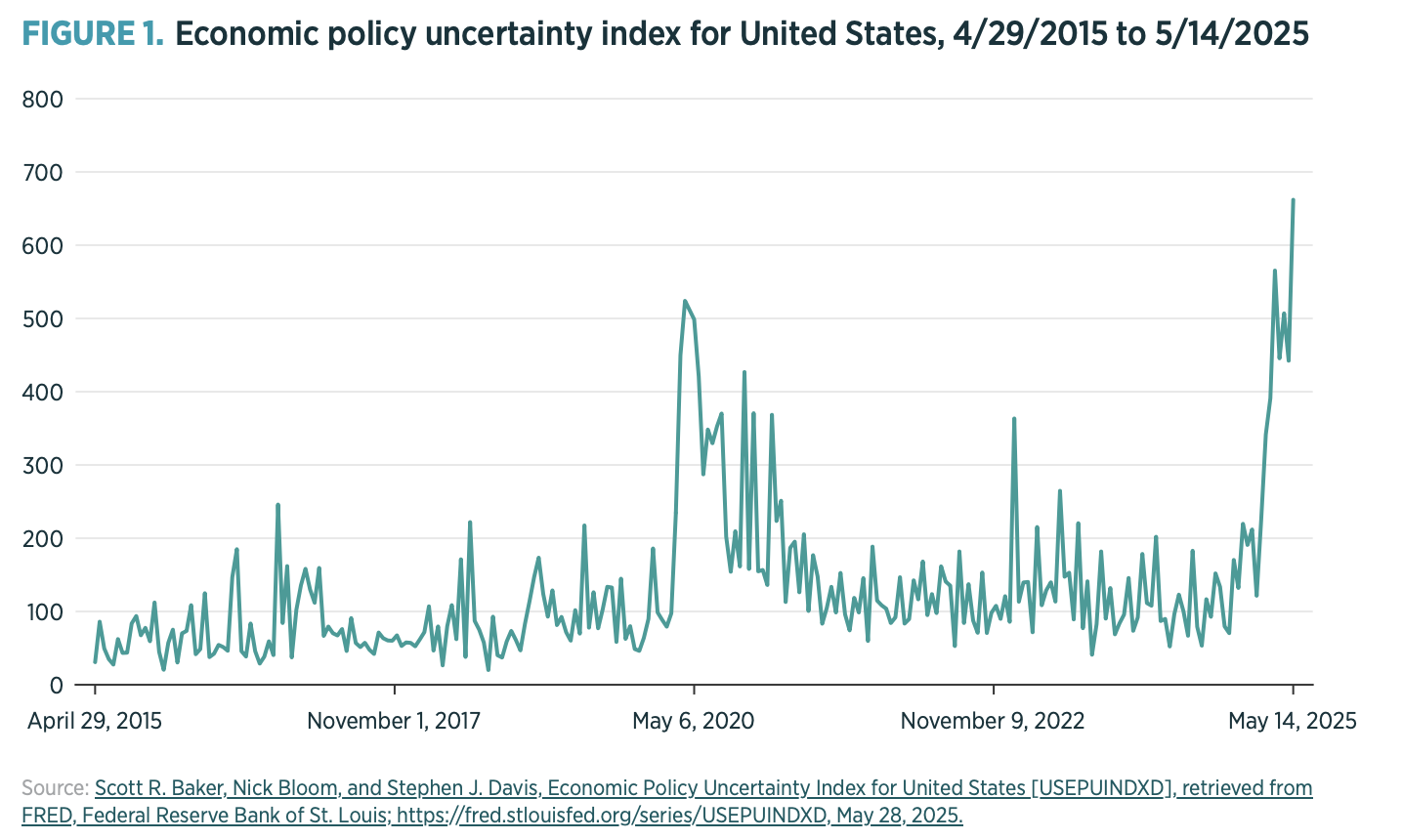

Mortgage rates have been consistent over the past three years. The expectation of lower mortgage rates that was widely held in early 2025 has been dashed by the administration’s economic policies, which are all inflationary, including tariffs, a higher deficit, the threat of potential wars in the near term, and significant policy inconsistency on a daily basis.

