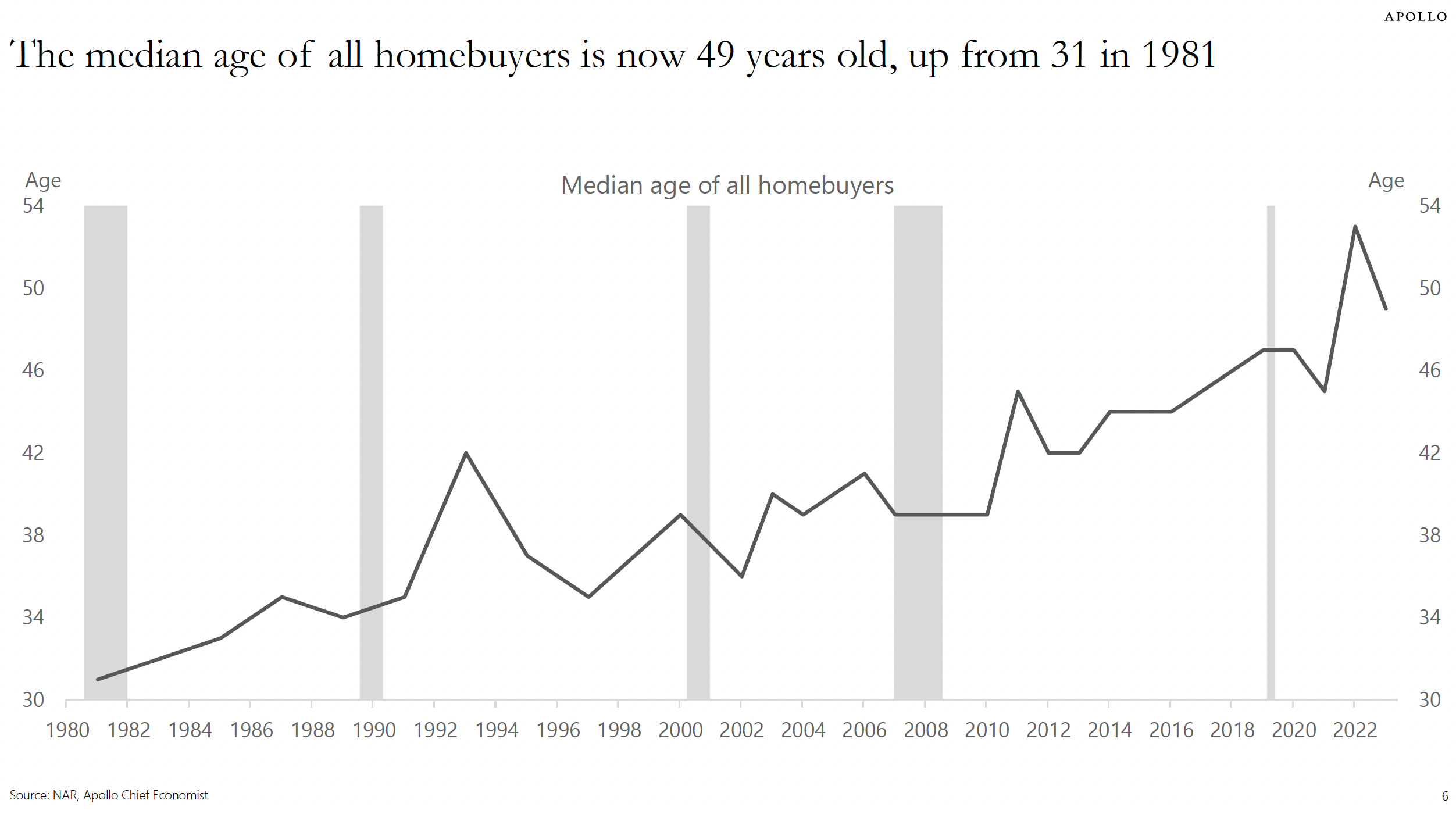

- The Median Age Of All Homebuyers Is 49, Up From 31 In 1981

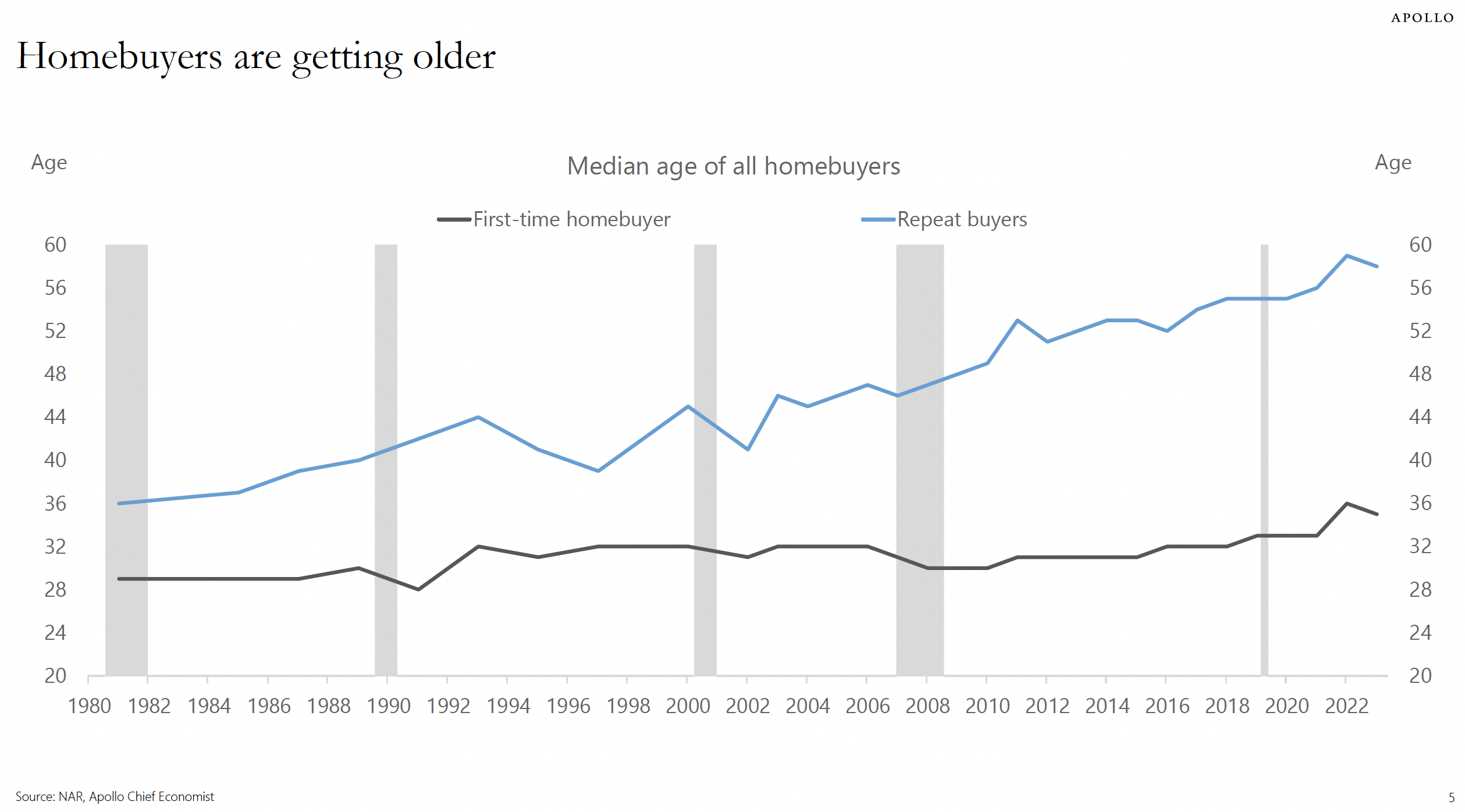

- First-time Homebuyer Age Is Only Up About 6 Years Over The Past 43 Years

- Repeat Buyers Are Aging Because They Have More Housing Options

When we launched our appraisal firm in the mid-1980s, most of my friends who lived outside of Manhattan already owned homes, so I chalked it up to the expensive market we lived in. After all, we had put everything we had into developing the business, and eleven years later, in 1996, at the age of 36, we bought our first home (in a three-way bidding war). We moved to the suburbs of Connecticut to do it and stayed for 8.5 years before buying our next one. Yet my parents and in-laws and most of their peers bought homes in their early twenties. Sure, there was the GI Bill and much lower housing prices, negotiated in $50 increments, but it was still hard for me to rationalize how buying so young was possible.

As it turns out, we were pretty “median,” if not “average,” based on national data, buying a home at age 36 in 1996. As it turns out, my peers were well ahead of national conditions, and I wasn’t as woefully behind as I had always assumed. The chart above shows how the median age of homebuyers has increased by 58.1% or 1.35% per year over these 43 years. Homebuyers are getting older. But it’s not what you think.

If I look at the above chart from a first-time homebuyer perspective, I was about five years behind the national median age in 1996. Arguably, I was behind, but not far behind my peers (hey, I’m competitive).

