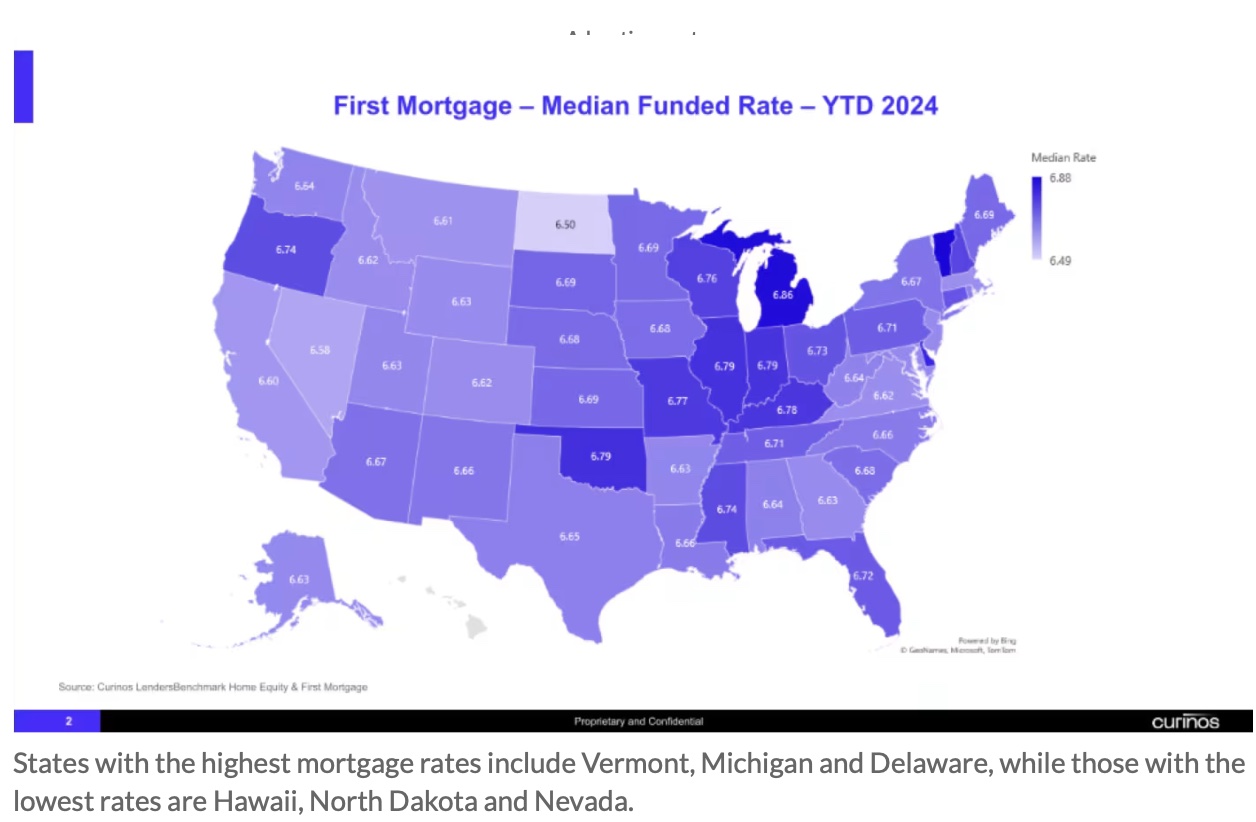

Yeah, I love peanut butter and I accept this and this. One of the most annoying aspects of covering the housing market is that we are bombarded with junk stats. Here’s an example from this Market Watch article: Mortgage rates can vary significantly by state. How many people are going to move to another state to shave off 25 to 40 basis points from their mortgage? Do consumers think the same way about mortgages as they do shopping for peanut butter (with rodent hair knowledge) at the grocery store?

If someone is contemplating moving from North Dakota to the Sunbelt for the warmer weather and a job prospect comes up in Alabama, is the higher rate going to push them to Mississippi to save 25 points on their mortgage? Perhaps on the margin, but how does this help inform the consumer? And most importantly, do they do peanut butter?