The expansion of mortgage applications is being driven by the rise in listing inventory, greater price stabilization, and builder incentives to a lesser degree.

Long Island Housing Illustrates National Condition

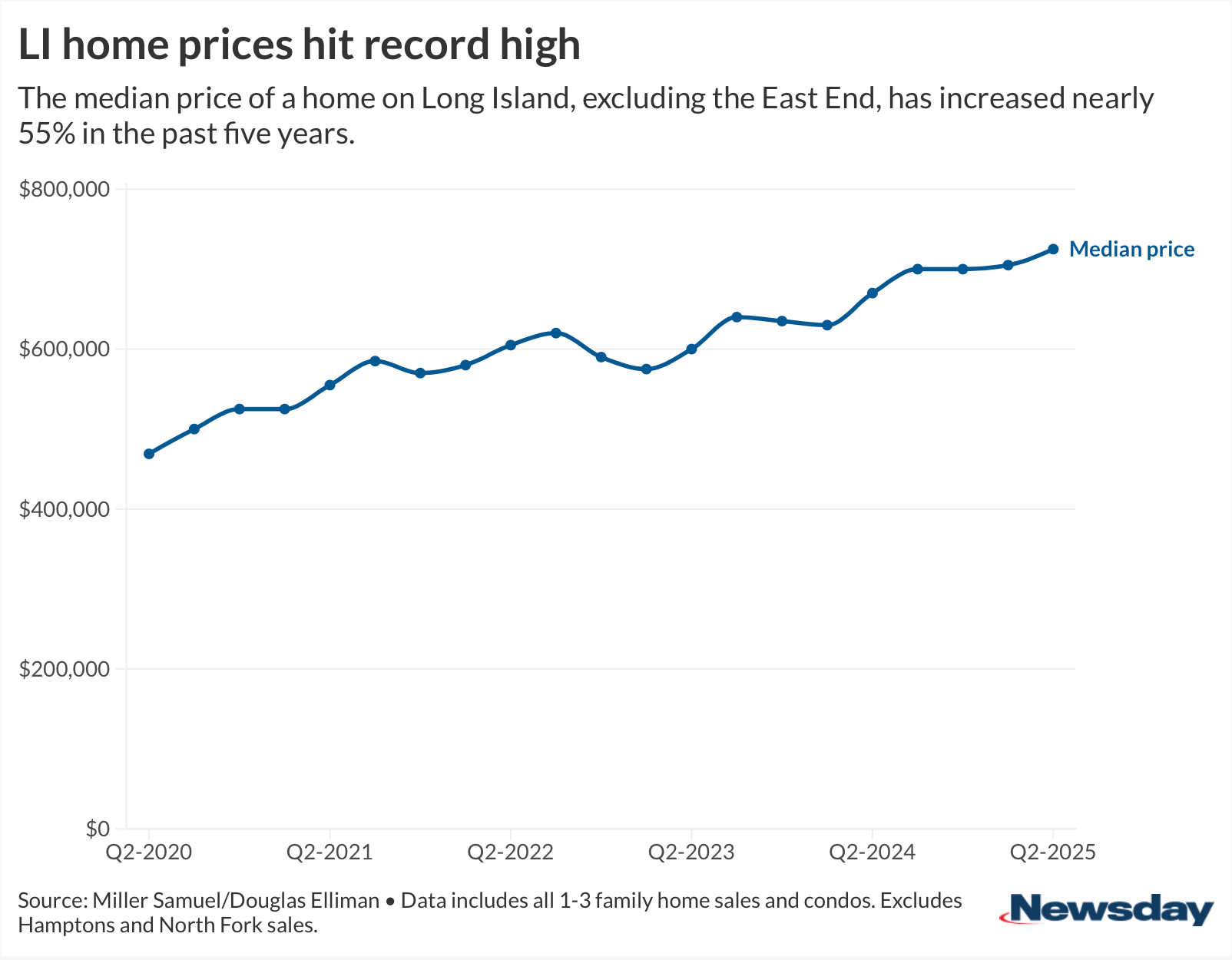

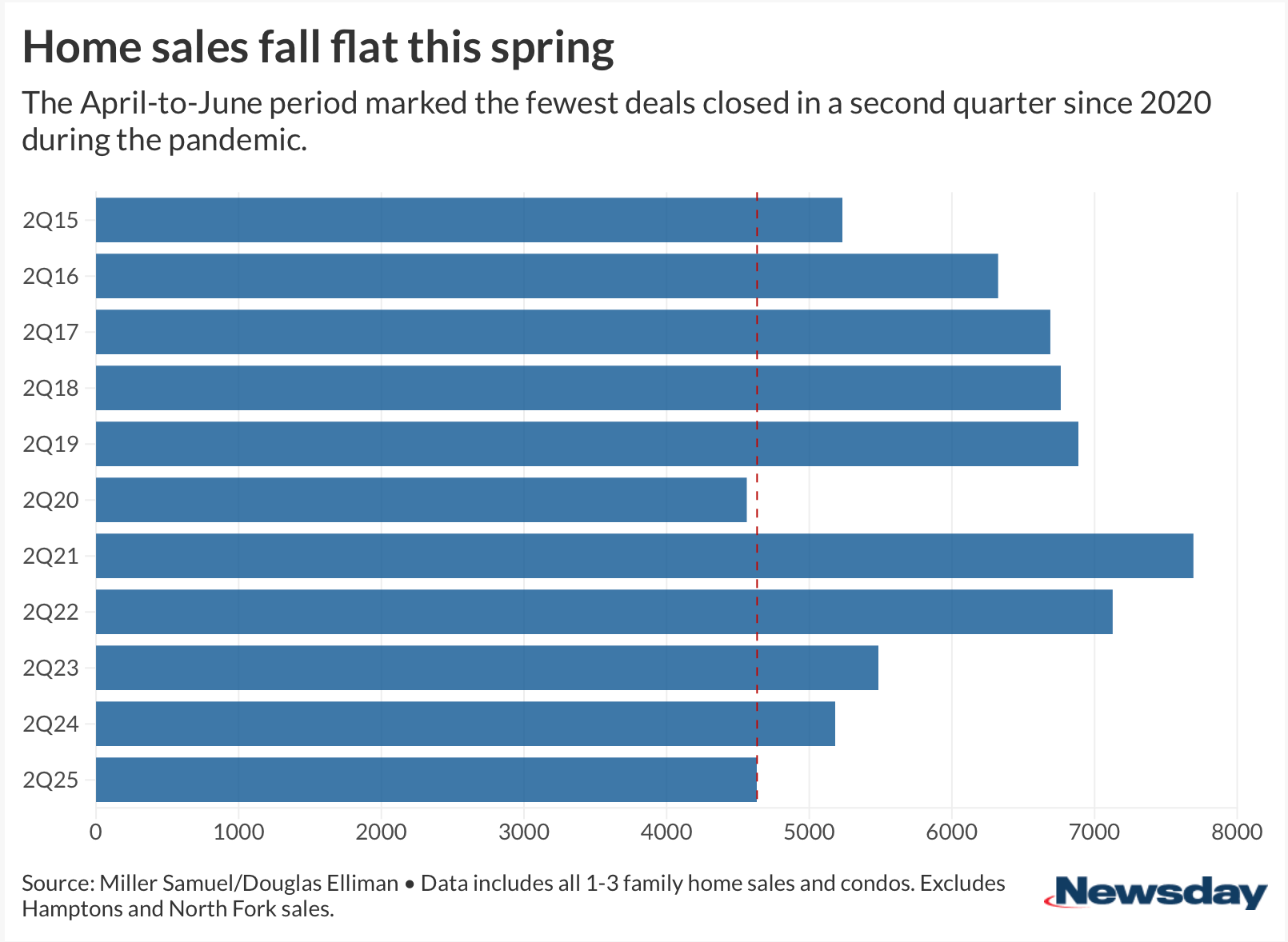

Our Long Island housing research, published by Douglas Elliman yesterday, was extensively covered by Newsday. Long Island housing appears to be a proxy for the national condition. Home prices continued to see new highs due to chronically low inventory. Sales drifted lower, and bidding wars occurred in more than one in two sales.

