- NYC Crime Rates Haven’t Fully Returned To Pre-Pandemic Levels But Are Lower Than Much Of The U.S.

- One-Third Of NYC Price Appreciation Due To Drop In Crime

- You Can Still Buy Strawberries At 3 AM In Manhattan

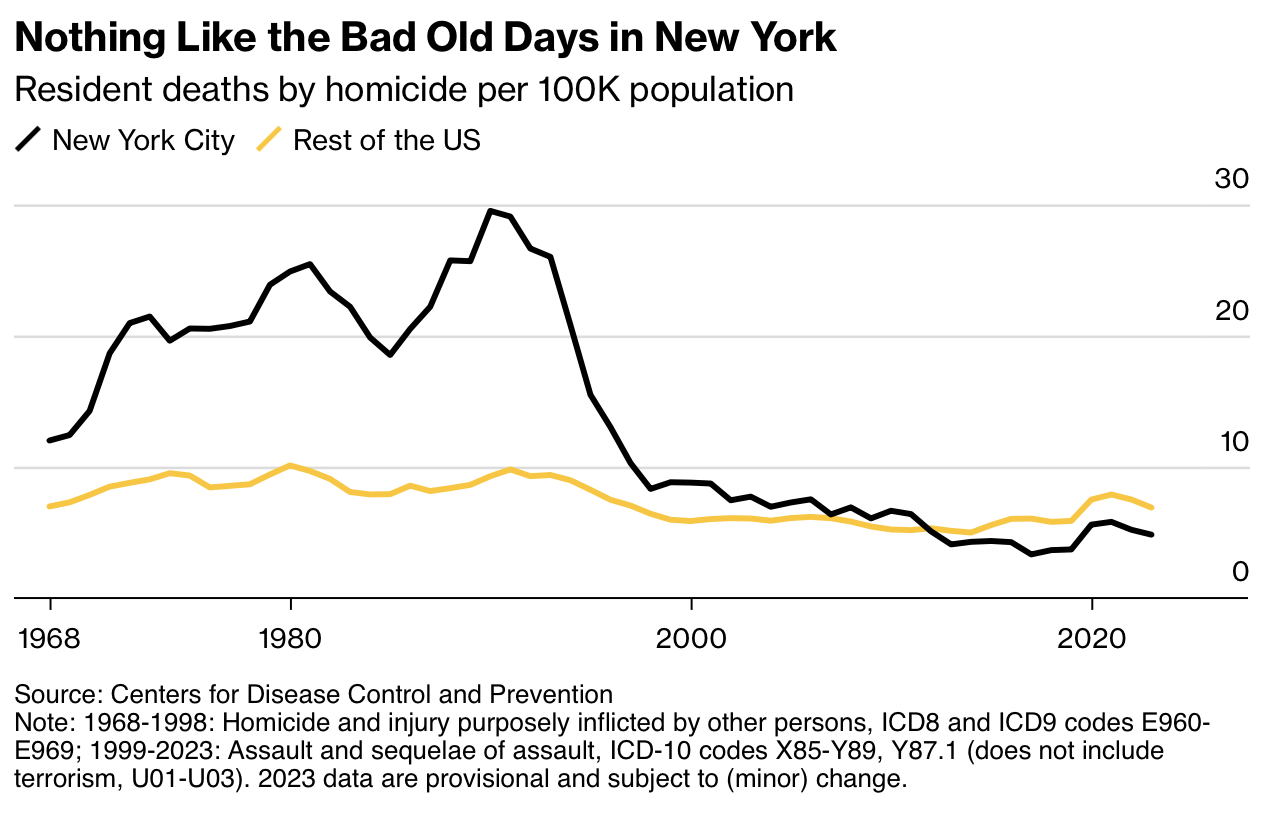

I’ve lived or worked in New York City since 1985 when my wife and I moved here from Chicagoland. The violent crime rate at the time was one of the highest on record, but for the first time in my life, I could buy strawberries at 3 am (my Dad always told me that was a key benefit of city living). Safety has significantly improved since then, and so have housing prices, but violent crime is not quite back to pre-pandemic lows. But NYC is now a lot safer than much of the U.S.

A few years ago, I was walking down Fifth Avenue across from the famous public library at 42nd Street and was texting with a relative in the Midwest. It was a crisp, sunny morning with couples pushing baby strollers, commuters walking to their offices, and tourists strolling while craning their necks upward at the tall buildings. The streets and sidewalks were clean while bustling with cabs, buses, and delivery trucks. But the person I was messaging with was sitting on a couch in a suburb glued to cable news, telling me not to walk around the city without a gun on both hips.

The above view was literally my view of the library as I debated NYC’s safety with someone who had not been here in 40 years. If I had to criticize the accuracy of the above Wiki photo, I would say it was a lot sunnier on that particular day. Our appraisers travel all over the city every day without incident. I’m making the point because I worry that the onslaught of misinformation about NYC has the potential to damage the housing market. Today reminds me of the relentless stories about violent crime and the tourist victims back in the 1980s when we first arrived here.