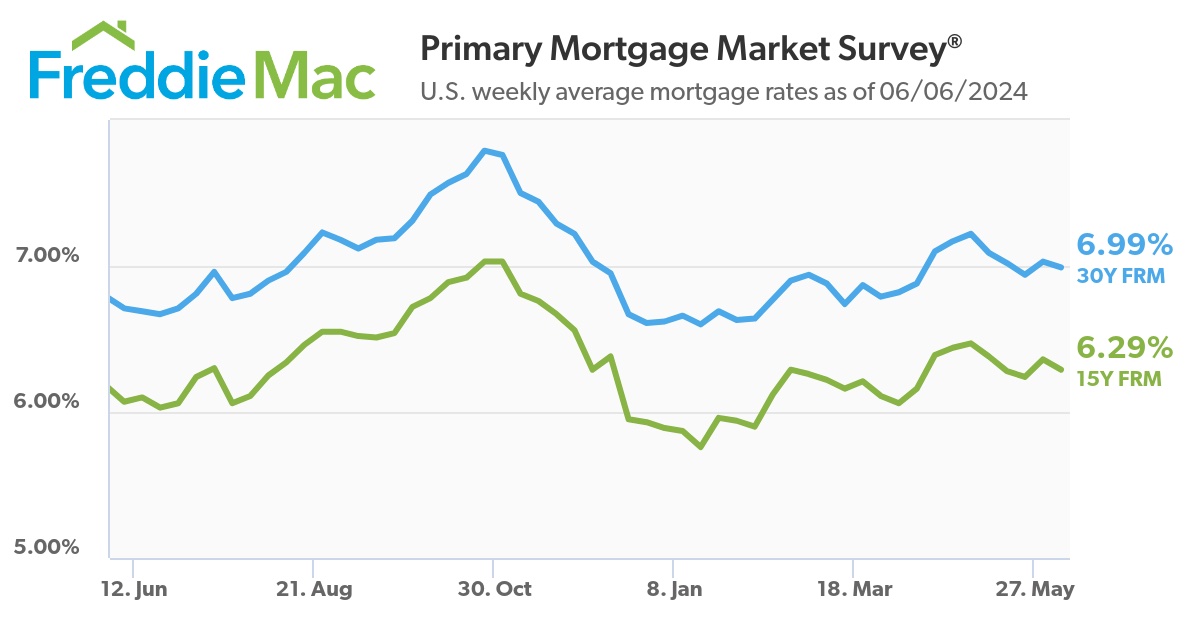

Mortgage rates have slid nominally lower over the past few weeks but are about the same level as they were last summer – still high relative to 2021.

When we think about mortgage rates and their trends, it is important to understand what government-sponsored entities (GSEs) like Fannie Mae and Freddie Mac are really for. According to their regulator, FEDERAL HOUSING FINANCE AGENCY (FHFA) the GSEs are to provide liquidity, stability and affordability to the mortgage market.

to provide liquidity, stability and affordability to the mortgage market.

FHFA

This is why we don’t have a 15% mortgage rate in Idaho at the same time we have 1% mortgages in South Carolina. Another way to think of mortgage rates is the opposite of what was presented in MW article: Housing is local, and mortgages are national.

