- Two Decades Worth Of Sales Show A Softening During An Election Year

- The Decline In Election Year Sales Is Subtle, Not Dramatic

- 23% Of Consumers Will Delay Their Home Purchases Until After The Election

For most of my career, the idea that sales slow during an election year seemed to be a certainty. However, an election’s impact was often exaggerated with proclamations in the real estate brokerage community, such as “sales completely die during an election year.” They don’t, but based on our research, sales do slow modestly during an “even” year. Why? Because a federal election adds a layer of uncertainty to the lives of potential homebuyers. It doesn’t seem to matter who the party or the candidate is. It just comes down to an additional piece of information to process by consumers. What do consumers do when they face uncertainty? Pause.

My Experience As An Elected Public Official

I held public office about twenty-four years ago in my Connecticut hometown. I served for two years as a representative town member (RTM), a typical New England form of small-town government, and served on the public works committee. We met about seven times in the nine months the body was in session. Those midweek evening meetings lasted about three hours (with 45 minutes of actual content), and I attended other meetings, including various committees and with the first selectman (the mayor). I initially got into our town government because Avalon Communities, the apartment REIT, wanted to develop the last piece of open land left in my town. My town held aspirations to build a park. The REIT seemed to specialize in going into small suburban towns as the heavy and were doing the same thing simultaneously in a handful of other nearby towns. They filmed all our public hearings and sued anyone who spoke against their development plans. The strong-arming and financial risk was quite disheartening as a volunteer. From those meetings, I learned how the sausage was made. Still, at the time, I was also running two companies, started a local Cub Scout pack with 94 families, and had four sons under twelve years old at home with all their extra-curricular activities beyond school. This was the year of the “hanging chad” Bush-Gore federal election. On election day, my wife got me a copy of the election slate used in the voting booths at Town Hall that had Bush, Gore, and my name on it! However, most of my constituents seemed to be focused on filling the small number of potholes around town; I kid you not, even though the town had a 20-year re-paving cycle. I greatly admire those who eagerly donate their time to local government, but progress in local government tends to be made at a glacial pace, and two years was enough for me. After 9/11, a year later, my wife and I pulled back from many of our too many public commitments and re-focused more time at home.

Applying Housing Data To Election Year Behavior

I provided a few decades of my research for an analysis of election year sales levels to the New York Times for a couple of super cool articles:

- I Can’t Buy a House. I Can’t Shop. I’m Too Worried About the Election. [gift link]

- How Elections Affect Our Shopping [gift link]

I focused on residential sales going back a few decades and came up with the following patterns.

“The Pivot Point” described by the New York Times:

“The dip isn’t dramatic, but it is consistent. In even years, sales fell by 5.5 percent in Los Angeles, 2.5 percent in Manhattan and 2.6 percent in Miami. In odd years, sales rose by 4.6 percent in Los Angeles, 8.5 percent in Manhattan and 10.2 percent in Miami. The pattern was not restricted to Democratic strongholds, either — it held in Suffolk County, N. Y., which typically votes for Republican candidates.”

The general pattern that was revealed showed the year before the federal presidential election or midterms (even years), sales slow and then are released the year after the election (odd years). I initially did this analysis with Manhattan co-ops because I could go back quite far, given my data collection here. When the New York Times approached me, I had to pick U.S. markets where I had the deepest data set, and most are limited to about two decades. The years 2004-2006 are when many MLS systems changed technologies and didn’t import past data series into their online systems.

A Federal Election Impacts Consumption Timing

The consumer pause is seen in other consumer goods industries as consumers don’t like uncertainty:

“When people feel they’re on unstable ground, they retreat and hoard resources. In the modern era, those resources are usually cash. “It’s not like people don’t know they’re going to need a house, they’re going to need a car,” said Kelly Goldsmith, a marketing professor and behavioral scientist at Vanderbilt University who studies the psychology of uncertainty and scarcity.”

