- Landmarking doesn’t always add market value because it restricts owner options

- Landmarking often benefits the community more by enhancing the sense of place

- Landmarking can maintain value and attract investment

Property owners have different motivations when it comes to landmarking a historically or culturally significant structure. For municipalities, the perception is that such a designation enhances the area around it – improving the sense of community by saving it from demolition. An individual property owner perhaps aspires to raise the property’s value or earn a tax deduction.

Penn Station. A Lesson Learned After Demolition.

New York City learned a lesson about landmarking when the famous Penn Station was torn down in 1963 and replaced with an awful-looking Madison Square Garden. A Penn Station revitalization plan is in the works.

Here is a before and after image…

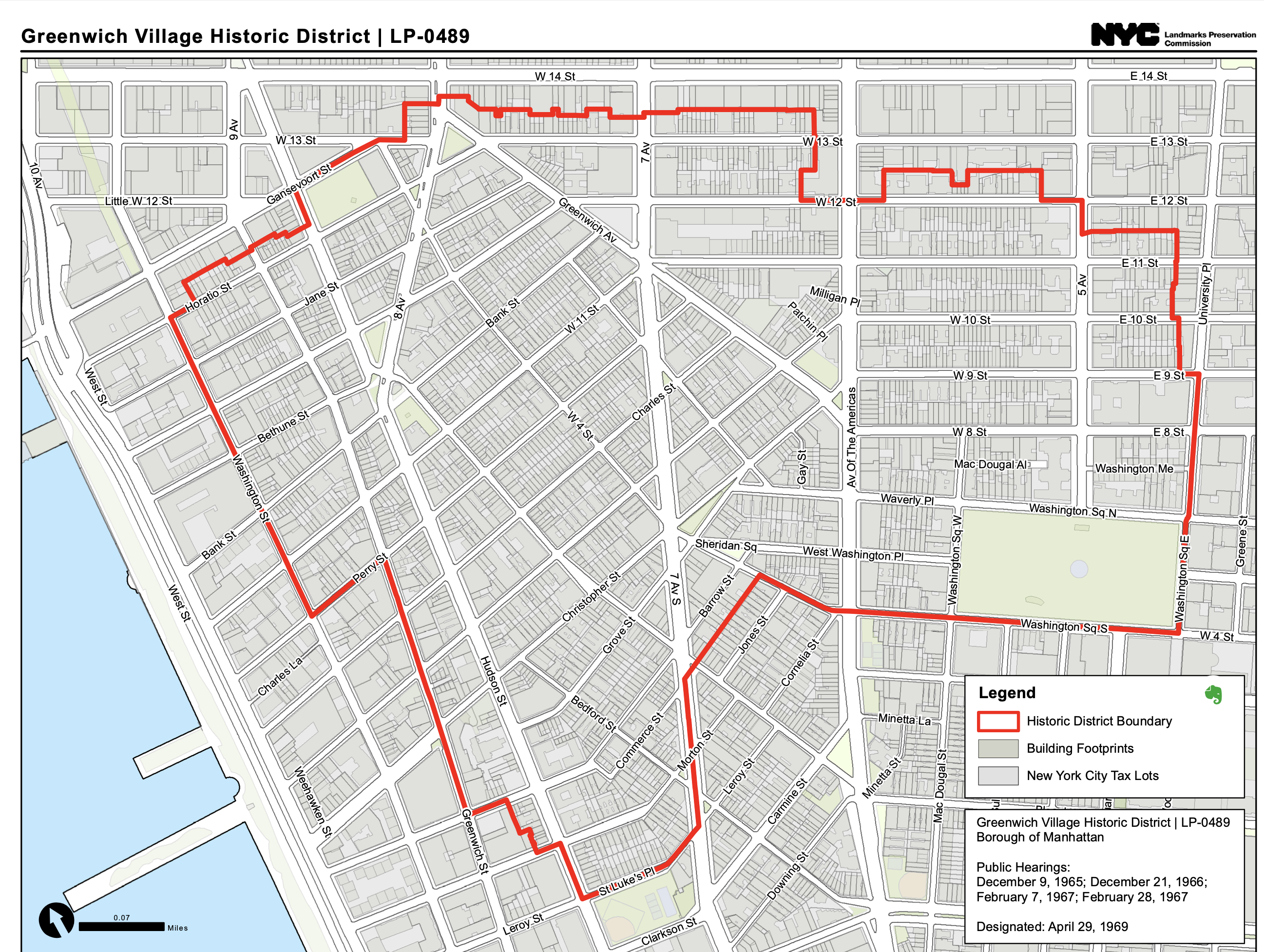

The New York City Landmarks Preservation Commission defines a landmark as a building, property or object that has a special character or special historical or aesthetic interest or value as part of the development, heritage, or cultural characteristics of the city, state, or nation.

