- Rising Homeownership Costs Push Average Age Higher

- First Time Homebuyers Average 38 Years Old, Up From Late 20s In The 1980s

- The Average US Homebuyer Is 56 Years Old

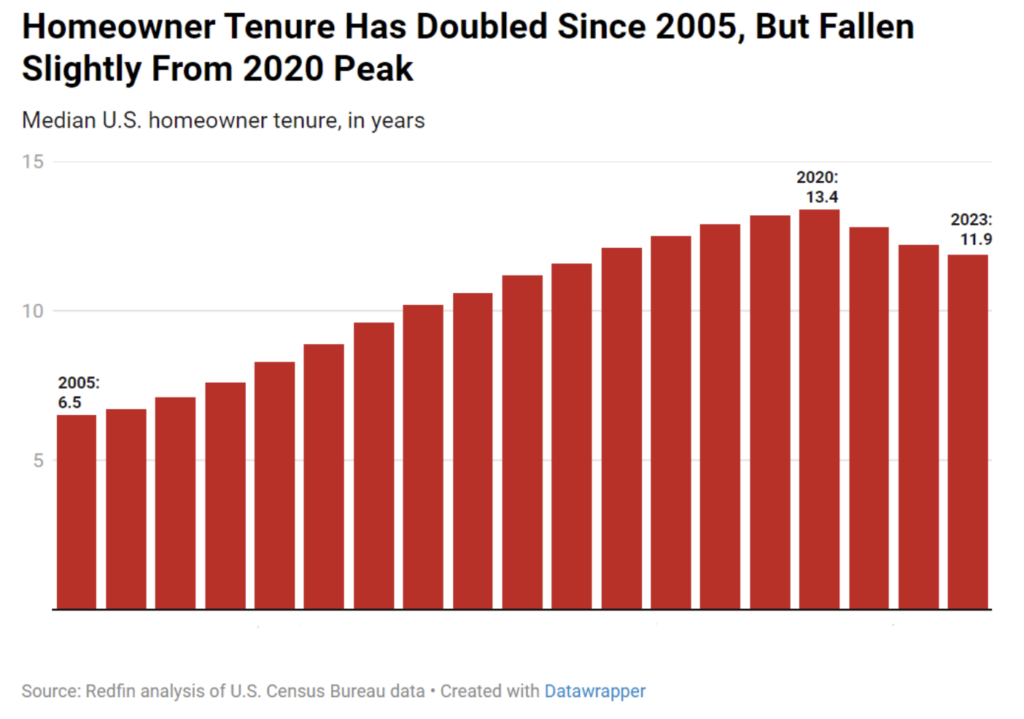

Throughout my real estate career, beginning in the mid-80s, I remember having conversations with real estate agents about how long buyers live in their homes, referred to as “tenure.” The answer I received generally averaged about 7 years. Now, my anecdotal market feedback suggests the length of time is closer to 12 years. The hard data out there varies greatly depending on whether average or median is used, but the math seems straightforward – the more expensive homeownership is relative to income, the longer the stay.

The Redfin report that came out last year shows results similar to what I see on the ground. However, my anecdotal is NYC-sourced and not national, so I suspect that the surge in mortgage rates that began in 2022 is probably pushing tenure out longer in 2025.

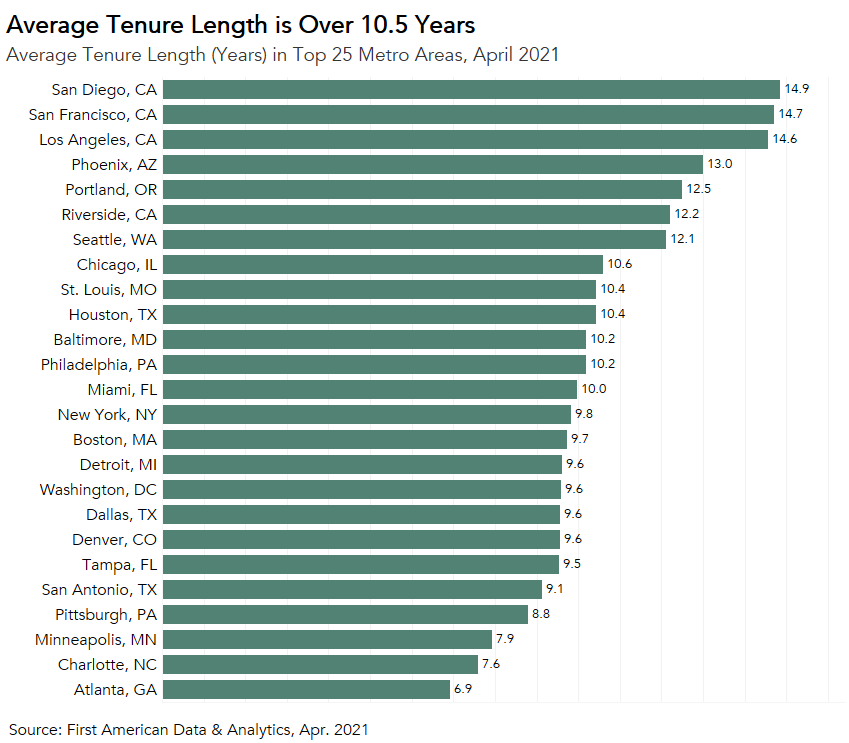

Back in 2021, when the above chart was published, New York homeownership tenure averaged 9.8 years, while that earlier Redfin chart indicated a US average of 13 years, a three-year difference between New York and National results. My anecdotal feedback of 12 years for New York today suggests that the national average is now closer to 15 years.

