- By 2022, San Fran’s Millenium Tower Sunk 18 Inches And Tilted By 28 Inches.

- The $100 Million Fix Was Completed, And The Building Appears To Have Stabilized.

- The SF Chronicle Incorrectly Blames 45% Drop Of A Millennium Sale On Overall Market.

The developers of the 2009 Millennium Tower, a 60-story residential condominium in San Francisco, reported to authorities in 2015 that it was sinking and tilting. The details vary depending on the source, but they are still shocking. By the time the public found out about it in 2016, it had already sunk 16 inches and tilted by 6 inches. Two years later, it had sunk by 18 inches and tilted by 14 inches, and by 2022, the tilt was 28 inches as measured from the top. After a $100 million fix completed in 2023, the building had “un-tilted by 1 inch” and is expected to lean back further towards the center.

Literally A ‘Grand’ Marketing Strategy

The first 25 floors of the luxury residential building were marketed as “residences,” and the top 26 floors were marketed as “grand residences.” The 13th and 44th floors were excluded from the numbering plan due to superstitions I have written about before. When I thought about this arbitrary luxury marketing, I harken back to when all four of our sons were very young, and we were at the local Dodge dealership ready to sign the papers on a new “taupe” Dodge Grand Caravan. We had been looking at Caravans and Grand Caravans, and the difference between the two types was about 14 inches of rear storage versus none for an additional $1,000. A perfect dad joke was born. I enthusiastically told the salesman that it was apparent Dodge came up with the name “Grand Caravan” because the minivans cost a “grand” more with the extra space. Sadly, the salesman didn’t get my brilliant joke, so I let it go. By the way, that minivan was terrific for our young family, even with all the fruit punch stains.

But I digress…

Back in 2016, there was a lot of media coverage of its 5,500-square-foot penthouse sale for $13 million, which came furnished and included some art pieces. The decor was really wild. An old Curbed SF article I just found reminded me of how much I missed the old days of Curbed SF with headlines like this (wait for it): Millennium Tower sellers cut prices, or vanish entirely: The writing is on the wall, and the wall is an inch shorter. When Curbed SF was active, they loved my Matrix blog, calling it “Completely Keanu Reeves-free real estate economics, not for beginners.” Ha. In 2023, the penthouse came back on the market for $14,000,000 “Cash.” I assume the “cash” reference is because mortgages for the 419 units in the building aren’t available due to the tilt-a-whirl legacy of the condo building. The $14 million penthouse listing was removed this past July after 14 months and supposedly no offers. When the penthouse was last sold in 2016, I remember half-heartedly thinking about the building sinking and tilting so much the penthouse might eventually become a garden unit on the ground floor.

And the condo owners keep incurring additional costs to repair the building. I’ve been following the relentless coverage by this NBC Bay Area TV Reporter, Jaxon Van Derbeken, since he began in 2016, on the status of the building’s safety. Notice this 2021 report about Ron Hamburger’s explanation of the status of the building’s sewage using terms like slope, clogs and plugging (Hamburger? Sorry, but its been a long day). This building has been an endless source of good reading material despite the hardship experienced by the unit owners.

Housing Market Weakness Versus Building Market Weakness

The recent San Francisco Chronicle article: A Millennium Tower condo lost 45% value in a decade. Has downtown S.F. real estate bottomed out? The piece seemed to conflate two market phenomenons: the overall real estate market and the sinking and tilting of the Millennium Tower. The article focuses on a condo unit that sold for just over $1 million in 2014 and now for $615,000 for a 45% drop in value. The article seems to suggest that the San Francisco market fell 45% without factoring in a building that had to be stabilized with eighteen, 250-foot pilings to stop the sinking and tilting that has occurred since the condo was purchased in 2014. The piece cites a two-bedroom listing priced just over $1 million in 2022 that just sold for $800,000 as if the $1 million ask reflected the impact of the tilt and sink of the building.

