- Tariffs Are Inflationary And Mass Implementation Will Cause Mortgage Rates To Rise

- 45% Of Americans Don’t Know What A Tariff Is

- The Typical Car Part Crosses The Border 7-8 Times

Apologies in advance for being too wonky today, but you’ll have plenty of time to read about tariffs all weekend. A while back, I wrote that from the perspective of a housing market economy hoping for lower mortgage rates in the near term, implementation of tariffs would be counterproductive. I never said that tariffs were terrible, just that they would probably help keep mortgage rates elevated. One of my particularly insightful readers responded that I was in danger of being political because tariffs were not inflationary based on the economic performance of 2016-2020. Shortly afterward, I was on a real estate panel and mentioned that widespread use of tariffs would reduce the odds of lower mortgage rates. A colleague on the panel that I respect excitedly exclaimed, “that’s a bunch of BS,” and recited a similar explanation for that same period. Yet, I frequently interact with many economists and Wall Streeters at many respected institutions, and I’ve never met one who thinks that big across-the-board tariffs are not inflationary in some way. Strategies are one thing. Inflation is another.

What Is A Tariff?

The Tax Foundation is a think tank that calls itself an “independent tax policy research organization” and has also been described as “business-friendly, conservative, and center-right.”

They define a Tariff as:

“Tariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters.“

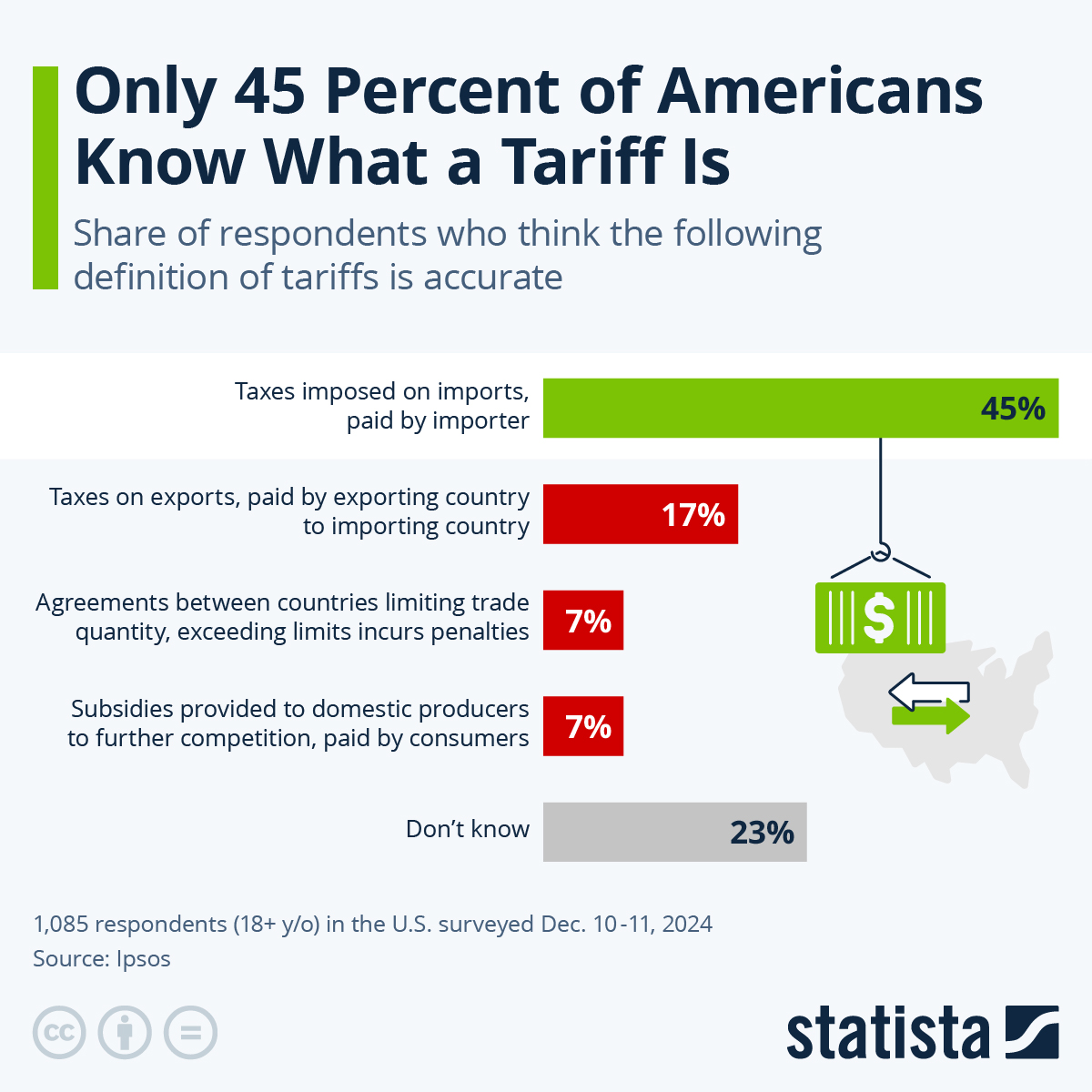

Only 45% Of Americans Understand What A Tariff Is

A key problem in setting economic policy is when the masses don’t understand that the policy can be against their best interests – such as creating inflation in a period already marked by a high cost of living.

