$100 Million Home Sales Are The New $50 Million Home Sales

Super Luxury Homes Are More Commonly Exceeding The $100M Threshold

These High-End Sales Are Long Term Asset Acquisitions As Buyers Bet On Future Higher Prices

The $200 Million Sales Is Beginning To Be A Little More Common

Americans have an unhealthy obsession with billionaires and real estate provides the perfect playground. Because I’m a dull and boring numbers guy, one of my hobbies since 2014 has been tracking closed U.S. residential units at or above the $50,000,000 threshold. Each sale in this market niche holds little resemblance to each respective local housing market. These sales are a collection of “one-off” transactions that have been the subject of my musings quite often over recent years. This wealth effect driver was probably initiated by the monetization of dating apps in the 1990s! Today, super luxury sales above $100,000,000 are the new $50,000,000 sale of just a few years ago. These top-tier sales are starting to regularly exceed the $200,000,000 threshold.

Super Luxury U.S. Locations Are A ‘Three-Legged’ Stool

The vast majority of these sales occur in three core locations (links to market reports I author):

However, one of the market phenomenons apparent in this pattern post-pandemic is the occurrence of more of these sales outside of the three core locations. And I suspect there will be a similar or even higher velocity over the next several years since the financial markets are thought to perform better with the incoming administration.

In addition, consumers in these locations tend to make more than in other locations. For example, [7-day gift link] San Francisco:

“The study found that about one in 127 jobs in the US pays more than $500,000 a year. In San Francisco that ratio is less than one in 50 — which is also the biggest share in the US — with Austin and New York following, according to the research by Issi Romem, an economist at the ADP Research Institute, based on anonymized payrolls.”

More Sales Than Ever Before?