What’s so fascinating about the following Newsday chart is how it shows the steady decline in sales over the past four years, from the Fed rate pivot in early 2022 to the lowest level in a decade, excluding 2020, during the pandemic’s darkest days. Higher mortgage rates and low supply are the culprits. I suspect that a noticeable drop in mortgage rates will create a modest housing boom if that were to occur. I don’t see how that is possible at the moment.

The current administration is placing pressure on the Fed to cut rates. That will not translate into lower mortgage rates. In fact, slashing rates by as much as 3% is quite an inflationary move in an economy already grappling with higher inflation,and we won’t face the full impact of the tariff policy chaos for several more months.

More Thoughts On The Economy And Real Estate

July 23, 2025 The Counselors of Real Estate: Lessons Learned: 5 Years After the Pandemic

“From the influential impact on the office market to the redefining of retail, the global pandemic prompted a rethinking of space utilization, investment strategies, valuations, and the overall approach to commercial and residential real estate, leading to lasting changes. Join Jonathan A. Schein CRE, Ruth Colp-Haber, CRE, William Pattison, CRE, and Jonathan Miller, CRE, Member of RAC, for a powerful hour of real estate dialogue, reflection, and analysis.”

July 23, 2025 CrossCountry Mortgage: A Pulse Check On The Real Estate Market

“Scott Nadler of Cross Country Mortgage Interviews Jonathan Miller on the state of mortgage residential lending and its relationship with the performance of the housing market.”

Final Thoughts On Uncertainty And It’s Impact On Rates

The housing market is challenged by mortgage rates remaining stuck just below 7%. Although listing inventory is expanding, it remains inadequate in many markets. Mortgage rates have remained remarkably stable over the past three years, which has weakened the lock-in effect, where consumers are waiting for rates to drop. Tariff policy is inflationary by definition. Adding to the federal deficit is inflationary. Threatening to replace the Fed Chair is inflationary. Pushing for a 3% rate cut is inflationary. All those items combined significantly reduce the likelihood of mortgage rates falling substantially.

We’re stuck for a while.

The Actual Final Thought – Back in the 1980s, I remember providing appraisals in a Manhattan neighborhood full of crumbling buildings, vacant lots full of debris, and burned-out school buses on blocks. It is now a vibrant residential housing market, commonly referred to as Alphabet City. I wish I knew my A’s, B’s, C’s, and D’s back then! This clip speaks the truth.

[Podcast] What It Means With Jonathan Miller

The Technology And The Housing Hype Cycle episode is just a click away. The podcast feed can be found for all three platforms we use are here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Collateral Risk Network 2.0 Meeting August 6-7, 2025

My friend, colleague, and former director of the Appraisal Subcommittee, Jim Park, is bringing his talents to revitalize the Collateral Risk Network(CRN). For more information on CRN, please visit this link. He asked me to share this event announcement with my readers. The event is being held this summer in Washington, DC, at the NAHB HQ. I hope to attend, schedule permitting.

Did you miss the previous Housing Notes?

July 24, 2025

Why On Earth Would Someone Buy In A “Ground Lease” Building?

Image: WSJ

Housing Notes Reads

- Palm Beach’s Ultra-Luxury Market Is Simmering as Other Florida Markets Cool [Mansion Global]

- Where the wealthy are moving now [New York Post]

- Decoded: 5 things brokers can do to increase walk-in traffic

- Palm Beach real estate bustled 'with remarkable resilience,' Q2 sales reports show [Palm Beach Daily News]

- Scams and a Rent Spike Follow New York City’s New Broker Fee Law [New York Times]

Market Reports

- Elliman Report: Boca Raton Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Palm Beach Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: St Petersburg Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Delray Beach Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

- Elliman Report: Vero Beach Sales 2Q 2025 | Miller Samuel Real Estate Appraisers & Consultants

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)