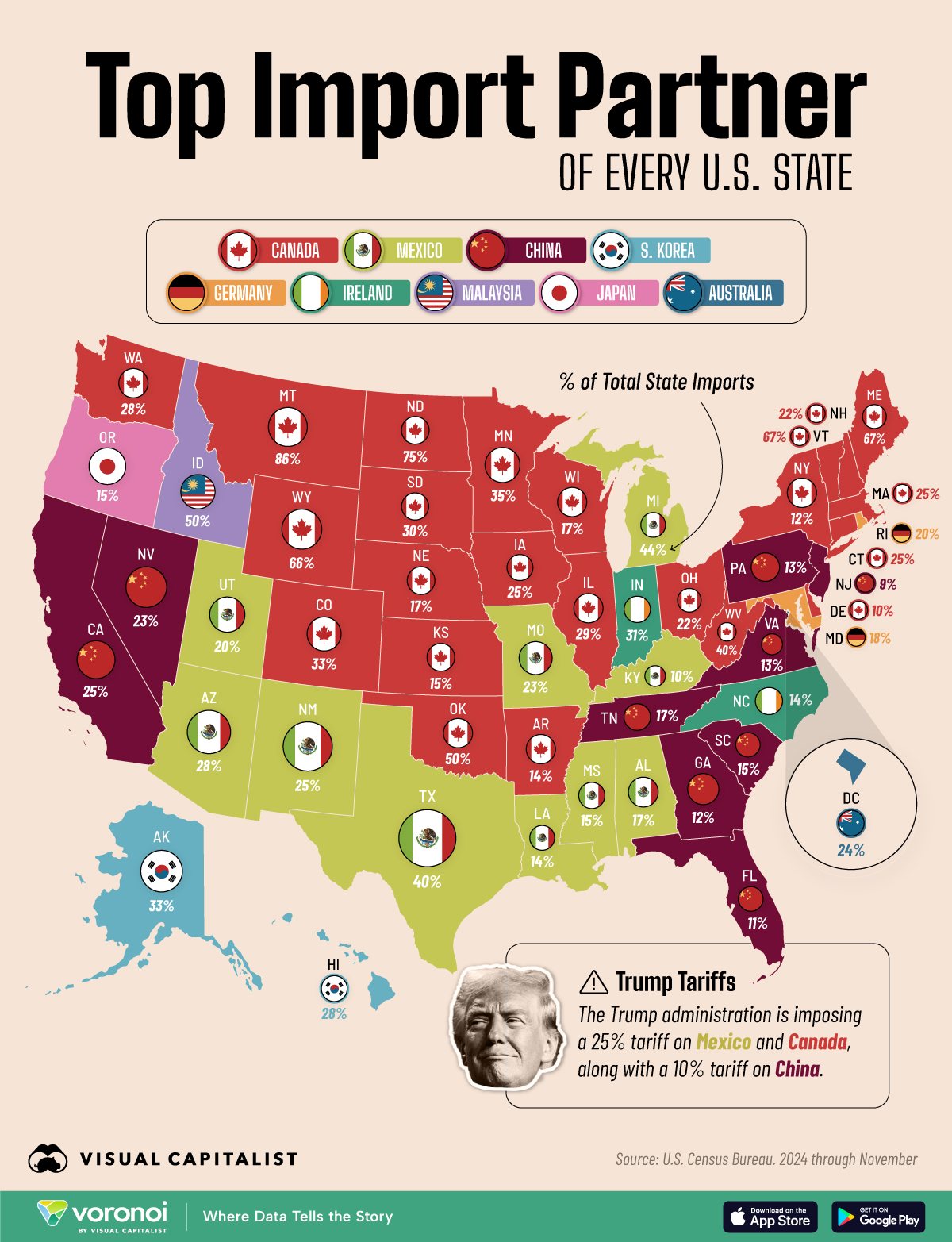

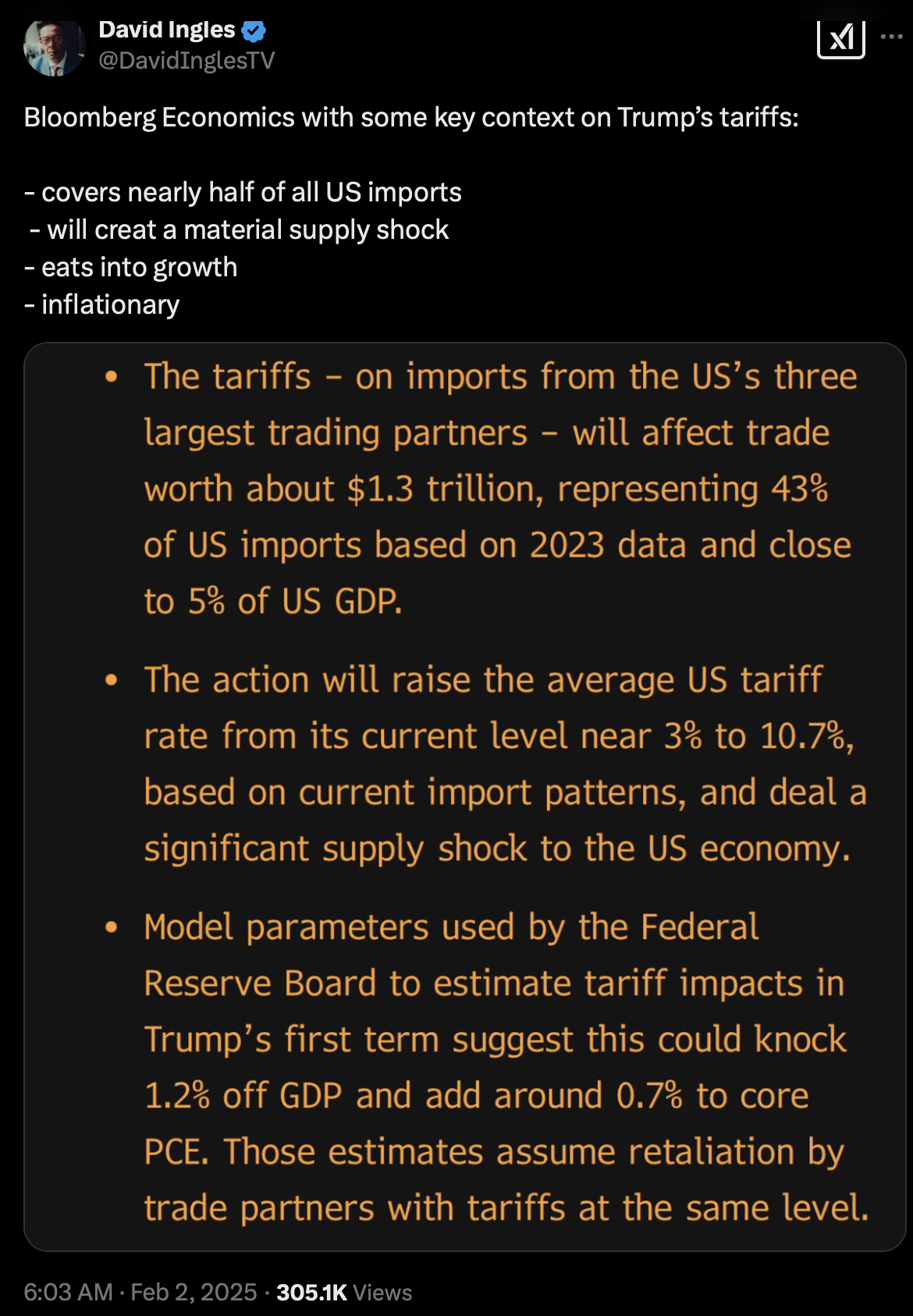

The Amount Of Proposed Tariffs Is Effectively On All Imports

The current administration plans to implement tariffs on ALL imports at varying amounts, even our closest trading partners, Canada and Mexico. I grew up thinking protectionism stunts economic growth. This amount dwarfs the previous tariff effort – what we saw in 2016-2020, so the impact on our economy is expected to be more significant. Visual Capitalist illustrates how massive the impact would be by state.