And that would make sense because the median age of first-time buyers is 38 years old, up from 35 in 2023. In the late 1980s, first-time buyers’ average age was in the late 20s. The average age of all home buyers is now 56, about 15 years later than was observed two decades ago. In other words, homeownership has morphed into an older person’s game.

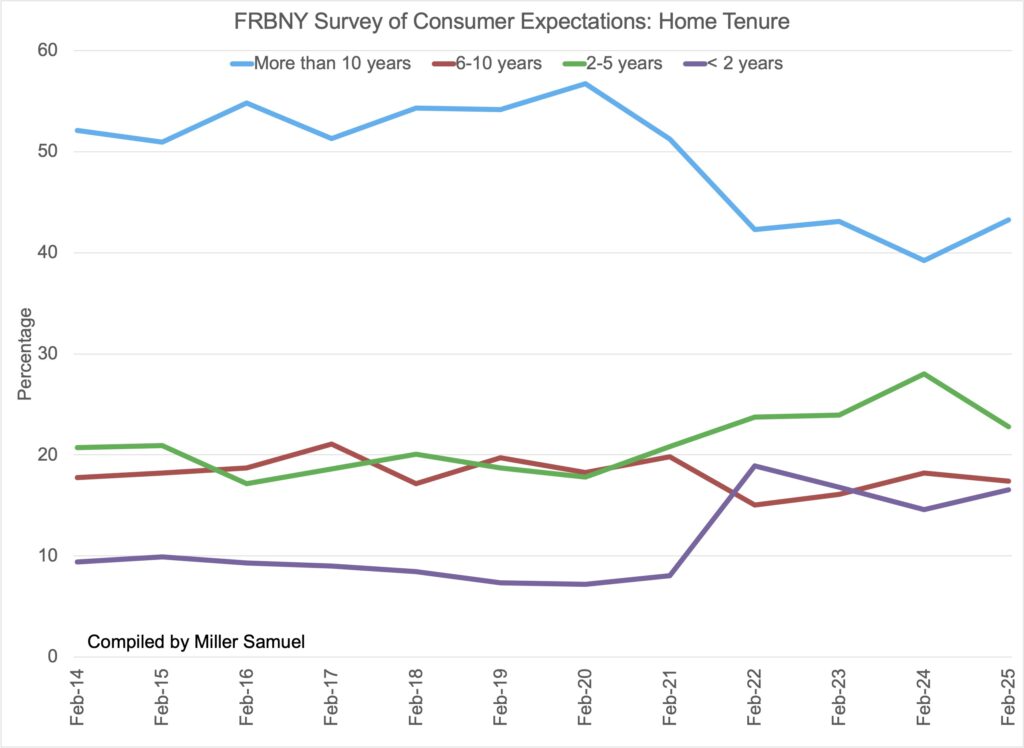

Expected Tenure Is Falling

The New York Fed recently released its Survey of Consumer Expectations, which had a host of soft data about housing. One of the surveys covered how long consumers expected to live in the homes they purchased. There is clearly a disconnect between what consumers think and what real estate agents think. While more than 50% of consumers expected to live in their homes for more than 10 years, those in the 6-10 year range remained somewhat consistent even after the spike in mortgage rates that began in 2022. What was surprising was the segment of the market that expected shorter stays of less than two years. The number of those consumers jumped after rates began to surge in 2022.

There’s an old saying in real estate: “Buyers are liars.” That’s because they tend to have unrealistic expectations when getting into a sale.

Final Thoughts

With the costs of homeownership rising through home prices, mortgage rates, insurance, real estate taxes, and HOA expenses, buyers entering the housing market continue to delay their decision. Homeownership is becoming more elusive to those who want it, and the current state of housing with its lack of inventory, high mortgage rates, and inflation impact on costs has delayed transactions. Baby boomers are killing it with their stock market gains and home equity gains over the past few decades, but they seem to be the exception. Despite the delay caused by higher costs, the greatest wealth transfer in history is underway from baby boomers to their children and is expected to drive more sales and higher prices over the next decade.

The Actual Final Thought – Negotiating is an art – so you have to understand the market. Wow, it really is!

Here’s My Podcast

Episode 4 is out! I spoke at a real estate event on Tuesday in Long Island, and I sincerely appreciated all the positive feedback I received on my WIM podcast. I’m trying to get into a rhythm and record these weekly. The plan is to do these at 10 am ET every Tuesday going forward. Next week’s primary topics are: “Looking At Rents + How Long Do Buyers Live In Their Homes?”

The latest episode of What It Means.

Here are the podcast feeds for “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- Troubles mount at Appraisal Institute, Chicago-based center of property valuations [Crains Chicago Business]

- It’s been a long time since we’ve seen housing stats like this [Sacramento Appraisal Blog]

- Homeowners Today Stay in Their Homes Twice As Long As They Did in 2005, Driven Largely By Older Americans Aging in Place [Redfin]

- Here's how old the typical U.S. homebuyer is today [CBS]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)