Village Preservation

For property owners or communities that take the step to preserve their properties, the perceived value increase is often offset by the loss of some of their bundle of rights. Limitations on the ability to perform certain renovations or restrict the use of the property have the potential to restrain value.

12305 Fifth Helena Drive. A Beautiful Thing.

Marilyn Monroe’s home where she lived and died came very close to being demolished. After a charged effort by community groups to stop the owners from tearing it down, the LA City Council voted 12-0 to preserve the home by adding it to the property roster for its historical significance. To some, the loss of control of a property by its owners is probably an affront. But in landmarking, the greater good tends to be the goal, much like zoning laws.

Los Angeles has 444 private residences that are landmarked out of 1,300 sites.

“Life is a beautiful thing, and there’s so much to smile about.”

Marilyn Monroe

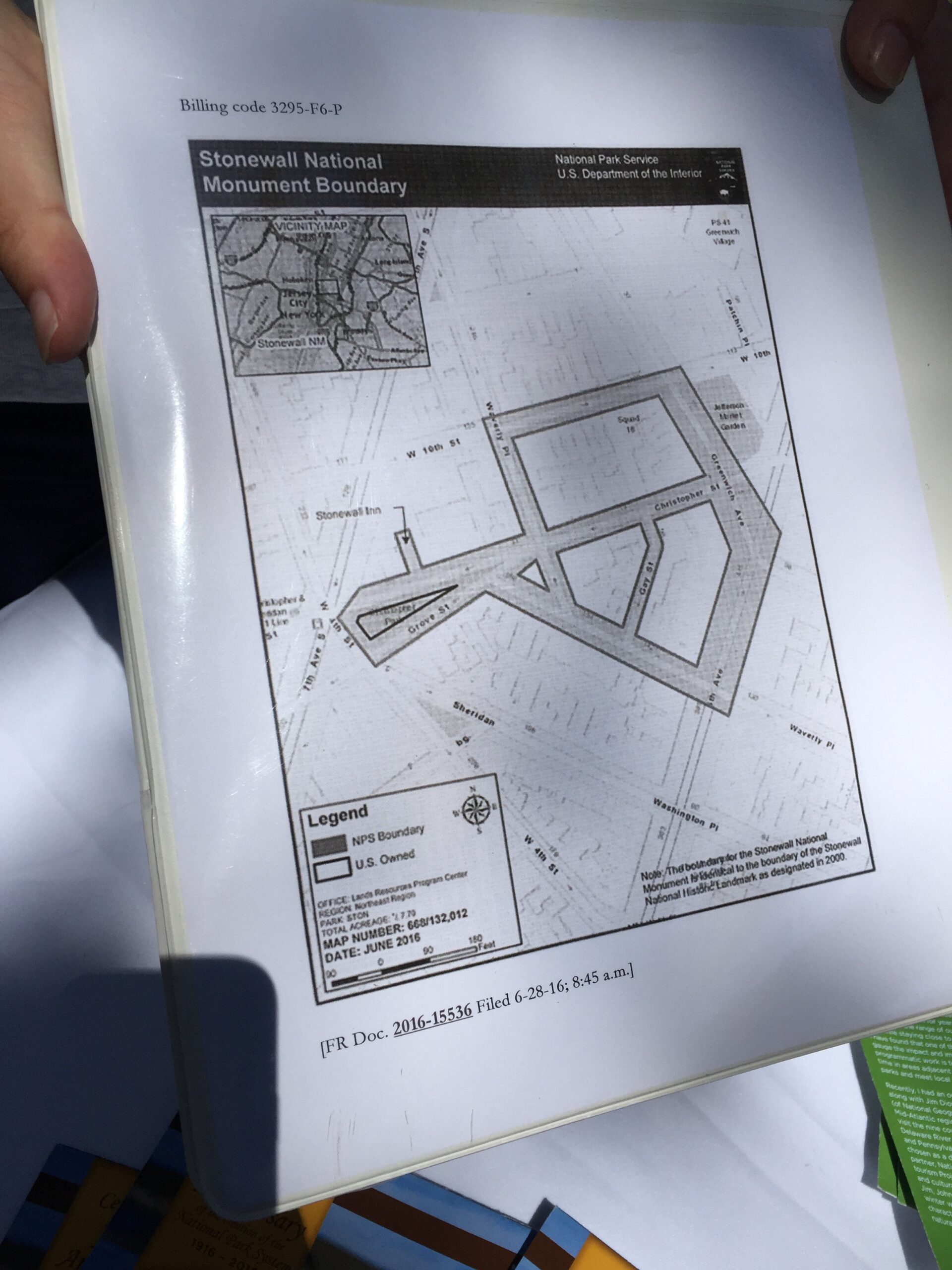

The Stonewall Inn. It’s Complicated