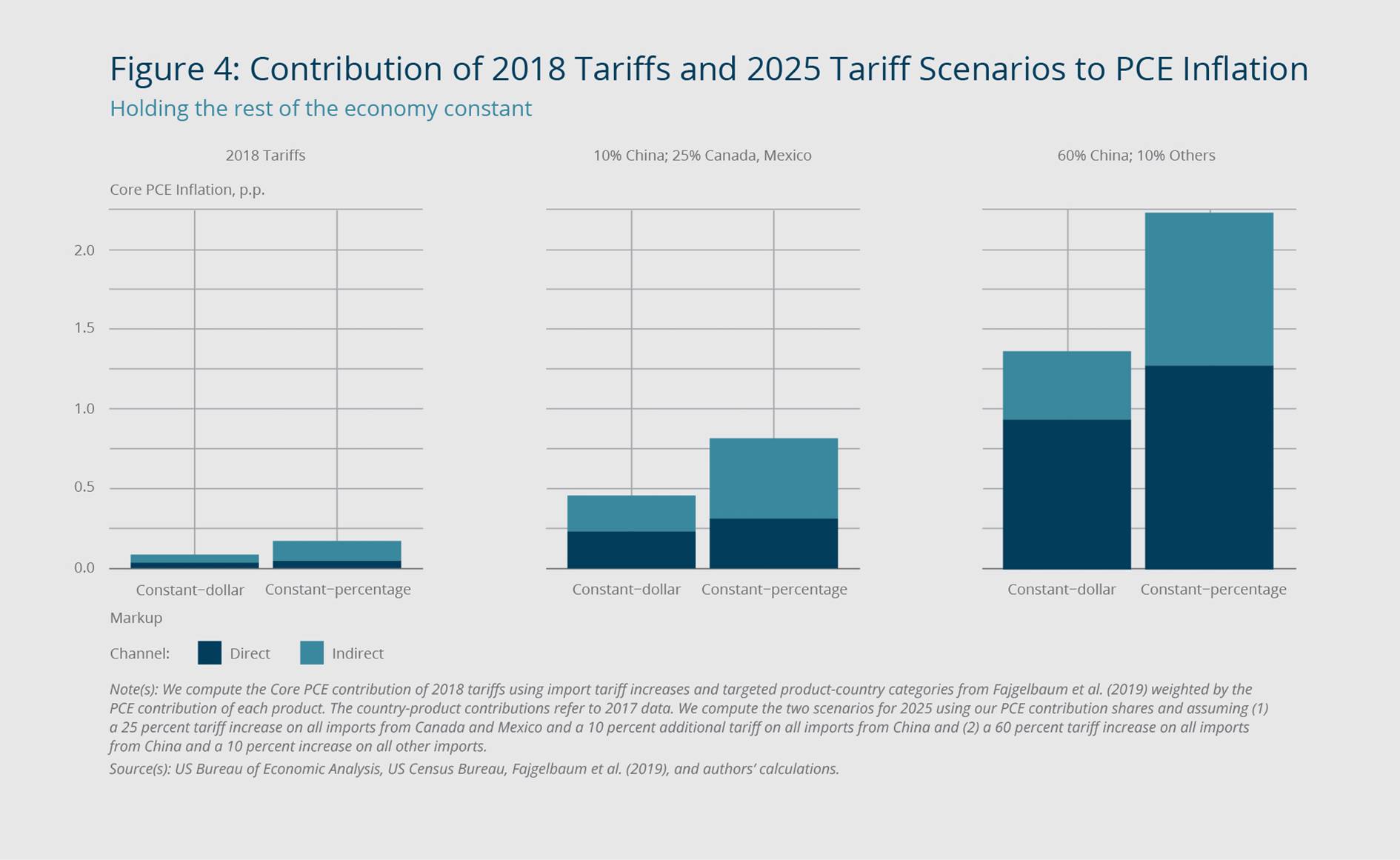

The Federal Reserve Projects Current Tariff Plans Will Increase Inflation

A Boston Fed study: The Impact of Tariffs on Inflation was published this week and found that:

“Turning to the 25 percent tariff on Canada and Mexico and 10 percent on China, we estimate an inflation impact of 0.5 to 0.8 percentage point, depending on the markup assumption. Under the more extreme scenario of a 60 percent tariff on China and a 10 percent tariff on the rest of the world, we estimate an inflation impact of 1.4 to 2.2 percentage points.”

