- Fortis Ghosted My Firm To Avoid Paying For Services Already Rendered

- Like Owning A Restaurant, Condo Development Is An Unusually Risky Business

- Avoid Extending Financial Credit To Someone Not On The Hook Personally

Well before the Manhattan luxury condo tower – 1 Seaport (aka 161 Maiden Lane) – topped out (that was in 2018), its superstar sales team of Fredrik Eklund/John Gomes asked me to give a presentation on the Manhattan housing market at their off-site sales office. What happened next is a story about what a developer does when everything goes wrong.

I’ve worked with the Eklund/Gomes Team many times and always have appreciated their professionalism. They are literally a tour de force, living up to all the reality shows and social media hype in addition to their tangible sales production numbers. They just know how to sell.

Disaster Strikes For Manhattan’s 1 Seaport

There is a fantastic New Yorker article on the Fortis Property Group debacle that eventually prompted me to write this Housing Note: The Leaning Tower of New York after deciding to say goodbye to the money Fortis owes my firm for services already rendered. Seemingly, their strategy in this disaster is not to pay anyone because they’re not going to make a profit. Personally, I don’t have the stomach to be a developer. The stress of having so many things beyond my control would be paralyzing. However, I know I would pay my vendors for services already rendered – and perhaps that’s another reason I chose a different line of work.

Fortis is in quite a pickle. There is an incredible quote in the New Yorker piece:

“Your Honor,” an attorney involved in a 1 Seaport lawsuit explained to a judge, “it’s shaped like a banana right now.”

2017 A construction worker fell to his death from the 29th floor. More trouble on the tower ensued.

2019 It was discovered that the tower was leaning 3″, up to 8″ at the top, and the lawsuits mounted.

2022 Our firm was brought in by the developer, Fortis, in conjunction with their law firm to provide an expert report. We interacted with both the developer and the law firm and prepared an expert report. We delivered it and were fully paid for our services.

2023 We were subsequently hired to provide expert testimony on our original report and, in good faith, provided those services. Typically, we collect our expert fees in advance so we will not be compromised in our reporting. Since we were already working closely with the law firm and Fortis, we trusted them. Our expert provided the services and gave deposition testimony before being paid. That was a mistake.

When we followed up with the law firm for payment, the law firm indicated they didn’t work for Fortis anymore, likely for the same reason. Then, Fortis ghosted us.

Final Thoughts

The financial scale of the 1 Seaport development makes our unpaid expert witness service fees look like a rounding error. We don’t have the financial largess to fight them. The New Yorker article makes it sound like the developer isn’t paying anyone even if they did their jobs, including their former law firm. Admittedly, I took a second to consider whether I wanted to write about this situation after I had seen the New Yorker article. Our firm spent about a year and a half trying to collect, and Fortis played wack-a-mole the whole time, hiding from our regular calls and not responding to our emails, which are all documented. I wanted to move on from the negativity. I didn’t write this post in hopes of getting paid. I’d already resolved that it won’t happen because it’s not in their model. It was a harsh reminder of why I don’t want to be anyone’s creditor. I want to be paid fairly for my services as agreed and move on to the next consultation. The significant time suck of owning a small business is weeding out potential deadbeats and firing clients that drain your time and resources.

Over the years, I have admired Fortis‘ ability to find real estate opportunities. They always seemed to be in the right place at the right time until 1 Seaport.

This situation is a harsh reminder that whenever an institution engages a small vendor for complex services and gives them grief about requiring payment upfront before delivering the final product, the person giving the grief usually isn’t on the hook personally like the vendor often is.

Fortis will eventually lick their wounds after this fiasco and probably go on to make hundreds of millions of dollars on the next deal. Small vendors need to be sure to collect in full (using the policy of trust, but verify) or turn down the work. We usually do that, but in this case, we were working as a team with them, and we had no apparent red flags about getting paid for the second step of the consultation, given the relationship. The story sure reads as if they stiffed their big law firm. The cynicism this all requires is a little soul-crushing, but that’s the world we live in. As my dad always warned me, New York is a special place where you can screw over your business colleague next door and then do business with the guy across the street. Sadly, while this is absolutely true, I still love the city.

The following is a life philosophy (wait for it) I strive to maintain, especially when trying to understand the illusion of free choice (below):