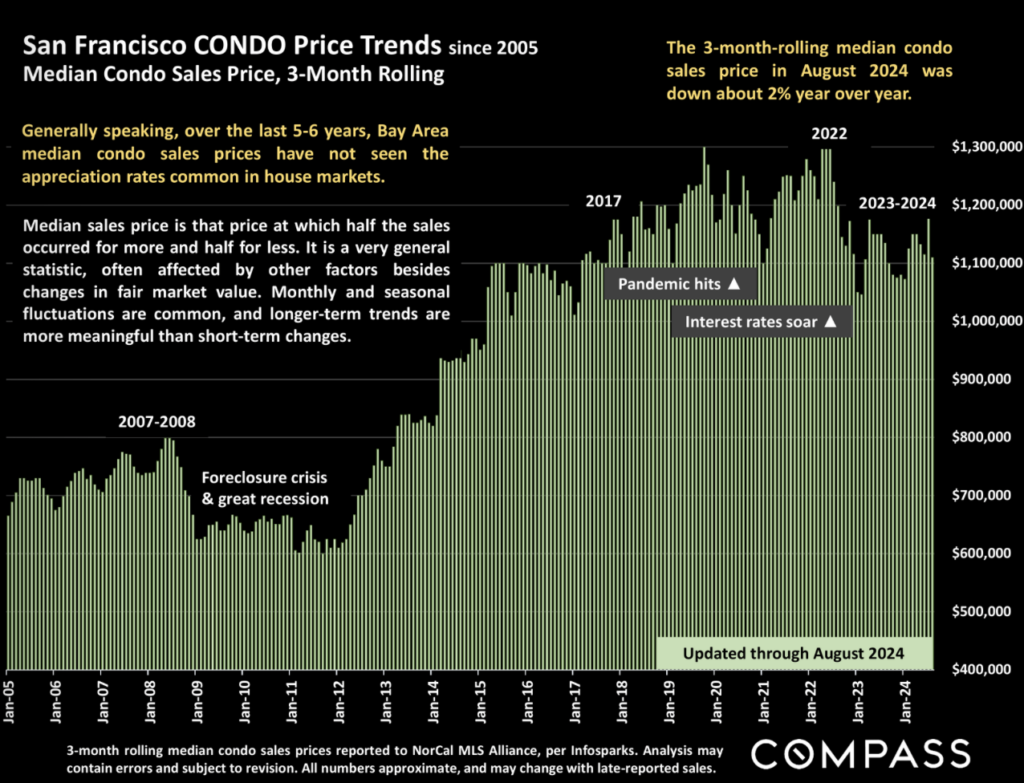

It’s doubly weird that there is no reference to price trends in the local market outside the building, but the reader is left with a feeling the market is in dire condition, with prices down by nearly half? The piece references Work From Home (WFH) as an opposing force in urban residential real estate when studies have shown that WFH has actually pushed prices higher. In fact, in markets I cover, like Southern California, Florida, and New York Metro, housing prices have been stable or increasing since the pandemic, even with rising mortgage rates. A cursory look at the data suggests that San Francisco condo price trends have been up significantly since 2014 but are slightly below pre-pandemic levels.

Critical Thinking On The Messaging Of Local Housing Conditions

The SF Chronicle piece conflated two market conditions – the overall market and the woes of Millennium Tower – leaving the reader with the impression that San Francisco’s housing prices have plummeted over the decade, yet they haven’t. When a luxury condo tower sinks by 18 inches and tilts by 28 inches, that, my friends, is the problem. Their recent $100 million fix appears to have stabilized the situation and potentially stabilized the damage to current pricing. However, I believe the pricing in the building has been reset to a lower level from the original pricing, regardless of whether the tilt becomes fully “un-tilted.” The “sink and tilt” are part of the building’s legacy story, and by market evidence, it still makes buyers uncomfortable. Let’s not explain the price drop away using WFH.

AN ASIDE

Urban Digs: Awakening from Market Hibernation with Jonathan Miller (click on image below).

ANOTHER ASIDE

My friend Phil Crawford of Voice of Appraisal informs as he entertains. He talks about the mysterious end of Cindy Chance’s presidency of the Appraisal Institute and the substantial loss for the industry (click on the image below).

Did you miss yesterday’s Housing Notes?

September 30, 2024

Having A Home Next To A Nuclear Power Plant May Become More Common

Image: ChatGPT

Housing Notes Reads

- 🛫 Hangar Games [Highest and Best]

- Remote work to blame for rise in housing prices [BLS]

- Awakening from Market Hibernation with Jonthan Miller [UrbanDigs]

- Voice of Appraisal E267 MELTDOWN? [VOA]

- Pace of Home Sales in San Francisco Drops [SocketSite™]

- WSJ News Exclusive | Penthouse Atop San Francisco’s Millennium Tower Asks $14 Million [Wall Street Journal]

- Millennium Tower breaks record, nets $13 million for penthouse [Curbed SF 2016)

- Millennium Tower (San Francisco) [Wikipedia]

- A Millennium Tower condo lost 45% value in a decade. Has downtown S.F. real estate bottomed out? [SF Chronicle]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)