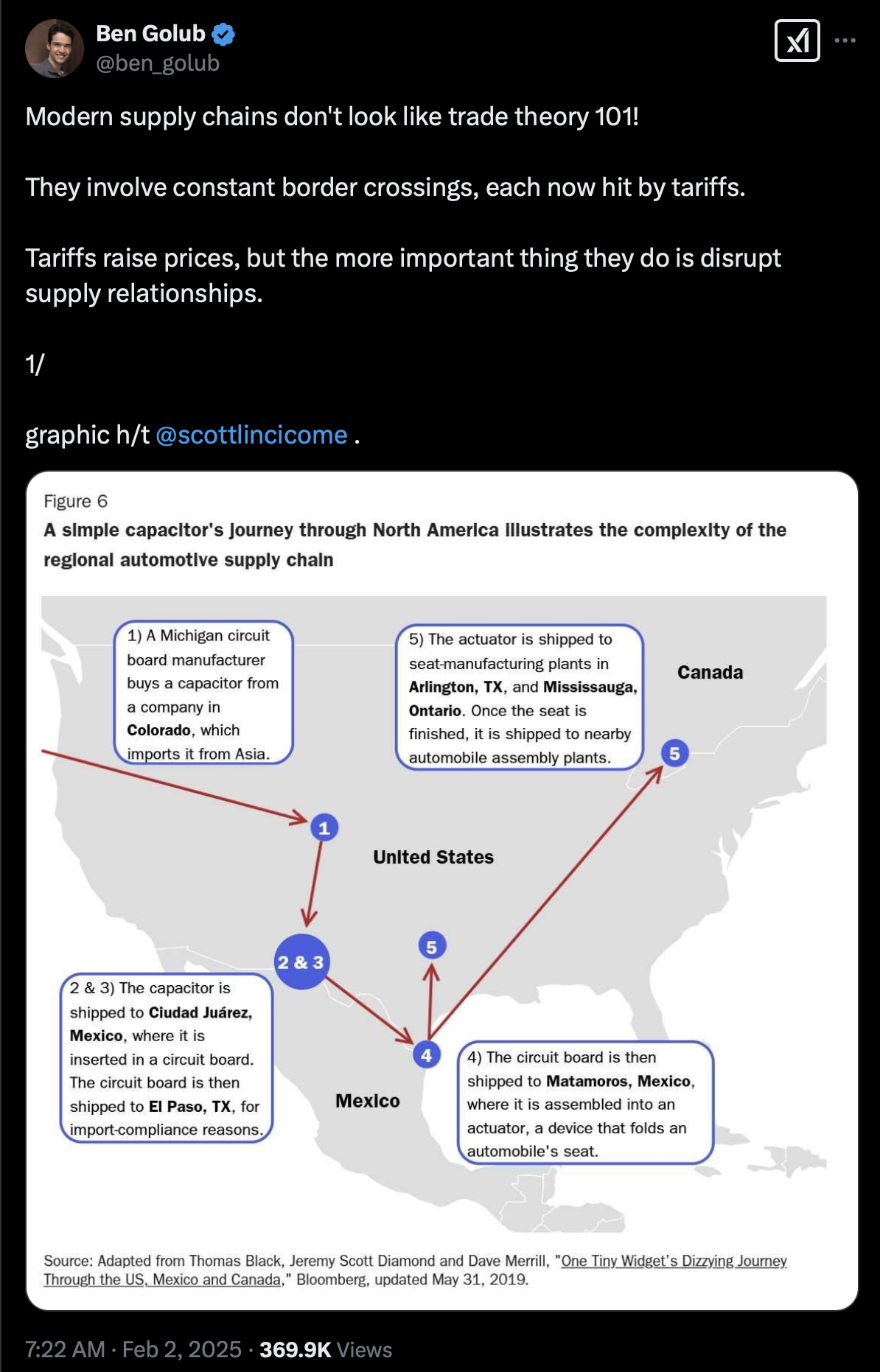

Car Parts Cross The Border 7-8 Times Before Assembly

There’s a good CBS news piece on this. The auto industry is alarmed about the potential cost of tariffs on their operations.

Each time a part crosses the U.S. border, it would incur a tariff. Here’s one example.

Trade With Canada And Mexico Is Not Just Cars

Housing supplies are a massive trade commodity with Canada. The cost of building homes will rise. That is an inflationary event.

The impact was quantified in USA Today:

“An analysis from John Burns Research and Consulting, which focuses on the housing industry, estimates the cost of a newly constructed home will increase by nearly 5% if the White House’s proposed tariffs are implemented. That’s about $21,000 on the median-priced new home.“

What Happens To The Economy

Wages are already super strong and employment remains very low. Adding inflationary pressure raises interest rates (a fact).

If Massive Tariffs Are Implemented, Its Time To Talk About Mortgage Rate Increases

