- Consumer Optimism About The Stock Market Is The Highest Ever Recorded

- Participants In The Stock Market Tend To Be More Affluent Overall

- Mortgage Rates Not Expected To Fall Sharply So Equity Withdrawals Are Favorable To Luxury Home Buyers

I’ve been appraising Manhattan properties since 1986, and it is natural for its residents to see the financial markets as a proxy for the local economy. After all, the securities industry represents roughly 23% of NYC’s wages and only 4% of its jobs. Of course, we all know that the stock market is not the economy.

Downtown Josh Brown, a prolific stock market analyst at Ritholtz Wealth Management, cites a piece by a member of his team, Optimistic Callie: All that really matters.

Josh writes on LinkedIn:

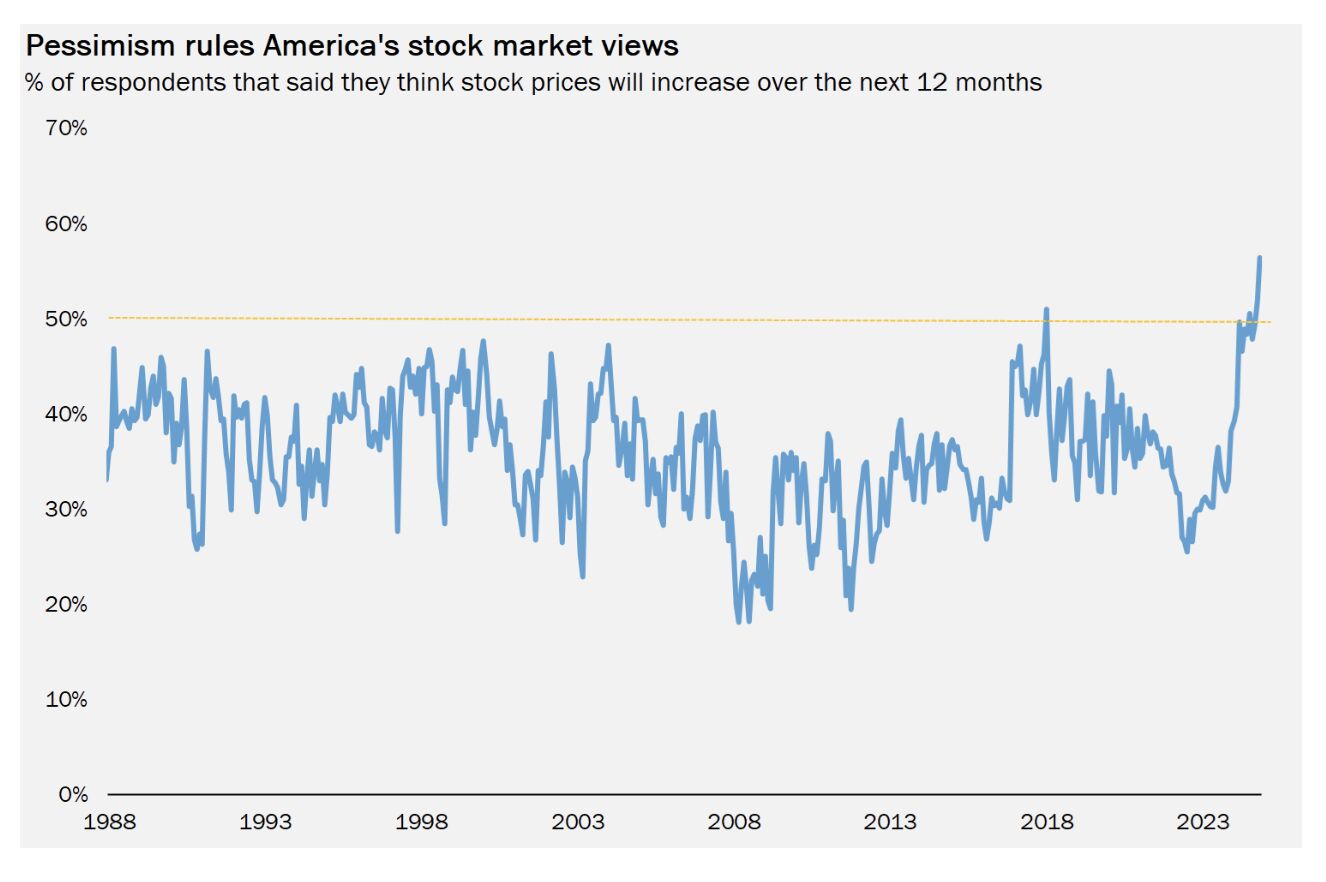

An absolutely INSANE stat from Callie Cox‘s final note of the year – the American public hasn’t been this bullish on stocks since, well, literally never in our lifetimes. Back to 1987, an average of 65% of respondents told the Conference Board’s monthly consumer survey they thought the market would drop. For about 43,000 Dow Jones points and counting.