Back then, parts of the city were very much like the 1981 Paul Newman movie Fort Apache, The Bronx, which, at the time, I found hard to believe its authenticity as a college student in the Midwest. But when we moved here, it was actually a reasonable depiction. The following Bloomberg chart is taken from the article Why Is New York City So Safe? Apparently, my wife and I moved here at “peak crime” in the mid-80s but somehow survived. I can attest that today, a NYC resident does not need to wear a gun on both hips and in fact, violent crime is lower than in the remainder of the U.S.

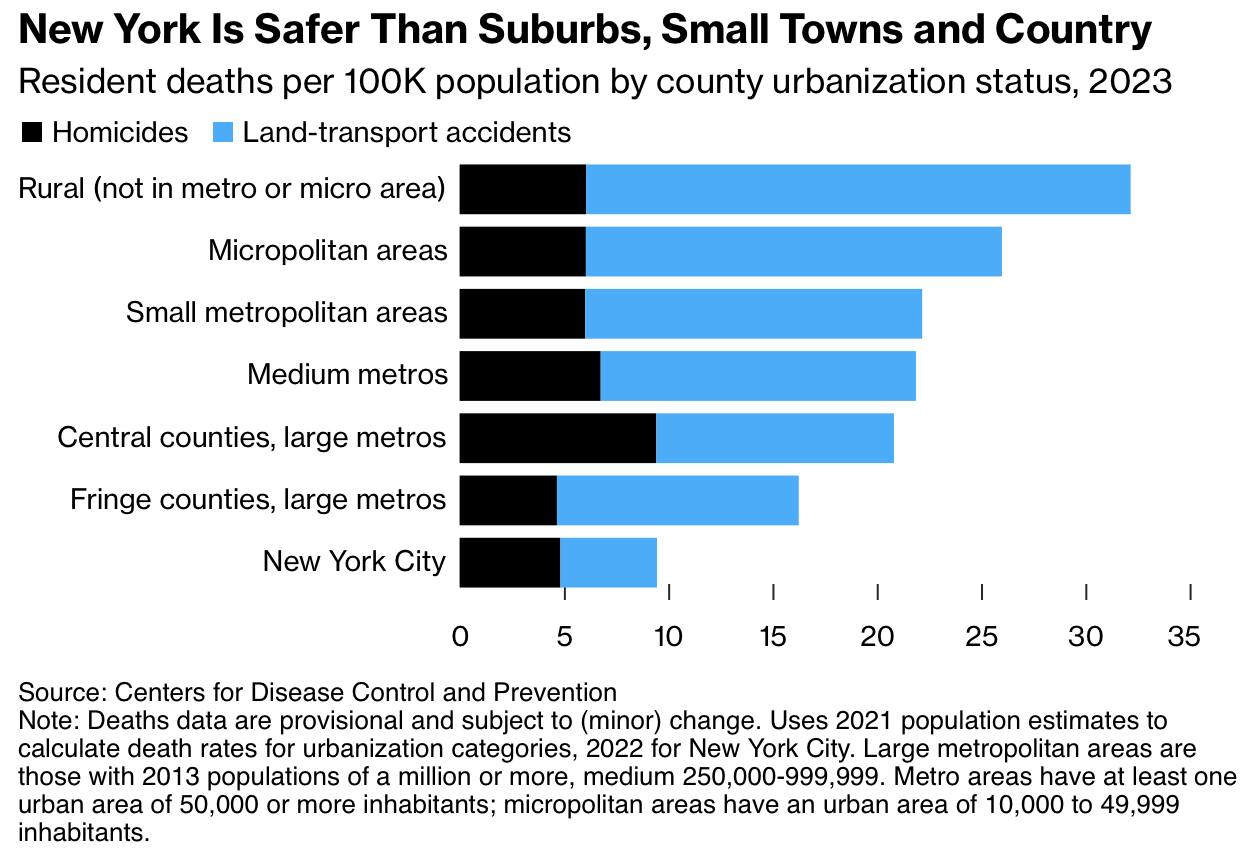

Parsing Out NYC Safety Comparisons

Tales of the city being dangerous aren’t matched by actual U.S. results, especially as compared to large and medium metro areas.