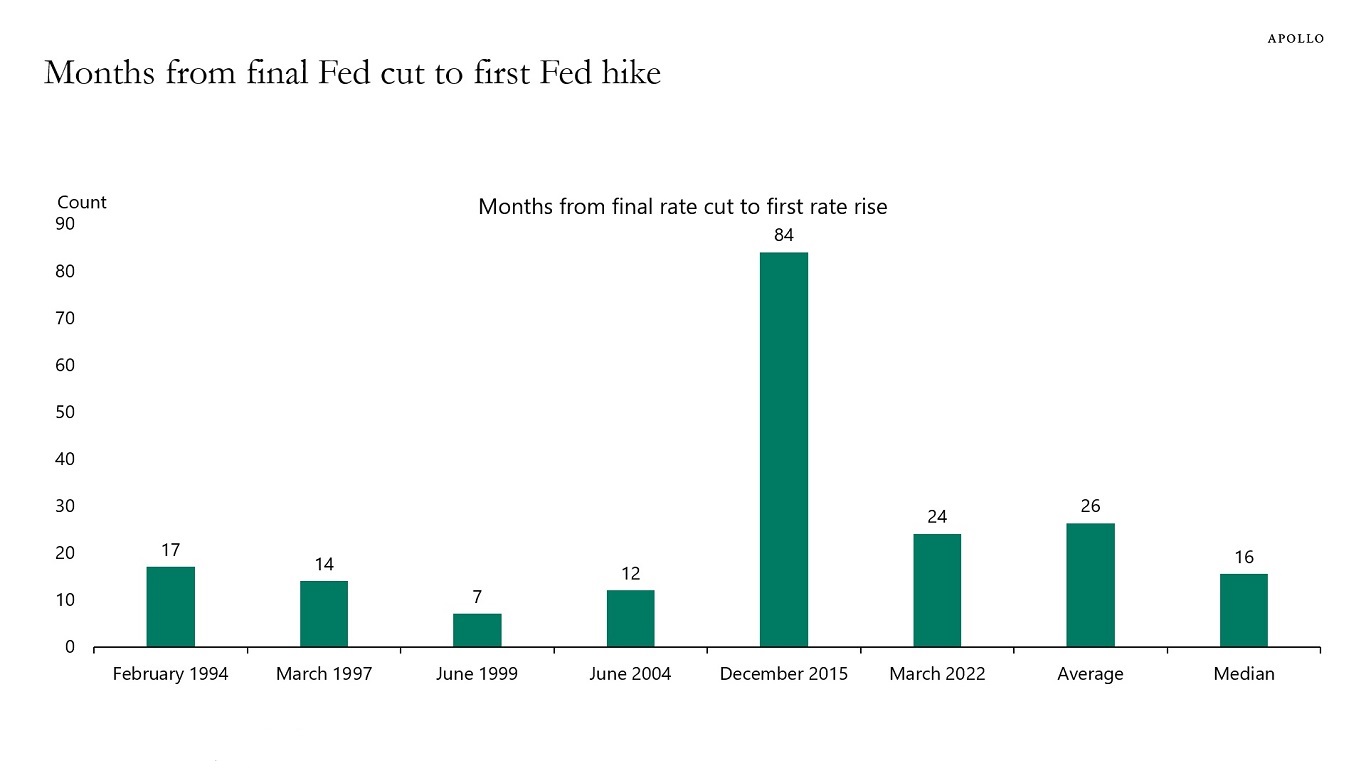

If the economy remains robust we could see rate cuts on June, according to Apollo. Why would we want to cause more inflation by implementing tariffs? It just raises the probability of higher mortgage rates (from the housing market perspective).

Final Thoughts

My friend, radio host, and prolific writer Barry pens (digitally!) a terrific piece on the Risks & Opportunities of The New Administration that touches on tariffs.

Incidentally, I didn’t get into the topic of “retalitory tariffs” which is what usually happens when the U.S. levies a tariff. The country that is the target of the tariff usually issues a tariff in response. The continued back and forth can escalate into a trade war.

Sorry about the length of this post. I never anticipated writing about tariffs in a newsletter about the housing market, but here we are. My only intent was to tamp down the false optimism that mortgage rates will fall sharply this year since the primary economic vehicle (tariffs) is inflationary. In all the research I’ve shared, admittedly, I am surprised the potential impact wasn’t more severe. Anecdotally, one of my sons works for a company that imports a ton of stuff from China, and they have been stockpiling materials for months in anticipation of the tariffs and its respective surge in their costs. For the very few people who thought I was “political” for suggesting that tariffs were inflationary, it looks like you have it backward.

If you’re still confused about the issue, you need to watch this entire 10:19 minute clip to clear your thoughts.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Months from Final Rate Cut to First Rate Hike [Apollo Academy]

- What to make of the jobs report. [CNBC]

- The Impact of Tariffs on Inflation [Federal Reserve Bank of Boston]

- Only 45% Of Americans Know What A Tariff Is [Statista]

- Are Realtors Having an Existential Crisis? [Freakonomics]

- Automakers say Trump tariffs on Canada and Mexico will cause U.S. car prices to rise [CBS News]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)