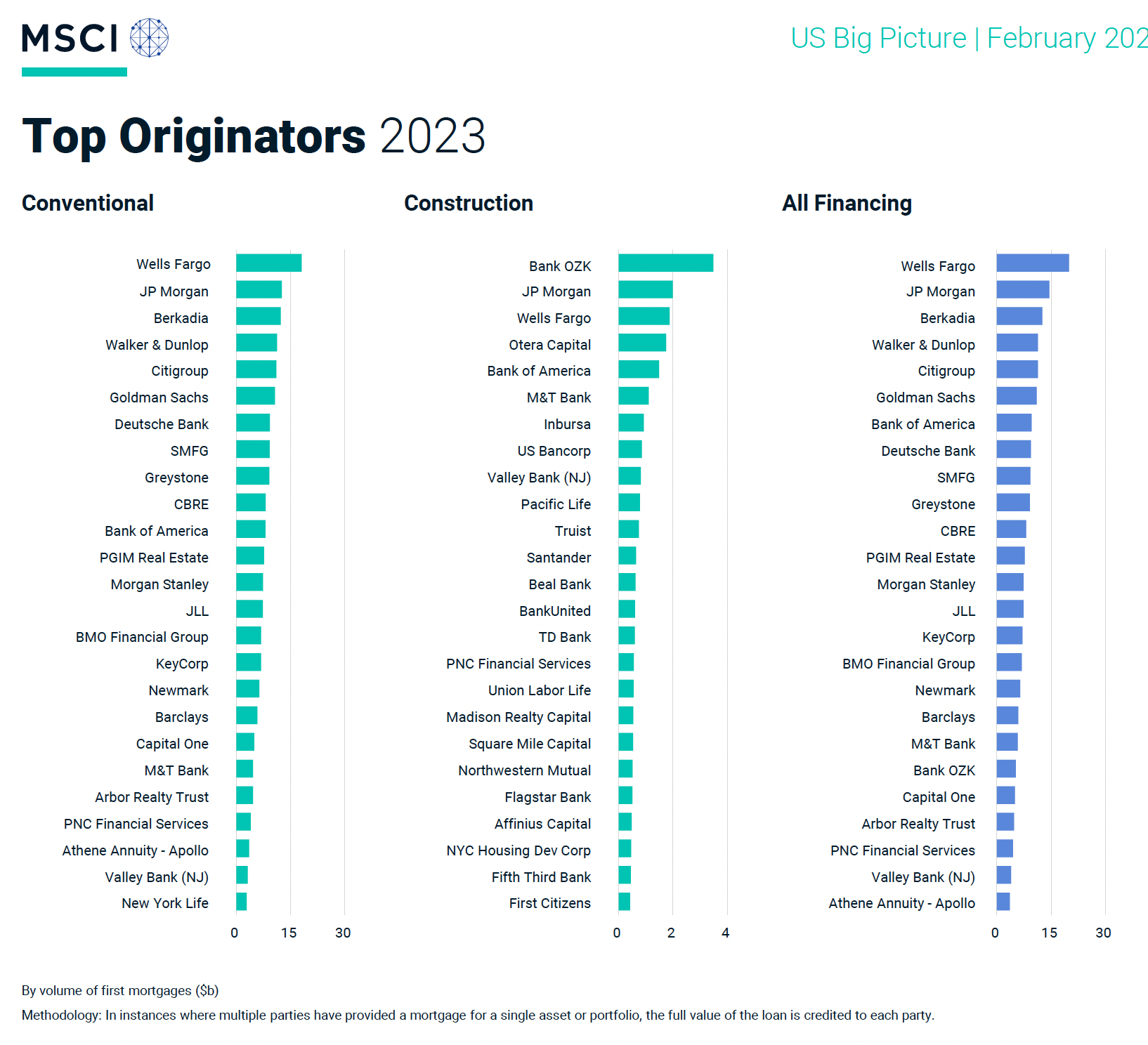

- OZK is the biggest U.S. construction lender by far

- OZK changed its name in 2018 from Bank of the Ozarks

- OZK dominated construction loans in New York City, now South Florida

Bank of the Ozarks changed its name to Bank OZK in 2018 to reflect its broader lending coverage. Coming out of the financial crisis, they acquired a bunch of failed banks. My peers wondered what a bank in Arkansas was doing providing New York City construction loans on luxury condominium towers. In fairness, many of us snickered that their Manhattan lending volume practices would end badly given their Ozark roots. Wrong.

Now Bank OZK is focused on some big lending volume in Florida, a regional beneficiary of work-from-home (WFH) migration patterns. After their smart pivot from a New York emphasis and record profits, it’s getting hard to vote against them in Florida.

Last year they were the top construction loan lender in the U.S., double that of second-place JP Morgan Chase, the nation’s largest bank. The differences between the two lenders are exemplified by their CEOs.

Jamie Dimon of JPM Chase is quoted in business periodicals seemingly every day. He said he won’t personally buy Bitcoin but he will defend your right to buy it. He’s modified and waffled on cryptocurrency over the years and we’ve all been fed his many takes. Dimon wants his employees back at the office but has modified his original stance to WFH doesn’t work for bosses.

George G Gleason II has been the CEO of OZK since 1979 and we only seem to hear about his bank’s business. Gleason was recently interviewed by Bisnow. Boring. They announced record earnings in the first quarter of 2024 but were downgraded by Citigroup in May but it wasn’t based on their property loans. They’ve made over $1 billion in South Florida construction loans in the past six months.

And now OZK just made the largest residential construction loan in Florida history, $668 million on the Waldorf Astoria Residences project in Miami…

…and another $100 million for the St. Regis development in Sunny Isles. Highest & Best was one of the first to notice OZK’s Florida unusual heavy lending volume in 🧲 Millionaire Magnet and 😎 Happy Home Insurance Vibes

I wonder if the difference in performance in the construction segment doesn’t just come down to focusing on one thing and doing it well.

Did you miss Friday’s Housing Notes?

June 14, 2024

Housing Notes Reads

- Bank OZK Has Dominated Construction Lending. Its CEO Has No Plans To Slow Down [Bisnow]

- How a little bank from Little Rock took over Miami real estate [Tampa Bay]

- 💰Miami Mega-Loan Mania! [Highest & Best]

- NYC renters were 'on the move' in May as lease signings hit near-record levels [Brick Underground]

- Manhattan apartment rents drop even as leasing activity picks up [WCBS News Radio 880]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 5-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)