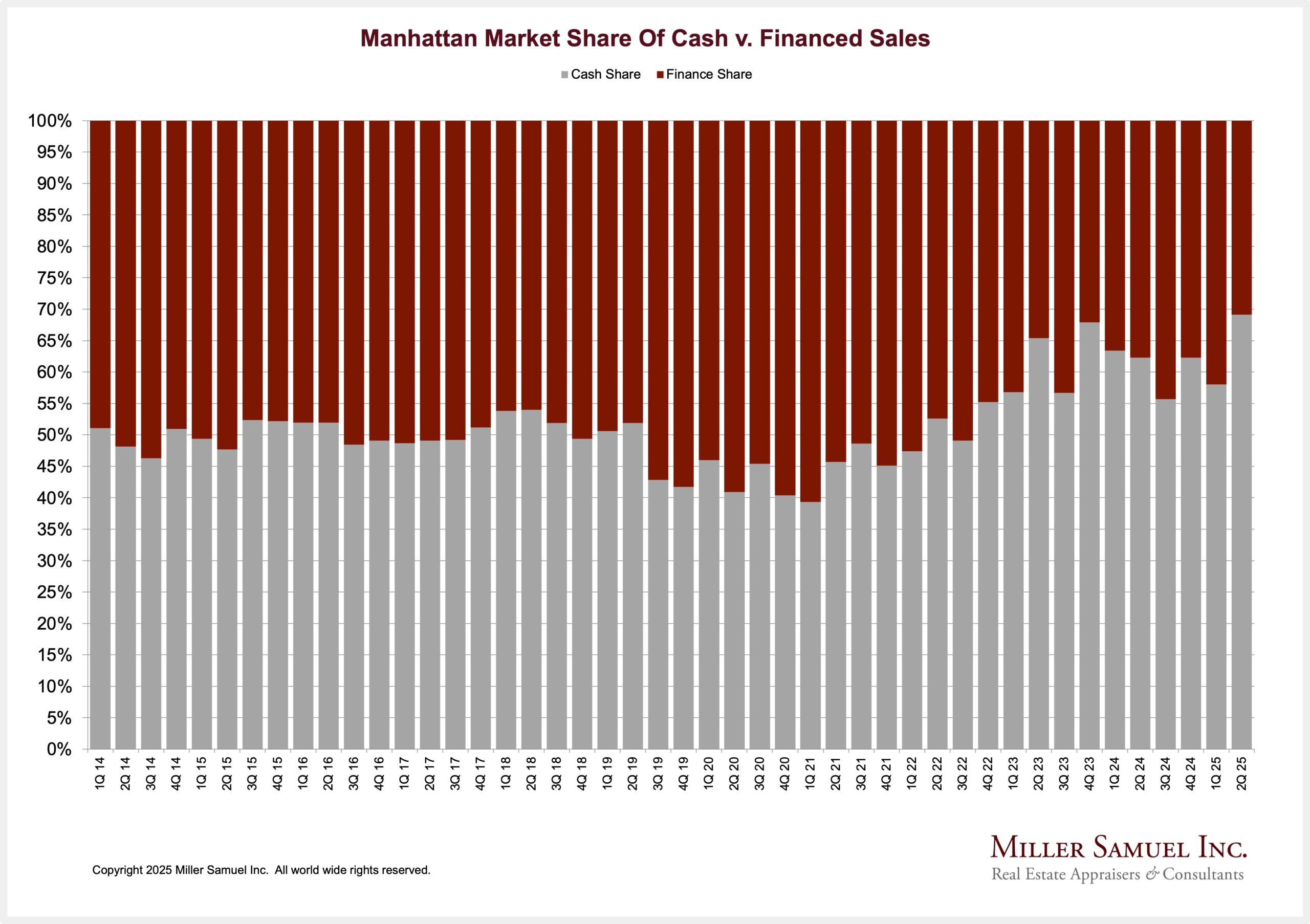

- Manhattan Cash Sales Surge To A Record 69.1% Market Share

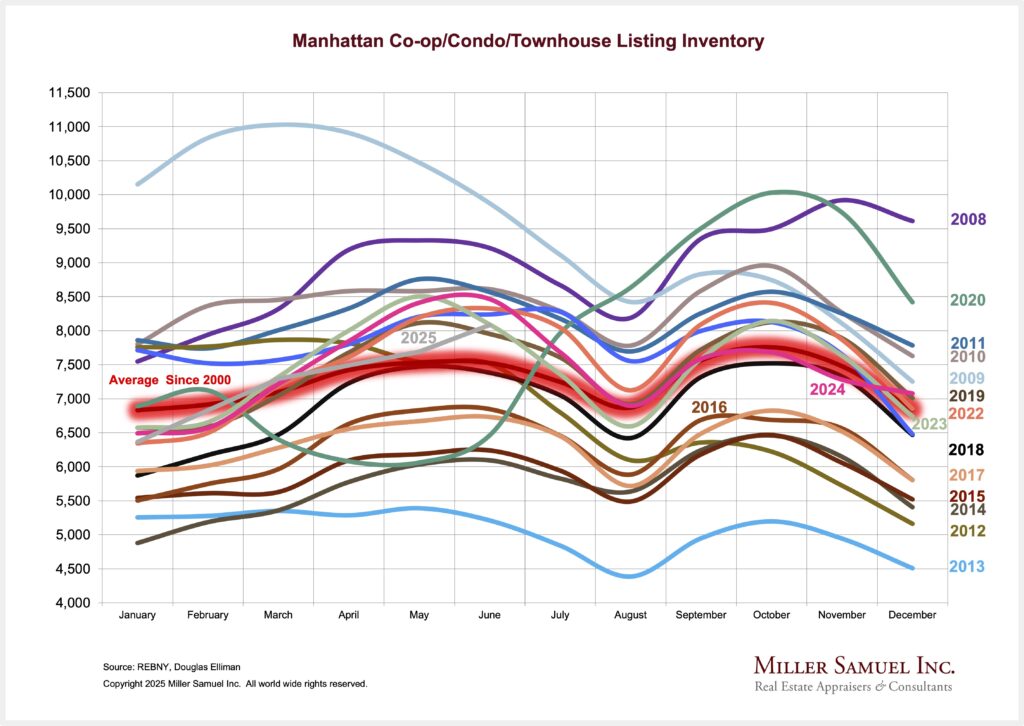

- Listing Inventory Saw Modest 3.1% Annual Gain As Luxury Fell 21.2%

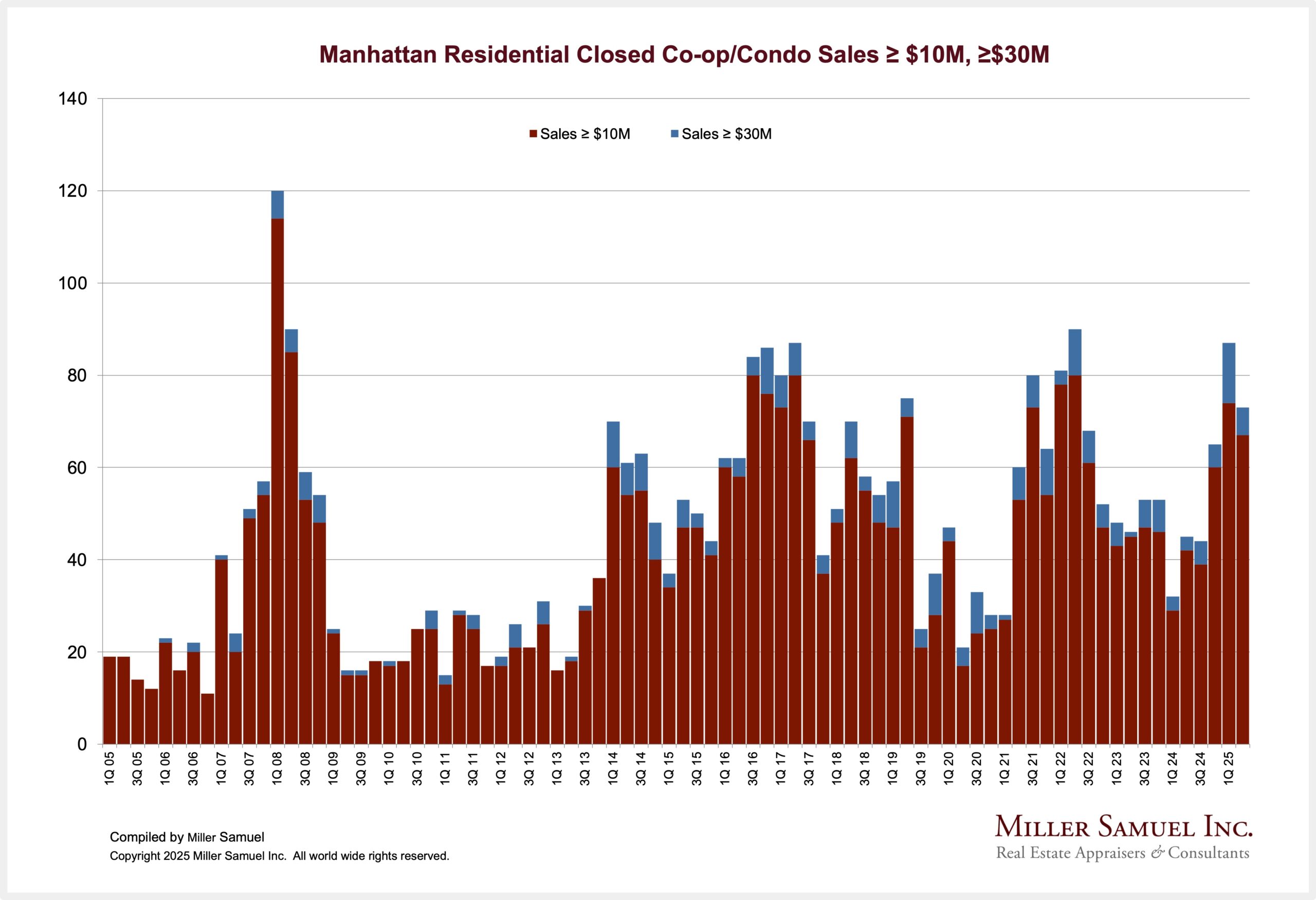

- Sales Jumped 16.6% Annually To Highest Level In Nearly Two Years

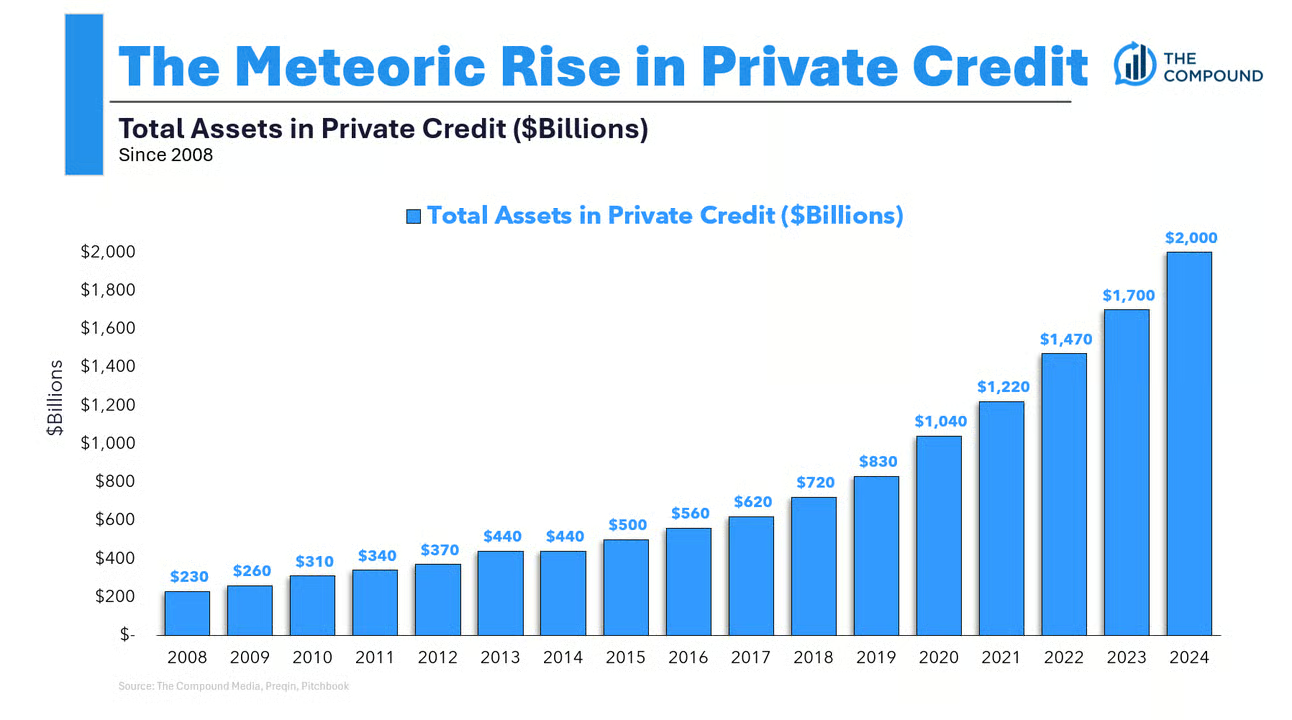

My headline is somewhat misleading. The Manhattan housing market had firm results for Q2 [gift link] in contrast with the on-the-ground sentiment of the real estate community. One thing I learned during the pandemic was that real estae agents tend to be more negative on the economy than home buyers and sellers because they are in the transactions business. The disconnect between hard and soft data is likely due to the fact that only about half of the sales contracts that closed in Q2 occurred before the Tariff Tantrums began in early April. The likely next Mayor of NYC [free link] wasn’t a widely known politician until very recently, when he called for a rent freeze on one million apartments. The market share of Manhattan cash buyers reached a new high of 69.1% as sales surged, likely aided by the robust but chaotic financial markets, a key source of alternative financing, as mortgage rates remain stuck just under 7%. In fact, the number of cash sales surged 23.1% annually while financed sales increased a more modest 5.3% over the same period.