The Conference Board consumer survey chart below tells us that we have been in the most optimistic stock market since the mid-1980s when the survey began (when I moved to Manhattan from Chicago).

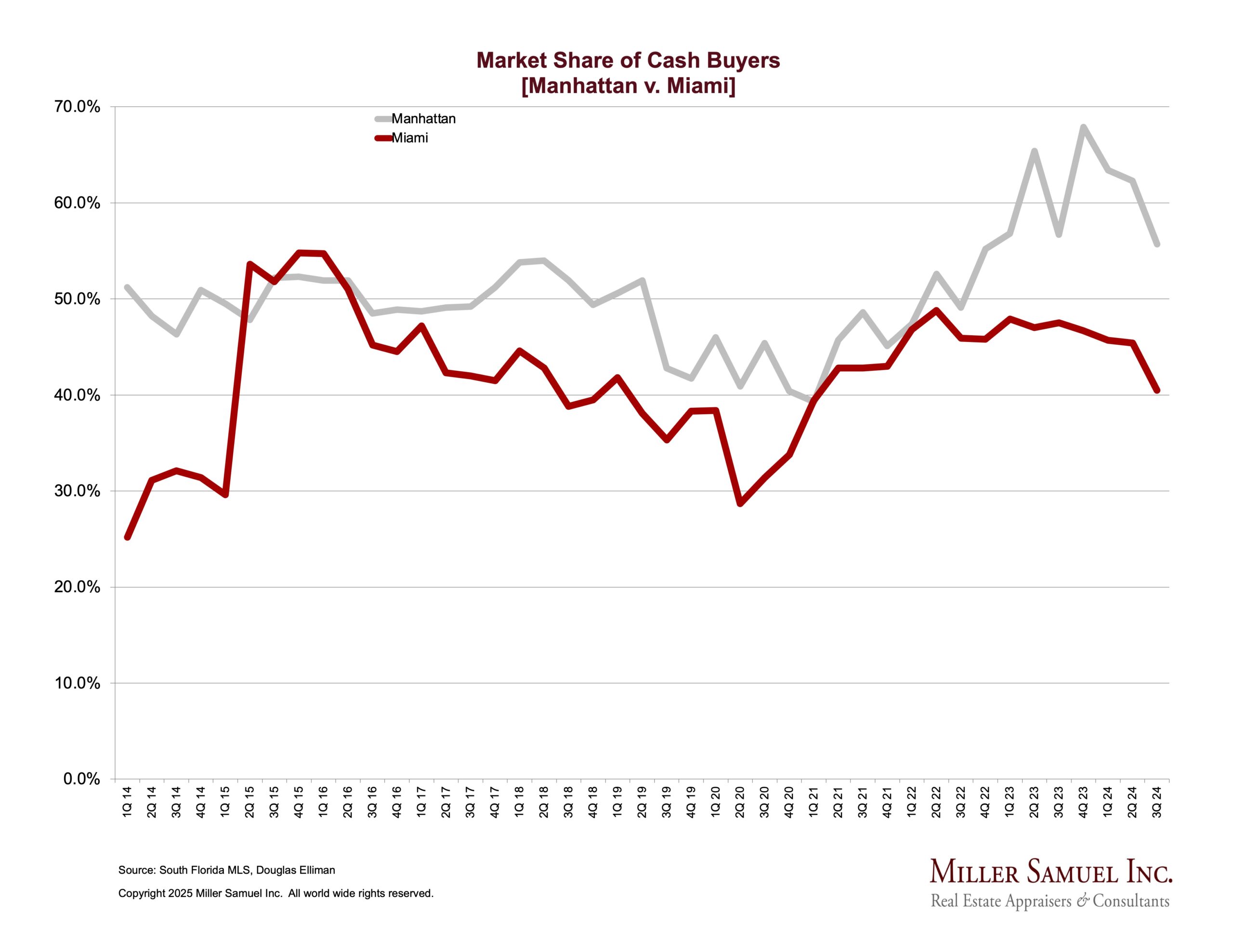

I have noted here in Housing Notes many times that luxury homebuyers care about mortgage rates but are more interested in the performance of the financial markets. This perspective is one of the key reasons we’ve seen above-normal levels of cash purchases over the past few years. Equity drawdowns from the financial markets are a vehicle for down payments and cash purchases that are less likely to be made by lower-wage earners.