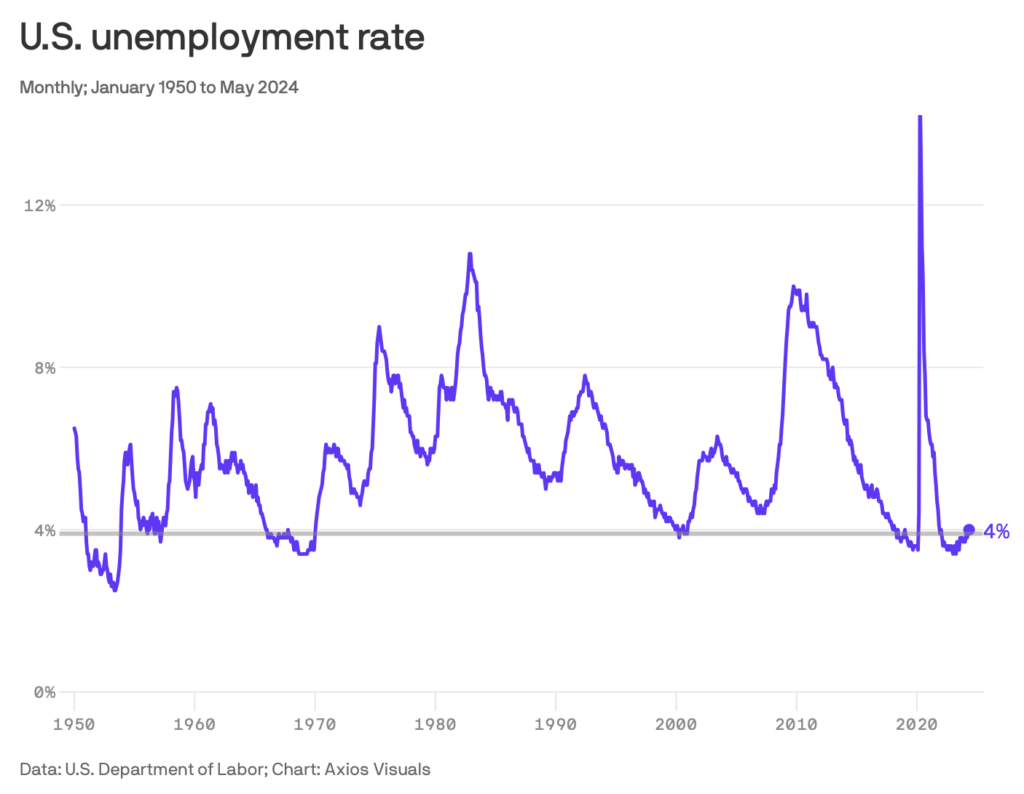

Here’s a question to ask about mortgage rates – if unemployment is so low (strong) then why would the Fed cut rates which would boost housing?

And since yesterday was the 80th anniversary of D-Day, the EU Central Bank cut rates which could be a promising sign that the Fed may cut before the end of the year. Or not.

Still, you might need to learn more about the history of peanut butter to better understand mortgage rates, considering the 3-4 rodent hairs in every jar of peanut butter.

Did you miss yesterday’s Housing Notes?

This Is A Whole New Thing – Housing Notes Daily

Well, I’ve been writing this Housing Notes newsletter since March 2015 (more than 9 years as a weekly exercise) and at last count were nearly 500 weekly iterations, evolving into a Friday 2 pm launch date no matter where I was in the world, whether or not I was on vacation, and what was going on in my personal life. It was such a consistent routine that many subscribers told me it marked the beginning of their weekend. But what is going to be so new about Housing Notes Daily?

Less is more. The type of content will largely remain the same but in a shorter format and the delivery will be daily instead of weekly. Starting immediately, Housing Notes will be released 5 weekdays each week at that same 2 pm Eastern time moment. My sidebar passion project Appraiserville is being moved to the Beehiiv platform soon and I plan on releasing it weekly while linking from here temporarily. More on that soon.

Housing Notes Reads

- U.S. Economic, Housing and Mortgage Market Outlook – August 2024 | Spotlight: Refinance Trends [FreddieMac]

- Sluggish Home Sales Expected as Consumers Hold Out for Improved Affordability [FannieMae]

- Toll Sees Solid Demand for Luxury Homes as Mortgage Rates Fall [Bloomberg]

- July existing home sales break a four-month losing streak as supply rises nearly 20% over last year [CNBC]

- NYC's Rent Surge Drives 86-Year-Old to Move in With a 'Boommate' [Bloomberg]

- Air conditioners fuel the climate crisis. Can nature help? [UNEP]

- Nearly 90% of U.S. households used air conditioning in 2020 – U.S. Energy Information Administration (EIA)

- How Air-Conditioning Made Us Expect Arizona to Feel the Same as Maine [NY Times]

- How Many U.S. Households Don’t Have Air Conditioning? [Energy Institute at HAAS]