In the latter half of the Obama administration, they became interested in preserving the Stonewall Inn. Several groups were working on plans to preserve the birthplace of the LGBTQ movement, which began with the Stonewall Riots. I was contacted by one of those groups to do an appraisal of the property. I offered to do it pro bono given the historic nature of the effort. The property owner also owned many of the adjacent buildings and expressed interest in selling it. I believe the group I was contacted by was going to raise money to purchase the Stonewall Inn from the owners but I did not have access to the full interior. I never completed the assignment as the group discontinued their effort, I believe, because another group had made progress. The Commercial Observer just published a piece on this The U.S. Has One LGBTQ National Monument, and It Took a Lot to Get There. The author does a good job explaining all the machinations of preserving the site.

I walked around the exterior of the property and took photos (the crowd/flags mark the property) nearly a decade ago.

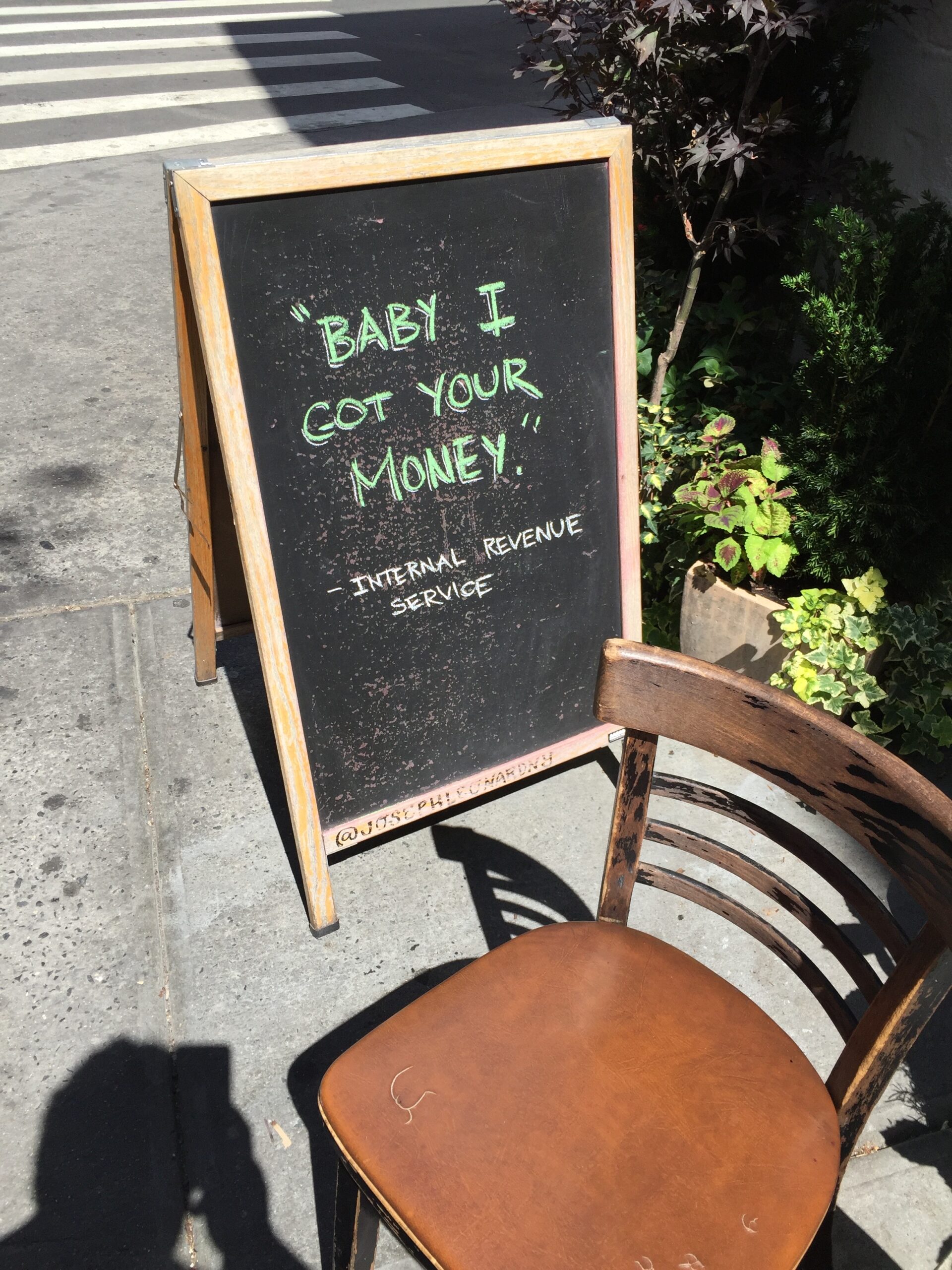

As seen outside the Stonewall Inn. Oh, the irony.