From there, it’s only a hop, a skip, and a jump (I love that there is a dictionary entry for this phrase) to see greater optimism toward the high-end housing market that would wash off from the financial market outlook.

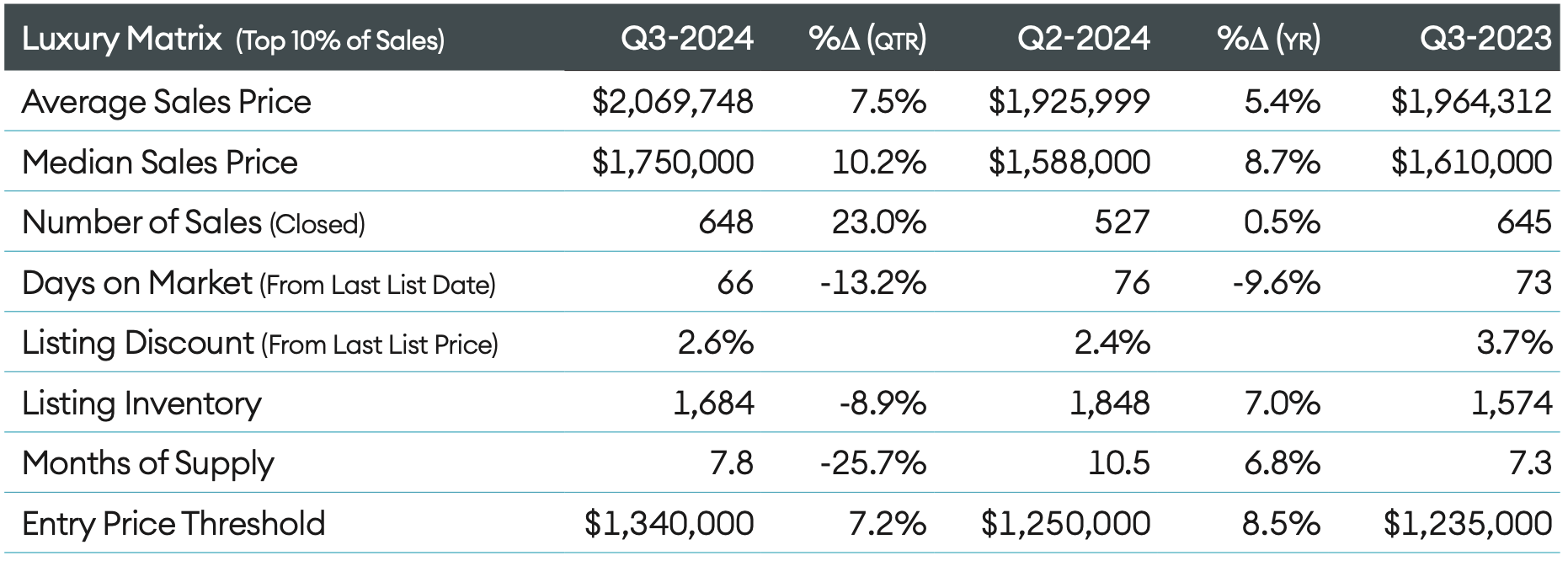

Defining Luxury In Market Analysis

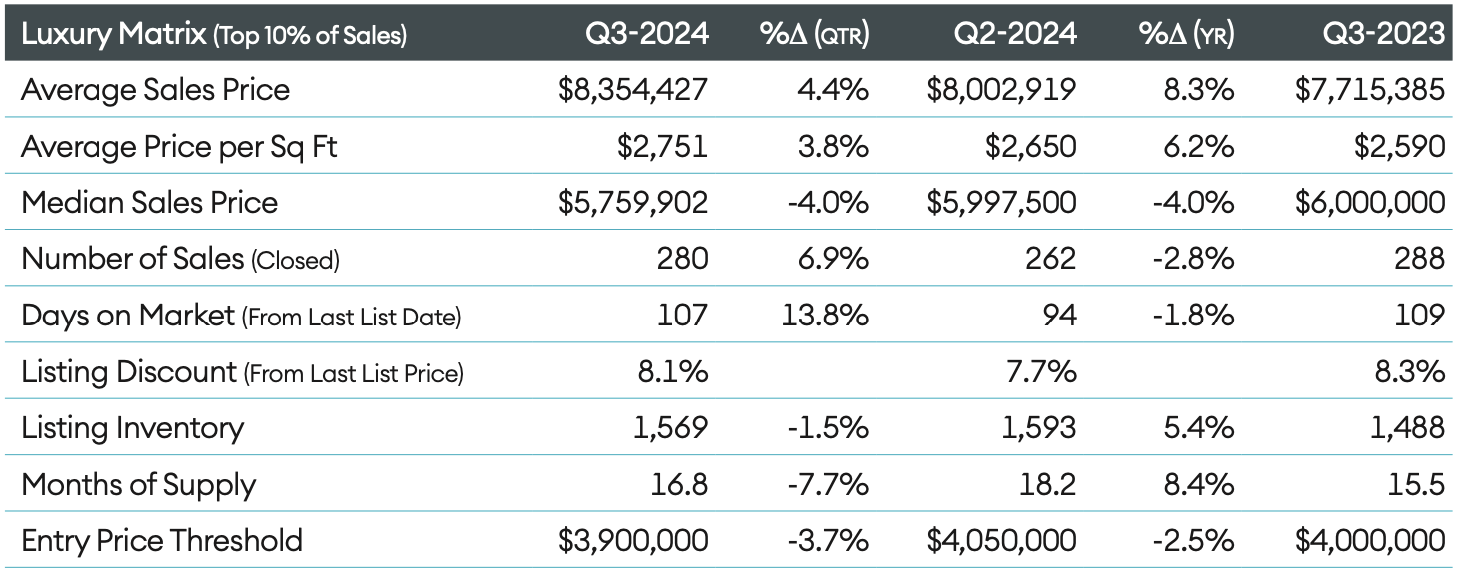

Since 1994, I’ve been writing public-facing housing market reports, beginning with Manhattan. Although marketing professionals tend to define “luxury” in a qualitative way, I’m much more pragmatic and stick to a quantitative methodology by defining “luxury” as the top 10% of any given market. I see luxury housing markets as relational to the remainder of the market, not a universal number. Of course, I also see super luxury markets (above $50 million) as completely disconnected from the local housing market.

For example, in Q3-2024, Manhattan’s entry threshold for the top ten percent of closings was $3,900,000. This represents the lowest-priced sale in the top ten percent of all sales during the reporting period.

In Q3-2024 Long Island (excluding the East End), the entry threshold for the luxury market was $1,340,000.

Annual Manhattan Records By Property Type

What I’ve always loved about this chart is the fact that I get to say every year (since 2019) how I had to move our company logo to the right to fit Ken Griffin’s 2019 $238 million condo sale. While co-ops dominate the overall market they can no longer be counted on to have the highest-priced sales of the year like they were when we started our appraisal firm in 1986.

Final Thoughts About The 2025 U.S. Luxury Housing Market

I covered these points above:

- Expectations of robust financial markets that skew to the more affluent consumers who are less focused on mortgage rates and have the wherewithal to sidestep them

- Cash buyer market share is expected to remain elevated due to large equity drawdowns enabled by stronger financial markets

Here are some additional thoughts about 2025:

- Mortgage rates are expected to slip but remain elevated, having less impact on higher-priced home buyers than starter home buyers

- Housing prices are not expected to fall given restraints on supply, which is more problematic for lower-income home buyers

- Existing inventory is still below normal levels, while new construction is expected to see more significant gains and tends to skew higher in price

- Listing inventory is growing faster in the Sun Belt, but in many of those markets, supply still remains at half of pre-pandemic levels

Epilogue – Seatbelt Shaming Was A Thing

It’s going to be a wild ride in 2025, so it’s a good idea to buckle up – specifically while sitting in the back seat.