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

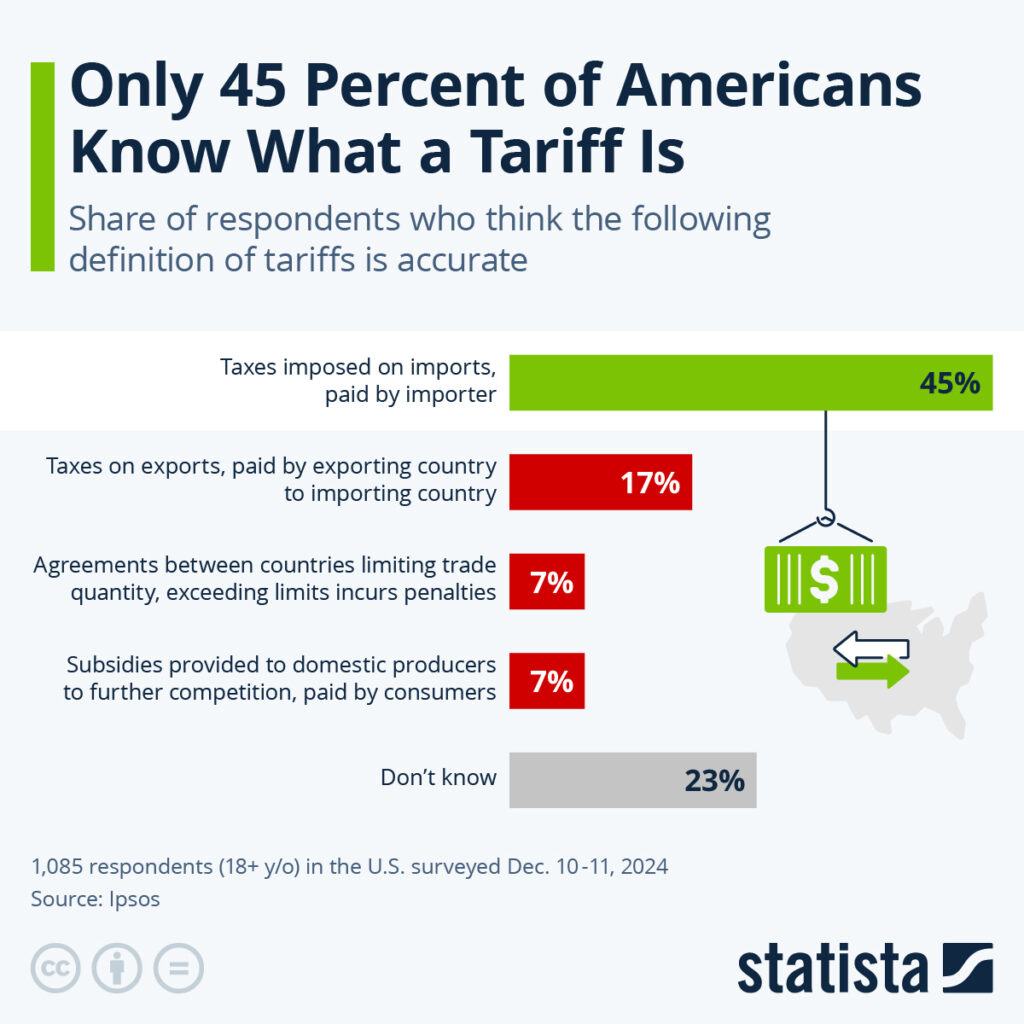

I received a hefty amount of feedback about my take on tariff-filled economic policy and the latest Compass double-speak marketing plan to hide critical information from buyers.

February 7, 2025: Of Tariffs And Mortgage Rates

- I believe your colleague’s “excited” and blunt response might, in fact, have been political. I’m sadly not surprised that 45% of Americans don’t know what tariffs are. Btw, great newsletter.

- a Trump appointee said on Squawk on the St that inflation was only a touch above 2% for all of Trump’s term on average. That may be true, but he increased M2 more than anyone has in decades and he sent out checks via stimulus to individuals and PPP to business people and we know that the effects of the stimulus checks and M2 have a lag of one year or more until it all filters through the economy. It takes a while for people to spend money. Meanwhile we have QE in full force and low rates that artificially drove up asset prices and would later drive up rents feeding the CPI. Trump wanted to goose the economy, and he caused much of the inflation which hit a year to two years later. Biden did not help anything and continued a spend stimulus type economy going, so they are both the blame but Trump seems to have escaped any blame for his super stimulus goose the economy now approach. The public seems to think inflation is a short term phenomena.

- Excellent piece of tariffs – might assign it to my class.

- Tariffs may technically be relative price increases but they are disproportionately felt by lower income households who shop at value stores like Wallmart and Target, so they will feel very inflationary and it will feed into the CPI basket, modestly overall if rents soften in some markets, but still it feel inflationary.

- The economists I read say the same thing and point to how tariffs helped kick off the Great Depression. That was clever of the Canadians.

- Tariffs may technically be relative price increases but they are disproportionately felt by lower income households who shop at value stores like Wallmart and Target, so they will feel very inflationary and it will feed into the CPI basket, modestly overall if rents soften in some markets, but still it feel inflationary.

February 3, 2025: The New Compass Plan Seems…2-Sided

- Trenchant insight about the Byzantine business model of the Compass crowd.

- Really really good note

- Great article…..

- I really enjoyed the column today on the Compass Hustle. It reminds me of the ’80s. The private network is the oldest game in the book and is good fodder for lawsuits. Lawsuit 1: Not representing the seller correctly with potential failure to achieve the highest and best price in a timely manner. Lawsuit 2: Fair Housing (which Compass has already been in before).

- This pre-market, off market, gray market form of selling is about as old and low tech as it gets. It serves no one but the agent and brokerage firm.

- Thank you for another blockbuster and such great reporting. And I am a long-time fan of your character, content, and courage. Not least, your humor.

- good issue! I hadn’t thought about the compass private listings as an agent recruitment driver but it makes sense, especially if they can pocket both sides of a transaction.

- Worth mentioning your affiliation with Douglas Elliman, a Compass competitor?

Did you miss the previous Housing Notes?

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)