Listing Inventory Is Incredibly Average

Supply is consistent with the long-term average, but admittedly, the listing inventory number is becoming less reliable because Compass, the largest firm in this market, is staking its future on private listings, which, by definition, are much less visible to market participants.

Mortgage Rates Seem Stuck

The Fed is hesitant to cut rates. With the robust jobs report numbers released today, any rate cuts are unlikely to translate into lower mortgage rates, but rather into more inflation. Mortgage rates have ticked nominally lower over the past five weeks on their own, but not enough to help the housing market significantly.

One of my favorite interpreters of the economy has been Kelly Evans at CNBC. I read her newsletter nearly every day, desperate for her clarity.

It’s clear after today’s jobs number that this is not an economy shedding jobs as if we were entering a recession, or anything like that. Not only did we just put up one of the best readings of the past year–adding 147,000 jobs last month–but the weekly filings of new jobless claims dropped as well, to historically low levels.

Kelly Evans, CNBC

The High-End Is Pulling Up More Sales

Cash buyers can more easily navigate the high mortgage rate environment, and they tend to be in higher property price strata. Manhattan had a median sales price of $1,200,000 in the second quarter, while the US median was $369,000, according to ATTOM. What was particularly unusual was that the sales jumped 16.6% year over year. I suspect that if mortgage rates had seen a meaningful decline, as was expected back in January, sales would have been a lot higher this spring. The surge in cash sales primarily created the sales jump.

Final Thoughts

Manhattan showed robust results despite all the adverse policy shocks the US has experienced over the past several months, many of which haven’t yet impacted the economy, including the new tax bill. NYC is likely to have a new mayor this year, and that brings yet another layer of uncertainty to the housing market.

All the economic uncertainty we face is fast becoming increasingly certain.

The Actual Final Thought – A good way to relate to the home Jeff Bezos is building.

[Podcast] What It Means With Jonathan Miller

The latest episode [Oh, Canada] is just a click away on the prior link or the image below. The podcast feed can be found below for the three platforms we use:

Apple (Douglas Elliman feed) Soundcloud Youtube

[CRE] Lessons Learned: 5 Years After The Pandemic

I’m looking forward to participating in this one – it should be a great discussion, especially with Jonathan Schein as moderator.

Collateral Risk Network 2.0 Meeting August 6-7, 2025

My friend, colleague, and former director of the Appraisal Subcommittee, Jim Park, is bringing his talents to revitalize the Collateral Risk Network(CRN). For more information on CRN, please visit this link. He asked me to share this event announcement with my readers. The event is being held this summer in Washington, DC, at the NAHB HQ. I hope to attend, schedule permitting.

Did you miss the previous Housing Notes?

Housing Notes Reads

- The Relentless Ask [The Irrelevant Investor]

- ‘Unfiltered’: A ‘huge risk’ of litigation over private listings? [Real Estate News]

- Bubbling Up? What Consumer Expectations Reveal About U.S. Housing Market Exuberance [Federal Reserve Bank of Dallas]

- Compass sues Zillow, escalating private listings fight [Real Estate News]

- A Shrinking Housing Market Means Upheaval for Buyers [Barron's]

Market Reports

- Elliman Report: Manhattan Sales 2Q 2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 6-2025 [Miller Samuel]

- Elliman Report May 2025 Manhattan, Brooklyn and Queens Rentals [Douglas Elliman]

- Elliman Report: Florida New Signed Contracts 5-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)