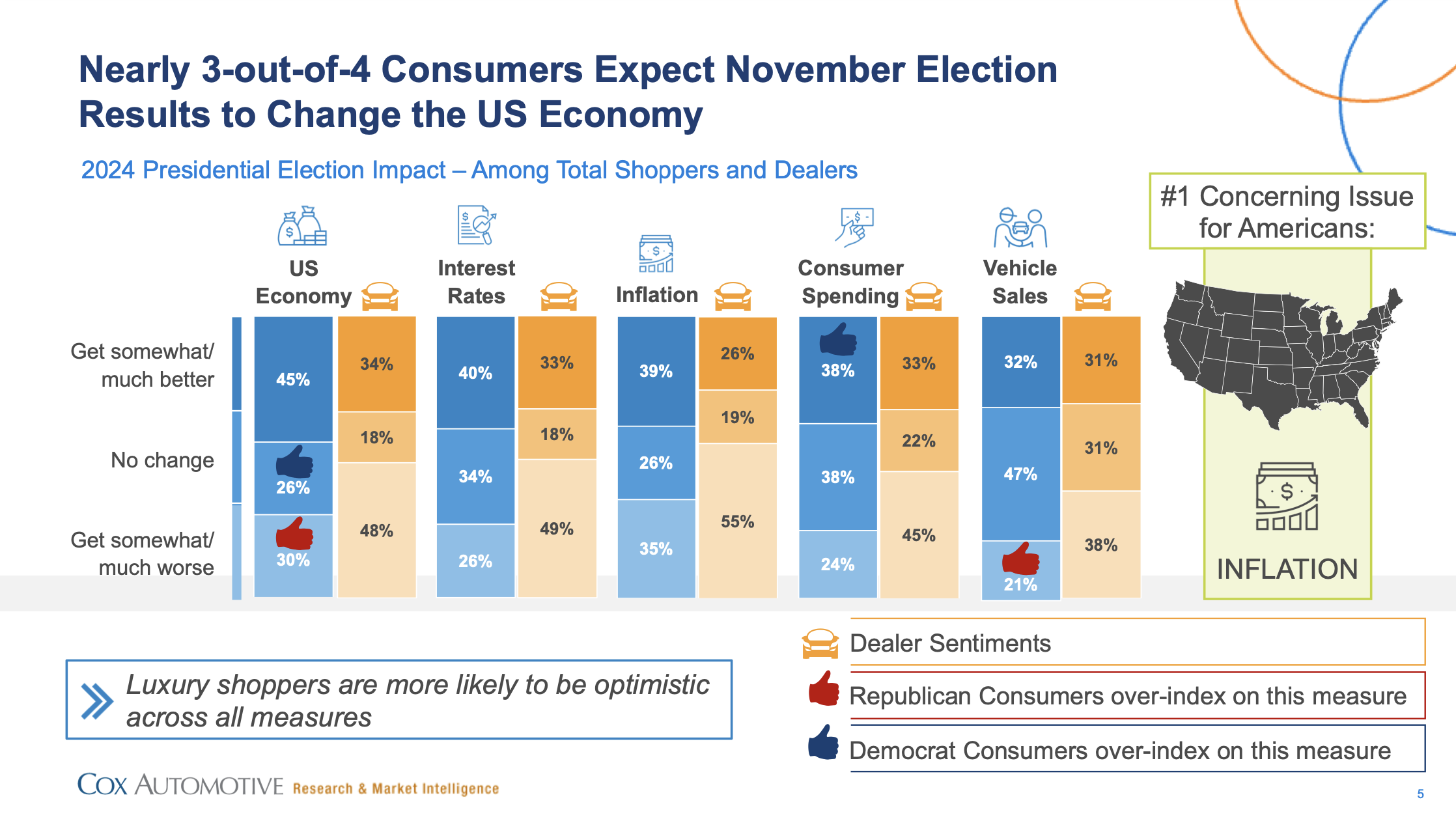

Amazon sees hesitation since the election is occupying consumer minds. QVC and Home Shopping Network see election-year pullbacks, as do auto sales. Here is an excellent consumer election research by Cox Automotive. Interestingly, they indicate that luxury shoppers are more optimistic across all issues. However, credit card usage towards bigger ticket items is on the downswing, as are fall wedding bookings.

Final Thoughts

The consumer makes a lot of decisions before opting to buy perhaps the largest asset of their lives. Election years tend to slow sales as they relate to non-election years. A recent Redfin survey indicated that 23% of homebuyers were delaying their purchase until after the election. For those markets seeing sales begin to rise, I contend that those markets would have seen more significant sales gains if this was a non-election year.

And this.

Monday Mailboxes, Etc.

October 18, 2024, Climate Risk As An Amenity

- Very interesting. Wildly inaccurate may be too kind a description of Zillow. I’d trust gas station sushi before a Zestimate of a home’s value.

Did you miss Friday’s Housing Notes?

Housing Notes Reads

- How Elections Affect Our Shopping [NY Times]

- I Can’t Buy a House. I Can’t Shop. I’m Too Worried About the Election. [NY Times]

- Slowed but Steady, South Florida’s Luxury-Home Market Is Still a Magnet for Wealthy Buyers [Mansion Global]

- 2024 Q3 Foreclosure Report: NYC Has Slowest Quarter Since Q4 2022 [Property Shark]

- Expert Tips on How to Navigate DC’s Weird Real Estate Market [Washingtonian]

- Jerome Powell has accidentally jammed the property market—especially for the ultra-rich [Yahoo Finance]

- 😲 Leaping Listings! [Highest & Best]

Market Reports

- Elliman Report: St. Petersburg Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Miami Beach + Barrier Islands Sales 3Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Boca Raton 3Q 2024 [Miller Samuel]

- Elliman Report: Brooklyn Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 9-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 9-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 9-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 3Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 8-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)