Miller has a poignant memory of visiting Stonewall about 10 years ago.

“I’m sitting there on a sunny day outside of the Stonewall Inn next to a man who was probably 6-foot-6 in a purple chiffon dress, and we chatted,” Miller said. “It just reminded me how awesome New York City is. I was wearing a dark suit, and it was so emblematic of the village.

Commercial Observer

Facade Easements Can Do Good, Yet Were Abused

More than two decades ago, my firm was approached by the organization then known as the National Architectural Trust (NAT) as they were having trouble with the quality of their appraisals. Their process involved blanketing historic neighborhoods with flyers and holding a meeting, where NAT told homeowners how to take advantage of the tax benefits. The facade easement covered the areas visible from the front of the property and appraisers were to value the easement as a percentage of the market value. With Manhattan’s historic brownstones, the facade easement covered the areas seen from the street. During this process, I ran into an attorney who had questions and I ended up hiring as our corporate attorney.

After working with them for a short while in 1999 into early 2000, the pressure from the homeowners to appraise “high” was rising and we stopped getting requests and then stopped accepting appraisal assignments in that space. NAT devolved into a salesman on a commission-like format where the NAT representative would tell the homeowner how to pressure the appraisers to get a bigger deduction and I assumed the salesperson would get a piece of that. I told NAT about my concerns and how there was no effort at quality control – to deaf ears so we stopped our work in this space. NAT seemed to attract the worst appraisers in our profession who would “hit the number” for a buck, in the same way mortgage brokers were pressuring appraisers to “hit the number” before the GFC. I remember a commercial appraiser I knew was valuing multi-family rental buildings subject to rent control and rent stabilization as a hypothetical “open market” rental building at an astronomically high number.

They eventually gave boilerplate to their appraisers to calculate the loss in value to the easement (as a percentage of the property value) and that became the tax deduction. Then think about a $6 million townhouse with a $660,000 easement valuation which ends up being a tax deduction and hundreds of property owners going through the process. The large sums of money it generated in tax savings definitely got the Internal Revenue Service’s attention.

The facade easement concept was a redundancy from the federal government where NAT had claimed that Landmarks Preservation was a private entity, and if they went under, the easement would remain in place in perpetuity as protection. One of the problems with this claim was that NAT had no landmark experts on staff at the time yet it was claiming that the redundancy in coverage of the easement was worth a federal tax deduction.

I ended up consulting with the IRS and even taking a deposition on the process as they sought to understand NAT’s appraisal process. In 2011, the Fed sued them. I lost track of what happened next.

The suit, filed in Federal District Court in Washington, D.C., also demands the names of 800 property owners in New York City, Boston and Baltimore who have claimed charitable deductions totaling more than $1.2 billion for the donation of easements to the Trust.

Forbes

Final Thoughts – Impact On Property Value

Don’t get me wrong here – I think landmarking is an important tool for municipalities and organizations to maintain the quality of a community and enhance the sense of place. This impact can bring economic improvement to the area and maintain or even enhance property values. A property owner loses some of their bundle of rights in the process to take the tax deduction or other benefit and it’s usually in perpetuity. I think of the impact on value in these two ways:

- When a property owner loses some control over their property after landmarking or other one-off status changes, it likely takes away some of the value or in the worst case, maintains value. Upon sale, the new owner has fewer options available to improve or change the use of the property. They usually have to go through government or preservation entities who make the approvals to make changes which can cost more time and money, or be told “no.”

- In the case of being part of an existing landmarked district or neighborhood, values can be maintained or elevated as a community because all properties are subjected to the same restrictions. This may or may not add a premium to those properties when compared to those nearby but outside the district.

Landmarking isn’t for everyone, but neither is a chiffon dress.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- The Lone LGBTQ National Monument in the U.S.: Its Backstory [Commercial Observer]

- Marilyn Monroe’s House Is Made a Los Angeles Landmark in Council Vote [NY Times]

- The Battle of the Blondes: second of three votes needed to save Marilyn Monroe's house [Esotouric Secret Los Angeles]

- Marilyn’s Brentwood Hacienda Granted Temporary Reprieve [The Marilyn Report]

- Unaffordability Expected to Remain Primary Constraint on Home Sales [Fannie Mae]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 5-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]