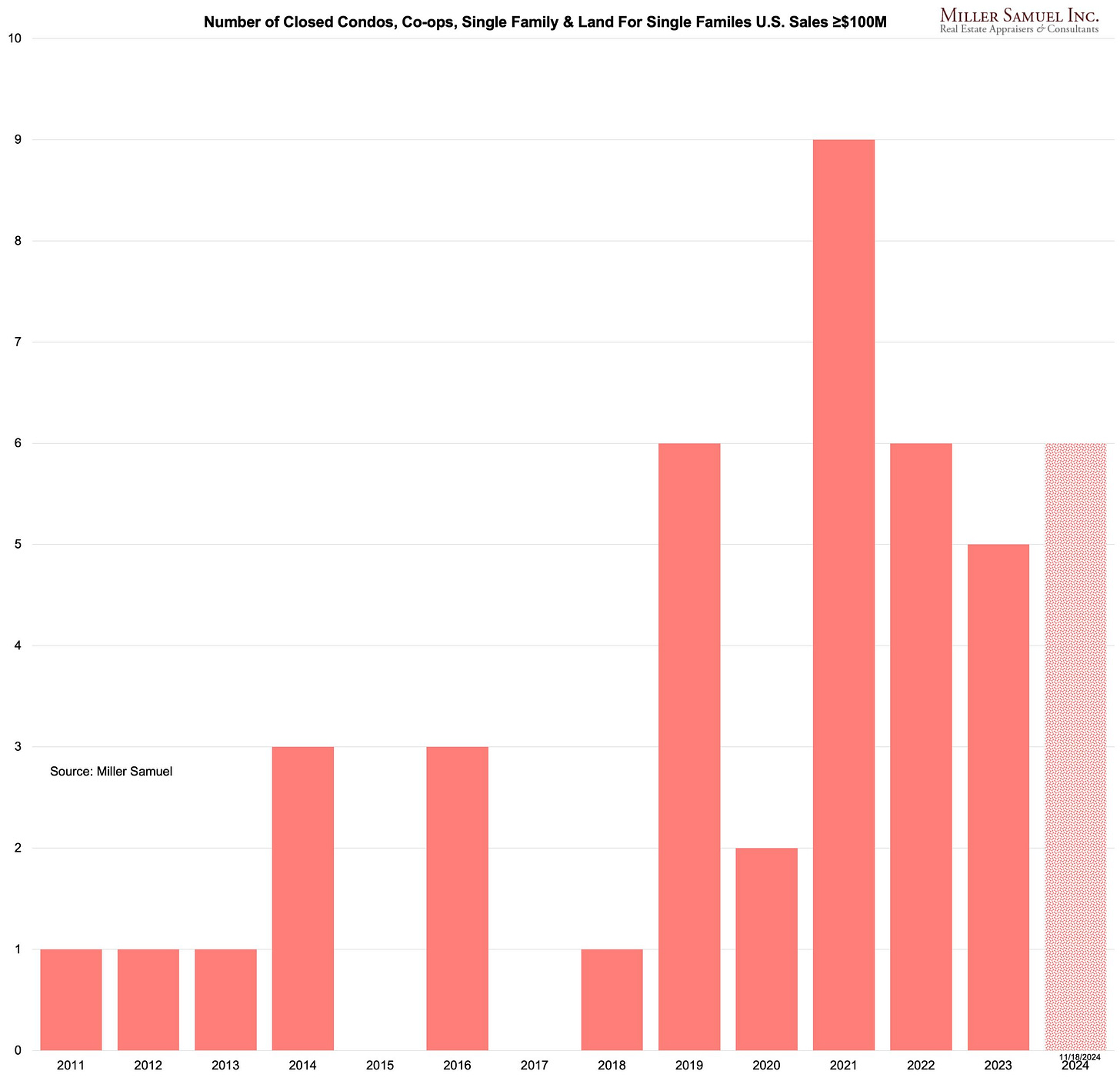

In my collection of $100+ million U.S. residential sales, the 2024 total as of today is tied with the second most on record – only three more are needed to tie the 2021 record and it is not unusual to see a cluster of these transactions at the end of the year. This is in sharp contrast to the below-normal sales levels of existing homes in the U.S. market.

Tales From The Luxury Real Estate Trenches

One of New York’s favorite publications, Curbed, pushed out a fun piece “The Trump Luxury Bump” last week. My favorite quote from the article:

“But for buyers with the luxury of not having to care about interest rates, whose hesitancy had less to do with 30-year mortgages than election-related agita, last week proved freeing.”

While the Wall Street Journal had an epic read “The Secret to Selling a $100 Million Mansion.” There have been more than 40 sales at or above the threshold in the thirteen years I have data – the first sale occurred in 2011. One of the agents in the piece said:

“Oftentimes, especially with superluxury homes, people want what other people can’t have. We’ve had buyers pay a premium because they don’t want the seller to put the property on the market. They don’t want anyone else to have it, and they don’t want anyone talking about it ever.”

One important subtext to these super luxury sales, some people don’t make money on the deal. Ken Griffin of Citadel accounts for the largest number of U.S. sales above $50 million. He opted to resell his record-breaking Chicago sale at a 44% loss after setting a record high of $34 million back in 2017. Of course, most of these buyers tend to hold on to these properties for decades. Griffen also sold his record-setting Faena penthouses for a 24% loss in 2021 after acquiring them in 2015.

Sooner or later it’s real money.

Final Thoughts

Sales of homes with 9-digit prices are becoming more common and they don’t have anything to do with their respective local housing markets. It’s a rarified market niche that’s not for everyone.

Clearly, I chose the wrong career path.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

November 15, 2024, Higher Mortgage Rates Are Driving New York City Rents Higher & Other Rate-Related Housing Distortions

First, thank you for your work on this newsletter. I’ve come to look forward to reading it as a real estate agent in Manhattan, who covers all five boroughs and has friends in the business around the country. You get the market in NYC but you also understand the national dynamics. Now regarding FARE, what people do not understand is that one of the main reasons rents are so high in NYC is because people are willing to pay for it. The vacancy rates for NYC apartments are low because there is huge demand. We need to change the supply side of the equation to really make any impact on pricing. That being said it is easy to demonize agents, and blame them for all the problems with the housing market. You are correct that landlords will fold the cost of hiring an agent into the rental price. Seems like an ok scenario for a renter, right? It hurts less to have to pay an additional 1-2 months of rent as a fee upfront. But what FARE does is penalize the long term renter, which most NYers are. See why in my example below. Now imagine this scenario over 10-15 years. How much more is a NYer paying in rent because of FARE over a lifetime?Has anyone on the City Council done this simple math? I’m doubtful they did. Would love to hear your opinion on my points.

I just saw this IG post from The Real Deal

https://www.instagram.com/p/DCW87cQvBAh/

So this is how the City Council makes decisions, based on Tik Tok?

This is so frustrating…… in terms of the rental fee, it seems to me they’ve now encouraged “bundling” the previously “unbundled” … which seems the opposite intent of the Sitzer decision. Or maybe rentals are different from sales and I’m in left field … ?! Who knows … Happy Friday!

Did you miss the previous Housing Notes?

November 15, 2024

Image: ChatGPT