In 2008, just before the financial crisis, I multi-tasked as the spokesman for a now-defunct Wall Street startup that was designed to take on the home price indices known as Case Shiller (now owned by S&P). The goal was to be able to hedge the housing market, the world’s largest asset class. The Case Shiller methodology relied on repeat sales indices, which proved to be far too delayed to trade options at scale and could be gamed by the likes of Zillow. Case Shiller and our effort never caught on.

However, during this Wall Street adventure, I remember being seatbelt-shamed in the back seat of town cars by the senior executives of our startup. Apparently, it was a Wall Street thing not to wear seat belts in the back seat. I was reminded of this every time we stepped into a car. I’m not sure if this belief still exists, but I still go through mental jujitsu every time I get in the back seat of a cab or an Uber. Make it stop!

Did you miss the previous Housing Notes?

Housing Notes Reads

- 🎁 All that really matters [OptimistiCallie]

- What a second Trump presidency could mean for NYC buyers and sellers [Brick Underground]

- Zillow's price estimates are screwing up homebuying [Business Insider]

Market Reports

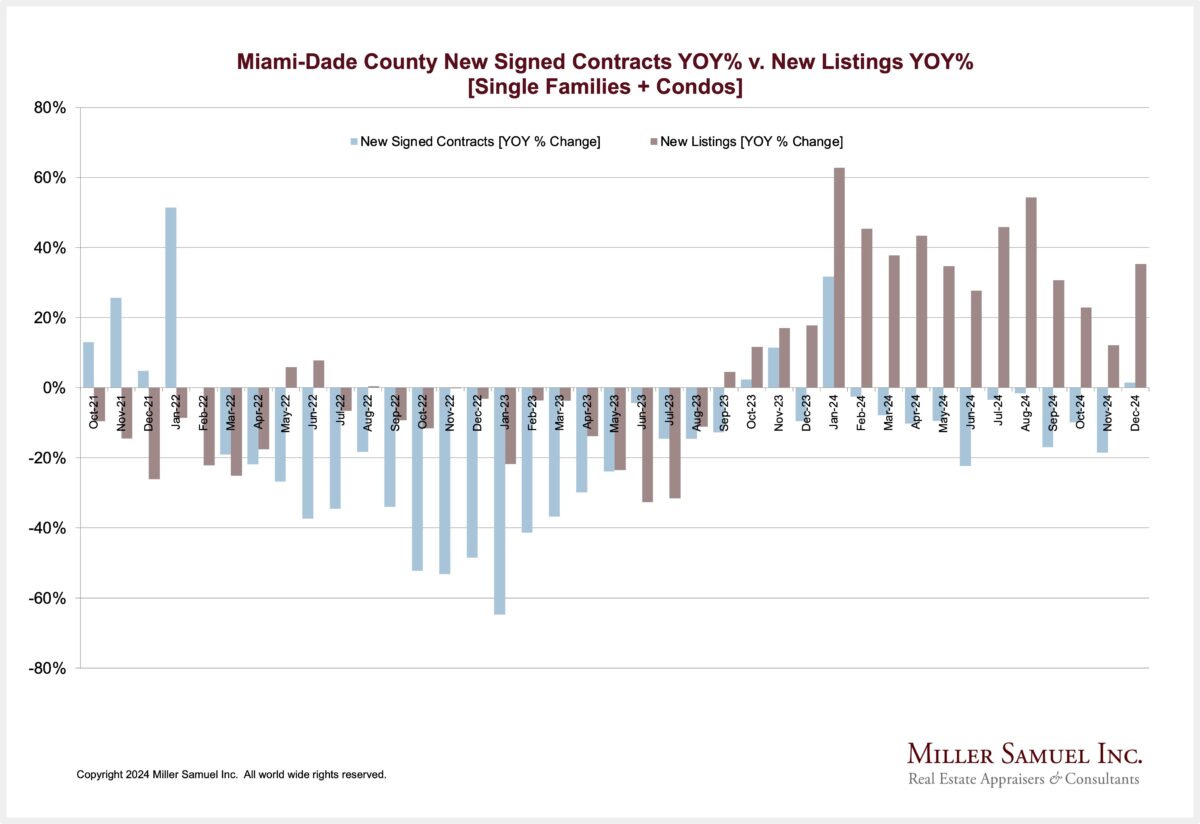

- Elliman Report: Florida New Signed Contracts 11-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 11-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2024 [Miller Samuel]