The Linkage Between Crime And Housing Prices

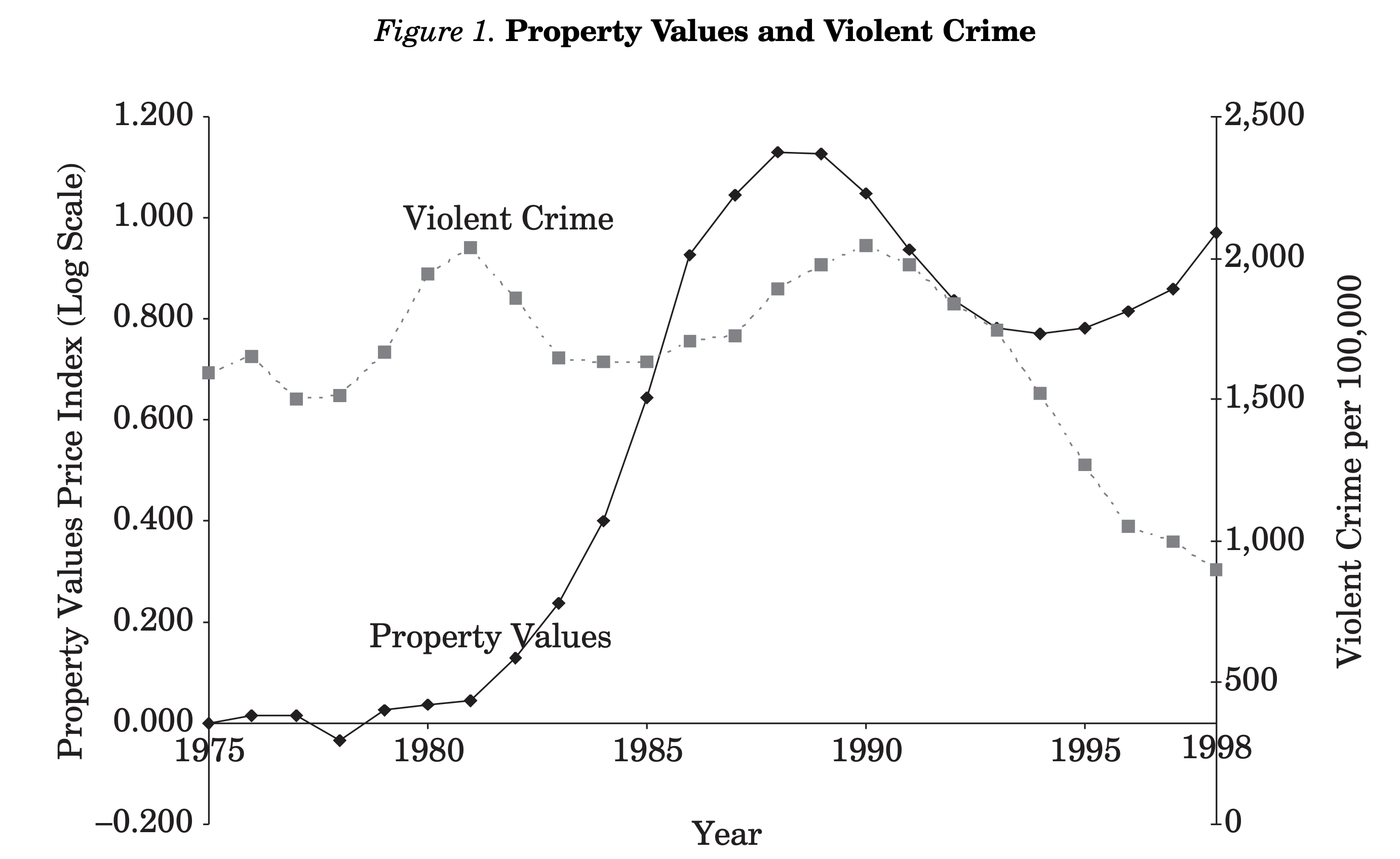

About 20 years ago, NYU Furman Center published a white paper on falling crime in NYC and its impact on housing prices. The turnaround was most substantial in both the city’s poorest and wealthiest areas, with only modest changes in middle-income areas. The study attributes one-third of price appreciation to the decline in violent crime, accounting for an 8% increase in housing prices.

A 2009 Florida State study on Crime and Housing Prices shows that a 10% increase in violent neighborhood crime reduces housing prices by as much as 6%. A quick online search shows reams of research on the negative impact of crime on housing prices.

Final Thoughts

The whole point of this piece was to bring to light the disconnect between actual on-the-ground conditions and the often inaccurate perception of those who live outside NYC. It’s a reminder of how markets change frequently and how empirical data rules the day.

Tomorrow, Wednesday, September 18, Is A Big Day

- 2 PM Rate Cut Decision – At the end of their two-day FOMC Meeting, The First Of Three 25-basis Point Rate Cuts for 2024 Is Expected. Although former NY Fed Chair Bill Dudley thinks a 50-basis-point cut is needed tomorrow. I find his commentary a little aggressive, but I’m not an economist, and I would prefer to see more significant cuts early on. About 250 basis points of cuts are projected through the end of 2025, then think about how much lower mortgage rates will be and how much higher sales will be as a result.

- 1 PM Roc360 Webcast goes live (see below). It goes live an hour before the Fed announcement, so you’ll be warmed up by then. I am looking forward to it!

Roc360 Webcast 9/18: Tackling Big Problems in Residential Real Estate with Jonathan Miller

Join Eric Abramovich, Brandon Dunn of Roc360, and Jonathan Miller of HousingNotes for an in-depth and insightful discussion on the ever-changing residential real estate market.

You can sign up here for the September 18th event.

Did you miss yesterday’s Housing Notes?

September 16, 2024

Image: ChatGPT

Housing Notes Reads

- Why Is New York City So Safe? [Bloomberg]

- Has Falling Crime Driven New York City’s Real Estate Boom? [Furman Center]