- The S&P 500 Outperforms Average Trading Days On Friday The 13th

- Wages Are Rising More Than Pre-pandemic And Mortgage Rates Are Falling

- FOMC Expectations Remain At Three Rate Cuts In 2024

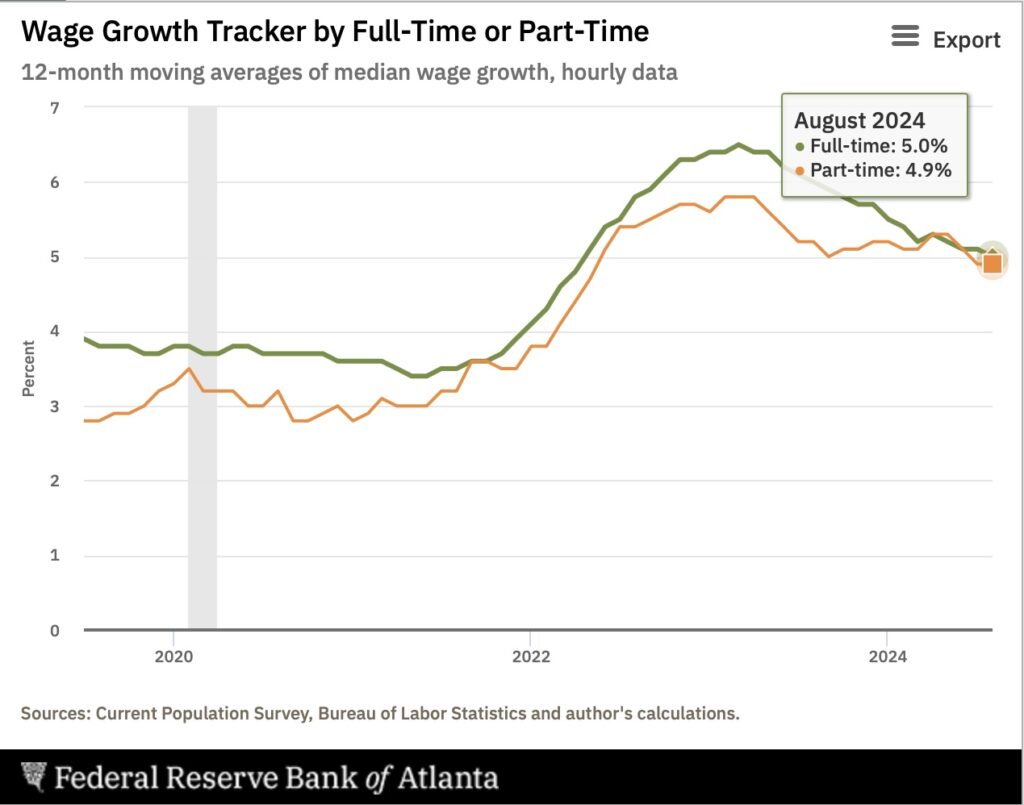

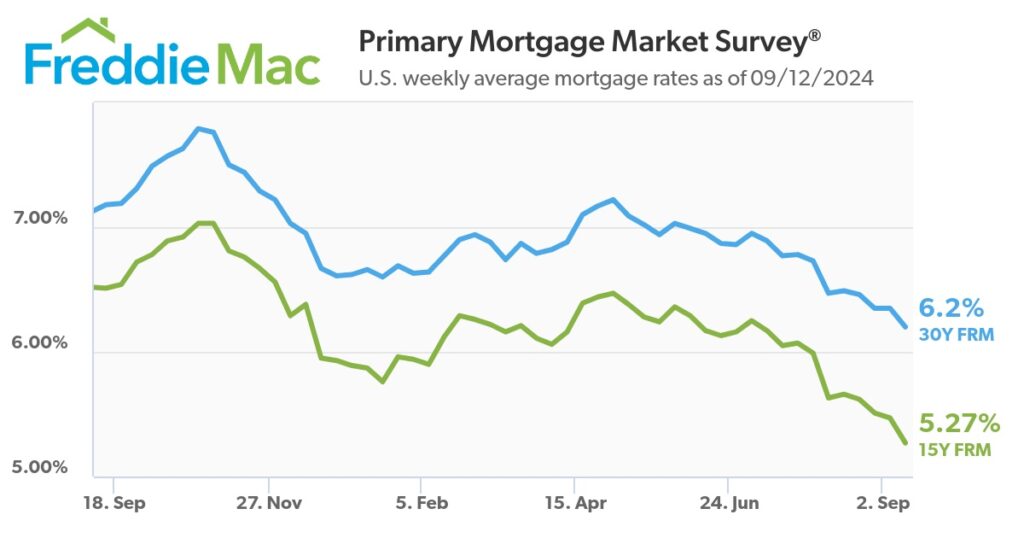

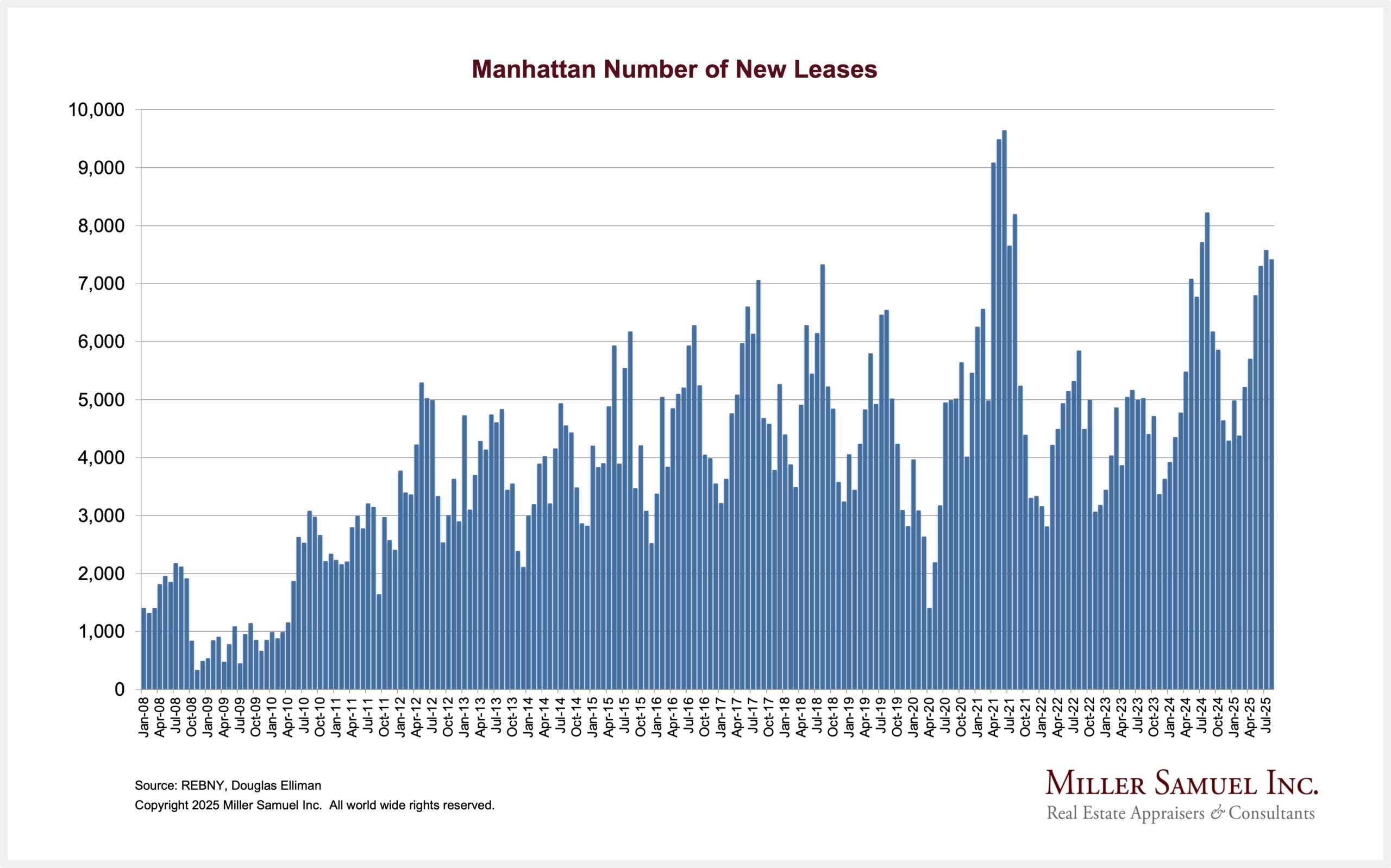

While I don’t believe in the unluckiness of today’s Friday the 13th (the movie and sentiment), I find comfort in the fact that S&P 500 investors agree with me. Incidentally, my last scary movie attendance was Halloween back in college, and I still think about the terror I felt while waiting for the movie to end (and yet there was no gore!) I decided right then and there that I would never allow potential nightmares into my head (my annual dilemma as a NY Jets fan) because I realized they never leave. According to Dow Jones, the S&P 500 index gains an average of 0.1% on Friday the 13th, tripling the average gain of 0.03% on all trading days. That being said, I think housing market professionals should probably be optimistic about the fall market. Back in June, there were expectations for one rate cut. Now, three cuts are expected before the end of 2024. The anticipated rate cut to be announced at next week’s FOMC meeting should push mortgage rates even lower. Lower mortgage rates will improve affordability only incrementally, but it’s a significant psychological barrier removed after 2.5 years of waiting for a sign. Wages are still rising at a 5% annual clip, higher than pre-pandemic, and mortgage rates are sliding towards 6% after nearly touching 8% almost a year ago. All of these conditions are favorable to more home sales.