- The power of swearing: What we know and what we don’t [Science Direct]

- Frankly, we do give a damn: improving patient outcomes with swearing [NIH]

Market Reports

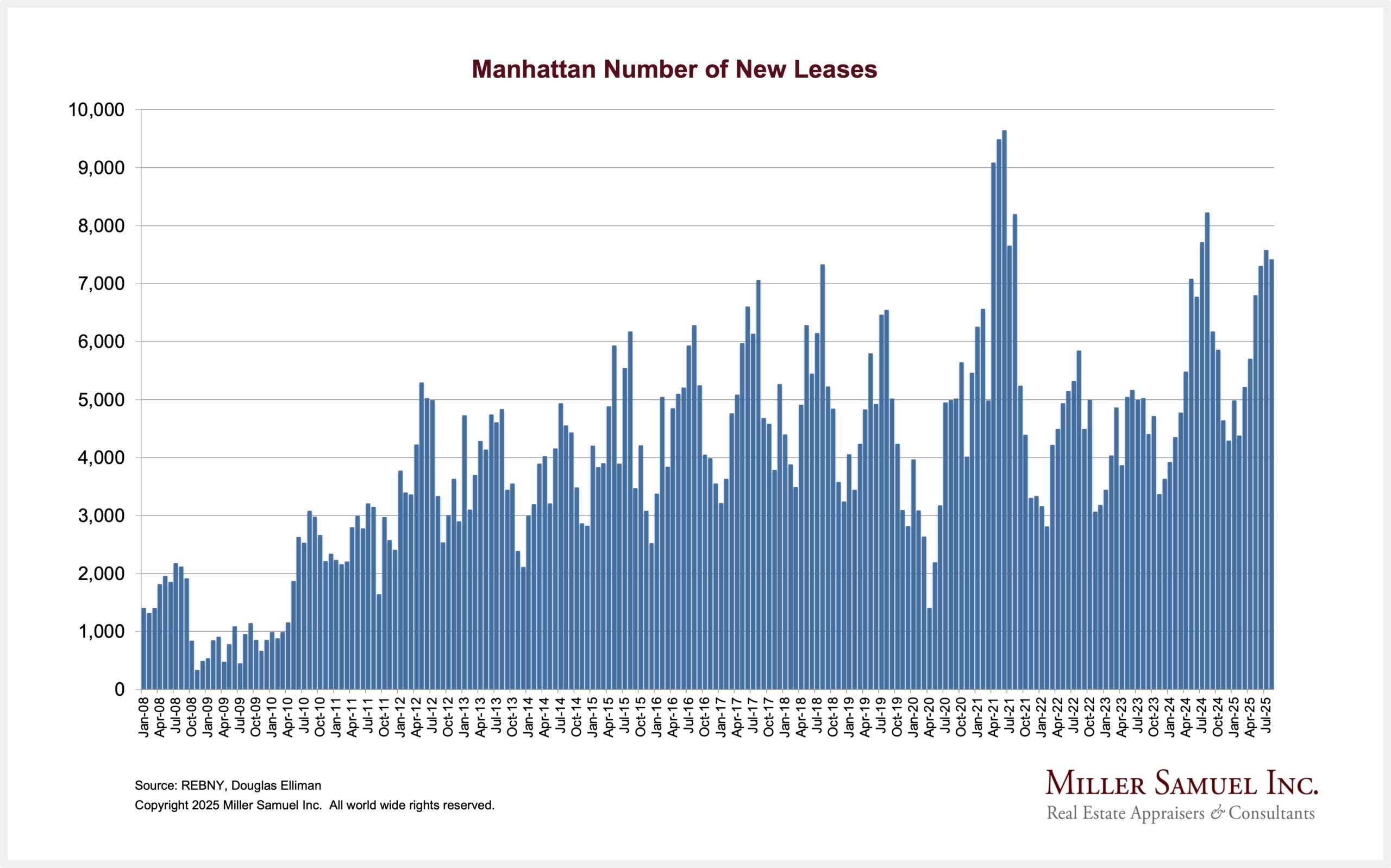

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: Orange County Sales 2Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 2Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)