But the separation of first-time homebuyers from repeat homebuyers tells us something else. The age of first-time home-buyers has expanded by about six years, from 29 in 1981 to 35 in 2023, which is likely attributable to the rising cost of homeownership, beyond inflation. Much of the increase in homebuyer age has occurred in repeat buyers, rising from 36 to 49 over the same period.

Repeat buyers have added other options to their plates besides the rising cost of homeownership. Back in the era when my parents and in-laws bought their first homes in the early 1960s, many stayed long enough to pay off their 30-year mortgages. Today, as consumers age and their income expands, there are more housing options, such as purchasing second homes, timeshares, investment properties, or becoming Airbnb landlords. Those trends drive the median age higher for repeat buyers in addition to the higher costs.

Can you think of any other reasons for the surge in repeat homebuyer ages? Please share.

Looking at the ages of repeat buyers is like looking at the 7/11 sign for years and not noticing the “lowercase ‘n.'”

Did you miss yesterday’s Housing Notes?

September 9, 2024

Image: Chat & Ask AI

Housing Notes Reads

- Why Long Island homebuyers can't catch a break in a market where prices are up 86% in 10 years [Newsday]

- Industry leader Clark Halstead dies at 83 [Inman]

- Teuerster Mietmarkt in den USA: New York ist wieder verrückt geworden [FAZ]

- What comes next for NAR’s Clear Cooperation policy? [Real Estate News]

- Rare Westhampton Beach condos hit market, starting at $990k [The Real Deal]

- Why Housing is Everyone's Favorite Investment [A Wealth of Common Sense]

Market Reports

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)