And then consider what has happened just in the past four days:

- 1. biggest ever one-month drop in online grocery prices

- 2. biggest ever one-week drop in shipping container rates

- 3. McDonald’s extends $5 value meal

- 4. Disney cut ad-tier streaming price

- 5. Gasoline futures imply an imminent sub-$3 national average

Final Thoughts & Memes

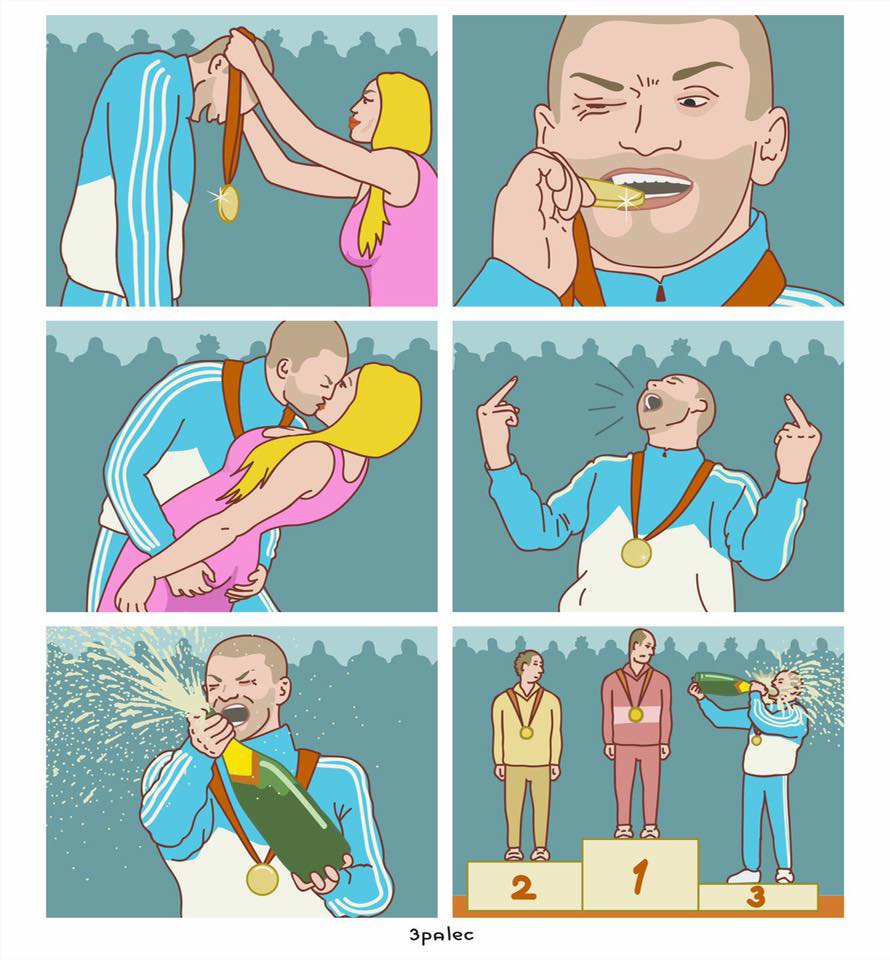

The upside outlook narrative to the housing market began in early August with the Japanese yen carry trade, which created more awareness of the potential U.S. economic downside and increased the probability of more rate cuts. It suggests to me an increase – beyond pre-August expectations – of more home sales in the fall. Of course, there is a danger in overhyping expectations with all this recent economic winning, which is accurately characterized in this obnoxious bronze medal meme.

Roc360 Webcast 9/18: Tackling Big Problems in Residential Real Estate with Jonathan Miller

Join Eric Abramovich, Brandon Dunn of Roc360, and Jonathan Miller of HousingNotes for an in-depth and insightful discussion on the ever-changing residential real estate market.

You can sign up here for the September 18th event.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Who's Afraid of Friday the 13th? Not the Stock Market. [Barron's]

- Real Average Wages [Econbrowser]

- Dozens of Properties Damaged in Southern California Wildfire [Mansion Global]

- Average mortgage rate drops to 6.2% — lowest since February 2023 [Newsday]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)